Solving Unpleasant Climate Math Requires Asset Managers to Step Up

The World Meteorological Organization stunned the scientific community recently with its prediction that average global warming could breach 1.5°C in the next five years.

The recurrence of the El Niño weather pattern in the Pacific is contributing to this threat. But so too is the fact that we are rapidly exhausting our carbon budget. At the current rate, we have less than 10 years before the world’s emissions surpass the minimum threshold thought to be required to maintain the 1.5°C benchmark.

This climate math is now driving the investment math. Leading asset managers are stepping up with new strategies that offer positive environmental impact with no discount to expected returns.

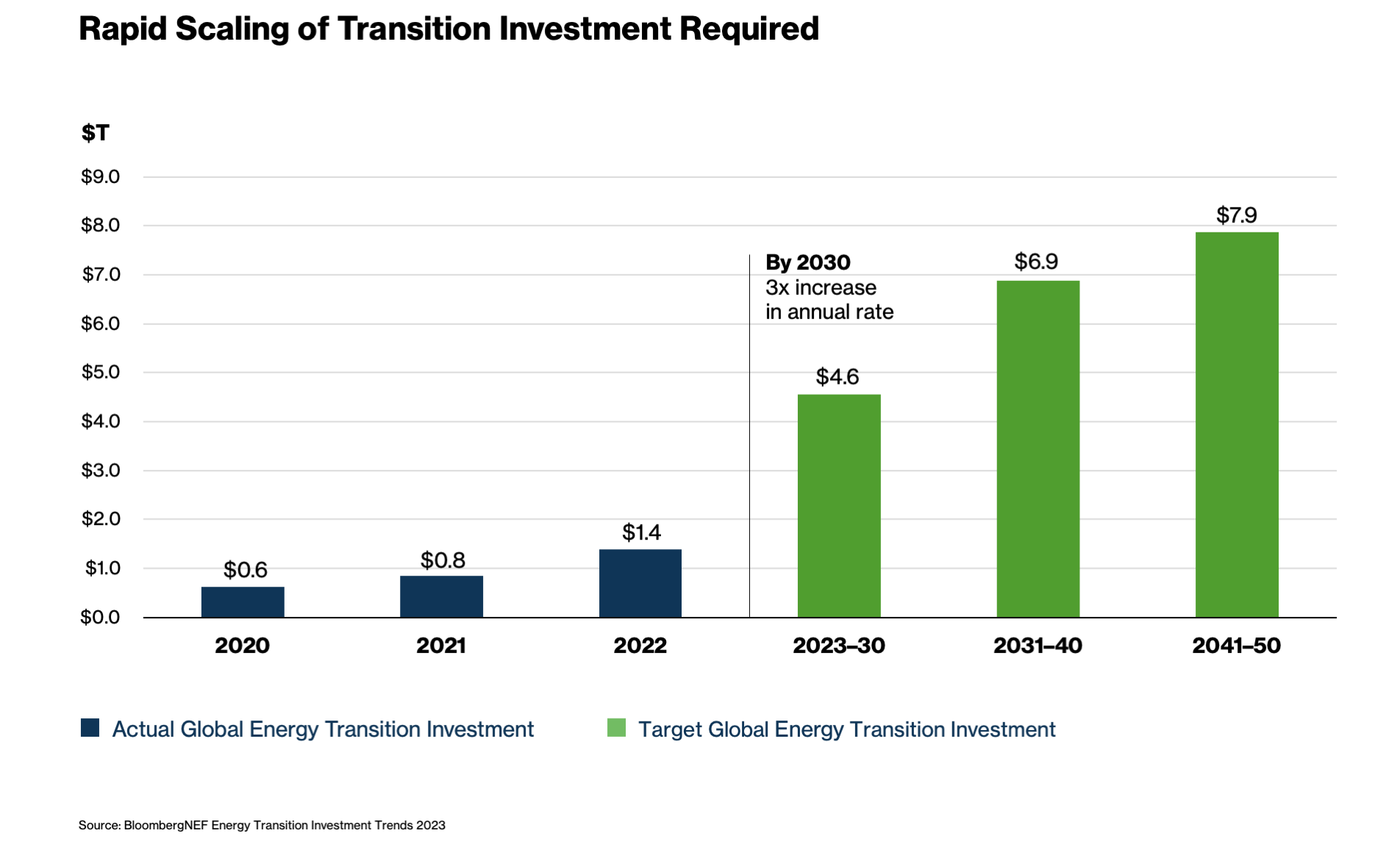

According to BloombergNEF, more than $200 trillion needs to be invested in clean energy supply and associated infrastructure between now and 2050. Annual investment rates must triple during this decade and increase fivefold by mid-century.

The good news is that progress is happening very fast. The International Energy Agency recently reported that there is sufficient manufacturing capacity for solar panels and batteries to meet the needs of its 2030 Net Zero scenario.

But the investment math continues to be a challenge in other ways. For every dollar spent on traditional energy, we need four dollars deployed in clean energy and its associated infrastructure. Today, we are spending just $1.70 on clean energy for every dollar spent on traditional fossil fuels.

As with any ratio, only two actions can change the equation: investing more in clean energy, and reducing the use of fossil fuels in our economy.

Or, in the words of Mark Carney, UN Climate Finance Envoy and Brookfield Asset Management’s Head of Transition Investing, “We must go where the emissions are.”

In practice, this means investors must be willing to work with and partner with carbon-intensive businesses to transition to more sustainable business models and help radically reduce their emissions.

Not every business can reduce its emissions overnight, nor is it always desirable to do so—sometimes the economic or security cost is too great. And such a transition can only be achieved when those businesses have a clear and committed pathway toward reducing emissions in line with global climate goals.

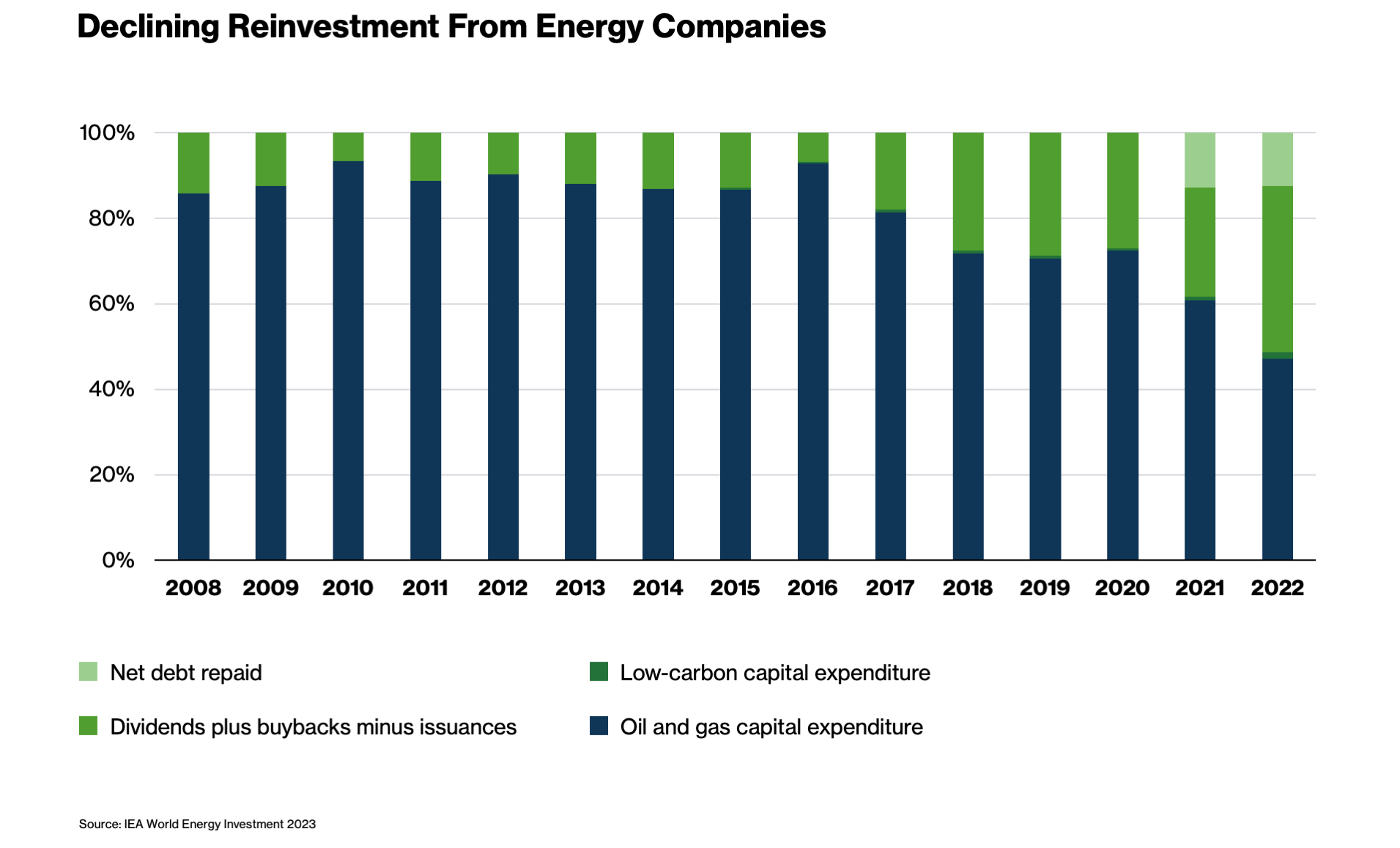

There have been some important steps forward in the oil and gas sector. International majors have increased clean energy investment to as much as a third of their overall capex.

But in ratio terms, this still represents just one dollar in clean energy for every two dollars they spend in fossil fuels. That is far too little to meet the goal. And the sector is reinvesting less, putting just 50% of its available cash into new projects in recent years, down from above 80% historically.

The excess cash is being returned to shareholders in record amounts, leaving investors the task of reallocating that capital into transition-friendly investments.

In place of the traditional energy companies, investors can now turn to specialist fund managers with both a track record of successful investing in renewables and the capability to invest where the emissions are.

Mark Carney sums up the challenge:

We need an industrial revolution at the pace of the digital revolution, and that means transition investment must accelerate in every sector of the economy. Investment firms will increasingly take up the gap left by traditional energy companies, and that creates a wall of opportunity for smart money.

— Mark Carney, UN Climate Finance Envoy and Brookfield Asset Management's Head of Transition Investing

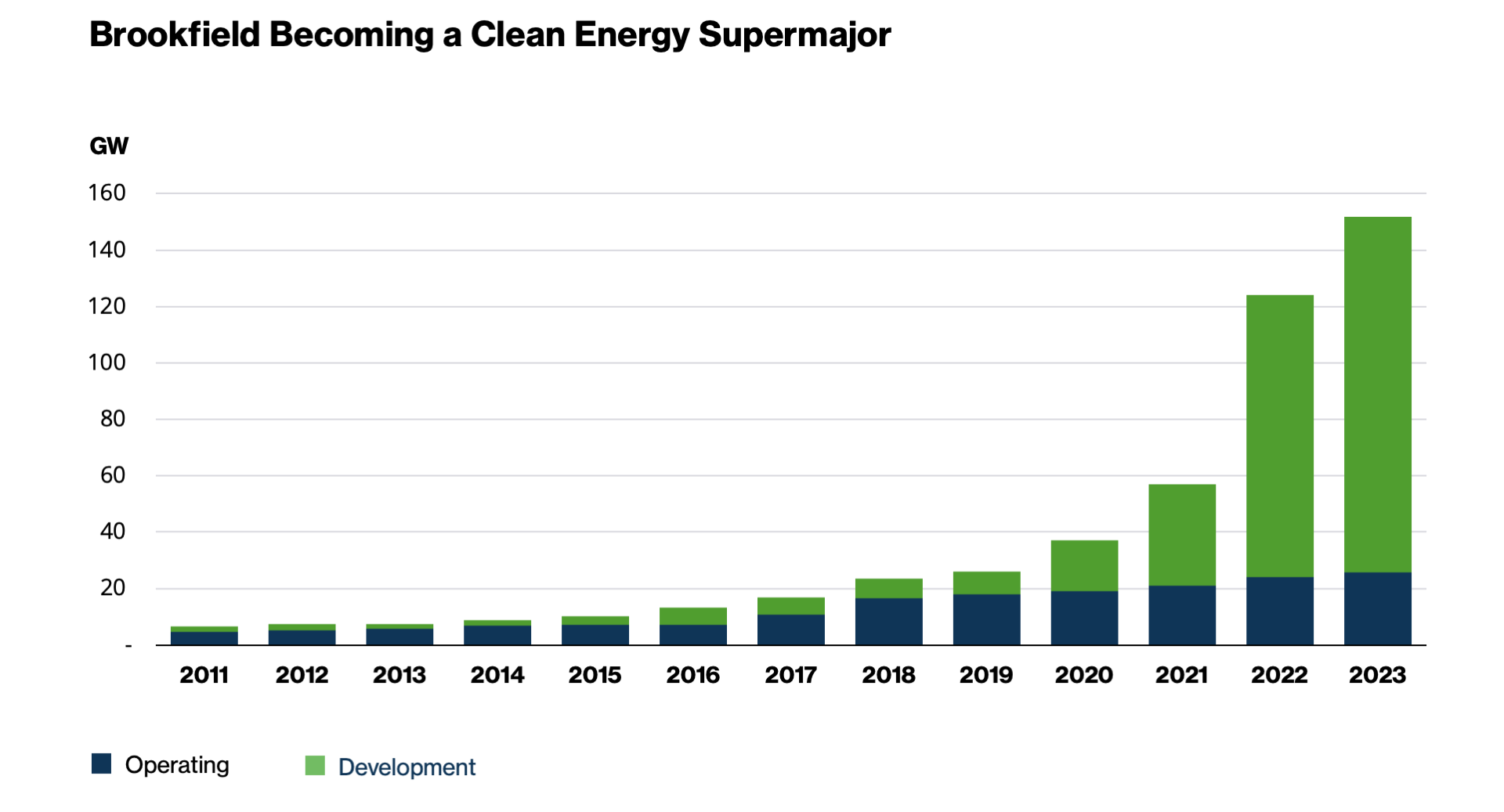

This includes firms such as Brookfield Asset Management—a leading private capital investor in the energy transition that was recently named the world’s largest impact fund manager by New Private Markets.

The firm is already a global leader in renewable energy deployment, building on over 30 years of specialist investing in this asset class. Since 2020, however, Brookfield has witnessed exponential growth in its Renewable Power and Transition investing strategy, cementing its role as one of the leading global players in the transition.

In the last two years, Brookfield has deployed its record-breaking $15 billion transition fund across a range of critical technologies including wind, solar, batteries, nuclear, carbon capture, waste recycling, distributed generation and renewable natural gas.

Brookfield recently announced a landmark deal for Australia’s Origin Energy that embodies what it means to go where the emissions are. The firm announced that it would acquire Origin’s Energy Market division, which operates Australia’s largest coal-fired power plant—making it Australia’s fifth-largest greenhouse gas emitter.

With the promise of a $20–30 billion in investment over the next 10 years, Brookfield aims to reduce Origin’s emissions by more than 70%, which would constitute 8% of Australia’s national emissions reduction target for 2030.

Traditional impact strategies that exclude investments in coal would have made such a strategy impossible to do at Origin. Instead, by going where the emissions are and tying together the impact and the business strategy, critical capital is now flowing to where it is needed most.

The asset management industry is primed to find those opportunities where less carbon can deliver more value, with zero compromise between the two.