Reshaping SME financing in the UAE

The engine of the global economy

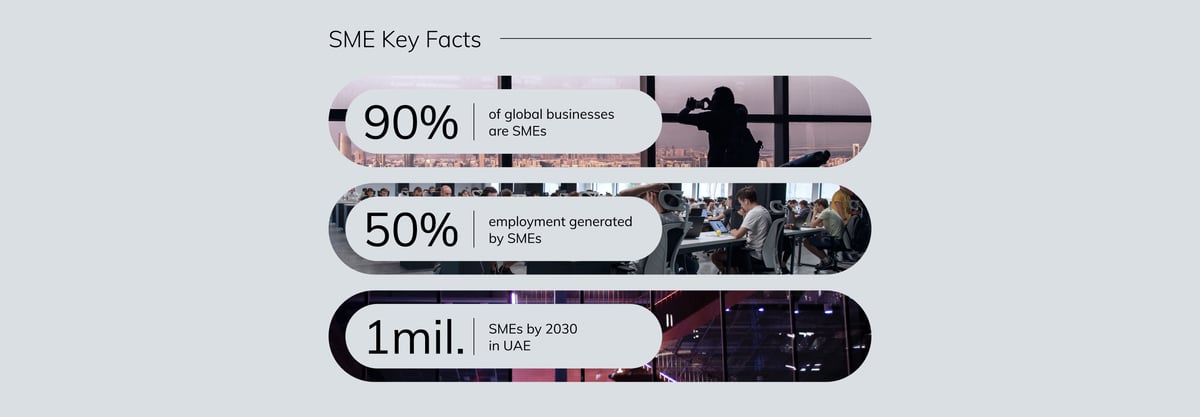

Small and medium enterprises (SMEs) are the beating heart of global production. They constitute 90% of global business and generate 50% of employment. These figures trend upwards if more informal SMEs are considered.

The United Arab Emirates, a global trade and business hub, is no different. SMEs have long been a mainstay of the country’s move towards economic diversification.

Recent figures shared by His Excellency Abdullah bin Touq Al Marri, UAE Minister of Economy, show that the UAE had 557,000 SMEs by the end of 2022. By 2030, the UAE wants this number to reach 1 million.

In the UAE, the role of boosting SME participation in the national economy is embedded in top-down strategy, supported at federal and Emirate levels through policies such as the National Agenda for Entrepreneurship and SMEs, and the Abu Dhabi SME Strategy and Policy Roadmap. In the adjacent Emirate of Dubai, the Dubai Economic Agenda (D33) also puts SMEs front and center.

Yet, forging an SME-enabling ecosystem can’t be left to government directives alone. It requires participation from the entire economic ecosystem, including financial institutions. For instance, access to bank finance and conventional debt instruments is a key challenge for the UAE’s SMEs, who are often forced to rely on alternative funding for early-stage survival.

FAB has a history of working for the SME growth cause. “In 2022, we financed almost 2.8 billion dirhams to SMEs in the UAE — a 10-12% growth compared to previous years. And we expect this number to keep increasing in the years to come,” notes Suresh.

Now, support for SMEs is codified in FAB’s strategy frameworks. “Supporting SMEs is an integral part of our ESG strategy. It resonates with our overall commitment to promote economic growth, foster entrepreneurship and address socio-economic challenges by providing sustainable financing and responsible banking,” says Salil.

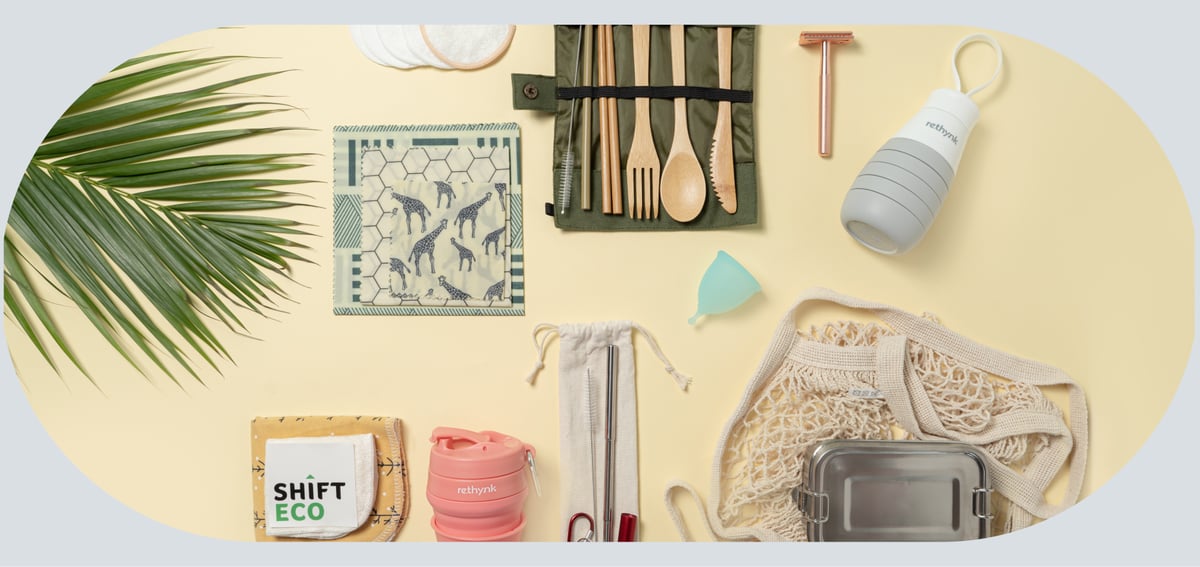

When Sukriti Verma and Namrata Budhraja looked around and saw how small consumer shifts in behavior could snowball into big environmental benefits, they turned their idea into Shift Eco — a platform that curates honest and impactful eco-friendly products and helps consumers and organizations go green.

Women-led and owned, Shift Eco is part of a new generation of nimble UAE SMEs powered by their founders’ drive. It also faces some of the same challenges as its contemporaries, such as getting larger firms to work with it.

In this instance though, Shift Eco found a corporate partner in FAB that was willing to listen and give small startups a chance. Today, the two firms have an ongoing relationship, collaborating on awareness events and working on corporate CSR programs.

“FAB’s partnership with Shift Eco shows their commitment towards building the SME economy. They’re very willing to work with smaller businesses, which is not something large companies do easily,” says co-founder Sukriti.

An emphasis on encouraging women-led SMEs has led FAB to partner with VISA on “She’s Next”, a global advocacy program that brings practical insights and tools to small and medium enterprises (SMEs), including networking, mentoring, and funding opportunities.

Thanks to their work with FAB and other successes, Sukriti and Namrata won the “She’s Next UAE” grant for 2022 – picked from a crowded field by an independent jury.

“Being recognized by “She’s Next” is an incredible opportunity. It gives us mentorship and a grant. It’s also a forum for female entrepreneurs to connect and learn from each other's journeys and inspire each other,” adds Sukriti.

Working with small businesses is obviously good for ESG and sustainability. But – importantly – it also makes good business sense. “Supporting SMEs is not just the right thing to do but it is also profitable. Today’s SMEs can become your mid-market and large corporate clients in the future. It helps the bank and also boosts the overall economy and ecosystem,” explains Suresh.

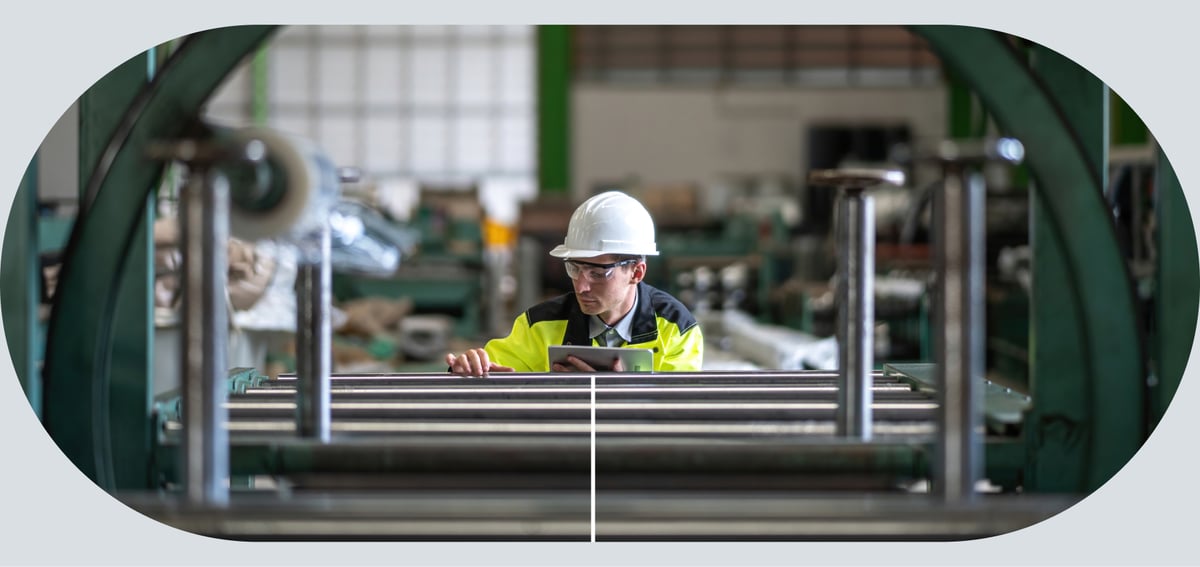

An example of just this sort of transition is Lin Scan, now falling under parent company PipeCare. Lin Scan’s story began in 1999 with founder Dr Khalid Muhamed Khaled El Chami and his assistant in a small office attached to a minuscule lab — with a dream to disrupt how the world’s expansive global network of energy pipelines was cared for.

“Our job is to protect people and the environment from leaks, cracks and spillage in pipes. Pipes breathe and react to their environment. We think of them like veins in the human body. Catastrophes happen if we don’t maintain them,” says Dr Khalid.

When Lin Scan began serving international clients, it needed bid bonds —third-party guarantees that the job would get done. FAB’s teams worked round the clock, dealing with a myriad time zones to generate these essential documents.

“We reached out to our robust network of banking partners worldwide. It involved a lot of liaising and working across multiple time zones but we were determined to help PipeCare achieve their aspirations,” says Suresh.

As Lin Scan grew and become part of parent company PipeCare, FAB’s offerings grew alongside them. In 2007, the bank was instrumental in getting PipeCare settled into a forever home by offering commercial mortgage funding. “Finding a home is a milestone that most businesses aspire to. And for us, this was something very important to enable for PipeCare,” Suresh adds.

SMEs want their banking partners to be timely, responsive and adaptable, working with the same agility and flexibility as them.

In response, FAB has innovated a phy-digital model to serve SMEs. “We equip clients with digital capabilities but also ensure that every SME has a relationship manager who can be proactive, understand client challenges and provide them advisory services,” says Salil.

Perhaps though, the real insight for FAB is that business and banking relationships are ultimately about human connection. “Every business story is also a human story. At FAB, we want to become part of that story early on, and then stay part of it. We make sure we listen carefully and understand so we can help,” concludes Salil.