Quality Over Hype: How to Build Resilience in a Concentrated Market with Quality Investing

After enjoying a multiyear equity market rally that sent U.S. stocks surging to record highs, investors are now contending with a more challenging market backdrop. The market’s violent reaction to recent downside data surprises and central bank uncertainty has only increased the sense of fragility felt by many investors. That sentiment is further driven by the reality that the blistering performance of the U.S. equity market has been driven by a small handful of mega-cap tech giants.

Many investors are now focused on resilience, turning to strategies that prioritize quality and a “growth-at-a-reasonable-price” approach to navigate today’s economic uncertainty and concentration risk.

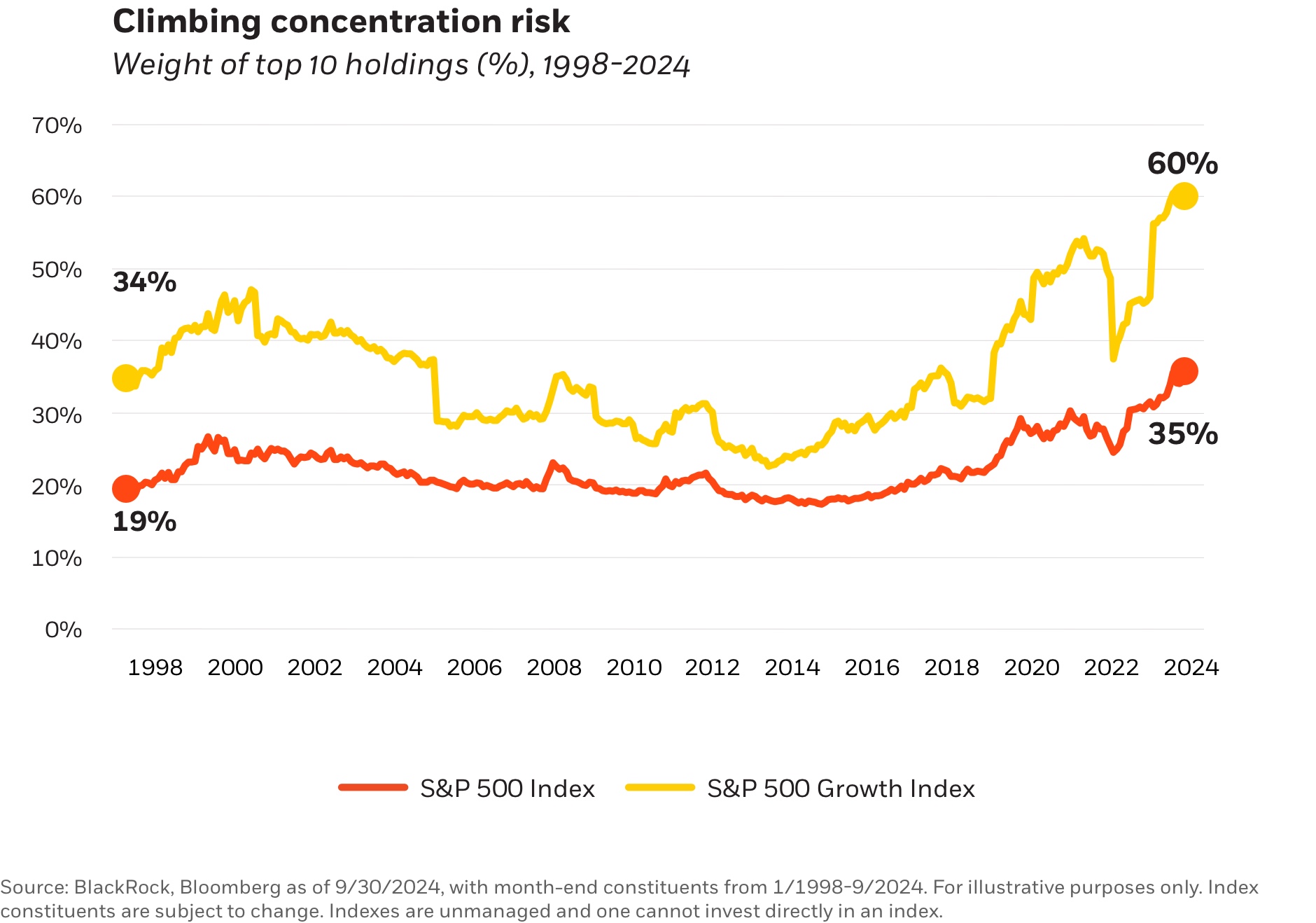

A group of market-leading stocks – the Magnificent 7, which is comprised of Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla – has grown to represent a historically high percentage of broad market exposures. The top 10 stocks in the S&P 500 Index represented 35% of the index at the end of September, a level not seen even during the tech bubble of the late 1990s and early 2000s. Growth investors today are dealing with even higher levels of concentration than during the dot.com era, with the top 10 holdings of the S&P 500 Growth Index almost doubling their share of the index since the start of 2023.

This record-high concentration is a result of the remarkably strong returns of these stocks in recent years. Artificial intelligence and the resilient U.S. economy have fueled double-digit returns for the S&P 500 Index through midyear, with the Magnificent 7 leading the way.

But traders have become increasingly skittish about soaring growth stocks, largely due to the economic uncertainty sparked by disappointing U.S. unemployment data in recent months.

“With the breadth of the market being so narrow, concentration risk comes up in nearly every conversation we have with investors,” says Kristy Akullian, Head of iShares Investment Strategy at BlackRock.

Investors want to know: How can they reduce the concentration risk in their portfolios while still leveraging the dominant themes supporting today’s wave of transformation?

Stronger fundamentals with quality investing

Quality investing, which focuses on identifying companies with solid fundamentals, is one approach to the quandary facing investors. This investment style is typically utilized as a buy-and-hold strategy at the core of a portfolio, but it has become increasingly popular as a tactical approach to avoid the riskiest pockets of the market.

“Investors sometimes conflate a quality-oriented portfolio with growth stocks or technology stocks, and while it’s certainly true that high-quality stocks can be found in those areas, stocks with attractive quality characteristics can be found across the market,” says Akullian.

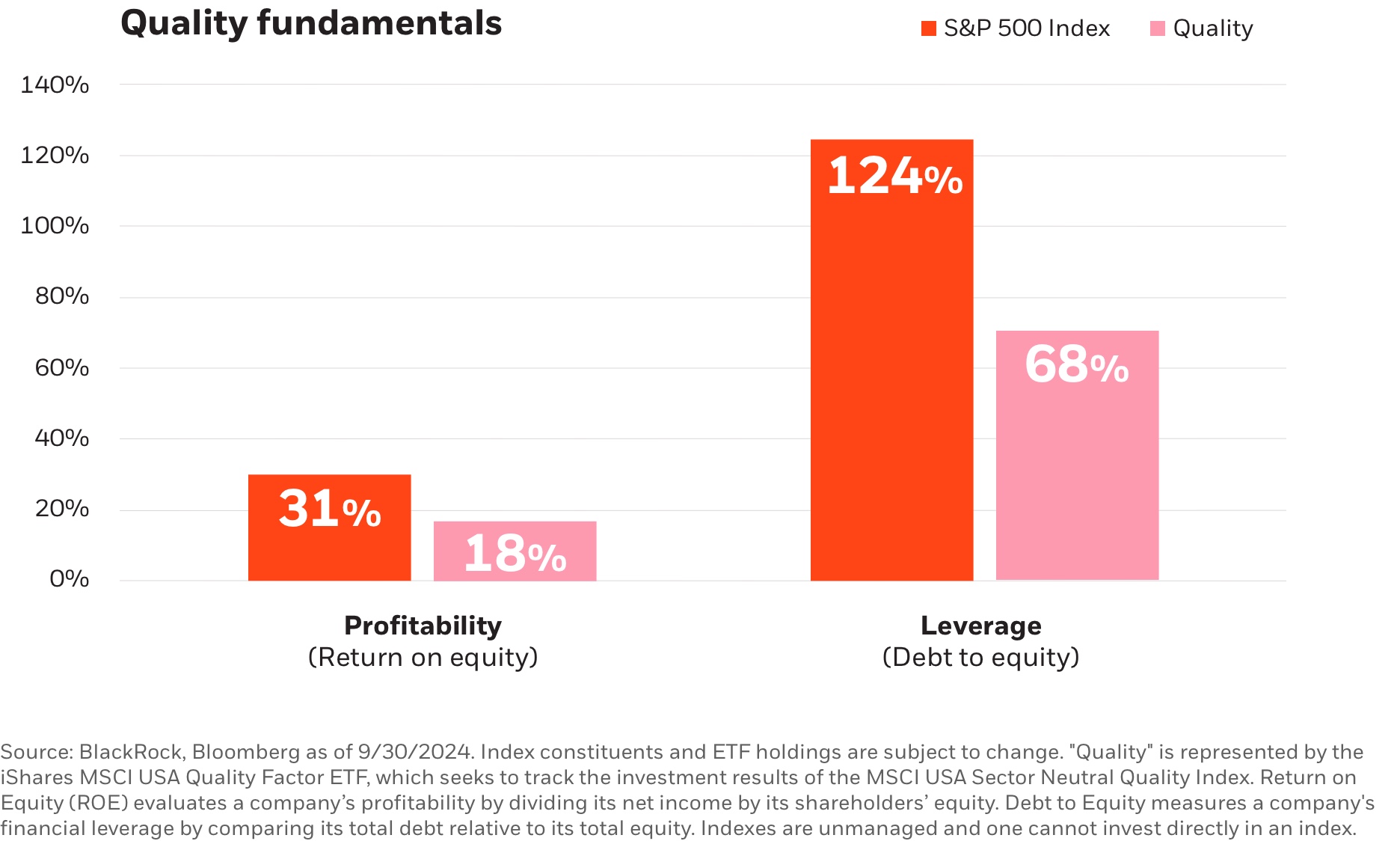

Quality-oriented characteristics include high profitability, low earnings variability and the overall strength of a company’s balance sheet. “Analyzing a company using multiple descriptors gives deeper insight into the company fundamentals, providing a more robust understanding of whether it’s a high-quality business,” says Mark Carver, Global Head of Equity Factor Products and Equity Portfolio Management at MSCI.

Key attributes such as profitability and earnings consistency help investors evaluate the sturdiness of companies, while indebtedness has become more important in a higher-for-longer interest rate environment.

“Our research shows that quality stocks provided higher risk-adjusted returns over time, but especially during periods of high market uncertainty,” says Carver.1 “Fundamental strength may have provided resilience in choppy markets, and many of our clients who are concerned about market concentration from the Magnificent 7 or a potential tech bubble have added quality exposure."

Many investors seeking quality are allocating to the iShares MSCI USA Quality Factor ETF (QUAL), says Akullian. QUAL has attracted over $5 billion in new money this year through September, bringing the fund’s assets under management (AUM) to nearly $50 billion.2

Capturing growth at a reasonable price

Over the past decade, growth investing has been one of the most richly rewarded investment styles.3 But today, there are two common criticisms of growth firms: high valuations and hype.

Growth companies can trade at exorbitant valuations, eating into future returns even if their growth expectations are realized. And given that growth investing seeks to identify firms with the potential for future profitability, it is critical to understand whether growth firms are running high-quality businesses.

Growth-at-a-reasonable-price investing seeks to address these concerns by targeting companies with solid track records, attractive historical growth rates, a strong analyst growth consensus and reasonable valuations.

“It goes back to that idea that owning fast-growing companies sounds great – wouldn’t you always want that?” says Akullian. “But if valuations are unreasonable – or the company hasn’t proven itself yet – that’s a time where it can be safer to avoid overpaying for growth potential, especially in a market with brittle risk sentiment.”

Akullian suggests the iShares MSCI USA Quality GARP ETF (GARP) as a way to target the growth-at-a-reasonable-price strategy.

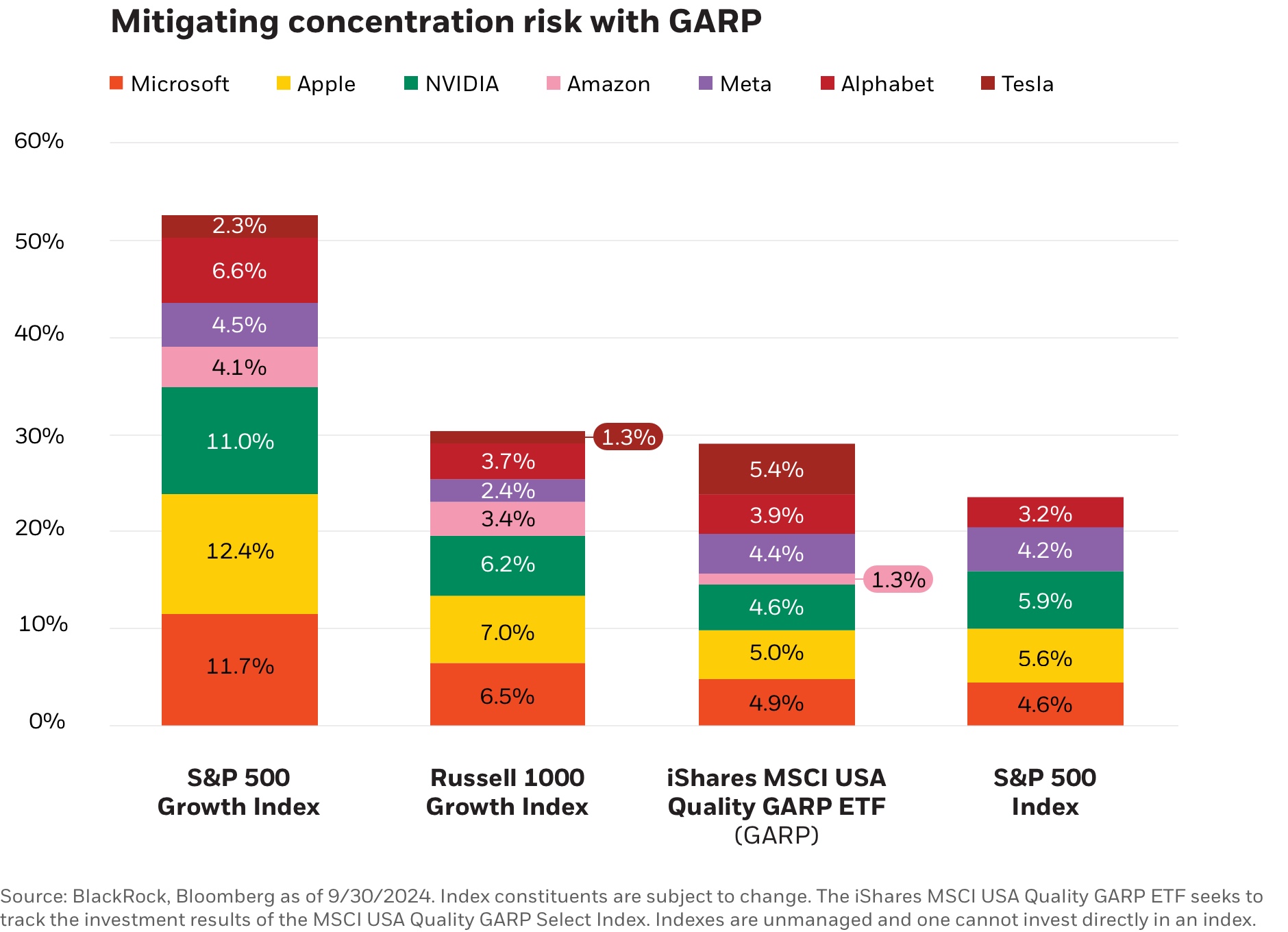

“GARP investing combines the insights of three investment styles: growth, value and quality,” adds Carver. “Investors may also choose to address risks like overconcentration by limiting exposure to any individual company.”

Magnificent 7 stocks comprise less than one-third of the MSCI USA Quality GARP Select Index4 – a similar level to the S&P 500 Index and far below that of standard growth indexes.

Growth-at-a-reasonable-price investing “can be a diversifier if investors feel overly allocated toward technology and growth,” Akullian says. “Bringing in select higher-quality value stocks and sectors is important, not just because you’re trying to time the market correctly, but because of the diversification benefit.”

Using these time-tested approaches, investors can seek to properly position their portfolios to address today’s unique and fast-changing market environment.

Investors interested in low-cost, efficient exposure to the quality factor can check out QUAL and GARP. For more information visit ishares.com/factors.

- Source: MSCI, "Quality Time: Understanding Factor Investing", June 2023.

- Source: BlackRock as of 9/30/2024.

- Source: BlackRock, Bloomberg as of 9/30/2024. Over the 10-year period ending 9/30/2024, the S&P 500 Growth Index cumulatively returned 324% compared to the 260% return of the S&P 500 Index and 184% return of the S&P 500 Value Index. Past performance is no guarantee of future results.

- GARP ETF refers to the iShares MSCI USA Quality GARP ETF

Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares Fund prospectus pages. Read the prospectus carefully before investing.

Investing involves risk, including possible loss of principal.

There can be no assurance that performance will be enhanced or risk will be reduced for funds that seek to provide exposure to certain quantitative investment characteristics ("factors"). Exposure to such investment factors may detract from performance in some market environments, perhaps for extended periods. In such circumstances, a fund may seek to maintain exposure to the targeted investment factors and not adjust to target different factors, which could result in losses.

Diversification and asset allocation may not protect against market risk or loss of principal.

Specific companies or issuers are mentioned for educational purposes only and should not be deemed as a recommendation to buy or sell any securities. Any companies mentioned do not necessarily represent current or future holdings of any BlackRock products. For actual fund holdings, please visit the respective fund product pages.

Funds that concentrate investments in specific industries, sectors, markets or asset classes may underperform or be more volatile than other industries, sectors, markets or asset classes and than the general securities market.

This material represents an assessment of the market environment as of the date indicated; is subject to change; and is not intended to be a forecast of future events or a guarantee of future results. This information should not be relied upon by the reader as research or investment advice regarding the funds or any issuer or security in particular.

The strategies discussed are strictly for illustrative and educational purposes and are not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. There is no guarantee that any strategies discussed will be effective.

The information presented does not take into consideration commissions, tax implications, or other transactions costs, which may significantly affect the economic consequences of a given strategy or investment decision.

This material contains general information only and does not take into account an individual's financial circumstances. This information should not be relied upon as a primary basis for an investment decision. Rather, an assessment should be made as to whether the information is appropriate in individual circumstances and consideration should be given to talking to a financial professional before making an investment decision.

The Funds are distributed by BlackRock Investments, LLC (together with its affiliates, "BlackRock").

The iShares Funds are not sponsored, endorsed, issued, sold or promoted by Bloomberg or MSCI Inc. None of these companies make any representation regarding the advisability of investing in the Funds. BlackRock Investments, LLC is not affiliated with the companies listed above.© 2024 BlackRock, Inc or its affiliates. All Rights Reserved. BLACKROCK and iSHARES are trademarks of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

iCRMH1024U/S-3863034