Eyes on Egypt

As Egypt prepares to host COP27 this year, the world is watching this dynamic and strategically located market closely as it builds a more sustainable future. Hussein Majid Abaza, CEO and Managing Director of Commercial International Bank (CIB), believes the momentum and finance is now in place to support the country’s pioneering transition.

How is the economy being decarbonized?

Egypt has initiated serious steps to apply decarbonization within a sustainable development model, at the heart of which lies climate change mitigation and adaptation.

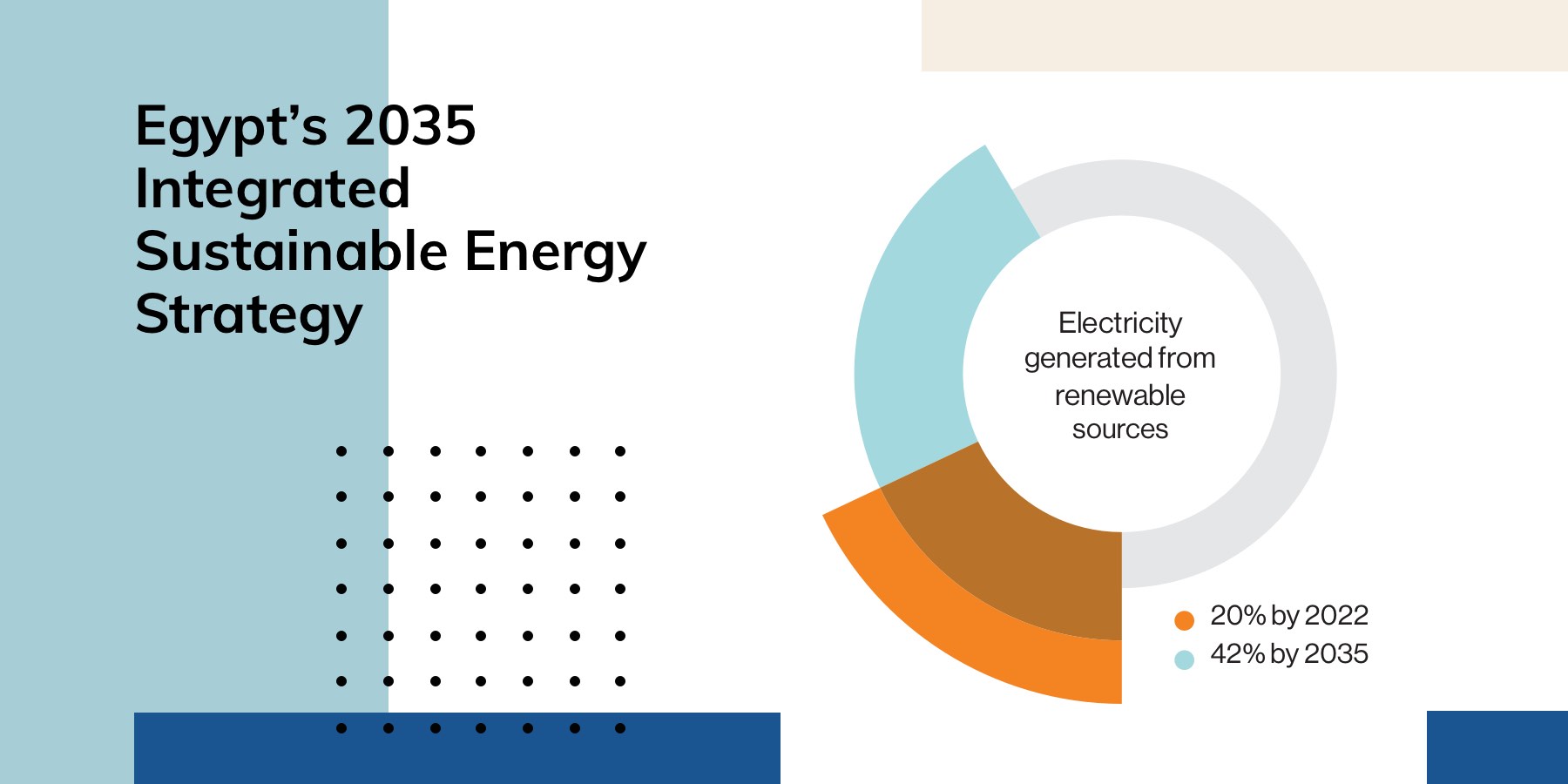

Egypt’s 2035 Integrated Sustainable Energy Strategy aims to increase the supply of electricity generated from renewable sources to 20% by 2022 and to 42% by 2035—with wind providing 14%, hydropower providing 2% and solar providing 26% of the energy mix—coinciding with the rationalization of energy subsidies. These ambitious decarbonization plans are expected to be achieved through a combination of government projects and private-sector investments.

Egypt is also working toward the transition to clean transportation by expanding its metro, rail and electric vehicle networks and preparing the necessary infrastructure for that, and establishing smart and sustainable cities. This is in addition to the implementation of projects to rationalize water consumption; the canal lining project; and the integrated management of coastal areas.

To fund those projects, Egypt issued its first sovereign green bond in 2020, at a value of $750 million.

How are businesses responding?

Many companies have started to institutionalize sustainability within their organizations and are developing ESG strategies and outlining steps to begin mitigating, measuring and reporting on their progress.

In July 2021, the Financial Regulatory Authority (FRA) further encouraged this activity, setting out a framework of standards that Egyptian Stock Exchange-listed companies are mandated to adhere to in their annual disclosures. This will standardize ESG reporting and, in turn, instigate a trickle-down effect to other private-sector companies.

Also in July 2021, the Central Bank of Egypt issued a directive that reinforces national efforts to achieve sustainable development. It provides a general framework for the adoption of sustainable finance and integration of ESG practices into banks’ day-to-day operations.

How is CIB encouraging green investment?

As a founding member of the Net-Zero Banking Alliance, launched in April 2021, and a member of its steering group representing Africa, CIB is committed to aligning its lending and investment portfolios with net-zero emissions by 2050.

Our robust environmental and social risk management system and pioneering green bond framework are driving portfolios toward low-carbon industries and renewable energy solutions, products and services. We are also providing technical assistance, awareness campaigns and capacity building to our staff and clients.

CIB’s green finance instruments adopt a holistic long-term strategy for the measurement, control and increase of the bank’s positive environmental impact to advance business growth, while reducing negative environmental impact.

"Egypt’s renewable capacity will rise 68% over the next five years."

— Hussein Majid Abaza, CEO & Managing Director, CIB

What is attracting international investors?

In Egypt, potential looms large. The International Energy Agency estimates that Egypt’s renewable capacity will rise 68% over the next five years. This would bring Egypt’s total renewable capacity to around 10.1 GW by 2026, up from 6.1 GW currently.

Egypt has a rich mix of renewable energy resources, a strong industrial base and access to markets. It is considered a “sunbelt” country, boasting 2,000 to 3,000 kWh/m2/year of direct solar radiation, and it enjoys excellent wind along the Gulf of Suez, with an average wind speed of 10.5 m/sec. It is also home to Benban Solar Park, Africa’s largest solar park, with 32 individual plants, each producing 20–50 MW.

Additionally, sunlight can directly or indirectly provide the energy to produce hydrogen. Using solar energy, Egypt will have the power it needs to produce hydrogen through processes including solar thermochemical production, photoelectrochemical production, electrolysis and photobiological production.

These factors provide a solid foundation for the country to build a robust green hydrogen industry. Given the country’s close proximity to African countries, Asia and Europe, as well as its natural gas export network, Egypt also has the necessary infrastructure to export energy on a global scale.