Rethinking Quality of Life: A Generational Shift for Wealth Management

Which generation is the most prepared for legacy planning? Do official retirement ages match aspirational ideals? Are younger investors more likely to favor sustainable funds?

The HSBC Quality of Life Report 2023 examines what a holistic quality of life, both now and in the future, means for 2,250 mass affluent and affluent individuals across nine diverse markets: mainland China, Hong Kong, India, Malaysia, Mexico, Singapore, the United Arab Emirates, the United Kingdom and the United States.

This inaugural study sheds light on the evolution of traditional milestones and financial attitudes, with surprising findings along the way. Read on to find out key generational differences in wealth management – and how familiar milestones are being reset.

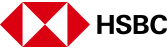

Investing Earlier

The study revealed that each successive generation is investing earlier than the ones before. Millennial respondents have a clear head start. On average, they began to actively invest almost a full decade before Boomers, and five years ahead of Gen X.

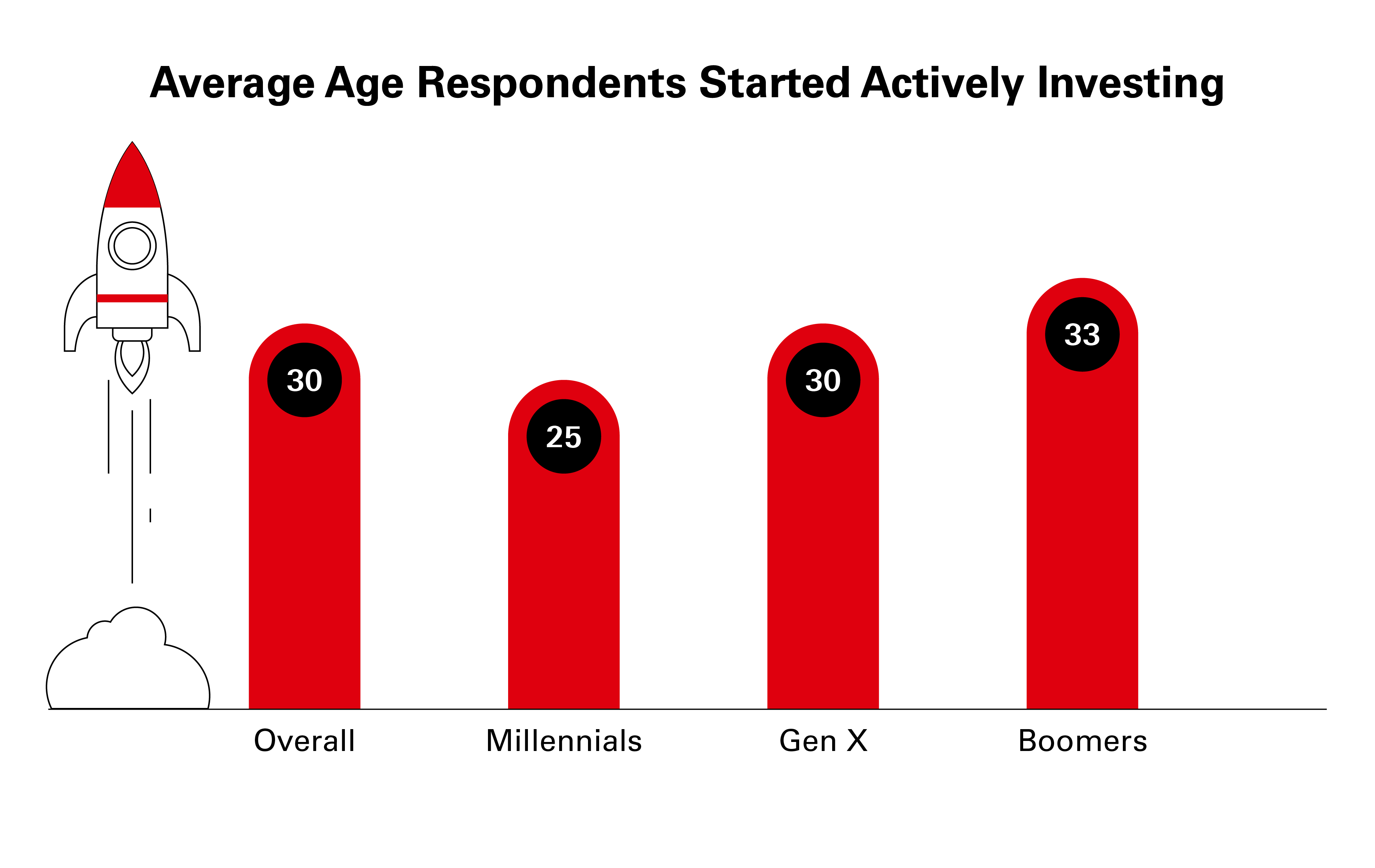

Retiring Earlier – Or Aiming To

Millennials and Gen X aim to retire earlier than Boomers, aiming to do so at 57, 60 and 64 respectively.

Across generations, 60 years is the average aspirational retirement age. This is several years earlier than the official retirement age range of 60 to 67 in most of the markets surveyed – and an interesting contrast to the recent raising of the retirement age in several major economies, including the United Kingdom, France and Singapore.

“The reality is that there is often a gap between the age we aspire to retire at, and when it actually happens. Many people are not really prepared for early retirement, financially or otherwise; thus it is even more critical for everyone to think about financial planning. At HSBC, we take a needs-based approach to help our customers think about the future, understand their needs and support them to achieve their goals,” comments Jenny Wang, Global Head of Retail Wealth, Wealth and Personal Banking at HSBC.

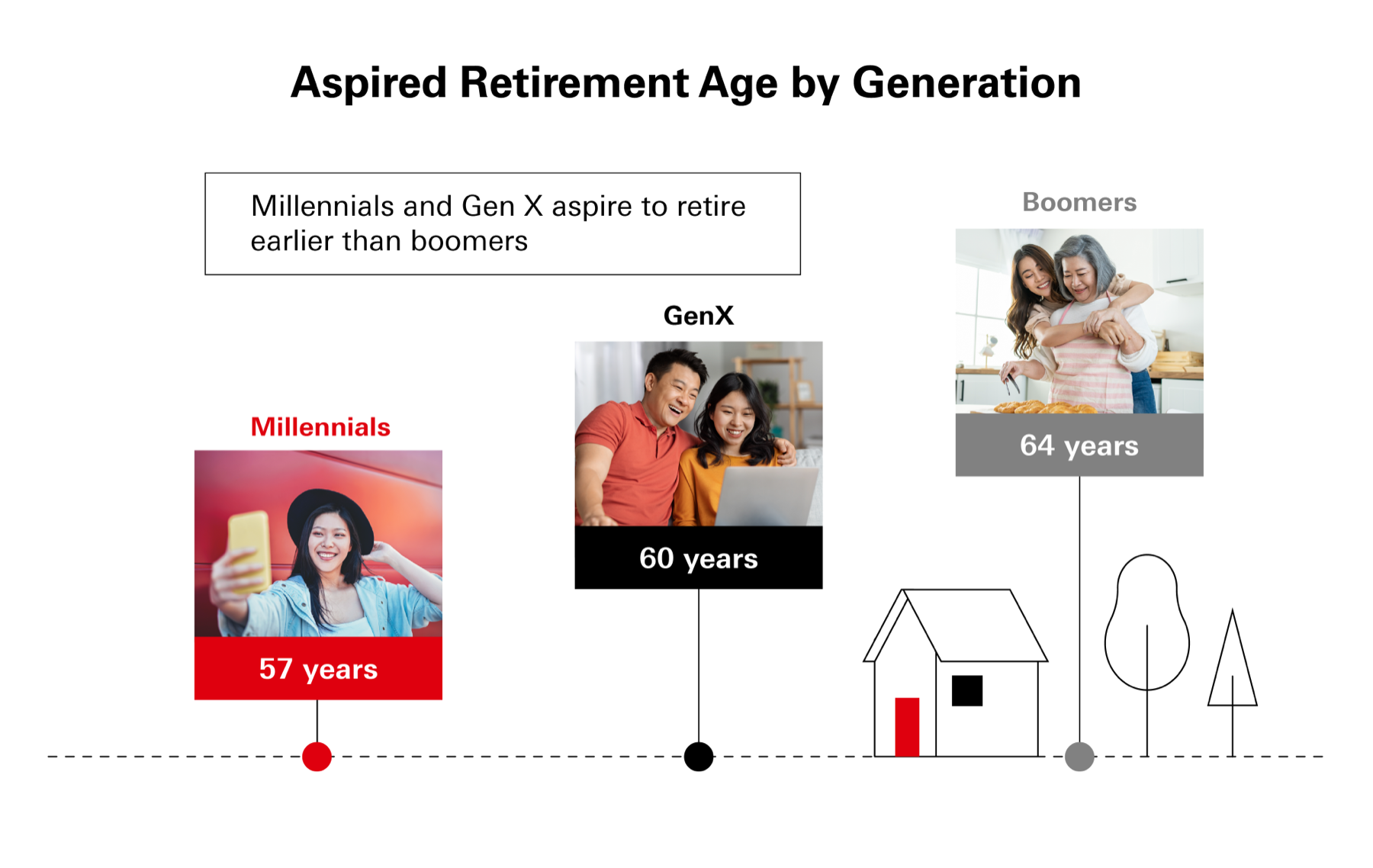

Not Switching Off

Even the very definition of retirement is changing.

According to the study, retirement doesn’t mean the end of work, but rather a shift in focus. More than one in two respondents do not exclude the possibility of taking on some form of work beyond retirement – and among those who want to continue working, 7 in 10 are driven by wanting to stay engaged and active, especially Gen X.

Boomers are slightly more motivated by financial reasons, which include fulfilling financial obligations and covering the costs of health insurance.

The increasingly open-ended nature of retirement points to the blurring of work, leisure and purpose, especially as global life expectancy rises.

“For many people, retirement, especially early retirement, provides an opportunity to refocus on things that interest them most without the same pressures. It could be consultancy work in a familiar area, or something completely different altogether. But the motivation is not always financial. At HSBC, retirement is one of our key goals and we work with our customers to understand their retirement needs, and build a diversified portfolio to achieve their aspirations," Wang adds.

Planning for Longevity

With their head start in investing and the knowledge economy, Millennial respondents are more likely to take a holistic view to legacy planning – perhaps inheriting lessons through the generations.

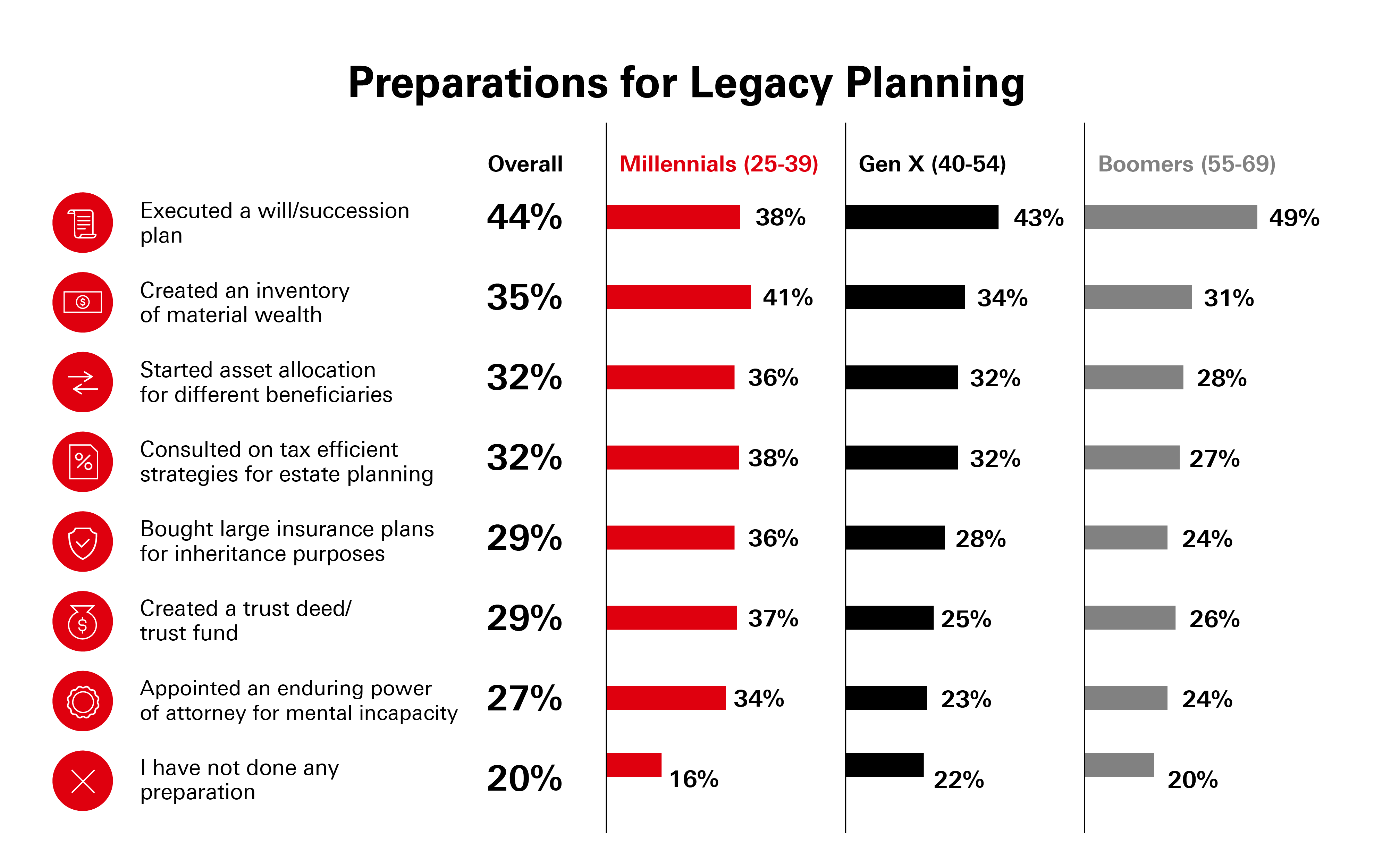

Despite being the least likely to have executed a will or succession plan, Millennials are thinking ahead of their seniors and have done more preparation for legacy planning in every other area. More than 40% of Millennials have created an inventory of material wealth, compared with just over 30% of Gen X and Boomers.

“Millennials are approaching their peak earning years, which means hitting key milestones such as buying houses and starting businesses. But having experienced multiple financial crises and a pandemic, they’re also concerned about the future and how their assets will endure for their lifetime and generations after them,” explains Wang.

"Legacy planning is complex. However, we support our customers every step of the way."

Investing With More Heart

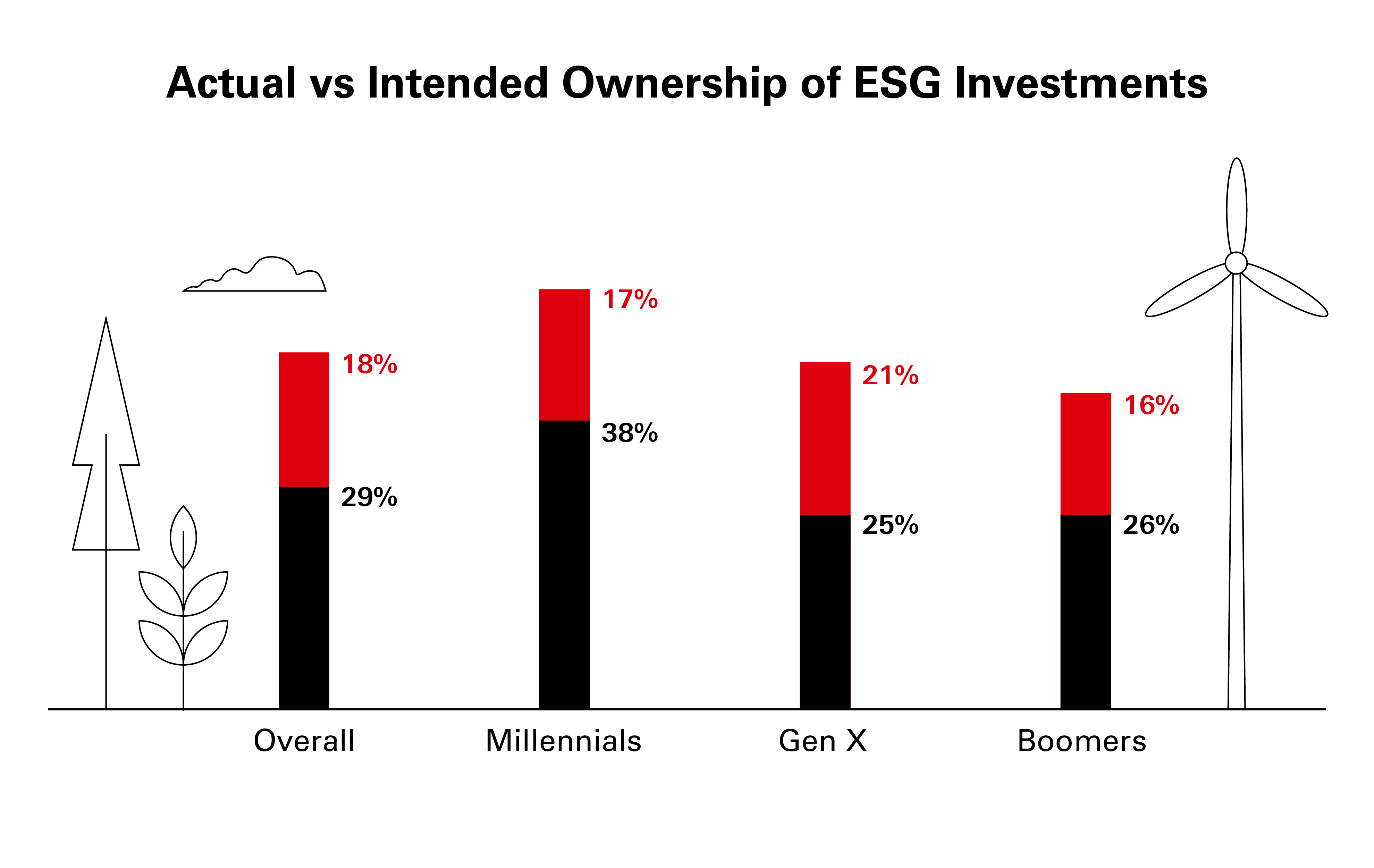

Across all generations, almost one in five respondents plan to invest in financial products linked to environmental, social and governance (ESG) factors in the next one to three years.

Millennials are leading the trend toward ESG investing right now, with 38% of Millennial respondents already owning ESG products, compared to an average of around 27% for earlier generations.

Millennials’ propensity for ESG investing could be influenced, in part, by their above-average reliance on real-time sources of investment guidance, including social media, financial blogs, specialized trading websites, podcasts and newsletters.

“The pursuit of purpose is increasingly driving investment decisions, even against a turbulent economic backdrop," says Jenny. "Millennials may have spurred the growth of sustainable investing, but now investors from all generations are interested in aligning their investment objectives with their values. We help our customers to build a future-proof portfolio aligned to the values of our customers."

Great Wealth Transfer

In the coming decades, trillions of dollars in assets held by Boomers worldwide will shift towards Gen X and Millennials. This will have a profound impact on the wealth management industry, as these younger generations choose to manage their inherited assets differently.

“The HSBC Quality of Life Report 2023 has given us some important insights into what motivates people across generations when it comes to managing their money and their lives," says Jenny.

“But the world is moving quickly. And it’s critical for wealth managers to be in tune with changing priorities and aspirations, whether that means helping clients to have a positive impact by incorporating environmental and social purpose into all investment decisions, or by facilitating early retirement and the start of a new business venture.”

Discover the HSBC Quality of Life Report 2023 here.