Electronic Gadget Manufacturing Drive Pushes Bangladesh to New Heights

.jpg)

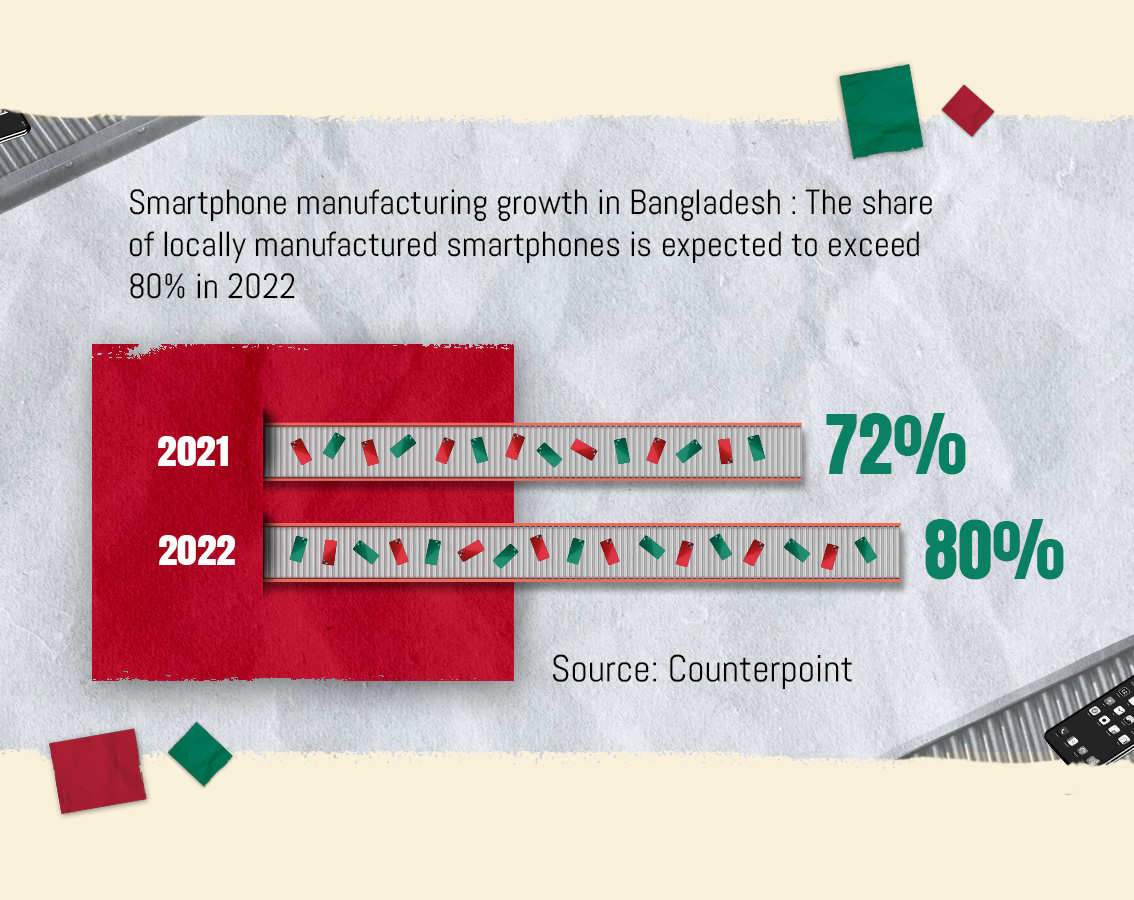

Nearly seven million mobile phones were manufactured[1] in Bangladesh in the first two months of this year, a remarkable achievement given that the first plant was built in 2017.

Now, the nation has 14 smartphone manufacturing plants,[2] with another four on the way, propelling it toward its goal of becoming a global hub for mobile technology with a high quality and skilled labor force. A young and internet-savvy population, rapid economic expansion and government tariffs on imported products have helped underpin this transformation.

That’s set to continue, as the nation recovers from the Covid-19 pandemic and consumer spending power builds. The next phase of the government’s strategy includes a plan to export $5 billion of digital devices by 2025, putting Bangladesh on course to further diversify its export base, move up the value chain and create more better-paying jobs for its citizens.

Samsung’s partnership with Fair Electronics is just one example of this in action. The South Korean multinational entered its partnership with Fair Group in 2017, creating a manufacturing plant at Narsingdi, around 50 kilometers northeast of Dhaka, that began producing phones in 2018.[3] As well as mobile handsets, the plant now also creates refrigerators, televisions, air conditioners, washing machines and microwave ovens, generating thousands of jobs.

.gif)

Drawing International Investment

As well as Samsung, other large smartphone companies like Nokia, Oppo, Vivo, Transsion and Realme have started manufacturing in Bangladesh[4] lured by direct access to the country’s large population and the opportunity to avoid import tariffs. With around 165 million people, Bangladesh is the world’s eighth most populous country[5] with 27% aged 10-24, compared with 17% in more developed countries.[6]

These, and other deals like them, put the country’s manufacturers on a hi-tech trajectory, combining the technical intelligence and investment in research and development of large multinationals with Bangladesh’s manufacturing capabilities and workforce.

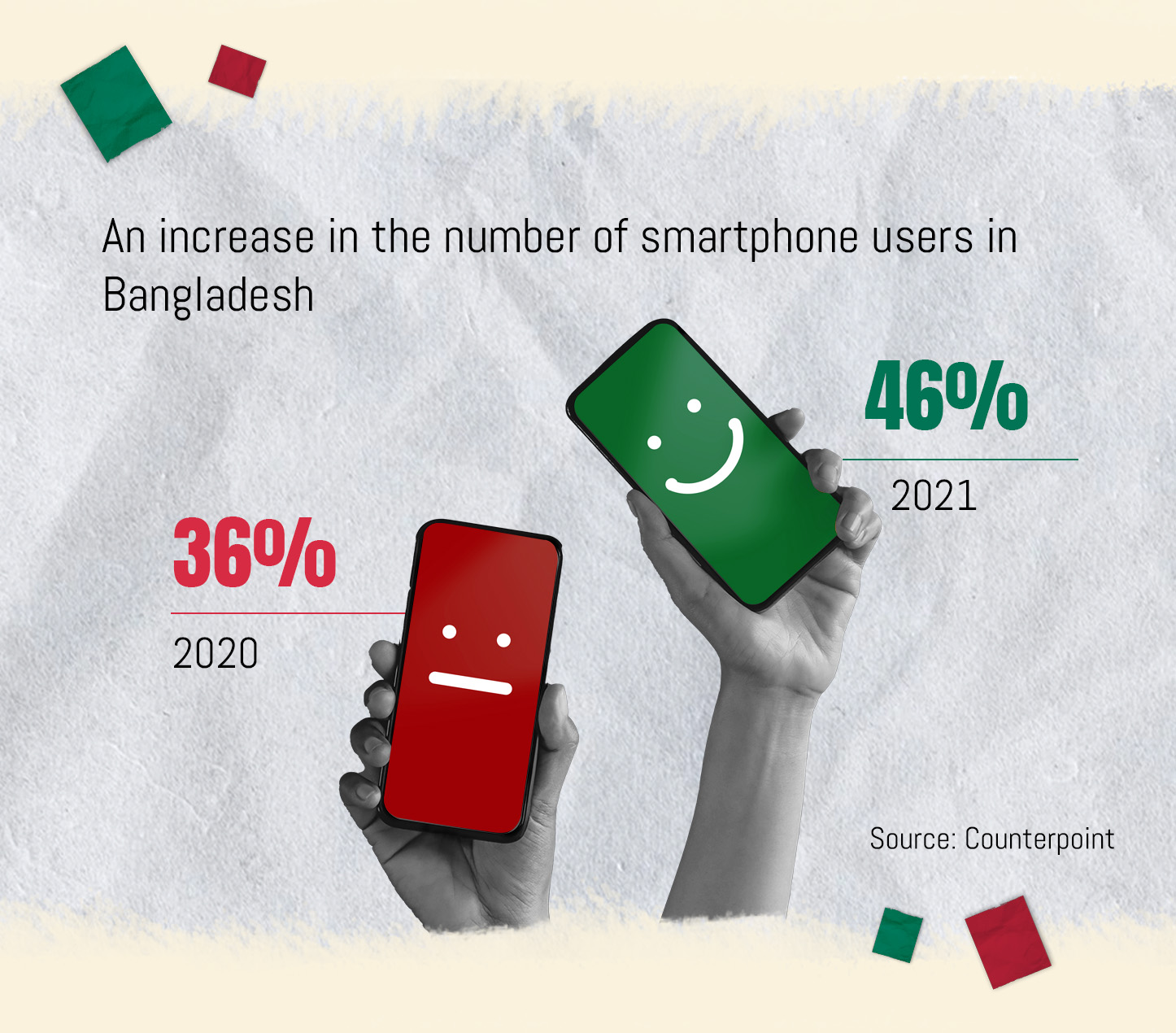

Local demand for mobile phones is also likely to remain healthy, as more of Bangladesh’s population transitions from feature phones to smartphones. This increase in the sophistication of products on sale is evident in data from Counterpoint Technology Market Research showing the smartphone segment[7] made up 46% of the overall handset market in 2021, up from 36% in 2020. And as of 2022, there were 178.5 million cellular mobile connections in Bangladesh.[8]

.gif)

Local Companies Stepping Up

While attracting these large players is a positive, Bangladesh’s local manufacturers are also expanding and taking on bigger roles, both in the domestic market and abroad.

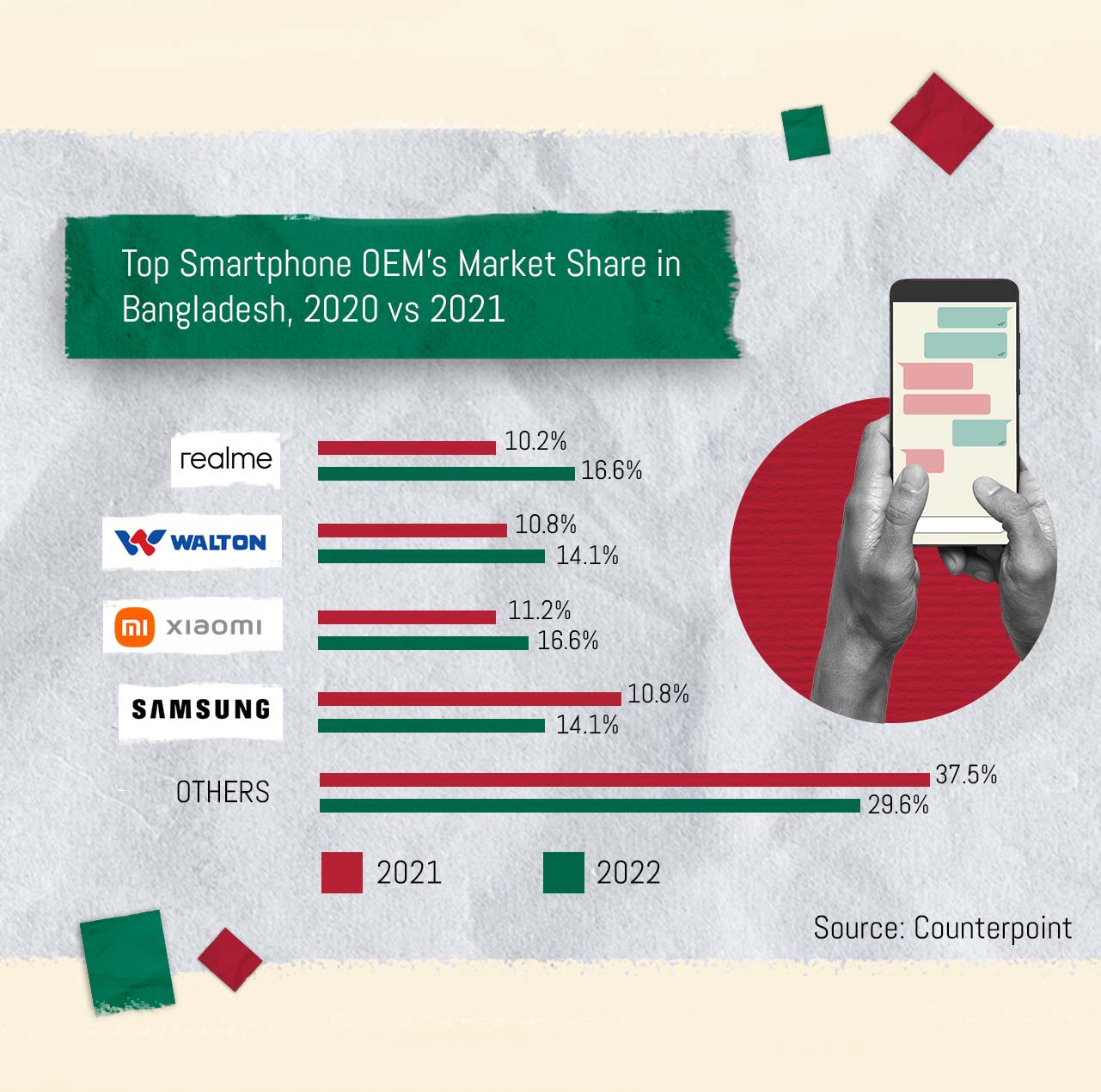

Walton Group was the second-largest smartphone brand in Bangladesh in 2021,[9] with a 14% market share and 46% growth compared with a year earlier. That puts it just behind China’s Realme Chongqing Mobile Telecommunications, which has a 17% market share.

_opt_plain.jpg)

“Establishing Walton as a sustainable leading global brand is our main target now.”

— Golam Murshed, CEO, Walton

Founded in 1977, with an electronics unit that began in 1995,[10] Walton now boasts a manufacturing plant of around 5 million square feet spread over 19 buildings and shades. The company employs more than 30,000 people producing a range of electrical and electronics goods including refrigerators, freezers, air conditioners, televisions, motorcycles, smartphones and other home appliances.

The company is working to expand its export capacity to more than 200 countries,[11] setting up operations in the U.S., Europe, Latin America, and Africa. This year Walton expanded its European foothold by buying three Italian compressor brands to cement its position as one of the world’s leading refrigerator manufacturers.[12] The deal marked the first time in Bangladesh's history that a local electronic products manufacturer had bought a foreign brand.

“Establishing Walton as a sustainable leading global brand is our main target now,” explained CEO Golam Murshed at a company event in March known as “Walton Day.” He said this relied on skills development within the company, supported by data-driven decision making.[13]

.gif)

A logical next step would be to break into the $600 billion[14]global semiconductor market, with only three local companies in Bangladesh currently providing mainstream chip design services. One of those companies – Ulkasemi – last year announced plans to invest $25 million in a semiconductor design service in Bangabandhu Hi-Tech Park,[15] one of several technology parks the government is setting up to attract higher-value investors. And with low manufacturing costs and a continued chip shortage affecting global supplies, this is an ideal opportunity for Bangladesh to move along the value chain.

The success of Bangladesh’s tech industry is also being mirrored in other sectors, where homegrown manufacturing companies are increasing their presence within the local market, and as exporters. It’s a trend that’s set to continue as the sector moves beyond its reliance on ready-made garment companies and toward a future characterized by technology and the increased spending power of the middle classes.

Leather goods, pharmaceuticals and food processing are other sectors that have the potential to break through, according to a World Bank report.[16]

.gif)

Big Plans Ahead

Underscoring these wins is a government roadmap.[17] to create 100,000 jobs by scaling up the digital device manufacturing industry and bolstering exports of domestically manufactured products. Officials want information and technology sector exports to grow to $5 billion by 2025, from around $1 billion in 2021. At the same time, mobiles, computers, and laptops will help tap the market at home

Partnerships with other jurisdictions, like the UK, European Union, and other nations, can help, according to the Bangladesh Association of Software and Information Services (BASIS). While Bangladesh offers local industry, competitive pricing and a thriving ecosystem for start-ups, its partners can assist with upskilling, reskilling, knowledge sharing and training for the digital jobs of the future.

For instance, the International Labour Organization (ILO) and the EU partnered with the Bangladesh government to create "Skills 21,” a technical and vocational education initiative geared towards producing more skilled workers – especially in digital – to meet national development goals.[18] While Chinese tech giant Huawei partnered with Bangladesh’s Information and Communication Technology Ministry to run “digital buses” across 64 districts, providing training to around 240,000 women in rural areas.[19]

Where once Bangladesh’s mobile market was dependent on imports, the country’s thriving manufacturing center is becoming more tech-savvy and sophisticated every day. The sector is a hallmark of the country’s journey to become a global export hub and represents a microcosm of the future of manufacturing: paving the way for other industries to mirror and emulate its success, and for Bangladesh to continue on the fast track to a hi-tech, high-skilled future.

[1] BTRC [2] Daily Star [3] TBS News [4] Nikkei [5] Worldometer [6] UNFPA [7] Counterpoint Research [8] GSMA [9] Counterpoint Research [10] Dhaka Tribune [11] Walton [12] Hawker BD [13] Rising BD [14] Semiconductor Industry Association [15] Lightcastle [16] World Bank [17] TB News [18] ILO [19] Huawei