Is the Sandwich Generation Ready for Retirement?

Nearly 75% of adults in the aptly named “Sandwich Generation” have adjusted their retirement goals to support their adult children and aging relatives, according to a 2025 survey conducted for Athene by The Harris Poll.

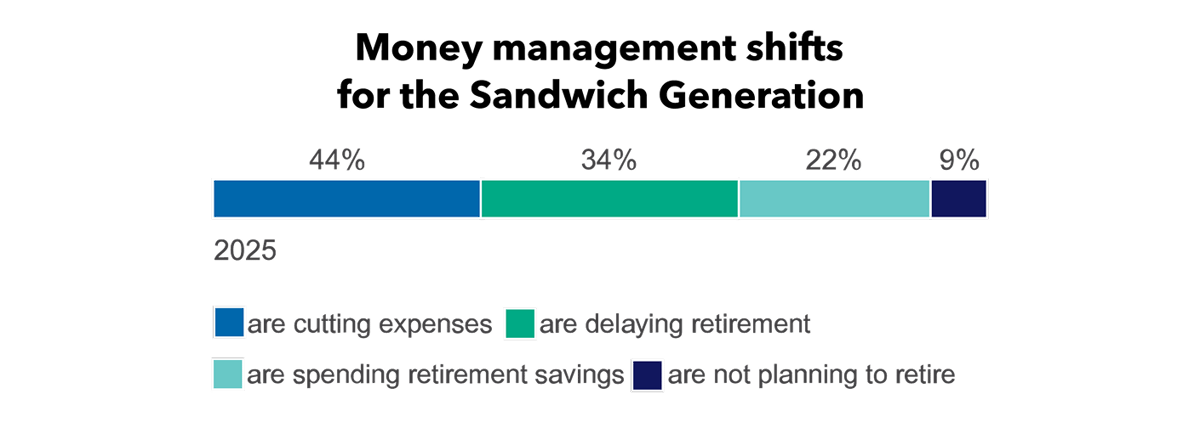

According to survey results, feelings toward saving money, managing financial priorities and retiring have shifted for these 40- to 59-year-olds who provide financial or caregiving support to adult children and elderly family members. To meet their family’s needs, some members of the Sandwich Generation are reducing expenses, delaying retirement or dipping into their retirement savings, while others aren’t planning to retire at all.

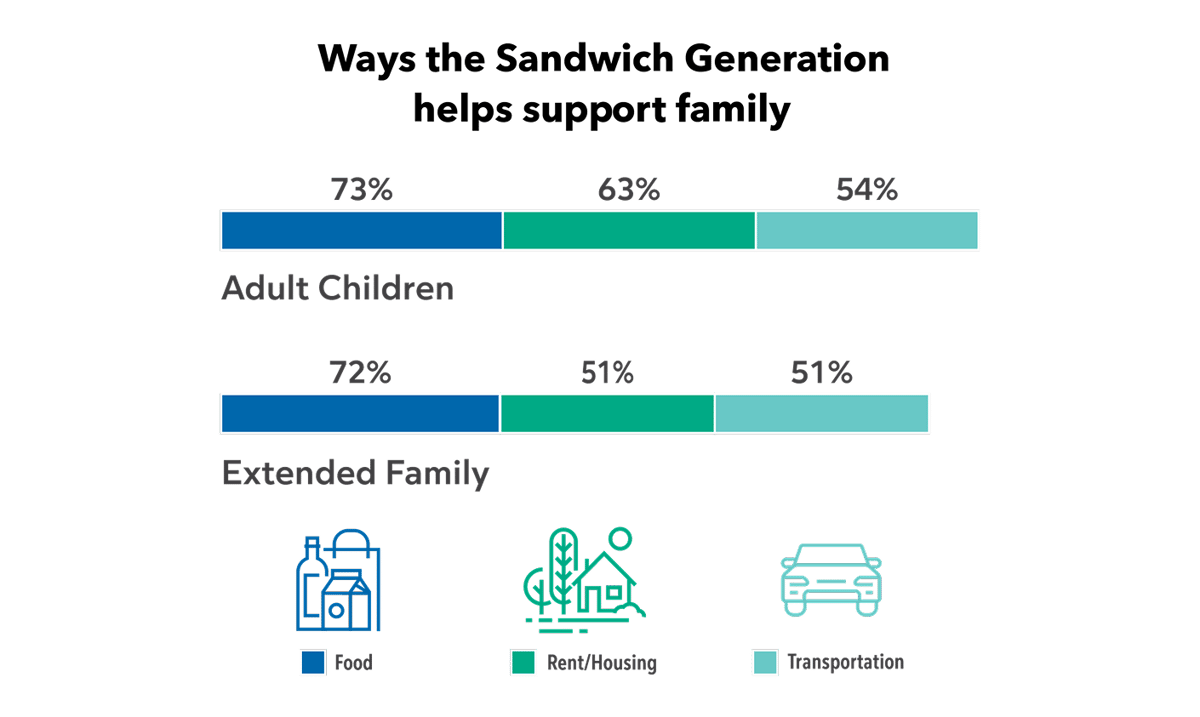

Sandwiched adults often cover expenses like housing, food, phone bills and education for family members. Over 70% help with food costs, and more than half contribute to housing.

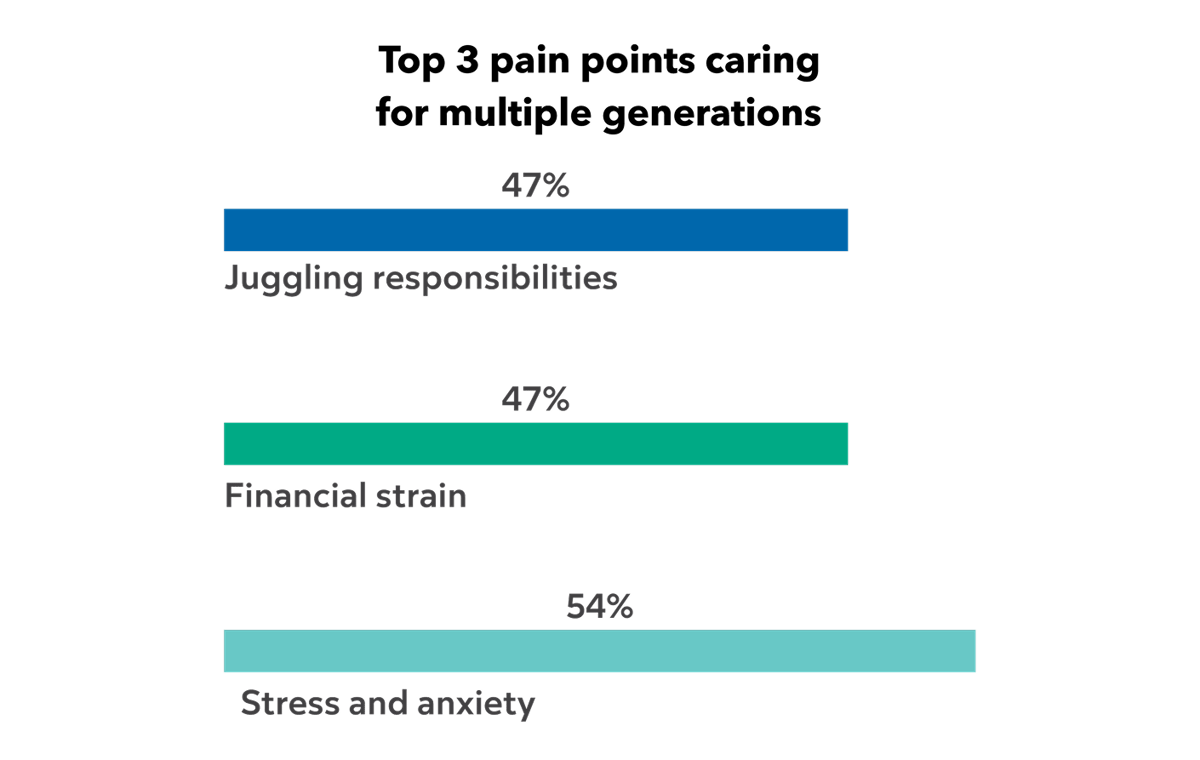

Supporting multiple generations involves more than financial costs — it also brings emotional stress and feelings of being overwhelmed. Managing income, schedules, and transportation can be challenging, especially when torn between the needs of children and aging parents. Still, over half of respondents feel confident in their ability to help financially, while 66% of those less confident believe more income would improve their situation.

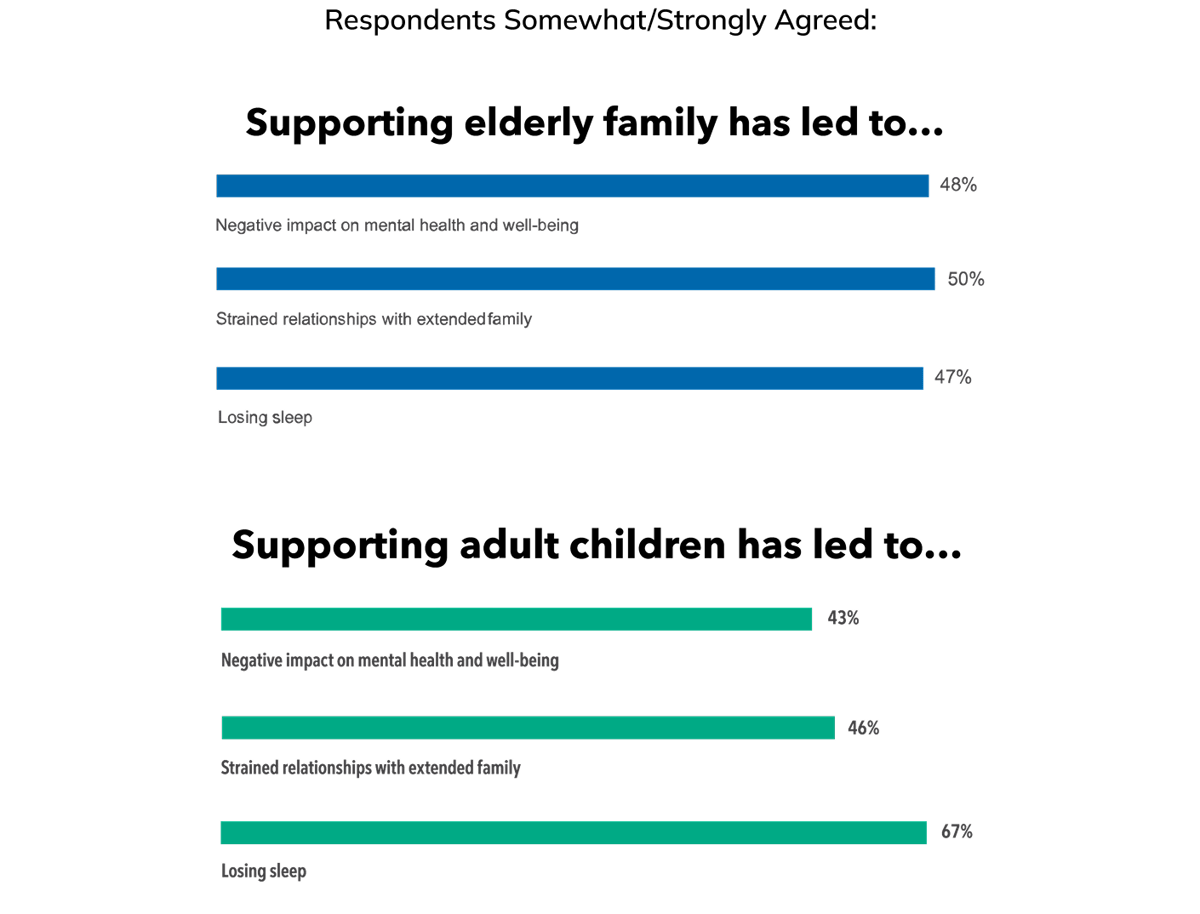

The survey revealed added stress from handling legal and financial issues and modifying homes for aging relatives. Financial support often leads to strained relationships, mental health challenges and sleep loss due to financial pressures.

Different genders, different challenges

Most sandwiched caregivers commit to long-term support, with 74% helping adult children until they’re financially stable or as long as needed, and 77% aiding adult relatives as long as needed or indefinitely.

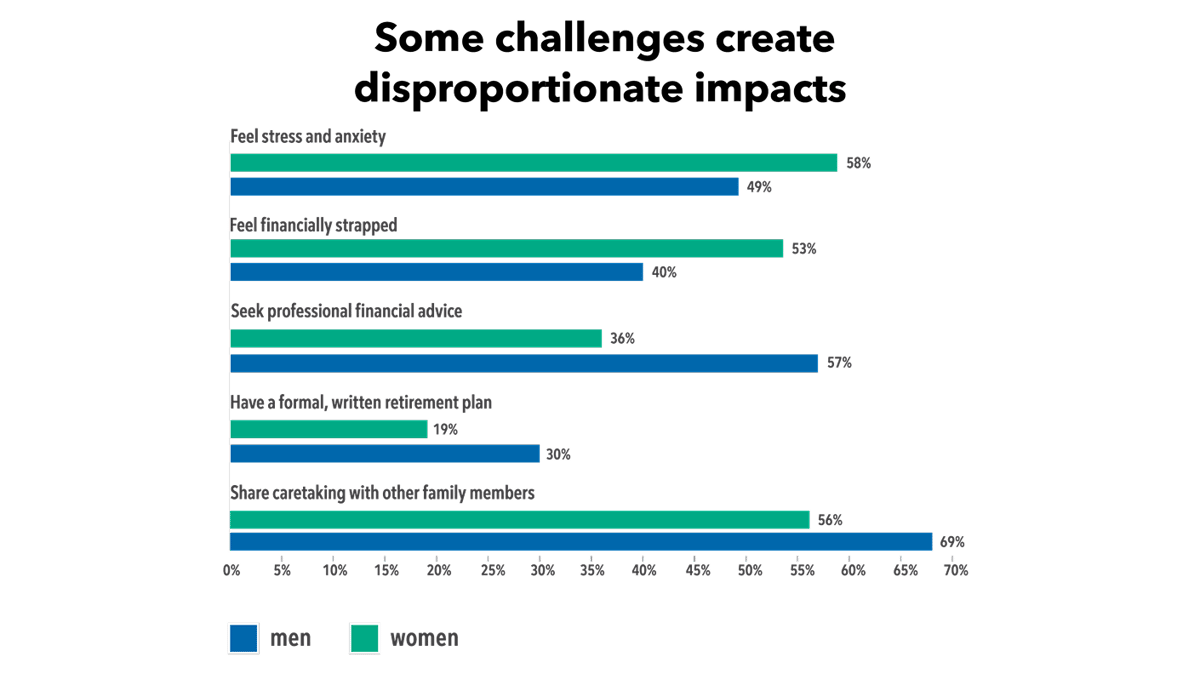

Overall results only tell part of the story. Men and women offer different types of support. Women are more likely to help adult children with food (80% vs. 66%) and clothing (57% vs. 50%), while men are more likely to support extended family with insurance (31% vs. 23%) and senior day care (26% vs. 18%).

Seeking professional financial help

More sandwiched women than men reported feeling stress, anxiety, financial strain and other negative impacts related to the support they provide family members. In addition to the toll on their mental and emotional well-being, fewer women are getting the support they need.

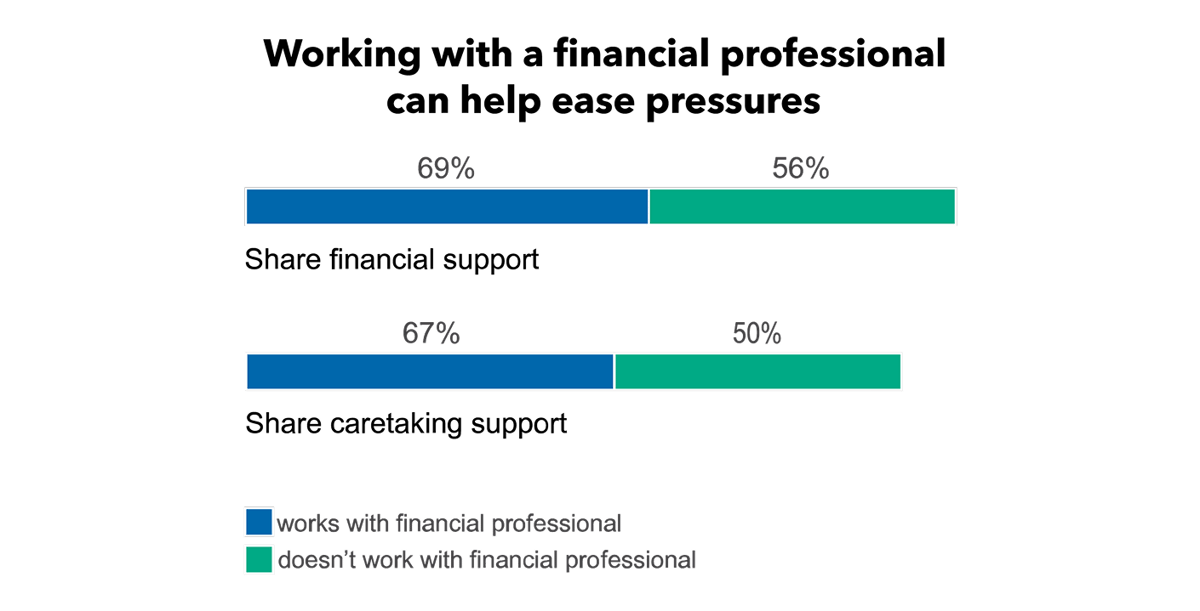

If you’re supporting both adult children and aging relatives, on top of meeting your own expenses, working with a financial professional may help. According to survey results, 90% of people working with a financial professional have seen a positive impact on their financial future. And, they’re more likely to share financial and caregiving responsibilities with others, helping ease financial pressure and stress.

3 more ways financial professionals can help

Financial professionals can provide more than just help managing your retirement savings. There are several other kinds of support that can help you manage competing financial priorities, care for loved ones and manage daily life.

- Prioritizing your retirement

Retirement planning can take a back seat to present demands. A financial professional can help you budget, start saving and build a retirement plan — boosting confidence in your financial future. - Helping adult children gain financial independence

Many adult children earn income but struggle with saving or debt. Nearly half of respondents (48%) believe teaching financial responsibility earlier would help. It’s not too late — explore ways to support their path to independence. - Helping with resources for aging relatives

Caregiving can be complex, but a financial professional can help you save, manage taxes and reduce costs. They can also offer support for your aging relatives.

• Making sure their income is managed well

• Helping with long-term care planning

• Addressing taxes

• Managing estate planning

A financial professional can help identify the best ways to help achieve your financial goals and explain solutions like fixed indexed annuities that can provide protected accumulation and guaranteed retirement income. No matter your timeline, expert guidance can boost confidence and financial security.

Methodology

Athene surveyed 1,024 Americans aged 40–59 who support adult children and elderly relatives to explore the impact on retirement readiness. Conducted by Harris Poll, the survey ran from January 2-19, 2025.

Indexed annuities are not stock market investments and do not directly participate in any stock or equity investments. Market indices may not include dividends paid on the underlying stocks and therefore may not reflect the total return of the underlying stocks; neither an index nor any market-indexed annuity is comparable to a direct investment in the equity markets.

The term “financial professional” is not intended to imply engagement in an advisory business with compensation unrelated to sales. Financial professionals will be paid a commission on the sale of an Athene annuity.

This material is a general description intended for informational and educational purposes. Athene Annuity and Life Company (61689), headquartered in West Des Moines, Iowa, and issuing annuities in 49 states (excluding NY) and in D.C., and Athene Annuity & Life Assurance Company of New York (68039), headquartered in Pearl River, New York, and issuing annuities in New York, are not undertaking to provide investment advice for any individual or in any individual situation, and therefore nothing in this should be read as investment advice. Please reach out to your financial professional if you have any questions about Athene products or their features.

INVESTMENT AND INSURANCE PRODUCTS ARE: • NOT FDIC INSURED • NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY • NOT A DEPOSIT OR OTHER OBLIGATION OF, OR GUARANTEED BY, THE BANK OR ANY OF ITS AFFILIATES • SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED