FAB Accelerates Net Zero Agenda

When the heat is on

Temperatures in the Middle East are climbing almost twice as fast as the rest of the world. Over the past century, they’ve risen 1.5 degrees Celsius, twice the global average.

As the preeminent Middle Eastern business hub and tourism destination, the United Arab Emirates (UAE) is cognizant of the challenge posed by global climate change. It was the first country in the Middle East to commit to net zero emissions by 2050.

In this effort, it has been joined by the country’s largest lender, First Abu Dhabi Bank. As a leader and pace setter in sustainable financing, First Abu Dhabi Bank became a signatory to the Abu Dhabi Sustainable Finance Declaration in 2017. Then in October 2021, it became the first bank in the UAE and Gulf Cooperation Council (GCC) to join the global Net-Zero Banking Alliance (NZBA). Convened by the UN, the industry-led alliance brings together global banks for rapid action and accountability.

“Prior to the Net-Zero Banking Alliance, banks were trying to create their own frameworks towards decarbonization. Moving to a common framework under the NZBA was a very important first step. However, we now need to go further to take regional context and regulations into account. Decarbonization journeys can look different in different parts of the world. With regional sub-frameworks, we can move towards measuring our clients in the right context. What works for the EU and the USA may not be the same process as in Africa, India or the MENA region,” says Shargiil Bashir, Chief Sustainability Officer at FAB.

FAB’s joining of the Net-Zero Banking Alliance was a step further on an existing path towards environmental sustainability in finance. In 2017, FAB had already become the first MENA region bank to issue a green bond. Since that debut, FAB has taken its total of issued green bonds to 13, with 6 issuances occurring in 2021 alone.

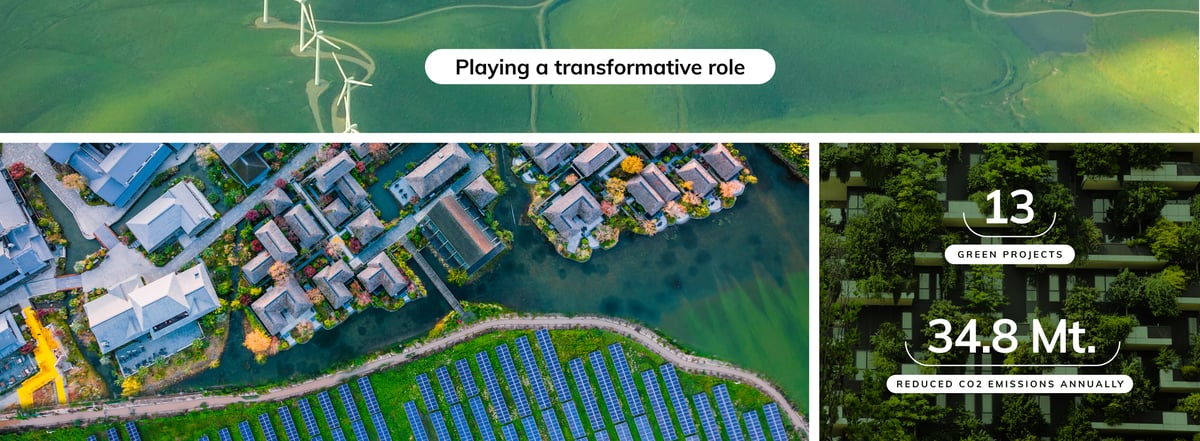

The bank’s first green bond matured in March 2022. During that tenure, it created notable impact, helping finance 13 green projects in key markets. The bond helped add 2,577 megawatts of renewable energy globally, reduced emissions by around 34.8 million tonnes of CO2 annually, and delivered 430,000 m3 of wastewater treatment capacity.

FAB believes that financial institutions have a crucial role to play in broad socio-economic change, and that net zero can’t be achieved without their active participation.

“Financial institutions have played key roles in several transformations over past decades, including the move to digital, and the rise of ESG and compliance considerations. We must also play a similar role in confronting the challenge of climate change. In 2023, the UAE is hosting COP 28. We are advocating for more banks in Africa and the MENA region to commit to collective action and join the NZBA by then because it’s not possible to achieve net zero without their involvement. These are big challenges where FAB can facilitate discussions and help catalyze action,”

— Shargiil Bashir, EVP & Chief Sustainability Officer at FAB

FAB is expanding its green bond program. It has also evolved its bond issuing process into a Sustainable Finance Framework to carefully select projects offering environmental and social benefits. The Framework highlights the areas FAB wants to focus on to fund responsible solutions.

Importantly, the Framework offers internationally accepted guidelines for green project selection, with mechanisms for independent review. It draws on global best practices from the International Capital Market Association (ICMA) Green Bond Principles (GBP), Social Bond Principles (SBP), and Sustainability Bond Guidelines (SBG).

The aim, according to Bashir, is to ensure that all green projects funded are up to standard and capable of delivering genuine results. Comprehensive reporting and evaluation are integral to the process.

This Framework was followed by a comprehensive ESG strategy along with a commitment to lend, invest and facilitate $75 billion in transactions focused on environmental and socially responsible solutions by 2030.

Recently, FAB broadened its Sustainable Finance Framework to develop new ESG businesses covering green trade finance, equity capital markets, treasury issuances and commercial mortgage-backed securities.

For FAB, one size doesn’t fit all in sustainability financing. Timeframes are longer, and environmental targets often don’t immediately boost profits. Dialogue and consultation are key to achieving long-term impact.

“We help customers move from commitment to action through advisory services, financial services and exchanging ideas about their decarbonization strategies. Every business has different needs for its decarbonization journey. That’s why it’s important for us to not only communicate, but also work together with clients to progress towards net zero by 2050,” notes Bashir.

One such FAB client is Etihad Airways, the UAE’s national carrier. In 2021, FAB acted as strategic partner and financer for the very first sustainability-linked loan in global aviation tied to ESG targets. The $1.2 billion loan is linked to three ESG performance indicators for the airline — reducing CO2 emissions, increasing corporate governance and promoting female participation.[1] Meeting KPIs lowers the cost of the loan while missing them does the opposite.

As a key global player in aviation - a sector on the frontlines of the fight against climate change - Etihad is taking proactive action towards sustainability. The airline has already committed to a target of net zero carbon emissions by 2050 and halving its 2019 net emission levels by 2035.

The FAB-supported Sustainability Linked Loan is helping drive multiple decarbonization programs at the airline, including research into locally produced biofuels in association with Masdar Institute.[2] Etihad eco-flights using biofuel are breaking new ground in reducing carbon impact.

On October 23rd 2021, a special Etihad eco-flight took off from London Heathrow to land in Abu Dubai. It was, at the time, Etihad’s most sustainable flight ever, using biofuel, sustainable crockery and other optimizations to reduce CO2 emissions by 72%. Part of the Etihad Greenliner Programme with Boeing, it was also the first commercial flight to explore contrail avoidance, adjusting its flight route to avoid ice super-saturated atmospheric regions.

FAB continues strengthening relationships with its sustainability clients. Recently, the bank partnered with Etihad and Visa to co-create the FAB Etihad Guest Visa Sustainable card, which introduces sustainability-focused benefits and rewards members for making sustainable choices.

Communication, collaboration and partnerships remain central to FAB’s agenda of driving sustainability.

“Our partnerships with clients undertaking sustainability transformations will continue growing. Sustainability is not a challenge any company can solve by itself. We need collaboration between financial institutions, customers and regulators to create meaningful decarbonization journeys. At FAB, we will continue leading concerted action that helps our partners develop products, services and initiatives addressing sustainability challenges,” concludes Bashir.