How an Annuity Can Help Protect Your Retirement Savings From High Inflation and Market Volatility

Athene is standing up to tough times by offering versatile retirement products that can be a win-win for the annuity industry and consumers.

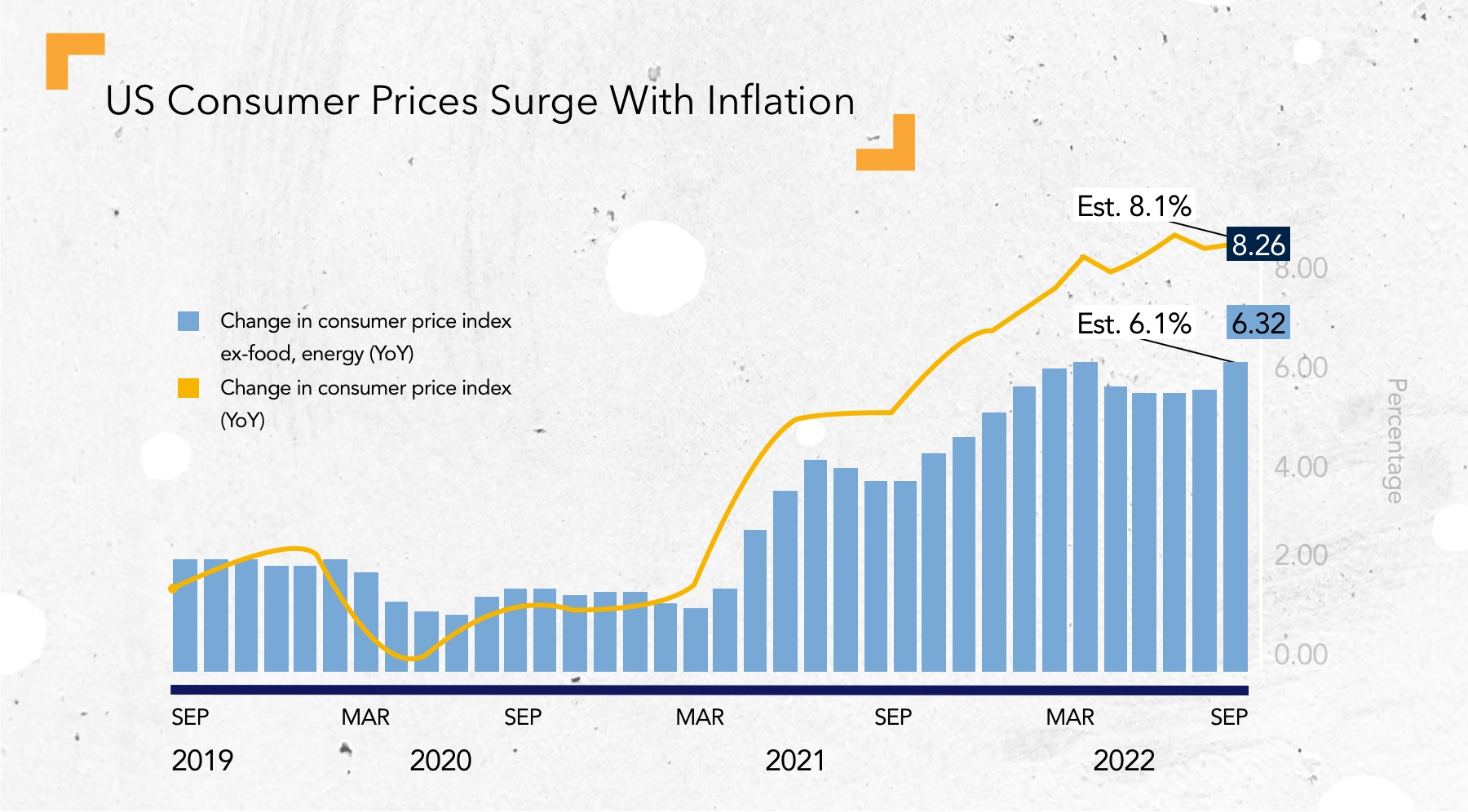

In June 2022, the US inflation rate hit a 40-year high as the Consumer Price Index for All Urban Consumers increased 9.1%, the largest 12-month increase since 1981, according to the Bureau of Labor Statistics. For consumers, inflation not only affects their ability to pay for essential goods and services such as food, housing and gas, it also erodes the value of their investments and retirement savings. In retirement, inflation also leaves consumers with less assets to tap into for these basic needs.

Looking for guaranteed returns and protection against market loss and inflation, financial professionals are recommending annuities for their clients at record levels. According to LIMRA, total U.S. annuity sales increased 16% to $79.4 billion in the second quarter of 2022, easily surpassing the previous quarterly sales record of $68 billion set during the Great Recession of 2008.

At Athene, the West Des Moines, Iowa-based provider of retirement income solutions, rising inflation has presented a tremendous opportunity for the company’s annuity offerings to help customers find a measure of financial security during turbulent times. In both 2020 and 2021, Athene was ranked No. 1 in the industry in fixed indexed annuity sales, according to LIMRA.

1 LIMRA, U.S. Individual Annuities Sales Report, 2Q22

“Athene’s retail product suite is designed to help people retire better and meet them on their terms, their age, their risk tolerances and the amount of investable assets, whether large or small,” says Mike Downing, Athene’s Chief Operating Officer. “Our success really rests with our customers and financial professionals who entrust us to take care of their financial future. It’s imperative that we deliver on that to be successful as a business.”

How annuities keep pace with inflation

Nearly nine of out 10 people aged 65 and older in the United States are receiving Social Security retirement benefits, according to the Social Security Administration.

Annuities keep up with inflation in two key ways, according to Downing. First, annuities may still accumulate value as rates rise, unlike a bond portfolio where, when rates go up, the value goes down.

Second, Athene’s most popular product, fixed indexed annuities, provide both the principal protection to guard against market downturns as well as growth potential that is connected to the growth of a variety of indices. “What you might see is that as inflation rises, equity markets will rise in conjunction with that more rapidly,” Downing says. “A fixed indexed annuity that is tied to that type of index will also rise more rapidly and actually react in time to a rising rate environment. That’s the bread and butter of what Athene has to offer.”

A well-prepared financial professional for the well-prepared customer

There are many common misconceptions about annuities, according to Downing. Many people think of annuities, he says, as exchanging a large amount of their asset portfolio for a fixed level of income, as opposed to a product that can also provide basic retirement needs like principal protection, income generation and, in some cases, guaranteed lifetime income. Often, potential customers can benefit from talking to an experienced financial professional who can educate them about some of these misconceptions.

“What I think really connects the customer to a financial professional is that a good financial professional will understand the full spectrum of features that an annuity has to offer,” Downing says. “The financial professional that understands these key features is going to be better able to incorporate an annuity within a broader retirement strategy.”

For Downing, the first thing a financial professional should understand is how inflation is personally impacting their client. “Inflation is going to impact clients in different ways,” he says. “And it’s incumbent upon a financial professional to be able to understand which aspects of inflation they need to manage. Secondly, as a financial professional, I would explain how these annuities can offer ways to help mitigate the risk of losing purchasing power due to inflation, depending on the type of annuity and features that customers are comfortable with.”

The right time for an annuity

While customers are concerned about inflation, it's presented a unique opportunity for insurance carriers like Athene to step up with annuity solutions to ease fears and provide customers with more value from rising rates.

“Financial professionals and customers are seeing more value in the benefits of annuities, so more money is being steered into the insurance space, in general,” Downing says. "What's probably most important for nearing retirement customers is that if they haven't been looking at annuities in the past, now may be a good time to start as values rise. By partnering with a financial professional, they can learn about annuity options that can help them ease their worries so they can confidently live out the retirement they envisioned."

Read more about market fluctuationsThis material is provided by Athene Annuity and Life Company (61689) headquartered in West Des Moines, Iowa, which issues annuities in 49 states (excluding NY) and in D.C.

Not Stock market Investment: Indexed annuities are not stock market investments and do not directly participate in any stock or equity investments. Market indices may not include dividends paid on the underlying stocks, and therefore may not reflect the total return of the underlying stocks; neither an index nor any market-indexed annuity is comparable to a direct investment in the equity markets.

Financial professional defined disclosure: The term “financial professional” is not intended to imply engagement in an advisory business with compensation unrelated to sales. Financial professionals will be paid a commission on the sale of an Athene annuity.

ATHENE ANNUITIES ARE PRODUCTS OF THE INSURANCE INDUSTRY AND NOT GUARANTEED BY ANY BANK NOR INSURED BY FDIC OR NCUA/NCUSIF. MAY LOSE VALUE. NO BANK/CREDIT UNION GUARANTEE. NOT A DEPOSIT. NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY. MAY ONLY BE OFFERED BY A LICENSED INSURANCE AGENT.

Invitation to Inquire disclosure in bold: Annuities contain features, exclusions, limitations and availability that vary by state and/or sales distributor. For a full explanation of an annuity, please refer to the Certificate of Disclosure or Prospectus (as applicable) and contact your financial professional or the company for costs and complete details. This material is a general description intended for general public use.