How the Great Resignation Generation Can Make Smart Retirement Decisions

Quitting or changing your job shouldn’t be the end of the road for your retirement savings.

52% of Gen Z and millennials are somewhat or extremely likely to consider a job change in the coming year, according to the Microsoft Worker Survey.¹

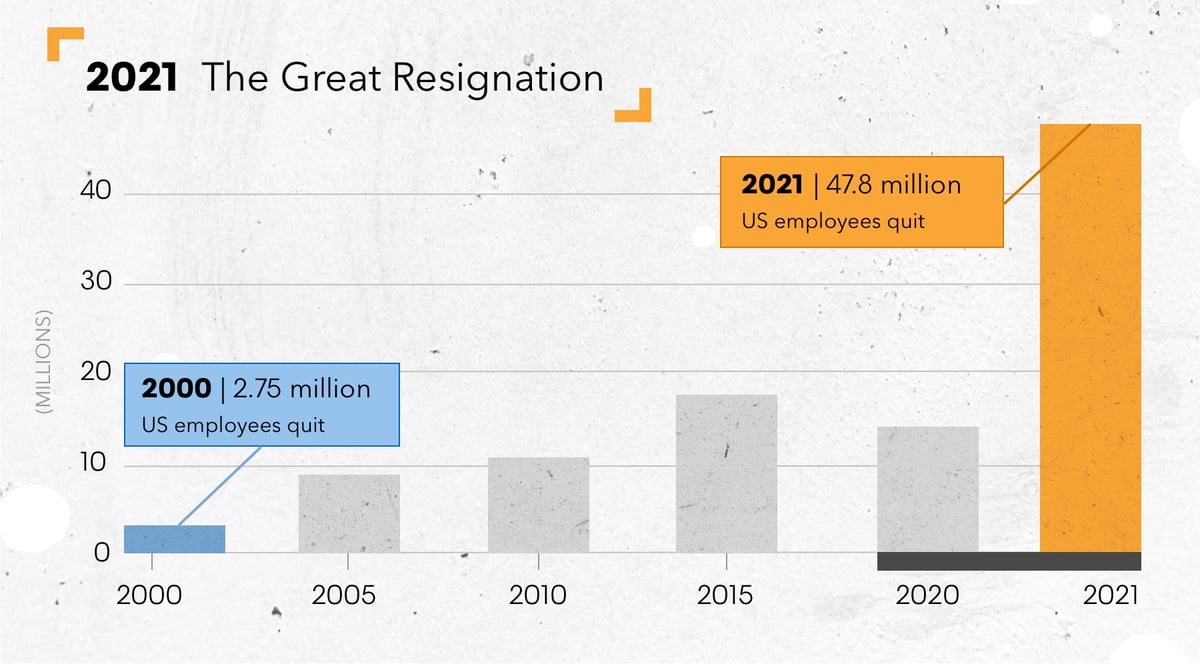

In 2021, 47.8 million US workers quit their jobs, an average of nearly 4 million each month—the highest monthly average since the Bureau of Labor Statistics began providing this data in 2000. Many of these people left 401(k)s with their employers or cashed them out.

Amid this Great Resignation, exacerbated by the Covid-19 epidemic, a 2021 report by Capitalize estimated that 24 million forgotten 401(k)s held $1.35 trillion in assets. These forgotten 401(k)s, says Capitalize, represent on average almost $700,000 in retirement savings.

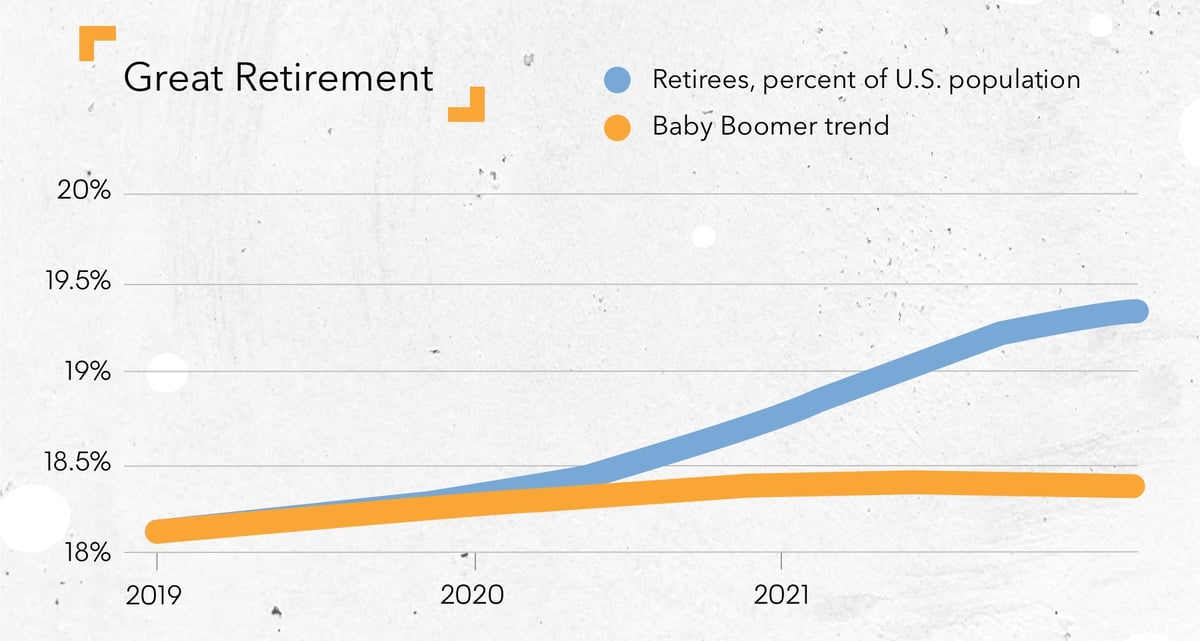

The Great Resignation occurred concurrently with the Great Retirement, as 3.5 million people aged 55 and older retired in 2020 and 2021, according to the Pew Research Center.

People who have voluntarily left the workforce must now consider using their retirement savings for vital long-term needs such as health care costs. According to a Harris Poll, almost 40% of Americans will make these decisions with the help of a financial professional, who increasingly recommend solutions for their client’s retirement income needs from companies like Athene.

Over the last few years, Covid restrictions prompted Athene, a retirement solutions provider, to host video conferences with thousands of financial professionals to educate them about its annuity products. Attendance ranged from two or three people up to 500 per session, and Athene focused on client needs and helping financial professionals educate consumers about annuities. The West Des Moines, Iowa-based leader in annuity sales2 was forced to use these less than conventional means to meet the growing demands of a steadily evolving workforce.

Offering guaranteed income for life, protection from market downturns and growth potential, annuities are a popular option for customers creating a retirement income strategy. In 2021, total annuity sales were $254.8 billion, the highest annual sales figure since 2008 and the third highest on record, according to the Secure Retirement Institute (SRI). Athene went from fourth in the industry in fixed-income annuity sales at the beginning of the pandemic to first within 12 months.

“Annuities are not some kind of silver bullet for a secure retirement,” says Chris Grady, Head of Retail Sales at Athene. “But we do believe that most people should have a diversified portfolio that includes annuities, which can help provide the protection, growth potential and guaranteed income they need for a financially secure retirement.”

Why annuities are the right choice for the Great Resignation generation

Within 401(k)s, there are typically growth options like mutual funds, fixed income funds and money market funds. An annuity provides similar diversification options by providing a variety of index-linked options like S&P 500® and other custom indices. However, Grady believes the biggest benefit to moving money into an annuity is that you need to work with a financial professional to purchase one, allowing you to receive guidance for the option best suited for you.

“Most 401k(s) don’t give you individual advice,” he says. “But when purchase an annuity, you're going to get a financial professional that is dedicated to helping you make your retirement dreams a reality.”

Grady says that there are three reasons why financial professionals recommend Athene annuities. Athene offers competitive rates, which provide value and growth potential for clients. Second, following its merger in January 2022 with Apollo—one of the largest asset managers in the world, with $512 billion assets under management—Athene has the capital to grow in a very cash-intensive business, which results in more innovative product solutions that fit client’s unique retirement needs. Third, Athene has a very specific mission. “We’re driven to help our customers retire better,” Grady says. “We do this by focusing on one core retirement option—annuities.”

How financial professionals help clients shift their mentality from wealth creation to protection

Most financial professionals are focused on wealth creation, whereas Athene, as a retirement income solution provider, is dedicated to wealth preservation. Amid the Great Resignation, Grady believes it’s important for financial professionals to learn how to make this transition to wealth protectors as market volatility may cause their client’s retirement assets to fluctuate significantly. Athene will help financial professionals start to move their clients to options with protection from market loss to help them live out retirement more confidently.

To determine a course of action, financial professionals must perform a needs analysis with each client. “Everybody’s needs are different,” Grady says. “A good financial professional will match suitable solutions to cover the needs of the client.”

Long- and short-term solutions for Great Resigners

Every day, more than 10,000 people in the U.S. turn 65, according to the Department of Health and Human Services. Grady says that the Great Resignation group and those turning 65 require both short- and long-term solutions. Grady encourages financial professionals to ask their clients two starter questions: 1. How long are you going to live? 2. How much will you pay in health care costs?

“These are two important unknowns that clients likely won't have an answer for but need to plan for,” he says “Making sure their clients are prepared for retirement risks that could disrupt their plan is important. Annuities with guaranteed lifetime income can be one way to help solve for that."

Grady says that the industry must do a better job of simplifying the message about its products for customers and financial professionals. “The Great Resignation has shown us that we need to simplify the stories we tell about annuities and get creative with how we educate financial professionals and their clients,” he says. “We recognize that talking about retirement isn’t comfortable for everybody. Yet we know that we have a big responsibility to give you the resources you need to become more knowledgeable through these life changing decisions so you can retire better.”

Curious how a fixed indexed annuity could fit into your retirement plan? Learn more from Athene.

²Per LIMRA US Individual Annuities YTD 4Q2021, Athene ranked number one in fixed indexed annuity sales for calendar year 2021.

Athene Annuity and Life Company (61689), headquartered in West Des Moines, Iowa, and issuing annuities in 49 states (excluding NY) and in D.C., and Athene Annuity & Life Assurance Company of New York (68039), headquartered in Pearl River, New York, and issuing annuities in New York, are not undertaking to provide investment advice for any individual or in any individual situation, and therefore nothing in this should be read as investment advice.

The purpose of this material is solicitation of insurance. Any sale of an annuity will require contact with a financial professional. The term “financial professional” is not intended to imply engagement in an advisory business with compensation unrelated to sales. Financial professionals will be paid a commission on the sale of an Athene annuity.

ANNUITIES ARE PRODUCTS OF THE INSURANCE INDUSTRY AND NOT GUARANTEED BY ANY BANK NOR INSURED BY FDIC OR NCUA/NCUSIF. MAY LOSE VALUE. NO BANK/CREDIT UNION GUARANTEE. NOT A DEPOSIT. NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY. MAY ONLY BE OFFERED BY A LICENSED INSURANCE AGENT.

Annuities contain features, exclusions, limitations and availability that may vary by state and/or sales distributor. For a full explanation of an annuity, please refer to the Certificate of Disclosure or Prospectus (as applicable) and contact your financial professional or the company for costs and complete details.