Upwardly Mobile: How Asia’s Largest Food Delivery Platform Is Creating an Inclusive Digital Economy

Food delivery is booming across Asia.[1]

In a logistical feat that took just ten years, one of the region’s favorite food delivery platforms has grown from its Singapore home base to become Asia’s largest food and grocery delivery network outside of China.[2]

Today, foodpanda serves millions of users – riders, customers and merchants – in 400 cities across 11 markets. Its success wasn’t founded on chance, but built on new ways of bringing food, people, culture and tech closer together.

When the pandemic hit Asia in 2020, foodpanda recognized the need to quickly help local communities sustain their businesses and connect them with customers who needed food and daily essentials amid movement restrictions. It raced to digitize the small businesses and merchants who had lost their footfall overnight, including hawkers, market vendors and mom-and-pop stores, and helped thousands of displaced workers transition to delivery riders.

Covid-19 also highlighted the limitations of once-prevalent cash on delivery – and revealed the need to stay on top of changing consumer preferences. Here, foodpanda realized there was one area that needed to be improved and scaled rapidly.

Reaching the Unbanked

While contactless payments were already gaining traction before the pandemic, lockdowns and the need to minimize physical contact accelerated the shift from cash to digital financial services.[3]

“Throughout the global upheaval, our priority was to ensure that anyone, in cities big and small, could get easy access to essential food and grocery deliveries, especially during times of lockdowns.”

— Arun Makhija, Chief Financial Officer of foodpanda Asia

For foodpanda, this meant reaching underserved communities that lacked access to credit cards or bank accounts, instead of limiting them to cash-only. Finding a way to accept mobile wallet payments became especially crucial in places like Bangladesh and the Philippines, two foodpanda markets where almost half the adult population remains unbanked.[4]

“As a platform, we want to give our customers options so they can pay using whichever method they prefer – whether it’s cash, credit cards or a new category of digital wallets,” said Arun Makhija, Chief Financial Officer for foodpanda Asia. “We needed to quickly bolster our payments systems to cater to more new users, so we had to move fast.”

Finding the Right Partner

To reach the most people in the shortest time, foodpanda needed localized digital payment methods at scale. It found an ideal partner in Ant Group’s Alipay+, whose suite of cross-border digital payment solutions and frictionless, one-time integration enabled foodpanda to unlock popular digital payment methods across its diverse markets.

“For our millions of customers in Asia, this created a new option for payments that gave them the freedom of choice to pay as they prefer. With Alipay+, we were aligned in our goal of efficiency – through a single partnership, we were able to support a large range of payment methods across multiple markets,” explains Makhija.

Since September 2020, Alipay+ has integrated foodpanda with leading local mobile wallets: GCash in the Philippines, TrueMoney in Thailand, bKash in Bangladesh and AlipayHK in Hong Kong, connecting new consumer segments with foodpanda’s extensive merchant base and enhancing the payment experience for all.

As Jia Hang, Regional General Manager for Southeast Asia at Ant Group, notes, “Ant Group is committed to continuously innovating and enabling inclusive, convenient digital payments and digital financial services. Our partnership with foodpanda, the first of its kind, offers more inclusive and convenient payment services to both consumers and businesses. And it demonstrates how digital payments are key to driving the digitalization of business activities as the last mile of a consumer purchase journey.”

Making Marketing Mobile

As mobile wallet payments rapidly become a way of life, with their transaction value projected to surge from $4.1 trillion in 2020 to $7 trillion in 2025 across Asia-Pacific,[5] foodpanda and Alipay+ are constantly thinking of new ways to enhance the customer journey and increase user retention.

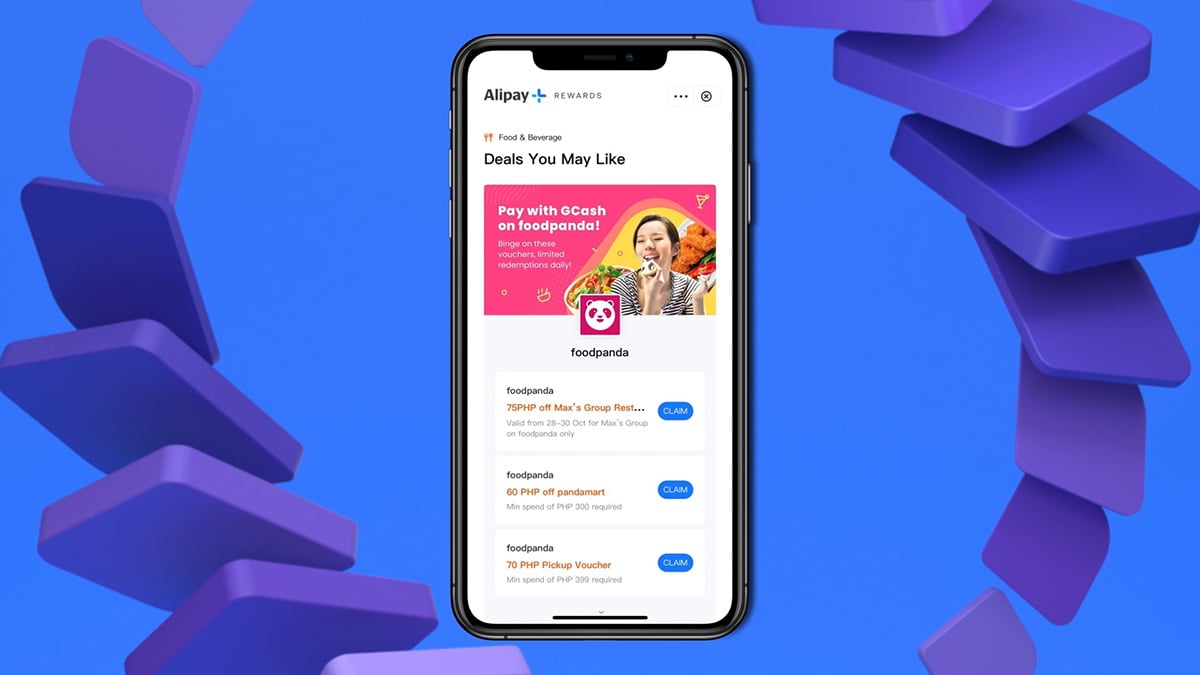

Besides payments, Alipay+ also provides digital marketing solutions. Alipay+ Rewards enables foodpanda merchants to embed exclusive deals and discounts directly within native mobile wallet apps, driving user stickiness and even online-to-offline conversion. GCash users in the Philippines, for example, could head to KFC’s brick-and-mortar outlets to redeem the KFC vouchers they discovered in their GCash app, driving in-store traffic.

A Region on the Rise

Since forming its partnership with Alipay+, foodpanda has seen double-digit growth in the number of its digital payment transactions across Asia. As digital consumption intensifies, continued growth is on the horizon.

In Southeast Asia alone, the food delivery sector added the greatest proportion of new adopters to become the most penetrated digital service in 2021, with more than 7 in 10 internet users ordering food delivery at least once.[6]

The opportunities are immense – and as food delivery evolves and hurtles the region’s digital economy to a $1 trillion opportunity by 2030,[7] Alipay+ and foodpanda are just getting started.

“As Alipay+ continues to expand our ecosystem partners with more digital payments providers, we certainly hope to connect more payment methods for foodpanda,” says Jia Hang of Ant Group, Alipay+'s parent.

That ambition is shared by foodpanda. “We see Alipay+ as an important partner in our journey ahead as we continue to build on speed and convenience for millions of customers in Asia,” adds Makhija. “To achieve this, we will continue to explore and evaluate new and innovative ways of collaboration.”