How Blockchain Can Transform Insurance

Chainlink Labs is a Business Reporter client.

In 2020, more than 30% of small businesses were uninsured, even though 75% of business owners reported experiencing an insurable event that year. One reason for this is that navigating the traditional insurance market is a challenging experience for many small businesses, which can face long and complicated claims processes—if they’re even able to secure insurance in the first place.

Blockchain-based parametric insurance can help address some of these issues, as it distributes payouts automatically according to predetermined events, rather than through a manual and inefficient claims process. Developments in blockchain technology are making parametric insurance solutions from specialized providers cheaper, faster and more accessible, helping to create social good.

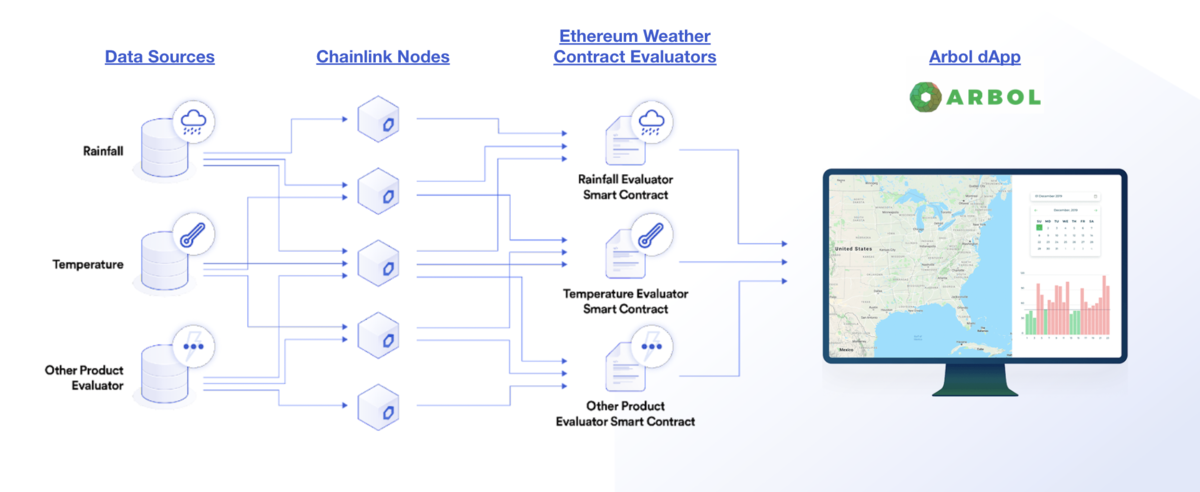

Parametric insurance smart contracts are digital agreements on blockchains with conditions attached to their execution (if X occurs, execute Y). Oracle networks, such as the industry-leading Chainlink, connect blockchains to external systems and provide the real-world information necessary to confirm that policy conditions have been met and that the insurance company should therefore pay out the claim.

Blockchains keep an immutable record of transactions, providing accountability. Smart contracts improve efficiency by automating contracts. And oracle networks, which connect blockchains to real-world data, validate that an event did indeed occur and help ensure that the automated payment cannot be manipulated.

Here are four blockchain-based parametric insurance products that small businesses can use to maximize their operational security and minimize risk:

Crop insurance

According to one parametric crop insurance provider, $1 trillion of global agricultural risk is not insured. Much of this risk is in developing nations, where many farmers do not have access to insurance. Smaller farmers, or those facing highly variable weather conditions, may also struggle to receive the coverage they need. Climate change will continue to increase the need for crop insurance as weather patterns become less predictable and extreme weather events become more frequent.

Parametric crop insurance that helps farmers secure economic protection is already available, with some providers offering it to anybody with a smartphone and an internet connection. Some of these insurers use Chainlink to help create insurance contracts based on weather data from the US National Oceanic and Atmospheric Administration (NOAA). For instance, a farmer could receive a payout if data from the oracle network indicated that their region received less than 20 inches of rain over a two-month period.

Access to insurance prevents farmers from needing to uproot their families and abandon their farmland when they face unfavorable weather conditions. They can also benefit from quickly disbursed aid, while insurance providers are assured that the process is accountable, transparent and fraud-proof because all activity happens on the blockchain and payouts are determined by verified external conditions.

Flight and travel delay insurance

Anybody who flies knows the sudden dread that accompanies the realization that a flight has been delayed or canceled. Although airlines compensate fliers for cancellations, delays may cause fliers to miss important events or connections, with little recourse other than booking new and often expensive last-minute travel. Insurtechs are emerging to meet flight insurance needs, and providers that leverage blockchain technology will help the space advance further. Parametric insurance allows travelers to quickly repurpose funds and purchase a new ticket, as payouts are automatically distributed as soon as a flight is canceled or delayed.

Logistics and supply chain insurance

Businesses are often uninsured for low-probability events that nonetheless have the potential to be catastrophic. For example, prior to the Covid-19 pandemic, very few businesses had purchased (or even had the choice to purchase) pandemic insurance, leading to a last-minute surge in demand. For logistics, parametric insurance can cover highly variable and rare events, from pandemics to extreme weather. Additionally, oracle networks can connect IoT sensor data to blockchains, enabling the creation of supply chain parametric insurance products that offer companies the opportunity to mitigate any potential quality control problems, such as losses from shipping issues, particularly for perishable goods.

One of the benefits of parametric insurance is the ability to tailor contracts. For instance, a supply chain company with operations vulnerable to winter storms might take out a policy to protect against disruptions, although initially it may not be clear when, or to what extent, an ice storm could lead to delays. A parametric insurance policy can source NOAA data regarding ice accumulation in the relevant region, and other data, and customize the policy accordingly. Whether the storm delays shipments by hours or days, the supplier is protected.

Connecting IoT device data to blockchains via oracles can also improve data on shipment quality. Refrigerated unit sensors can inform a parametric insurance policy that pays out if temperature fluctuations compromise product safety; oracles connected to the sensors can trigger the payouts. With these contracts, payouts are much faster than the typical wait for quality testing required for claims processes for spoiled goods. There’s also the benefit of knowing that a shipment is in good condition when it arrives, as safety issues would be recorded on-chain prior to delivery.

Live event insurance

Live events such as concerts and sports matches are sensitive to inclement weather (as well as, it turns out, rare catastrophic events such as pandemics). Parametric insurance can help, as some of these events are unlikely to be able to secure insurance through traditional brokers. Event organizers can use parametric insurance to absorb cancellation losses, helping them to mitigate risk and smooth out the impact of cancelled events.

Further, parametric insurance could protect organizers in cases of event cancellations that require refunding all attendees, or when rescheduling, which creates additional logistical challenges. Parametric insurance can also help if event attendance is simply suppressed (for example, if icy conditions prompt 20% of attendees to skip the event because they don’t want to drive). Variability can be built into the parametric insurance contract, allowing event organizers to secure the exact amount of coverage they need.

To learn more please visit chain.link/use-cases/social-impact. And visit here for a look at the experiences of several blockchain pioneers.This article originally appeared in Business Reporter.

Header image: iStock id1365436662

Body image: Courtesy of Chainlink Labs