In a Volatile World, It’s Good to Have Options

A confluence of excessive valuations, recession risks and sticky inflation has thrown global financial markets into a tailspin. Investors are struggling to find the silver lining, yet the most experienced know an impasse is an opportunity in disguise—especially when you have options.

The current market tumult has led some to question whether steadfast crypto investors would HODL. Yet, in the context of the wider market rout, there may well be cause for optimism.

“Cryptos were a leading indicator of speculative excesses in 2020-21 and are likely poised to resume outperforming most risk assets when the dust settles from the great reversion of 2022,” Bloomberg Intelligence wrote in its Global Crypto Assets Midyear Outlook. “Slightly below $1 trillion at the start of 1H, the crypto market cap is a fraction of the about $25 trillion wiped out from global stock markets.”

Options for All Market Conditions

Regardless of whether prices of Bitcoin, Ether and other cryptocurrencies follow a north or southbound trajectory in the months ahead, investors can use options to manage all market conditions—and potentially profit from them.

“With futures, there are only two directions: up or down,” says Hao Yang, Principal Product Director and Head of Options at Bybit. “But with options, there are many more ways that you can trade and construct a certain risk and return profile.”

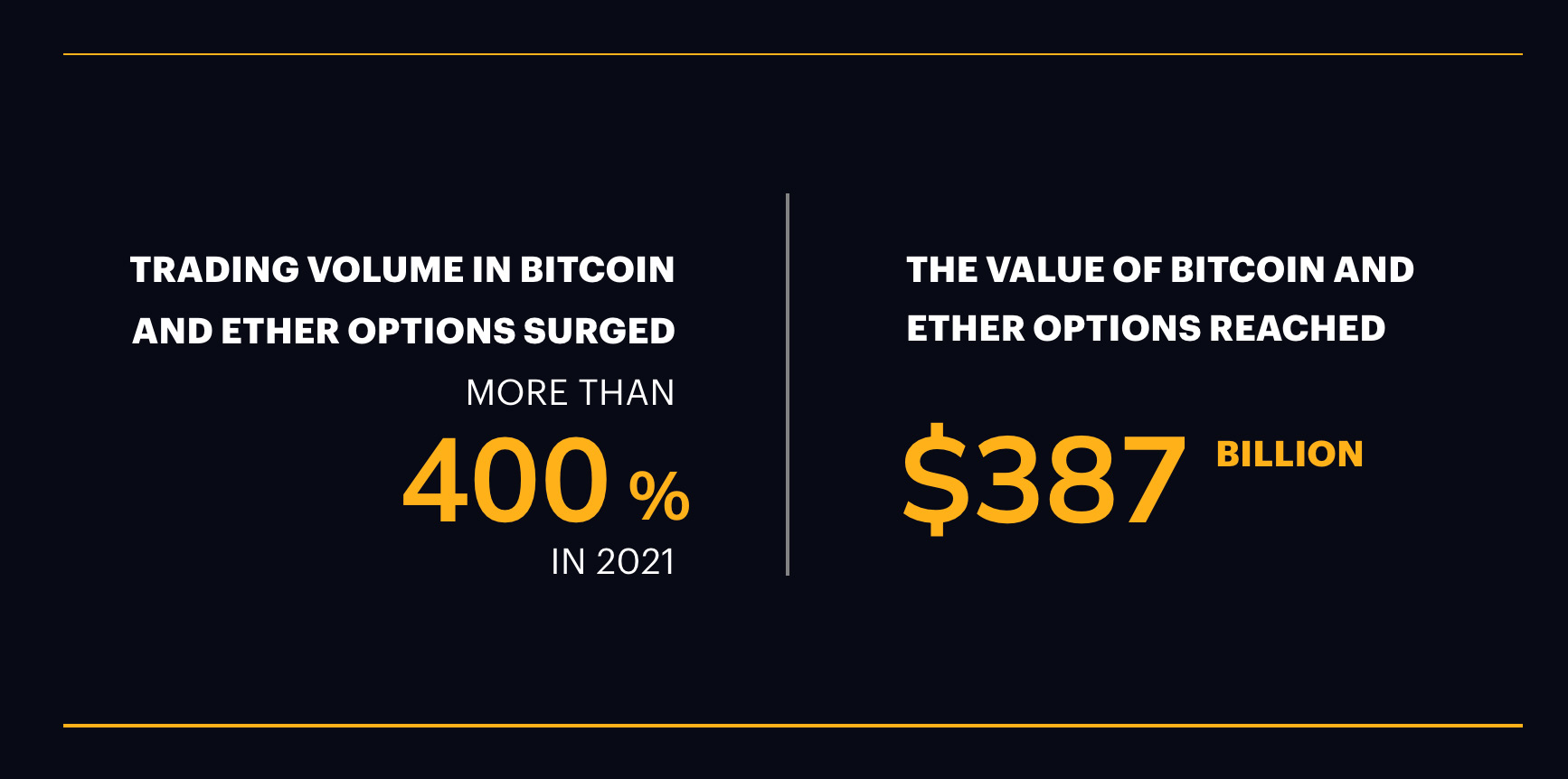

That versatility has already spurred the crypto options market. Trading volume in Bitcoin and Ether options surged more than 400% in 2021 to a value of about $387 billion, from $71 billion the year before.[1] While that’s merely a fraction of the $32 trillion in crypto futures trading volume, it signals growing demand for different ways to play the market.[2]

Yet, building an options trading system is no easy feat. Yang can attest to this. He helped Bybit launch Bitcoin options with seven expires last year and is now hard at work on Ether and Solana options, which the exchange plans to launch in August.

“We put significant effort into finding the right talent to build our options product,” Yang says. “Options traders have rigorous needs, so we had to work hard to create the best possible trading experience. One way we’ve done that is by settling options in USDC, which removes a layer of complexity.”

Unlike Bitcoin-settled contracts, using USDC allows for stable prices for the duration of each contract. Bybit’s European-style, USDC-settled options also benefit from the newly launched unified margin account, which offers a completely new derivatives trading structure in which users can deploy all assets under their account as collateral to trade USDC options.

Bringing Crypto Options to the Masses

While the versatility that options offer is a boon for crypto investors, complexity could still prove a challenge. Novice investors account for a large portion of crypto retail trading. And 55% of people who held Bitcoin as of December 2021 had only made their first crypto investment within the previous 12 months.[3]

Bybit has taken this to heart: “We are rolling out several blogs, conducting community AMAs (Ask Me Anything) and posting YouTube videos to explain how options work,” Yang says. “Soon we’ll work with data providers to give our clients in-depth research articles. We invested a lot of time in building the infrastructure for our crypto options products. In 2023, our focus will move heavily towards educating investors.”

Bybit’s educational content will eventually cover everything from basic terminology to the difference between Risk Offsetting and Profit & Loss offsetting. It will also offer insights into trading strategies for various market conditions. For instance:

Rising Market—the Bull-Call Spread: In this strategy, an investor buys one “at the money” (ATM) call—where the strike price matches the current price—and sells one “out of the money” (OTM) call—where the price is higher—with the same expiry date. The strategy profits from a rising price, but the investor manages risk by limiting potential gains and losses.

Falling Market—the Bear-Call Spread: This entails buying an OTM Call and selling an “in the money” (ITM) Call. The strategy profits from a declining price and/or time decay, but gains are limited to the net premium received, while losses are constrained by the long call if the price rises.

Beyond education, Bybit designed its options-trading structures to protect retail traders: “We have really improved the liquidation process,” Yang says. “How it works is that when your portfolio risk breaches the maintenance margin level, we start liquidation—but instead of taking your entire position in one go, we do it one small step at a time. For example, if a trader is over the risk limit at 110%, we'll find out which position we should liquidate, and how much, to reduce his risk level from 110% to 90% and then stop.

“That’s how we go about protecting our users, because we want to give regular people the opportunity to realize life-changing opportunities with crypto.”