Crypto ETF Provider DeFi Technologies Sees 133% Growth & Surpasses $1 Billion in AUM Amidst Mainstream Adoption and Regulatory Tailwinds

DeFi Technologies Inc. (DEFTF) is making significant strides in the digital asset space, positioning itself as a key player bridging traditional finance and decentralized finance (DeFi). With a focus on providing secure and regulated access to digital assets, the company is attracting attention from both traditional and crypto-native investors. Simply put, DeFi Technologies offers broad exposure to dozens of cryptocurrencies with lower risk than owning a coin through its exchange-traded products (ETPs).

Market Tailwinds and Regulatory Positivity

The broader crypto market is experiencing favorable conditions, with projections of new all-time highs in 2025. This optimism is driven by positive regulatory movements in the U.S. and a pro-crypto stance from the new Trump administration. The appointment of Paul Atkins, a respected Washington lawyer, to lead the Securities and Exchange Commission (SEC) signals a potential shift towards more supportive regulations for crypto assets. Additionally, financial advisors have been steadily increasing their allocations to digital assets, with the percentage of advisors investing in crypto doubling to 22% in 2024. This growing mainstream acceptance bodes well for companies like DeFi Technologies, which strive to offer secure, regulated gateways for digital assets.

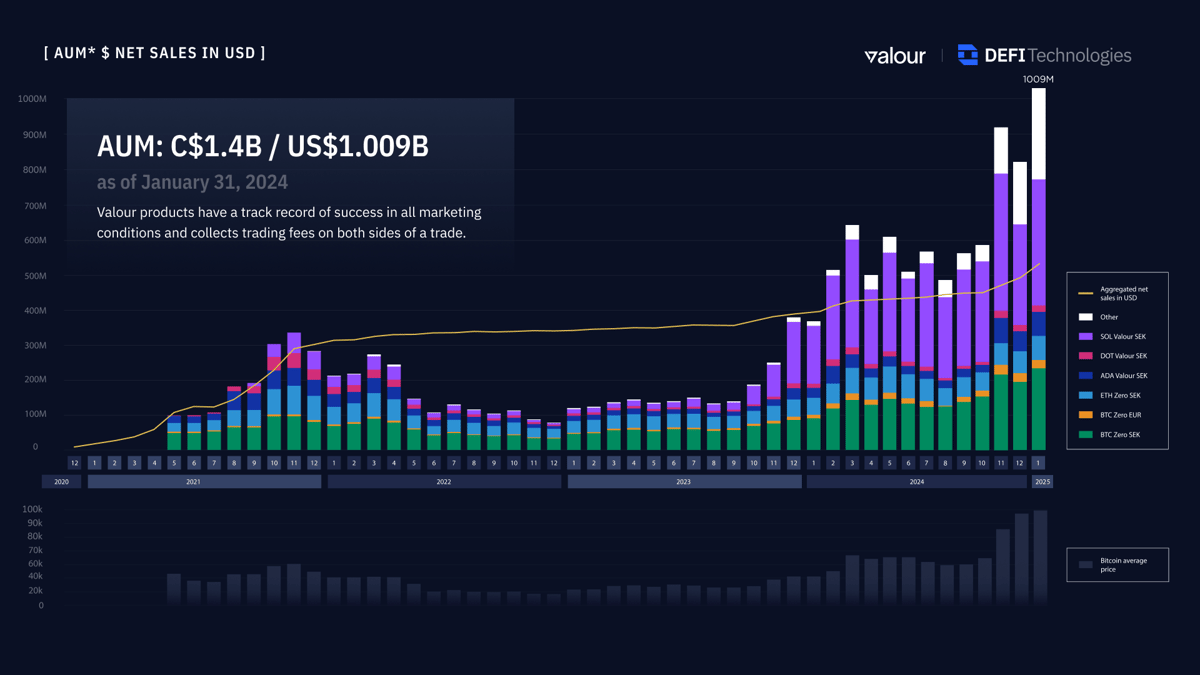

Valour's AUM Surpasses $1 Billion, Signaling Strong Growth

A major highlight for DeFi Technologies is the recent achievement of its subsidiary, Valour Inc., which has surpassed US$1 billion in Assets Under Management (AUM), reaching US$1.02 billion (C$1.46 billion) as of January 20, 2025[1][4]. This milestone underscores the increasing demand for secure and accessible digital asset investment products. Valour's AUM growth was an impressive 133% year-over-year in 2024, fueled by top-performing Exchange Traded Products (ETPs) such as Valour SOL, BTC, ETH, and ADA[1][4]. The company also saw record monthly net inflows of C$56 million (US$38.8 million) in December 2024, and launched 20 new digital asset ETPs[2].

Potential Nasdaq Uplisting

Underscoring its ambition to broaden its investor base and global visibility, DeFi Technologies recently filed a Form 40-F Registration Statement with the U.S. Securities and Exchange Commission (SEC). This filing is a key step toward the potential listing of its common shares on The Nasdaq Stock Market, contingent upon the SEC declaring the Form 40-F effective and Nasdaq's approval of the listing application. If successful, the uplisting could offer DeFi Technologies greater liquidity, enhanced market recognition, and expanded access to capital in the United States—aligning seamlessly with its ongoing global growth strategy.

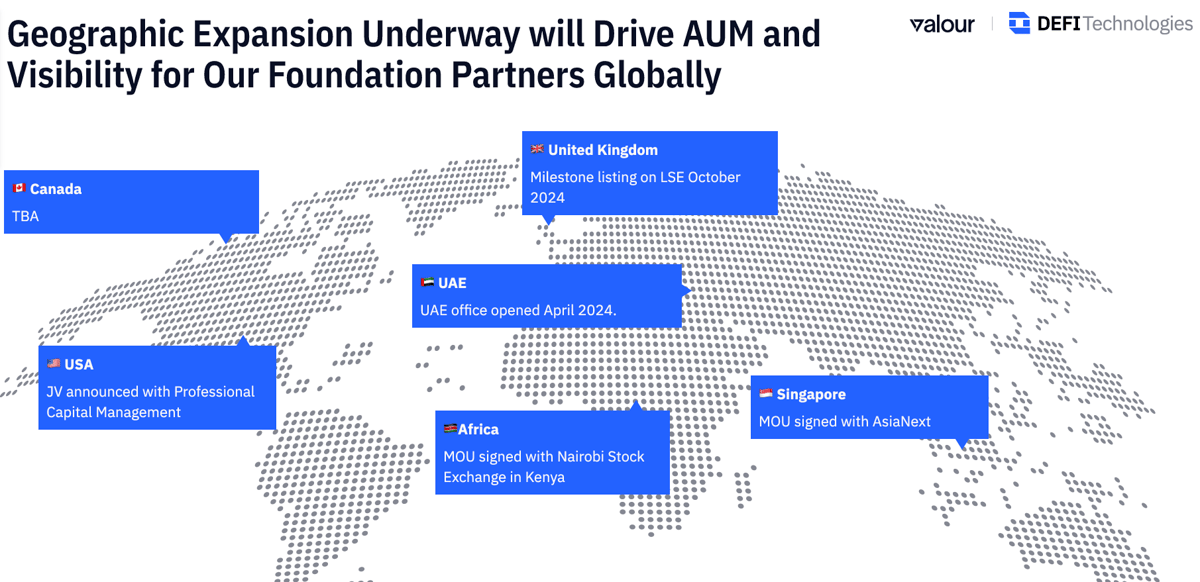

Strategic Global Expansion into Key Emerging Markets

DeFi Technologies is not just focused on Europe; it is actively expanding into high-growth regions. Valour has established Memorandums of Understanding (MOUs) with AsiaNext and SovFi to pursue the listing of its digital asset ETPs on AsiaNext's Singapore-licensed securities exchange, aiming to enhance institutional access across the Asia-Pacific region[1][4]. Additionally, Valour is collaborating with the Nairobi Securities Exchange (NSE) and SovFi to facilitate the creation, issuance, and trading of digital asset ETPs in Africa[1][4]. These strategic moves highlight the company's emphasis on capturing opportunities in emerging markets with increasing digital asset adoption. In particular, DeFi Technologies views Europe, Asia, Africa, and the Middle East as pivotal regions for growth in the coming years[4].

Strong Analyst Ratings and Positive Outlook

DeFi Technologies (DEFTF) is receiving positive attention from analysts. The company currently holds a strong buy recommendation with an average brokerage recommendation (ABR) of 1.00, based on ratings from four brokerage firms. The average price target for DEFTF is $4.52, with forecasts ranging from a low of $3.17 to a high of $5.92. The average price target represents a potential upside of 42.14% from the last closing price of $3.18. Zacks Investment Research gives the company an A score across value, growth, and momentum investment styles [9]. This bullish sentiment is reinforced by the fact that all four brokerage recommendations currently rate the stock a "Strong Buy."

Diverse Business Lines for Secure Exposure

DeFi Technologies offers multiple business lines that ensure secure exposure to digital assets:

- Valour Asset Management: Managing C$1.18B AUM as of December 31, 2024[2].

- DEFI Alpha: Produced C$132.1M in revenue as of September 30, 2024.

- DEFI Ventures: DeFi Technologies' venture portfolio valued at C$45.1M as of September 30, 2024.

- Reflexivity Research: Providing in-depth cryptocurrency and blockchain research.

- DEFI Infrastructure: Managing nodes for DeFi protocols, supported by Coinbase Cloud.

- Stillman Digital: Operating as an OTC desk, providing liquidity and trade execution across digital asset markets.

The Bottom Line For Investors

DeFi Technologies Inc. stands out as a company at the forefront of bridging traditional finance and the burgeoning DeFi ecosystem. Its impressive AUM growth, strategic forays into emerging markets, strong analyst ratings, and potential Nasdaq uplisting all point to a promising future. By offering a suite of products and services designed to meet the growing institutional and retail appetite for digital assets, DeFi Technologies is well-positioned to capitalize on the industry's accelerating mainstream acceptance and a shifting regulatory landscape that appears increasingly open to crypto innovation[3].

Sources:

[1] https://www.stocktitan.net/news/DEFTF/valour-surpasses-us-1-billion-in-assets-under-gx95uwwl6ubp.html

[2] https://www.newswire.ca/news-releases/defi-technologies-provides-monthly-corporate-update-valour-reports-c-1-18-billion-us-819-million-aum-and-record-monthly-net-inflows-of-c-56-million-us-38-8-million-in-december-2024-805931622.html

[3] https://www.prnewswire.com/news-releases/defi-technologies-subsidiary-valour-inc-reaches-record-c883-million-us633-million-in-aum-post-us-election-and-record-btc-prices-up-over-73-this-fiscal-year-with-net-sales-of-etp-products-exceeding-c120-million-us86-m-302298588.html

[4] https://www.newswire.ca/news-releases/valour-surpasses-us-1-billion-in-assets-under-management-845788660.html

[5] https://www.sec.gov/Archives/edgar/data/1888274/000121390025004675/ea022779701ex99-183_defitech.htm

[6] https://www.stocktitan.net/news/DEFTF/

[7] https://www.nasdaq.com/press-release/valour-surpasses-us-1-billion-assets-under-management-2025-01-21

[8] https://finance.yahoo.com/news/defi-technologies-provides-monthly-corporate-123000709.html

[9] https://www.zacks.com/stock/research/DEFTF/price-target-stock-forecast