Adding Value: Indonesia’s Bold Plans for a Downstream Future

Indonesia is embarking on a series of projects that will transform Southeast Asia’s largest economy.

With a targeted $545 billion in investment between now and 2040, the country plans to turn its resource-rich economy into a major exporter of manufactured products by stimulating raw-material development and pumping unprecedented investment into downstream processing.

To achieve its goals, Indonesia wants to expand and broaden the value chains of 21 commodities in minerals, coal, oil, natural gas, plantations, marine, forestry, and fisheries – cementing its position as a global manufacturing and trade hub.

Foreign investor interest in Indonesia is already at an all-time high, drawn to the country’s huge resource reserves, political stability, skilled and low-cost labour force, and strategic position within Asia and the burgeoning ASEAN economic region.

In 2022, investment realization surged 34% from the previous year to $84.1 billion. The share of FDI in that total grew from 50.4% in 2021 to 54.2% in 2022.[1] Investment in downstream sectors is also on an upward spiral as Indonesia’s flourishing opportunities draw more overseas businesses into several key sectors.

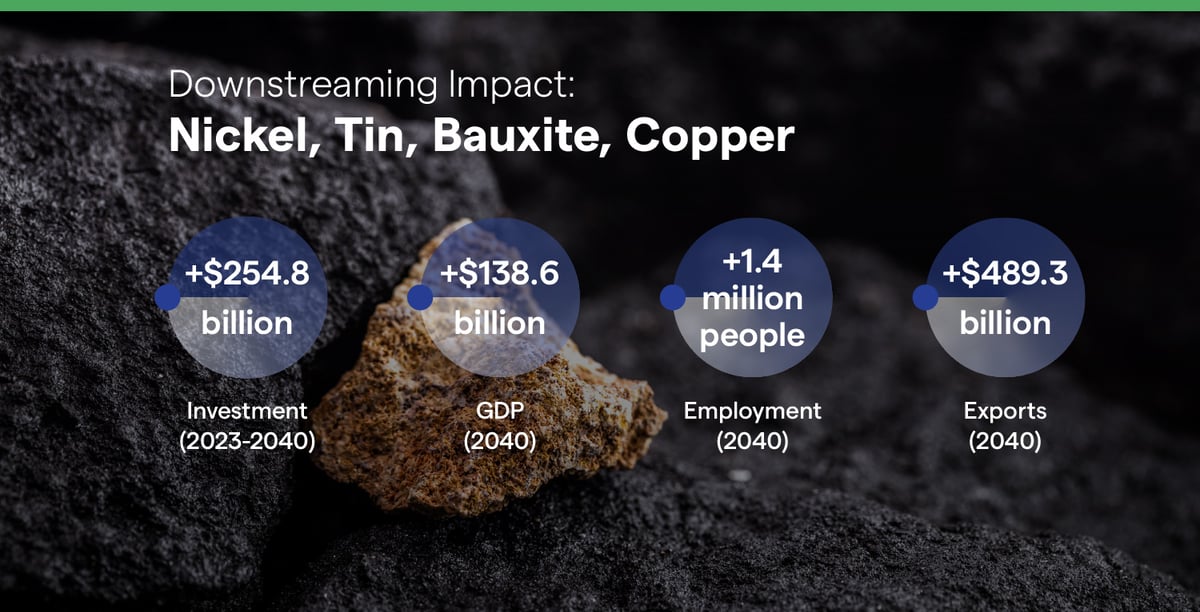

Minerals

Indonesia has been an important source of raw minerals for decades, but now the country is strengthening its position in downstream processing, too.

In 2022, investment in downstream mining rose to almost $9.2 billion, compared with $4.1 billion in 2019. These investments have made a crucial contribution to the evolution of Indonesia’s mining industry. Exports of raw nickel, for example, were valued at $3 billion in 2017. Five years later, exports of nickel products such as stainless steel were worth $33 billion.[2]

Accelerating that momentum will require more FDI, particularly in the field of electric vehicles and batteries, where nickel is a key ingredient. Indonesia has the world’s biggest nickel reserves, so rather than export nickel and import batteries, companies are seeing the advantages of manufacturing close to raw material sources.

For instance, Korean auto giant Hyundai recently started building a plant in Indonesia that will produce 130,000 electric vehicles. It also investing in a large-scale battery facility with LG Energy Solutions to help meet the surging global demand for electric vehicles.

Similarly, Indonesia has huge reserves of bauxite, tin, and copper, and with targeted investment through 2040, the country can become one of the world’s leading players in the future multi-billion-dollar markets for products like solar panels, EV components, PVC, cabling, and dynamos.

Plantations

Palm Oil – Indonesia is renowned globally as the world’s largest producer of palm oil. Demand for biofuel, oleochemicals, and oleo foods that rely on palm oil as a feedstock is expected to keep growing through at least 2040.

Indonesia’s 2022 Strategic Investment Downstream Roadmap has placed a priority on developing palm oil derivative products to cement Indonesia’s position as the market leader in oleochemicals (used in detergents, cosmetics, soaps, toothpaste) and oleo foods (cocoa butter substitute, carotene and tocopherol).

Rubber – Already the world’s second-largest natural rubber producer and exporter, Indonesia has set a target to become one of the top five global players in the downstream rubber products industry. Demand for a range of products including tyres (aircraft, motorcycles, bicycles and four-wheeled vehicles), construction bearings and medical gloves is expected to accelerate over the next two decades, and with the right investment, Indonesia can position itself as a key producer.

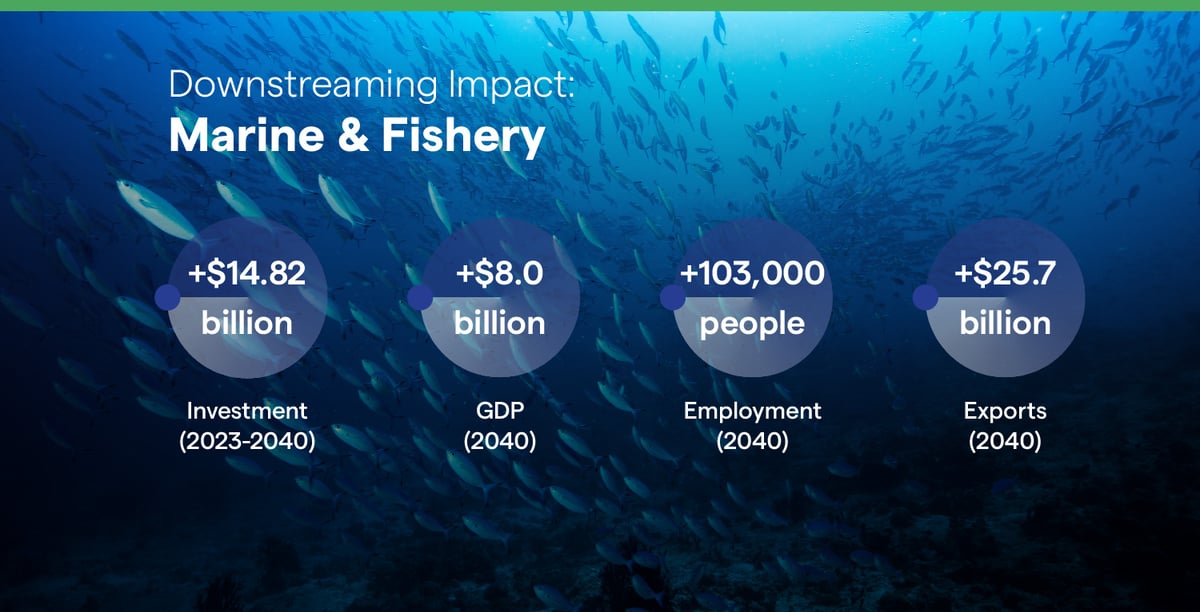

Marine & Fishery

Indonesia’s waters are of global importance, both as an economic resource and a trove of marine biodiversity. Exploiting these resources responsibly and sustainably, and at the same time positioning the country as an industry leader, is a top priority.

The country’s oceans and ponds produce the second-biggest volume of seafood in the world, including 10% of the planet’s skipjack tuna. Indonesia is also the second-largest producer of seaweed -- used for food -- flours, thickeners, and bio-stimulants.

The global market for marine products will continue to grow. Demand for animal protein is expected to rise by more than 50% in the next three decades, and terrestrial farms will not have the capacity to meet it. Indonesia has the resources to fill that gap.

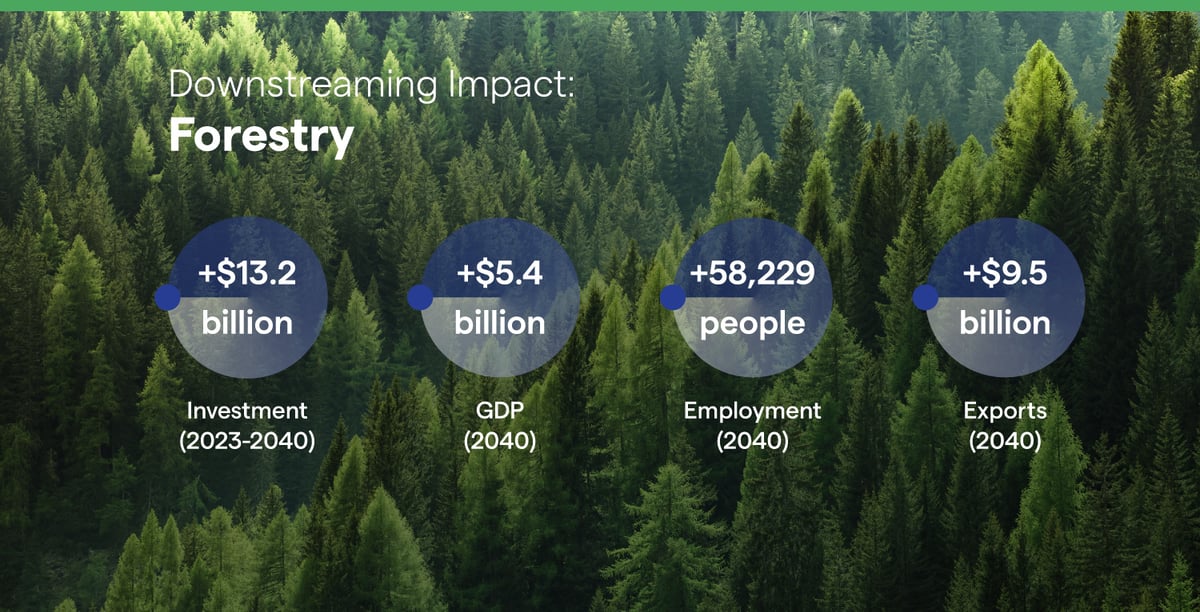

Forestry

Indonesia has the third-largest expanse of forest on Earth, and while the government’s conservation efforts have successfully cut the deforestation rate to the lowest in two decades, the country also has a thriving wood product industry to maintain.

After banning the export of logs in 2021, Indonesia’s exports reached an all-time high of $13.5 billion, but the opportunities in the export of premium plywood, furniture, house and ship components, and wood pellets remain robust. Meanwhile, demand for pine resin – which is used across numerous industries in products such as adhesives and sealants – looks positive, with the global market poised to grow at a CAGR of 4.5% by 2027.[3]

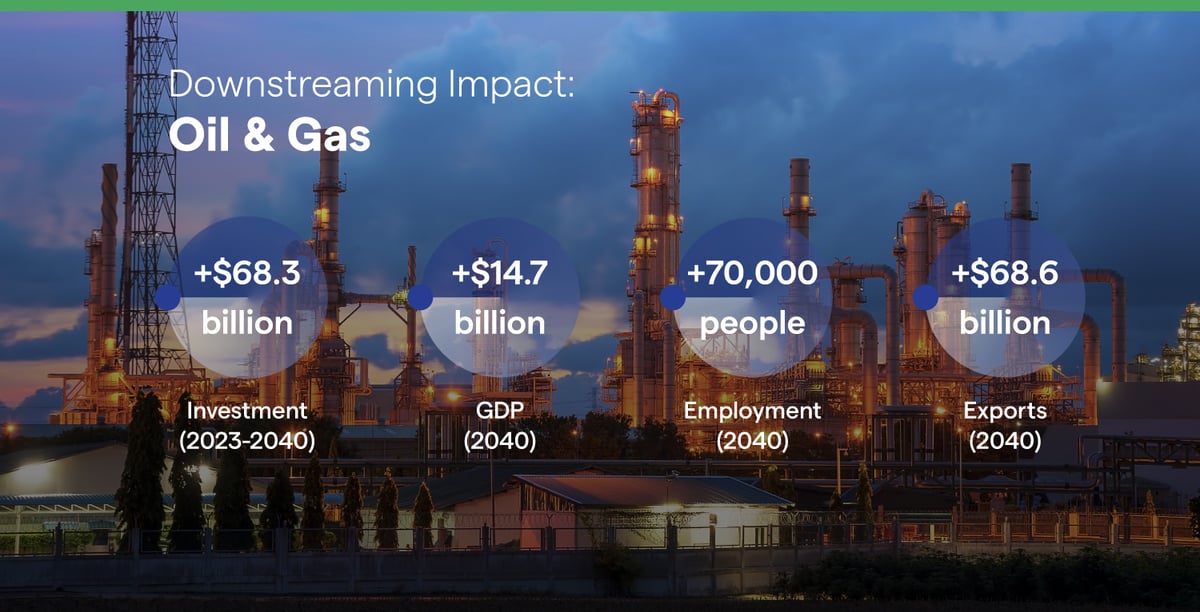

Oil & Gas

The downstream oil and gas industry is forecast to grow at around 4% a year through 2028, and Asia-Pacific will be the fastest-growing market.[4] In Indonesia, investments in refining and petrochemicals are surging to meet growing domestic demand. The country is speeding up plans to double refining capacity to meet this demand, as well as to cut reliance on imports.[5]

With the necessary FDI, Indonesia can boost exploration, revive stalled projects, and lift production of both crude oil and natural gas.

National Action Plan

Indonesia’s shift downstream will create jobs, increase profits for its commodities sector, and reduce carbon emissions -- part of a broader strategy to transition to an advanced economy.

The government’s national action plan will align stakeholders – from ministries to the private sector -- set downstream targets, and establish fiscal and non-fiscal incentives to achieve them. Indonesia will also continue to improve the investment ecosystem by clarifying and simplifying the licensing and legal process, while providing special incentives for priority investment sectors. It will also invest in its workforce through upskilling and re-skilling programs, and forge closer links between industry and the education sector.