Backbase’s Top 6 Predictions for Banking in 2025

Backbase is a Business Reporter client.

The banking industry is evolving at an exponential rate, and tracking its future is difficult, but we’re confident about these six trends that will have a huge impact in 2025 and beyond.

From the rise of AI-driven recommendation engines to the increasing momentum of neobank challengers, our top experts all weighed in, adding tips that will help your bank win in the years to come – and become your customers’ primary banking relationship. Let’s dive right in.

1: The rise of AI-driven recommendation engines

2025 will be the year where the banking industry witnesses widespread adoption of AI-driven recommendation engines for customers, either for personalization or engagement. If properly executed, these solutions will be incredibly impactful, helping financial institutions become their customers’ primary banking relationship in a period where many banks are struggling to generate sufficient revenue per customer. But to utilize this tech, banks will need to overhaul their legacy systems, preferably with a unified platform model.

2: The emergence of agentic AI

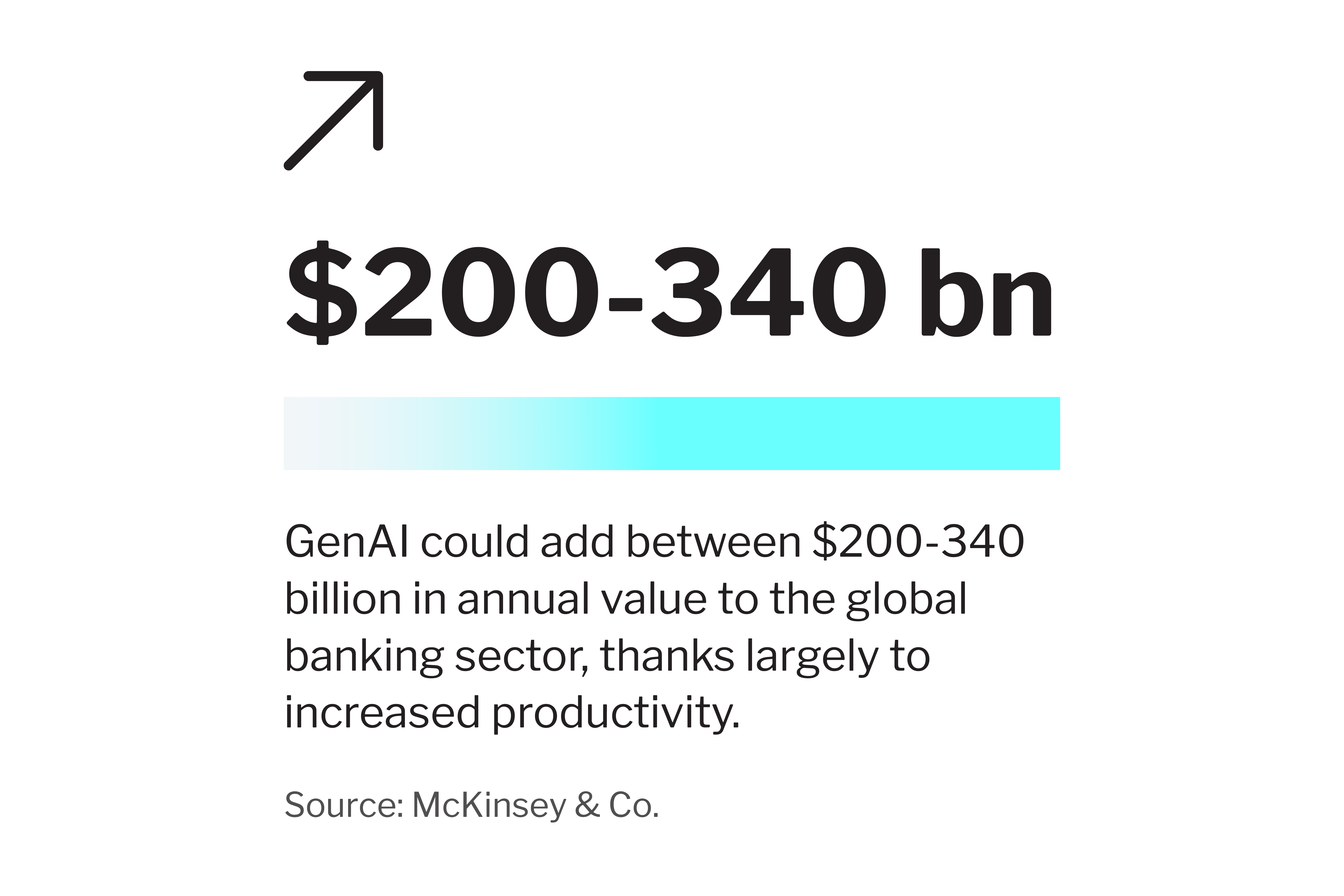

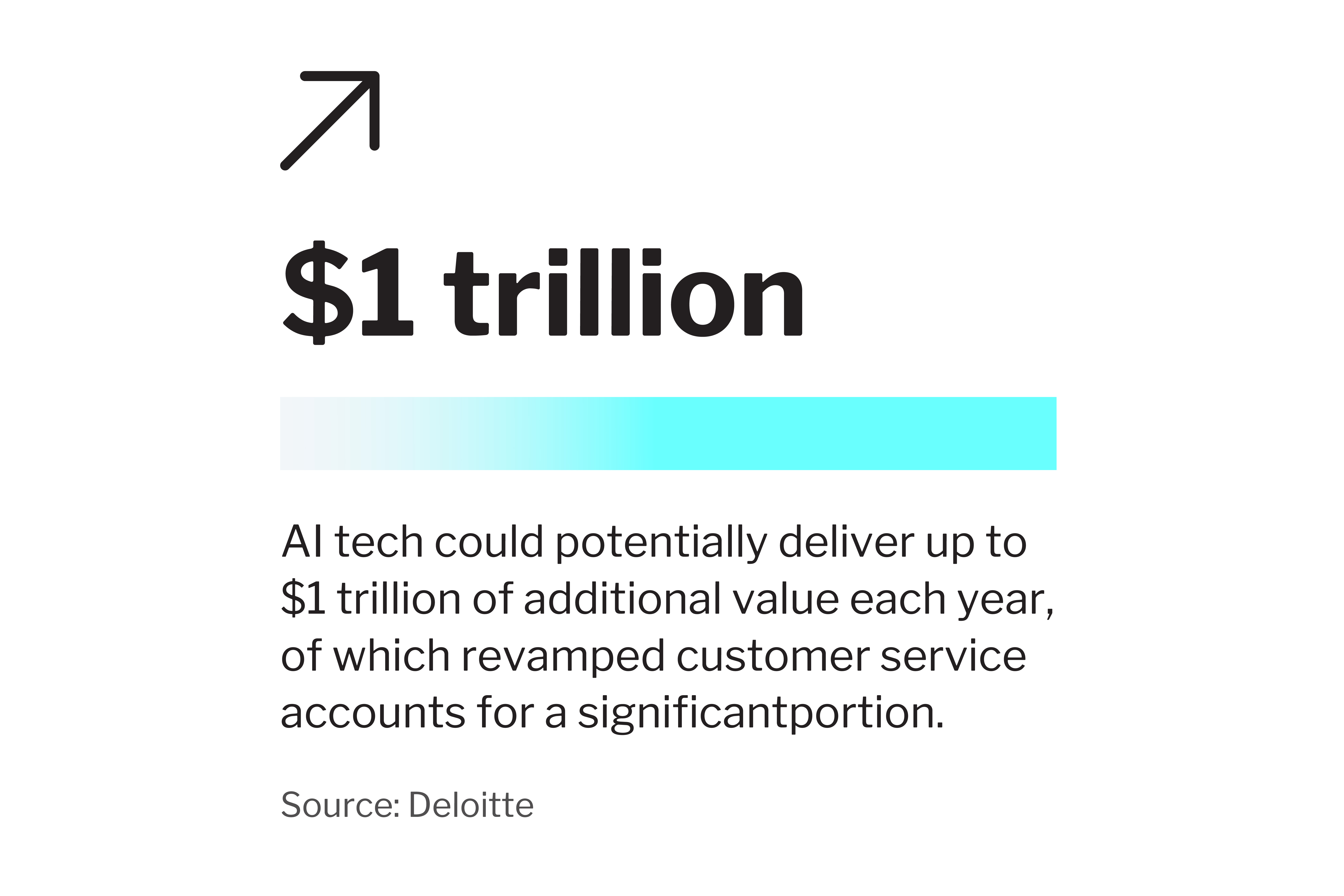

AI-powered customer-service assistants – especially AI agents – will become increasingly popular in 2025, as banks seek to realize productivity gains while providing white-glove user experiences. With minimal human intervention, these agents will be able to provide improved customer interactions, including proactive engagement, dynamic personalization and enhanced support, allowing banks to increase operational efficiency and freeing employees up to focus on more valuable activities. But determining a business case beforehand will be essential.

3: The global expansion of open finance

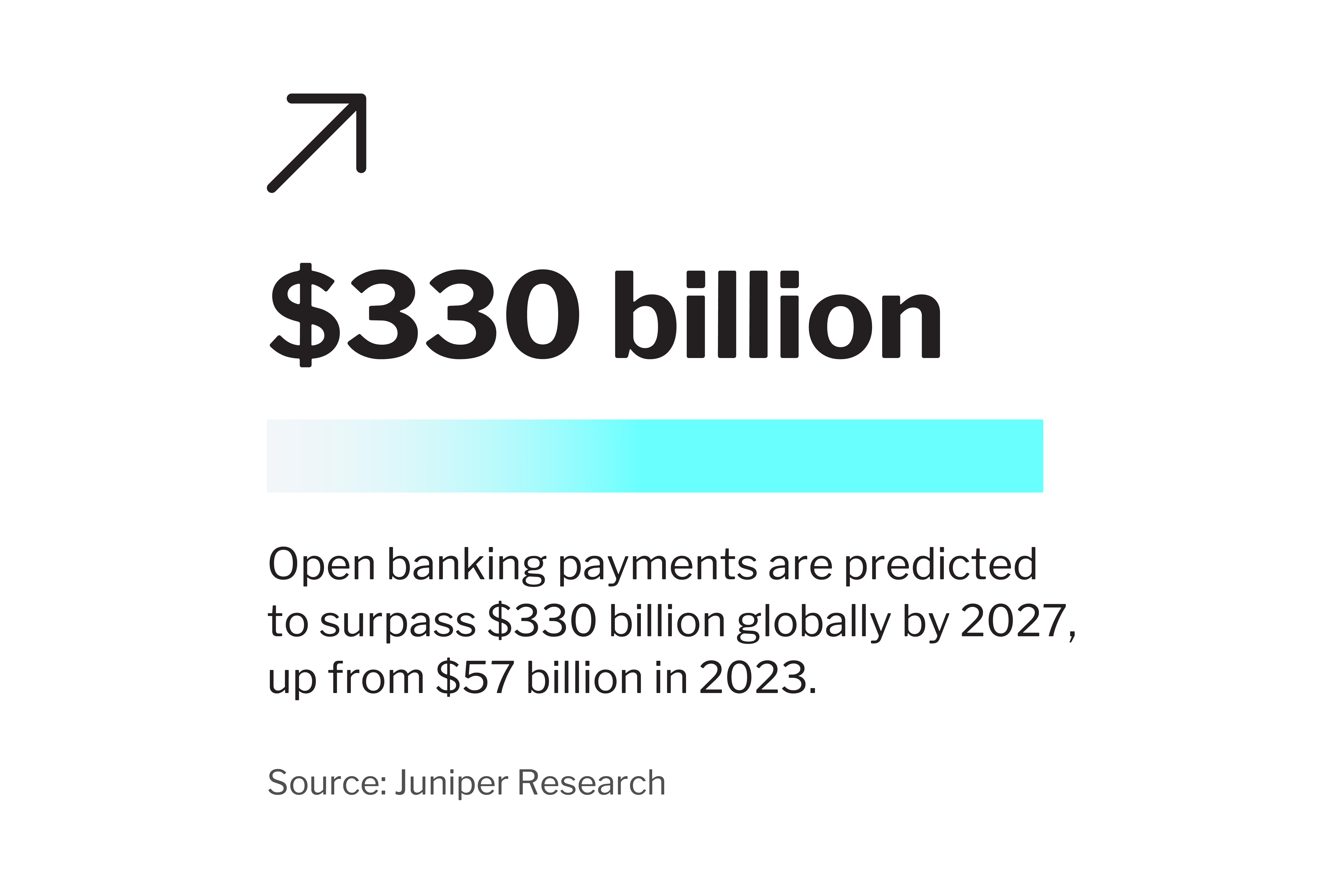

Open banking will give way to open finance in 2025 as these ecosystems continue to rapidly evolve, leading to the eventual end state of true embedded finance, though we may not realize this end-goal in the next year. With the advent of the platform model – as well as advances in API tech, cloud computing, and data analytics – open banking and open finance are not merely a possibility, they’re an inevitability. The expansion of open finance will also be driven by a variety of factors, including regulatory mandates, consumer demand and competitive pressure.

4: The arrival of industry IPaaS

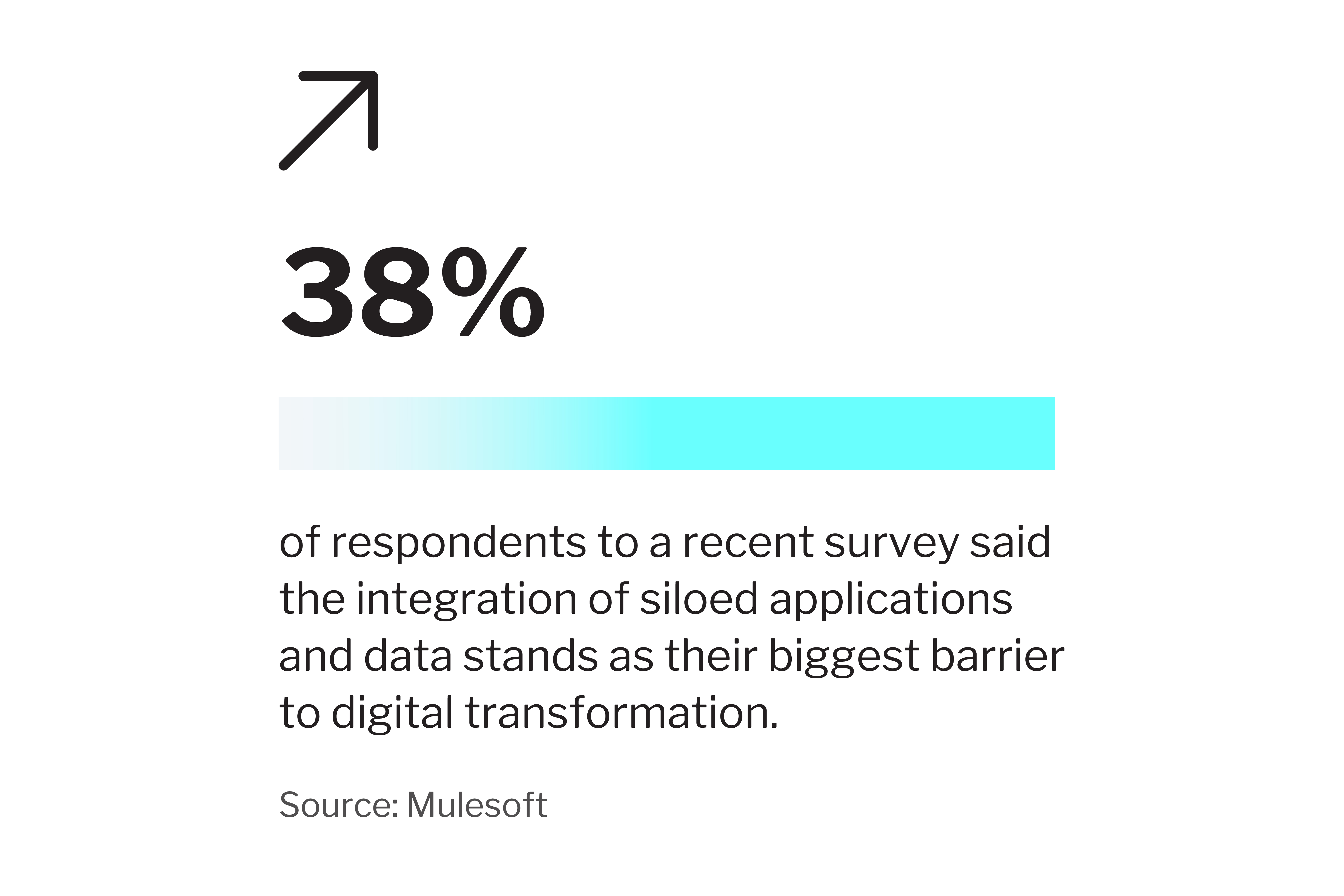

Vertical IPaaS solutions are the only viable path forward for integrations in banking, and that means we’ll see the rise of this tech in 2025. That will most likely happen sooner, rather than later, due in part to the momentum provided by open architectural frameworks, developer tools, and reference models. With an industry-specific IPaaS, banks will be able to harness unified APIs, connect channel applications, and unify their data, making a modular, composable approach a reality.

5: The expanded differentiation of servicing models

2025 is the year when banks finally solve the puzzle of differentiated service models. By using unified platforms, they’ll finally be able to get the most out of the data they’ve always possessed, but never been able to act on before. That means they’ll have the power to segment not only by line of business and basic demographic details, but also by the customer’s stage in their life journey, as well as their financial needs at that moment in time. This will save them time and money while boosting customer loyalty and retention, not to mention engagement.

6: The increasing momentum of neobank challengers

Neobanks, fintechs, and other tech titans will continue to gain momentum throughout 2025, further disrupting the traditional banking model and setting new standards for digital experiences, as well as operational efficiency. That means traditional banks need to get used to an increasingly competitive market, making digital transformation more urgent than ever. But by modernizing their tech and hollowing out their core systems, banks will find themselves on equal footing with neobanks, leveling the playing field and deepening essential customer relationships.

How your bank can win in 2025

We’re confident these predictions will inspire you to lead the change at your bank. But maybe you’re still doubtful about whether your tech infrastructure is up to the task. However, there are a number of ways to mitigate your most pressing barriers, lower costs, and accelerate your bank’s digital transformation. Here are our top three:

1: Hollow out your core banking system

As you’re well aware, many traditional banks are still shouldering the burden of their legacy tech, including decades-old systems, point solutions, and operational silos. These are all housed within monoliths, which contain valuable business logic you’d do well to preserve if you want to accelerate your bank’s digital transformation.

That’s why you shouldn’t simply toss out your core systems but rather hollow them out, extracting the logic – including services and processes – and moving them to a more appropriate layer of a modern, cloud-based banking architecture. The best approach is to use this logic to create modular capabilities and microservices that will help you further reduce your reliance on your core while also increasing agility, boosting cost efficiency, and empowering scalability.

2: Progressively modernize and future-proof your bank

Simply put, there’s a ton of duplication in business logic across your different channel applications, as well as numerous code bases needed to maintain each one. It’s tremendously laborious, and with a war on development talent, your bank probably doesn't have the time or resources. But with the headless approach to progressive modernization, you’ll clean up and rationalize your core systems – the infrastructure that actually powers these different channel applications – by adopting a digital banking platform.

The platform will then unify your channels, aggregating your data and removing silos, allowing your bank to run more smoothly, and all without disruption to your channels, core systems, or customer journeys. And, as you might expect, it’s becoming increasingly popular, even across industries. In fact, recent research indicates that 64% of enterprise organizations are currently using a headless approach, a nearly 25% increase from 2019. So you’d do well to consider whether this method is a solid fit for your bank, as it’s a great way to make a huge impact in 2025.

3. Select your bank’s strategic tech partner

As we’ve demonstrated above, digital transformation doesn’t have to be an impossible task. But it can be even easier – and more cost effective – with help from the right strategic partner. Believe us when we say that trying to achieve success in a vacuum is a recipe for failure, even with the biggest budgets and the top minds out there. This, of course, begs the question: who should you turn to for assistance? Which vendor will be the best strategic partner for your bank as you begin your digital transformation journey?

Of course, the best vendor for your bank depends entirely on your needs and priorities. The best advice we can give is to look for a platform provider that gives you the freedom to innovate on your own terms and at your own pace, one that doesn’t box you in but rather gives you access to a rich ecosystem of best-in-class solutions. More than a vendor, your bank needs a true strategic partner that will help you drive value in 2025 – and beyond.

For more insights, stats, and expert quotes, read the full predictions report today.

Header image credit: Backbase