Natural Advantages: Investing in Indonesia’s Growing Potential

Indonesia is blessed with abundant fertile farmland and bountiful seas. Going back as far as the 4th century, the country has been prized among foreign traders as a key supplier of the agricultural commodities that feed and fuel the world.

Today, Indonesia is among the world’s dominant players in the markets for economically vital products such as palm oil, biofuels, and rubber, as well as one of the largest suppliers of fish. But as Southeast Asia’s largest economy evolves, it will transform from being solely an exporter and into one of the planet’s biggest producers of goods such as oleochemicals, aircraft tyres, and sustainable seafood.

To achieve this, Indonesia will need about $45.4 billion in foreign direct investment (FDI) through 2040.

The government recently implemented new measures to ease the process of overseas investment. Regulations covering FDI have been harmonized and simplified, and legal complications resulting from conflicting or overlapping protocols have been eliminated through the Omnibus Law No. 6 of 2023.

All business fields have been fully opened to FDI (with a few exceptions) and investment licensing procedures have been simplified with an online single-submission system.

For foreign investors, the considerable opportunities offered by Indonesia’s agricultural economy have never been more accessible.

Seeds of Prosperity

Indonesia is already one of the two global powerhouses in palm oil production, and with renewed investment the industry stands on the cusp of a new era of growth.

Since 2008, about 85% of the FDI in Indonesia’s agriculture sector has been invested in palm oil, responding to a surge in global demand, which has more than doubled over the past two decades.[1] By attracting a further $4.3 billion in foreign investment through 2040, Indonesia can bolster that success and become a world leader in oleochemicals and oleo foods.

Most people are familiar with the use of palm for cooking oils and other food products, but it is also a vital industrial ingredient. Oleochemicals are used in rubber and paper production, as metalworking and automotive lubricants, fuel additives, and in personal care products like soaps, lotions, cosmetics and deodorants.[2]

The global market for these chemicals is forecast to grow from $29.8 billion in 2021 to $49 billion by 2030. [3]

Palm oil is also key in the production of renewable diesel, ethanol, biodiesel, and biojet fuels.

Indonesia is one of five countries globally that are leading the expansion of biofuel use[4]* as countries increasingly implement policies to reduce greenhouse gas emissions and use indigenous resources to reduce dependence on oil imports.

The United States, Brazil, Europe and Indonesia are the dominant biofuel markets, accounting for 85% of total demand. Nearly 60% of biofuel demand is in advanced economies and 40% in emerging economies.[5]

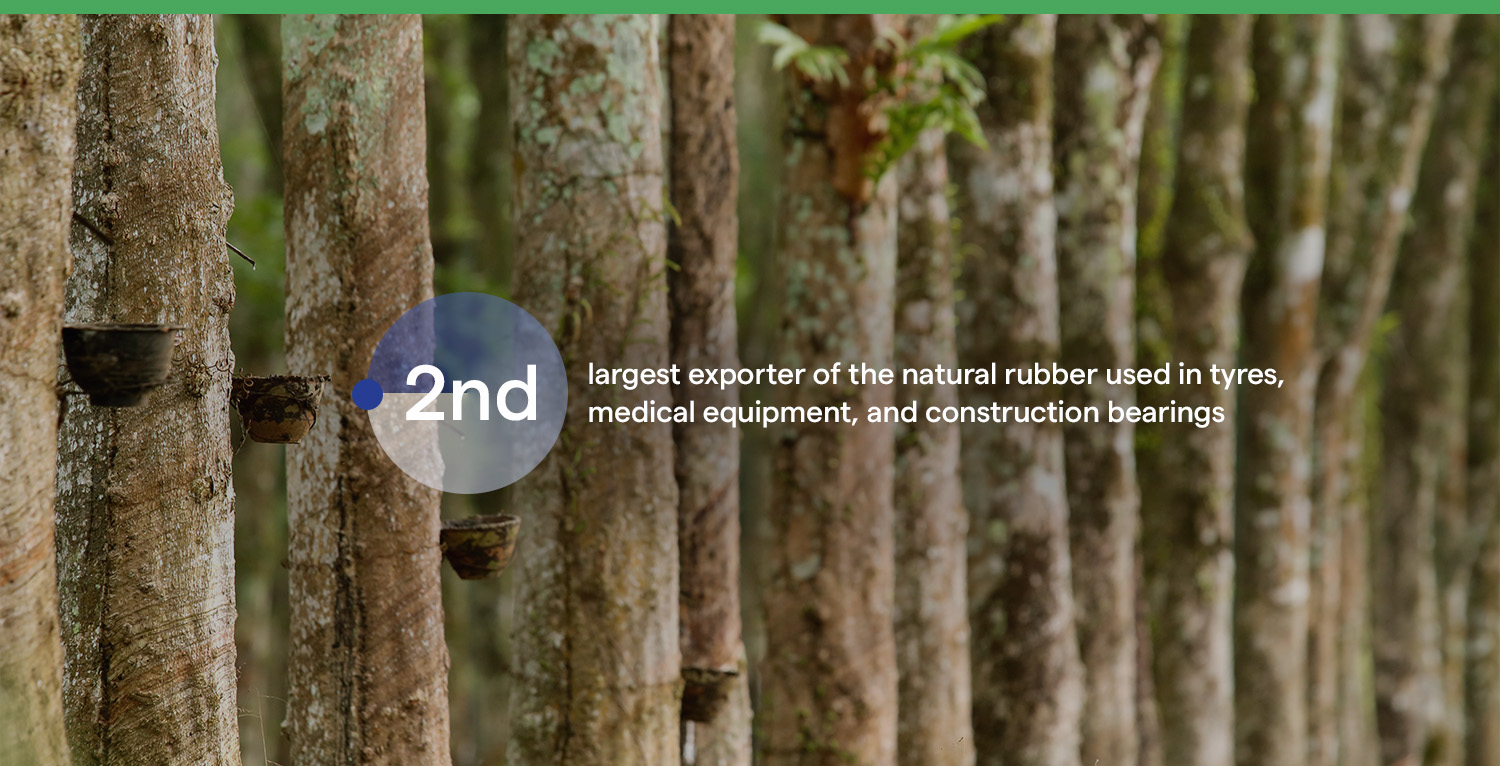

Indonesia is the second-largest exporter of the natural rubber used in tyres, medical equipment, and construction bearings, producing almost a quarter of the world’s entire supply.

Though it is a trade deeply rooted in history, the Indonesian rubber industry still has a promising future, with the global market for rubber predicted to grow at a CAGR of 4.6% between 2023 and 2030.[6]

Rubber from Indonesia has the technical specifications needed by the tyre industry, and with an estimated $6 billion in overseas investment over the next 16 years, according to the country's Ministry of Investment/BKPM, Indonesia could develop its capabilities in sectors such as aircraft tyres and construction bearings.

A Global Leader in Aquaculture

Indonesia has vast marine resources – both wild and farmed – and the country’s fisheries are of global importance.

Indonesian waters support more than 3,000 species of bony fishes, more than 850 types of sharks, rays, and chimaeras, and the world’s largest stocks of skipjack tuna. The country also has 6.5 million ponds, tended by 2.5 million farmers. Nationwide, the fisheries industry employs about 12 million people.[7]

Aquaculture production is valued at $12 billion a year,[8] making Indonesia the second-biggest seafood producer in the world in 2020, but the industry’s potential is much greater. With sufficient investment, the country has an opportunity to become a global leader in aquaculture and help meet the estimated 52% increase in global demand for animal protein over the next 30 years, with minimal impact on the planet.

Indonesia recognizes that it has a responsibility to “fish smarter, not harder,” and has put plans in place to transform its fisheries for long-term sustainability. To ensure its marine resources remain sustainable, Indonesia has established at least 20 million hectares of Marine Protected Areas (MPAs)[9] and is seeking investment and collaboration to develop practical, science-based solutions for fisheries management.

A quarter of the world’s farmed seaweed is also produced in Indonesia, with the majority of it consumed domestically, where it is a key ingredient in products such as agar-agar flour, bio-stimulants, and carrageenan.

A Well-Managed Forestry Future

Indonesia’s timber and forestry industry is thriving at a time when most of the other major producers in the world – including Brazil, Gabon, Mexico, and Congo – are struggling.

Indonesia is among the globe’s largest exporters of forestry and timber products, including plywood, pulp and paper, furniture, and handicrafts. Forestry exports reached a record $13.5 billion in 2021, led by paper ($4.3 billion), pulp ($3.7 billion), and wood panels ($2.9 billion).[10]

Demand for Indonesian-made furniture and crafts is forecast to boom, along with premium plywood, home and ship components and wood pellets. The government expects furniture exports alone to almost double to $5 billion in 2024, compared with $2.8 billion in 2022.[11]

Steps are also being taken to ensure Indonesian forestry products meet strict sustainability requirements. In March 2023, the country’s Ministry of Environment and Forestry launched its Timber Legality and Sustainability Verification System to help exporters and buyers verify that Indonesian wood is legal and sustainable.