The Company Driving the Future of Cross-Border Bank Payments

Currenxie is a Business Reporter client.

New trends were emerging in global commerce well before the Covid-19 pandemic accelerated them. Cross-border bank transactions were already on a fast-track journey, and the market is currently valued at nearly $21 trillion, with a 90% compound annual growth rate. Global payment remittance flows currently sit at $120 trillion.

The sheer scale of the cross-border bank payments prize is considerable. And—in a post-pandemic world that’s seen the rise of digital nomads and gig workers, and a surge of international online sales and cross-border trade—it’s predicted to grow exponentially in the coming months.

Yet, despite their importance in our increasingly connected world, cross-border bank payments remain expensive, slow, opaque and largely inaccessible to many who rely heavily on them to conduct business.

For example, SMEs, which form the backbone of local economies, are trading more frequently across borders, at 2.3 times the rate of large corporations, especially in emerging markets. But nearly half are turned down when trying to open a bank account due to the strict requirements set by traditional banks, which are geared toward serving MNCs. Those SMEs that do manage to open an account are often forced to pay exorbitant wire transfer and currency conversion fees.

Driven by these increasingly globalized small businesses and the staggering growth of e-commerce, the gap between traditional business accounts and the needs of the market is widening. A more accessible and cost-effective solution that is digital and global by nature is needed.

Making cross-border bank transactions as pain-free as possible

Riccardo Capelvenere knows the pain of international payments well, as his family has been a supplier of Italian wine in Hong Kong since the 1960s. He and his wife, Alison, both Goldman Sachs alumni, knew the exact difference their platform could make when they founded Currenxie.

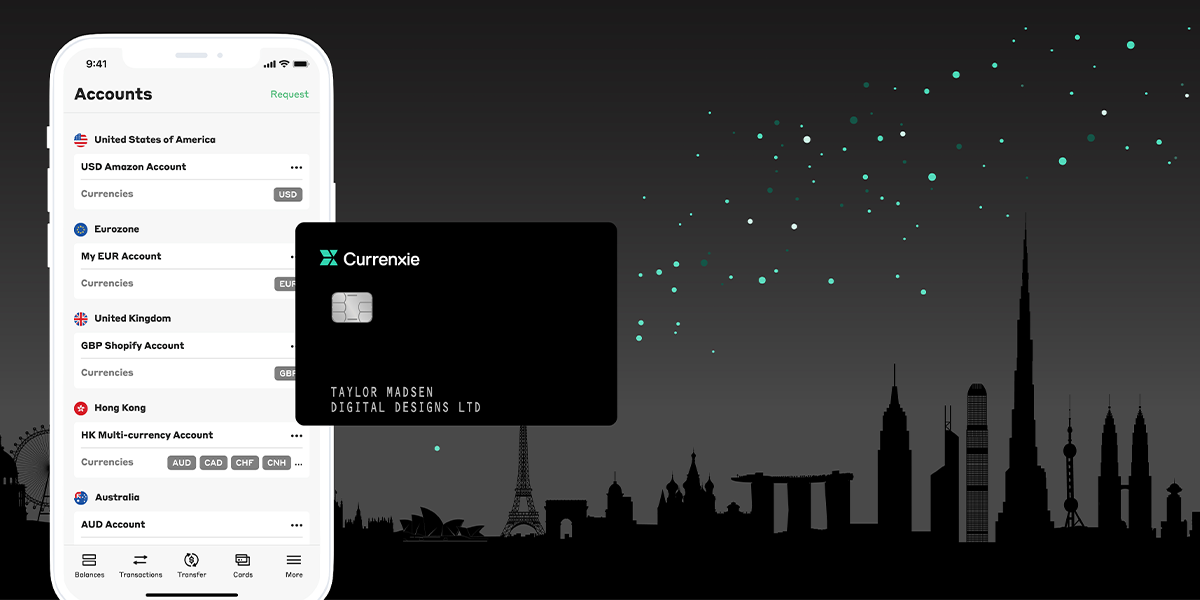

The Hong Kong-headquartered fintech uses its cloud-based technology to make cross-border services, such as wholesale foreign exchange and borderless bank payments, accessible to any business. Using the company’s Global Account platform, clients can tap into the vast global network of banking partners that the company has established.

Wherever they do business in Currenxie’s ever-growing network, clients can immediately access their virtual bank accounts to make seamless payments and enjoy the convenience of a multi-currency digital wallet that makes all their funds available to them anywhere, anytime.

Foreign exchange is offered at the real interbank rate, providing a rare level of transparency as well as affordability. Clients can receive instant virtual Visa cards to cover any other expenses.

The result is that businesses of all sizes, from all corners of the globe, can move swiftly into new markets without burdensome fees and restricted access to fundamental payment services. It means there is a system for global payments that can keep pace with the advancements that are breaking down borders to trade, such as e-commerce marketplaces and purely digital services.

The value and choices created by borderless trade can now be shared by all.

—Industry view from Currenxie

Access global commerce with Currenxie.

This article originally appeared on Business Reporter. Image credit: iStock id1206702750