Keep More of What You Earn: Adding Tax Alpha to Portfolios

Tax efficiency must become a prime investment consideration

One out of every three dollars invested in U.S. mutual funds was held in a taxable account at the end of 2023, representing $8.4 trillion in assets.1 Tax-related blind spots may affect millions of American households that own mutual funds in taxable, non-retirement accounts.

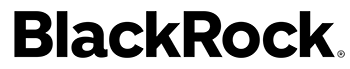

“If you ask the average investor what’s more detrimental to overall portfolio returns, they will probably say fees. But it’s actually the taxes,” says Daniel Prince, U.S. Head of iShares Consulting. In fact, taxes are a multiple of fees. “What’s underneath the iceberg has often been more detrimental to a taxable investor,” says Prince.

Taxes on distributions shaved an average of 2% off the annual performance of alpha-seeking (actively managed) U.S. Large-Cap Blend mutual funds for taxable investors in the decade ending in 2023. That figure is more than double the 0.82% average expense ratio charged by those same funds in 2023.2

Two steps you can take now that may help help clients lower their tax bills include: 1) monitoring and avoiding capital gain distributions and 2) tax loss harvesting

Over the past 10 years, mutual fund capital gains distributions have steadily increased,3 with strong U.S. equity returns and $2 trillion in alpha-seeking U.S. equity fund outflows adding fuel to the fire for taxable gains.

It is also important to understand that your clients may still owe capital gains on losing funds. For example, in 2022, when both stocks and bonds were down double digits, many shareholders were caught off guard when, somehow, they still owed taxes on capital gains distributions. How was this possible on funds posting losses?

Despite negative returns, these funds had realized gains on underlying positions that appreciated in value. “That really shined the light on structural differences between mutual funds and ETFs,” says Prince, who points to tax efficiency as a critical element of modern portfolio design. “It’s about how do you take that one step further and really focus on minimizing what’s becoming a very large cost – and that’s taxes.”

Structural differences in ETFs may help mitigate unwanted capital gains distributions.

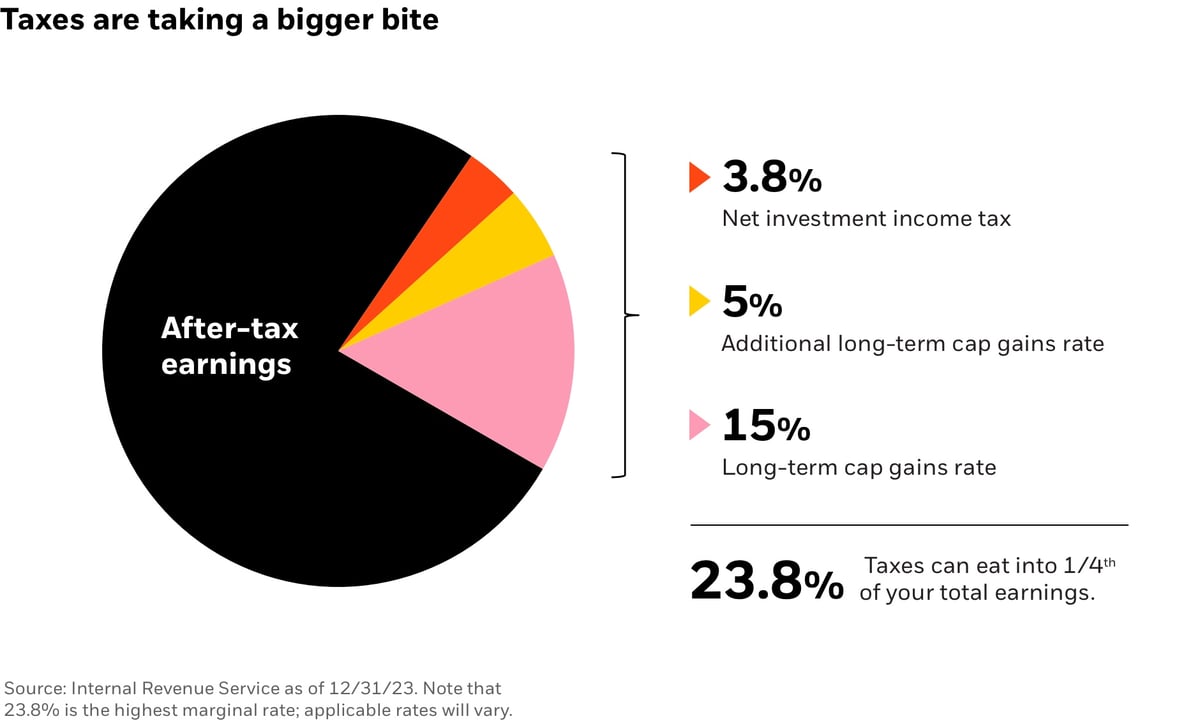

ETFs are one way to improve portfolio tax efficiencies. They represent 29% of the $27 trillion in U.S. managed fund assets but distributed less than 1% of 2023’s total capital gains distributions.4

“With ETFs, you generally pay your own capital gain when you sell,” says Prince. “They insulate your own activity from that of others. They say you are responsible for your own share of the gains.”

The structural benefits of ETFs are not limited to index-based funds. We’re seeing a surge in the popularity of actively managed ETFs that combine alpha strategies with the benefits of the ETF structure. Over the last three years, active ETFs have grown 37%, amassing $437 billion in flows.5 Active ETFs have many of the potential benefits of their indexed counterparts, including tradability, transparency and, in some cases, tax efficiency, while also providing access to professional investment management. Only 19% of active U.S. equity ETFs paid a capital gain in the last five years, compared to 76% of active U.S. equity mutual funds.6

Another way to minimize capital gains is through tax loss harvesting: a strategy in which investors can sell investments at a loss to offset capital gains elsewhere. To maintain a portfolio's asset allocation, consider investing the proceeds from the loss sale to buy a fund in the same Morningstar category. Don't forget to consider the potential implications of the tax wash sale rule.7

While monitoring capital gains and tax loss harvesting opportunities can be time-consuming, BlackRock’s Tax Evaluator can help. The tool helps financial advisors and their clients monitor capital gains estimates across the industry and identify tax loss harvesting opportunities using price return data. For FAs looking to sell a fund to sidestep an unwanted distribution or book a loss, the tool provides low-cost ETF replacement ideas to help clients stay invested.

Two-thirds of high-net-worth teams highlight “tax minimization” as a key offering for their clients.8 While timely tactics like monitoring capital gains and tax loss harvesting are critical levers for tax-efficient portfolios, tax minimization requires a year-round, strategic approach.

Aside from prioritizing more tax-efficient structures, BlackRock’s Tax Smart Framework recommends an after-tax mindset regarding asset location and asset allocation. “Getting smart about taxable versus non-taxable accounts and picking the right structure for the long term is going to give you the best head start on minimizing taxes,” says Prince. Increasingly, clients have been pairing ETFs in taxable accounts with active mutual funds in qualified accounts in an attempt to capture better after-tax returns.

More clients expect their advisors to keep taxes in mind when building portfolios and we are seeing tax planning quickly become the fastest-growing addition to high-net-worth service models. Set your practice apart by keeping strategies for maximizing after-tax returns at the forefront of your investment process.

Investors can monitor capital gain distribution estimates and identify tax loss harvesting opportunities with BlackRock's Tax Evaluator. For more information visit blackrock.com/tax-evaluator.

- Source: Investment Company Institute Fact Book (2023).

- Source: Morningstar as of Dec. 31, 2023. Data calculated using the oldest share class of active Large Blend Open-End Mutual Funds available in the U.S. Post-tax returns are based on pre-liquidation figures.

- Source: Cerulli Managed Accounts Q4 2023. Growth stats reflect three-year AUM CAGR of both organic growth and market appreciation. Captive AUM estimated using data from individual platforms where available (Parametric, UBS, Fidelity) or estimated using other industry sources (Goldman, JPM, Northern Trust). Industry growth is organic; asset class level includes inorganic.

- Source: Morningstar as of Dec. 31, 2023.

- Source: BlackRock Global Business Intelligence (GBI) and Morningstar as of 9/30/2024.

- Source: Morningstar as of 12/31/23. Includes funds categorized as “U.S. Equity” under Morningstar’s U.S. Category Group. % of funds that paid a gain = 5-year annual average % of funds that paid a gain from 2019-2023. Includes funds available as of 10/31 in each year from 2019-2023. Past distributions are not indicative of future distributions.

- Wash sale restrictions prevent investors from realizing a loss on a sale and then buying a “substantially identical” security 30 days before and after the sale of the security. While “substantially identical” remains undefined Many tax practitioners suggest that investors ought to consider the degree to which the funds’ holdings may overlap and the degree of difference in prospective returns. BlackRock does not provide tax advice. We urge you to consult with your client and a tax professional regarding the potential consequences of this rule.

- Source: Cerulli U.S. High-Net Worth and Ultra High-Net Worth Markets, 2023. “8 different categories” refers to other ranked categories from HNW advisors in this order: wealth preservation (72%), tax minimization (63%), wealth transfer strategies (48%), risk management (44%), income generation (35%), absolute return (35%), liquidity management (24%), inflation/deflation protection (24%).

Carefully consider the Funds’ investment objectives, risk factors, and charges and expenses before investing.

This and other information can be found in the Funds’ prospectuses or, if available, the summary prospectuses, which may be obtained by visiting www.iShares.com or www.blackrock.com. Read the prospectus carefully before investing.

Investing involves risk, including possible loss of principal.

Important Risks of Mutual Funds: The funds are actively managed and their characteristics will vary. Bond values fluctuate in price so the value of your investment can go down depending on market conditions. Fixed income risks include interest-rate and credit risk. Typically, when interest rates rise, there is a corresponding decline in bond values. Credit risk refers to the possibility that the bond issuer will not be able to make principal and interest payments. Non-investment-grade debt securities (high yield / junk bonds) may be subject to greater market fluctuations, risk of default or loss of income and principal than higher rated securities. There may be less information on the financial condition of municipal issuers than for public corporations. The market for municipal bonds may be less liquid than for taxable bonds. Some investors may be subject to Alternative Minimum Tax (AMT). Capital gains distributions, if any, are taxable. The fund may use derivatives to hedge its investments or to seek to enhance returns. Derivatives entail risks relating to liquidity, leverage and credit that may reduce returns and increase volatility.

Important Risks of ETFs: Fixed income risks include interest-rate and credit risk. Typically, when interest rates rise, there is a corresponding decline in bond values. Credit risk refers to the possibility that the bond issuer will not be able to make principal and interest payments.

Transactions in shares of ETFs may result in brokerage commissions and will generate tax consequences. All regulated investment companies are obliged to distribute portfolio gains to shareholders. Certain traditional mutual funds can also be tax efficient. This material is provided for educational purposes only and does not constitute investment advice. The information contained herein is based on current tax laws, which may change in the future. BlackRock cannot be held responsible for any direct or incidental loss resulting from applying any of the information provided in this publication or from any other source mentioned.

Actively managed funds do not seek to replicate the performance of a specified index, may have higher portfolio turnover, and may charge higher fees than index funds due to increased trading and research expenses.

The information provided in this material does not constitute any specific legal, tax or accounting advice. Please consult with qualified professionals for this type of advice.

There can be no assurance that an active trading market for shares of an ETF will develop or be maintained. Shares of iShares ETFs may be bought and sold throughout the day on the exchange through any brokerage account. Shares are not individually redeemable from the ETF, however, shares may be redeemed directly from an ETF by Authorized Participants, in very large creation/redemption units.

Wash sale restrictions prevent investors from realizing a loss on a sale and then buying a “substantially identical” security 30 days before and after the sale of the security. The Internal Revenue Service has not released a definitive opinion regarding the definition of “substantially identical” securities and its application to the wash sale rule and ETFs. The information and examples provided are not intended to be a complete analysis of every material fact respecting tax strategy and are presented for educational and illustrative purposes only. Tax consequences will vary by individual taxpayer and individuals must carefully evaluate their tax position before engaging in any tax strategy.

The strategies discussed are strictly for illustrative and educational purposes and are not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. There is no guarantee that any strategies discussed will be effective. The information presented does not take into consideration commissions, tax implications or other transactions costs, which may significantly affect the economic consequences of a given strategy or investment decision.

Investment comparisons are for illustrative purposes only. To better understand the similarities and differences between investments, including investment objectives, risks, fees and expenses, it is important to read the products’ prospectuses.

This material is provided for educational purposes only and does not constitute investment advice. The information contained herein is based on current tax laws, which may change in the future. BlackRock cannot be held responsible for any direct or incidental loss resulting from applying any of the information provided in this publication or from any other source mentioned.

No proprietary technology or asset allocation model is a guarantee against loss of principal. There can be no assurance that an investment strategy based on the tools will be successful.

The information provided in this material does not constitute any specific legal, tax or accounting advice. Please consult with qualified professionals for this type of advice.

Prepared by BlackRock Investments, LLC, member FINRA.

©2024 BlackRock, Inc. or its affiliates. All Rights Reserved. BLACKROCK and iSHARES are trademarks of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.