Closing the Gender Gap in Social Security Income

How an Athene annuity can help women take control of their retirement.

Social Security is the major source of retirement income for most older adults. Among elderly beneficiaries, 37% of men and 42% of women receive 50% or more of their income from Social Security, according to the Social Security Administration. Women—who earn, on average, $0.80 for every $1 earned by men, and thus receive less monthly income from their Social Security—rely on it more heavily.

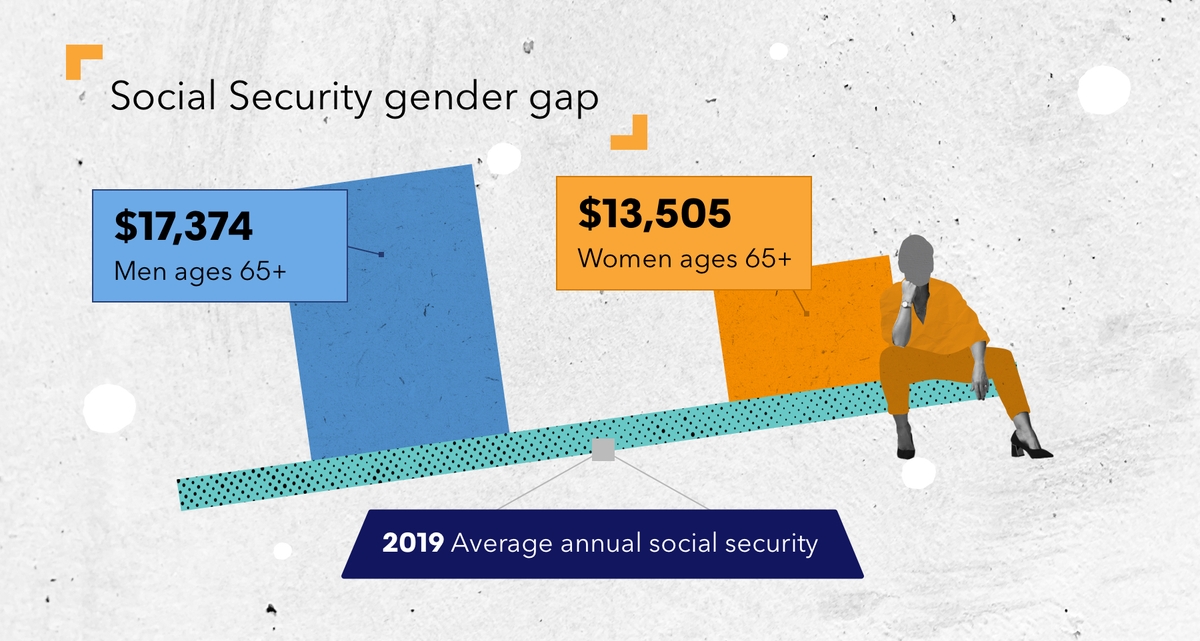

In 2019, the average annual Social Security income received by women 65 years and older was $13,505, compared to $17,374 for men. Living, on average, four years longer than men, women may need to save more throughout their lifetime to accommodate longer periods in retirement, according to the Pensions Policy Institute.

Athene, the West Des Moines, Iowa-based provider of retirement income solutions, believes it’s vital for women to understand the Social Security issues facing them and how they impact their overall retirement strategy.

“I’d encourage financial professionals to develop a well-rounded understanding of Social Security and its role in creating a sound, capital-efficient income plan for their clients,” says Rod Mims, Athene’s Senior Vice President of National Sales. “Athene offers a comprehensive collection of Social Security materials to help educate and enhance conversations with clients.”

Mims says that it’s never too early for financial professionals to start the conversation. He says that financial professionals should begin by asking their clients these key questions:

- Have you estimated the amount of money you’ll need to live the lifestyle you want?

- Do you know your estimated Social Security benefit at the age you plan to retire?

- What other sources will you rely on for income in retirement?

“Even when retirement is years away, it’s important to understand the potential impact when making life decisions,” Mims says. “A change in your own or a loved one’s health, a job change, or a loss of income can dramatically affect your ability to save money for retirement and the social security benefit amount you receive.”

How education about Social Security benefits can reinforce the need for an annuity

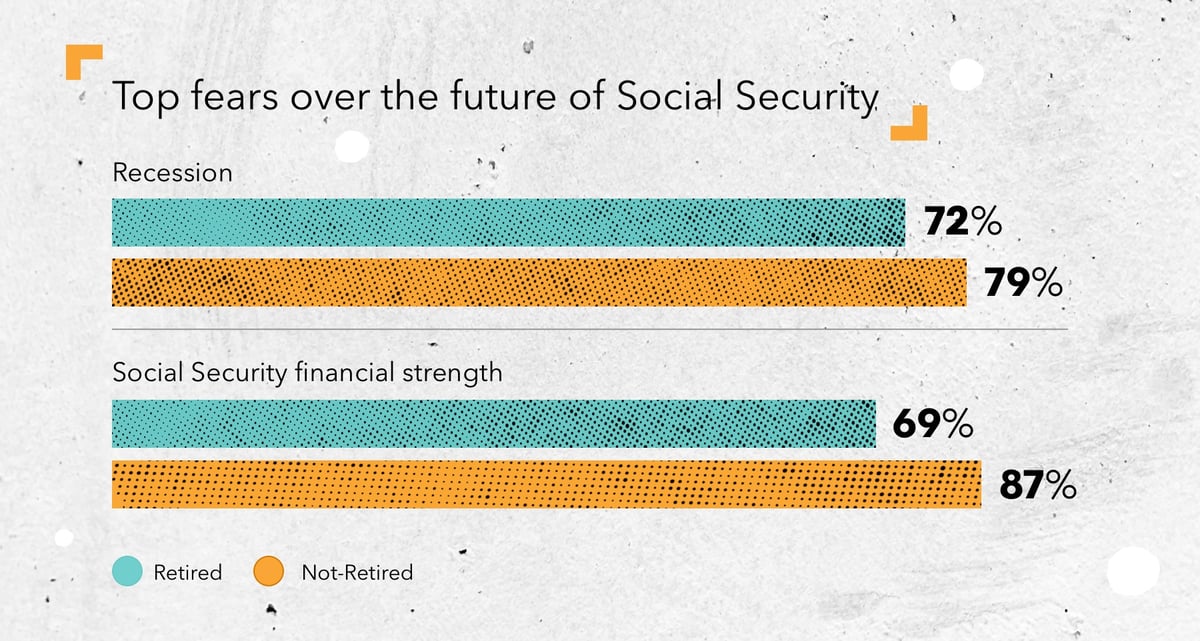

Athene recently conducted a survey with Kiplinger on the impact of guaranteed income in retirement. Fears about a US recession and uncertainty over the future of Social Security were respondents’ top two financial concerns. Seventy-five percent of survey respondents said they would like to have more guaranteed income in retirement than they already have or expect to have. Most (57%) said more guaranteed income would ease concerns about running out of money. Over one-third say more would ease volatility concerns.

Social Security is one source of guaranteed income. As pension benefits decline, the only other source for most Americans is an annuity. Athene offers annuities that help accumulate funds, protect principal from risk of loss due to market downturns, and provide a source of guaranteed lifetime income. For example, annuities can help you bridge the income gap between when you leave your job to full Social Security age, allowing you to maximize your Social Security benefit amount.

Annuities offer a variety of benefits and features that can be tapped into based on individual needs. That need may mean more growth in your retirement dollars, tax-deferred advantages or having the flexibility to start guaranteed income when you need it or make legacy planning decisions.

“Learning more about Social Security can also help reinforce, for financial professionals and their clients, the importance of guaranteed income when managing risks, such as longevity, and conserving retirement assets,” Mims says.

Fixed indexed annuities offer the potential for interest earnings tied to the performance of stock market indexes while providing a level of protection from loss due to market downturns. They also offer the option for guaranteed income that can’t be outlived.

“People get caught up with this idea of ‘what’s the number of dollars I need to accumulate to retire,’ but it’s really about the income generated from those assets that will determine how much you can spend in retirement and how long that income will last,” Mims says.

Women, annuities and filling the income gap

According to the Center for Retirement Research at Boston College, married women aged 50–59 tend to fare much better financially in retirement than those who never married or are divorced. However, married women who depend on a spouse’s retirement benefits may suffer severe income decline after their spouse’s death, when their spouse’s pension plan is either reduced or terminated, although they may be eligible for Social Security survivors' benefits.

Social Security is based on earned income and the benefit is backed by the US government. Annuities are part of a person’s retirement savings and investments and guaranteed by the issuing company. Social Security benefits include an annual cost-of-living adjustment; annuities may have that feature at an additional cost.

If a spouse passes while receiving Social Security, the surviving spouse may receive most or part of their benefits as a survivor, but depending on their status, the payment could be greatly reduced. Similarly, depending on how an annuity is set up, they may continue to receive a surviving spouse benefit from the annuity, or could receive a lump-sum payment. However, annuities also include features for the surviving spouse to continue the same benefit even after the spouse has passed and unlike Social Security, this benefit doesn’t get reduced.

While Social Security representatives are trained to explain Social Security options, they cannot ask personal questions or give advice. Annuities, on the other hand, are offered by insurance carriers through financial professionals who are highly trained and understand the complexities of designing a retirement income plan and will take the time to understand each individual’s unique situation.

“The financial professional is an important dynamic in these relationships, particularly as they help women sift through their Social Security benefit options,” Mims says. “At Athene, we understand the financial challenges women face with Social Security and offer solutions that can help them optimize a comprehensive retirement income plan so they can retire with confidence.”

Not affiliated with or endorsed by the Social Security Administration or any governmental agency.

Annuities contain features, exclusions, limitations and availability that may vary by state and/or sales distributor. For a full explanation of an annuity, please refer to the Certificate of Disclosure or Prospectus (as applicable) and contact your financial professional or the company for costs and complete details.

Athene Annuity and Life Company (61689), headquartered in West Des Moines, Iowa, and issuing annuities in 49 states (excluding NY) and in D.C., and Athene Annuity & Life Assurance Company of New York (68039), headquartered in Pearl River, New York, and issuing annuities in New York, are not undertaking to provide investment advice for any individual or in any individual situation, and therefore nothing in this should be read as investment advice.

The purpose of this material is solicitation of insurance. Any sale of an annuity will require contact with a financial professional. The term “financial professional” is not intended to imply engagement in an advisory business with compensation unrelated to sales. Financial professionals will be paid a commission on the sale of an Athene annuity.

ANNUITIES ARE PRODUCTS OF THE INSURANCE INDUSTRY AND NOT GUARANTEED BY ANY BANK NOR INSURED BY FDIC OR NCUA/NCUSIF. MAY LOSE VALUE. NO BANK/CREDIT UNION GUARANTEE. NOT A DEPOSIT. NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY. MAY ONLY BE OFFERED BY A LICENSED INSURANCE AGENT.