How Finance Leaders Are Navigating Dramatic Change

Digital transformation is helping finance leaders drive business strategy and boost the bottom line

During the early days of the global pandemic, many of Nicole Carrillo’s C-suite colleagues were grappling with the challenges of mostly remote teams working with antiquated systems to support loanDepot’s critical finance processes.

At the same time, Carrillo, loanDepot’s Chief Accounting Officer, was helping to orchestrate a digital finance transformation that would move the consumer lender and real estate services provider off its legacy technology system, which acted as their enterprise resource planning (ERP) system of record.

“We had a ‘vintage’ system—literally built for mortgage companies 20 years ago—and there was no option to work remotely,” says Carrillo, who started with loanDepot in 2018. “We had all this downtime while the system was refreshing. It was horrendous working with that system during the pandemic.”

Carrillo says that once loanDepot made the decision to go beyond traditional ERP and transitioned to Workday Enterprise Management Cloud and other Workday financial management solutions in 2021, she saw a marked improvement in productivity and employee satisfaction.

“It’s really enabled our people to be more efficient and more productive,” she says. “And now, the team is able to work from wherever they want without sacrificing functionality or system performance on their local machine.”

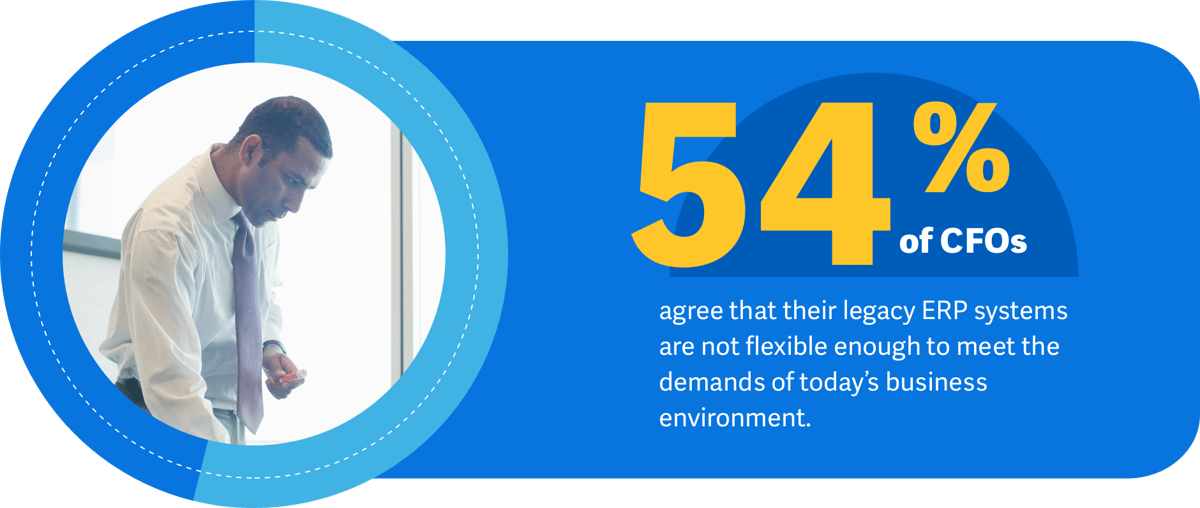

Source: The CFO Indicator Study: The CFO-CIO Relationship: The Path to ERP-Enabled Finance Transformation, by Workday, July 2022

At a time when the role of finance leaders is evolving, the challenges that resulted from the global COVID-19 pandemic highlighted the inefficiencies of legacy finance and accounting processes. As the “next normal” has emerged, no longer are CAOs, CFOs and controllers only considered to be the gatekeepers of accounting principles and knowledge. Now, they’re also expected to drive business strategy and help make decisions that will boost the bottom line.

But many finance departments are stymied by inefficient legacy systems, which prevent them from accessing and analyzing all of the available data to unlock and produce valuable insights. Increasingly, finance leaders are realizing the importance of partnering with CIOs and other business leaders across their organization to embrace technology that streamlines manual processes, creates opportunities for real-time analytics and insights, and frees up the workforce to focus on strategic business objectives.

Partnering with IT is a key step in reimagining the enterprise

Pre-pandemic, many companies were considering digital transformation as part of their technology roadmap to remain competitive. But after offices globally were shut down due to Covid-19, many organizations discovered just how inefficient their internal systems and processes were in a remote work environment. Out of necessity, many companies considering digital transformation projects accelerated the timeline on these initiatives. Just look at the growth in cloud ERP revenue one year into the pandemic: It grew 18% to a market value of $23.3 billion in 2021. For the first time, cloud revenue overtook license and maintenance revenue to become the dominant revenue contributor; in 2021, 53% of ERP revenue came from cloud, versus 49% in 2020 (contributing $19.8 billion).* Companies realized they needed an environment that could quickly adapt to unforeseen changes and made the decision to transform their infrastructure.

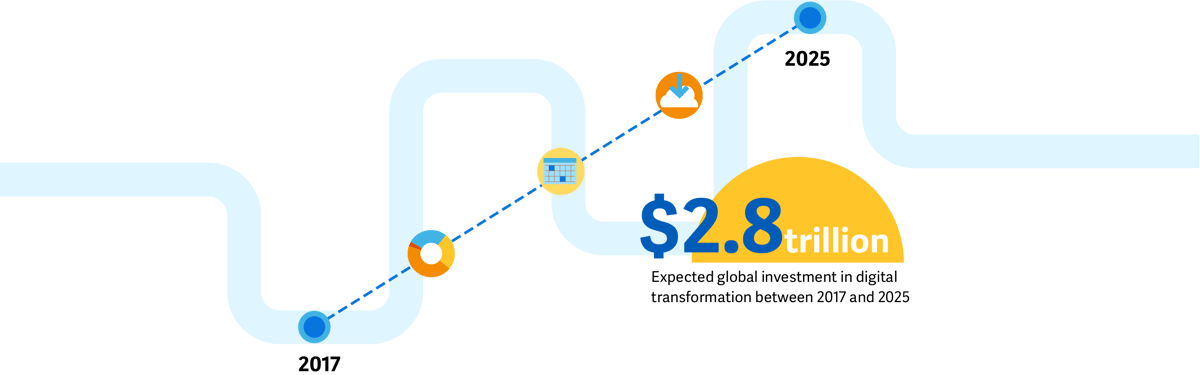

Source: Global digital transformation spending 2025, by Statista Research Department, 16 Feb, 2022

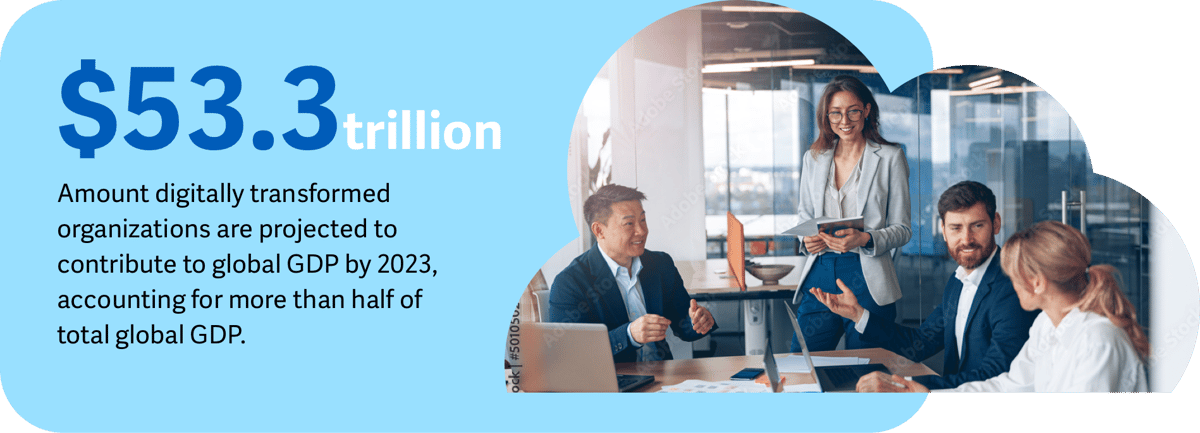

Many companies look solely to their CIO to drive digital transformation, but more finance leaders are partnering with IT to reimagine their companies for success, and to create a digital finance footprint that enables more agile decision-making and better business outcomes.

Source: Nominal GDP driven by digitally transformed and other enterprises worldwide 2018-2023, by Statista Research Department, 23 May, 2022

Digital finance transformation reduces an eight-hour wait to a mere 30 minutes

Carrillo had these goals in mind when she partnered with loanDepot’s CIO to begin its digital transformation. She says that embarking on this endeavor was challenging—especially during a pandemic—but it was key to empowering teams to help move the business forward.

The stakes were high. Founded in 2010, loanDepot is one of the nation’s largest non-bank retail mortgage lenders. The company has thousands of employees who assist over 10,000 customers each month.

“Digital transformation for us was really about taking our team out of data input and day-to-day tasks and automating those so that they could spend more time doing higher-level data analysis to glean strategic insights,” she says. “We wanted to get data and information in a way—and in a system—where we could be more helpful to the business.”

The productivity gains of loanDepot’s digital transformation have been significant, Carrillo says. For instance, with the previous system, it used to take six to eight hours to upload standard mortgage-related entries, but using Workday solutions, it now takes about 30 minutes. Making scenario-modeling changes to a salesperson’s commission plan previously involved two teams and required four systems and a week’s worth of work.

“You could probably have one or two people from a team do it in one to two days now, leveraging Workday’s Adaptive Planning Suite,” she says. Carrillo adds that the productivity increase has given the accounting team the time to focus on driving value—for customers, shareholders, and other stakeholders. The recovery rate on receivables, for instance, has jumped at least 40%, which essentially means that the accounting department is saving loanDepot money that would’ve been written off and resulted in an operating loss for the company.

“This system really has enabled us to lift our team and myself out of the day-to-day tasks, so we can be more powerful and provide more strategic insights to the business,” Carrillo says.

*Citation: Gartner Market Share Analysis: ERP Software, Worldwide, 2021, Chris Pang, Dennis Gaughan, 9 August 2022