CFOs Join Forces to Make Sustainability Thrive

It’s been three years since a small group of global CFOs first gathered to discuss how best to meld sustainability into business strategy and operations.

The period since then has only underlined the critical importance of the vision developed by the CFO Coalition for the SDGs.

Following a grueling pandemic—and with rich and poor nations alike now being buffeted by climate disasters, food shortages and energy shocks—the need for companies to contribute positively to a more sustainable world has never been more urgent.

The scale of the task is daunting. The UN estimates that the world will need to spend between $3 trillion and $5 trillion annually to meet its Sustainable Development Goals (SDGs) by 2030.

But the CFO Coalition for the SDGs, which has expanded since its formation in 2019, is confident of progress. This year, the group, formerly known as the CFO Taskforce for the SDGs, adopted its new name, symbolizing its evolution from defining the challenge to acting on it.

“We have walked a long road since the launch of the CFO Taskforce, back in December 2019, developing a set of principles that has been supporting the financial world in integrating sustainability in different ways into businesses,” says Alberto De Paoli, Coalition Co-chair and CFO of Italian utility giant Enel Group. “Today, three years after it was launched, the CFO Coalition for the SDGs continues to address the gap in necessary SDGs financing.”

Corporations take the lead

Since those CFOs first got together, momentum for business action on sustainability has picked up pace on several fronts.

Support for climate risk reporting has grown. Last year, the G7 countries backed mandatory disclosure using the Task Force on Climate-related Financial Disclosure framework for large companies, with the UK, France and Japan among the first to roll out legislation.

Additionally, an increasing number of companies have made decisive moves to reallocate resources and refocus their operations around sustainability. Over 5,000 businesses have made net-zero carbon commitments as part of the UN’s Race to Zero campaign.

Rather than being led by policy makers, corporations are in some cases prodding governments into action on sustainability. In the UK, for example, 116 businesses called on newly appointed Prime Minister Liz Truss not to sideline the net-zero transition in her dash for economic growth.

First responders and pioneers

The critical role of CFOs in driving sustainability is being more widely acknowledged.

As stewards of trillions of dollars in corporate investments, CFOs are recognized as uniquely positioned to reshape corporate finance and investments as catalysts for growth, value creation and sustainable impact.

At this year’s Davos gathering, World Economic Forum CFO and Managing Director Julien Gattoni weighed in on this theme, declaring that the CFO is the “first responder” in tackling climate change and, going forward, will need to be “a champion, pioneer and sponsor of sustainability.”

In September 2021, coalition CFOs announced their commitment to collectively invest $500 billion by 2025 toward achieving the SDGs and to link nearly 50% of their corporate financing to sustainability performance. The group has extended its ambitions and by 2023 it expects to increase the number of participants from 70 to 100 CFOs. Their work is critical if companies’ financial activity is to be steered in the right direction, according to De Paoli.

“The leadership members of the coalition are working together, and inside their companies, to promote further integration of the SDGs in corporate investment and finance,” he says. “Understanding how corporates are acting to move towards sustainable businesses, using the SDGs as a compass, is key to defining ambitious pathways for all actors in the financial value chain.”

A template for transformation

De Paoli is taking every opportunity to spread the word to fellow CFOs. In a presentation to the SDG Investment Forum in New York City in September, he offered insights into Enel’s own journey to a business model based on “stakeholder capitalism.” This entails measuring Enel Group’s entire performance against the value it provides to all of its stakeholders, including society, using the utility’s ENEL STAKECAP©TM model.

In addition, Enel was an early mover in issuing sustainability-linked bonds, but this was not a stand-alone venture. “It is not a sustainability-linked finance transaction that makes a company ambitious,” De Paoli emphasized. “It is instead the sustainable strategy that makes a company ambitious or not, credible or not.”

He told the forum how, having identified the need to strengthen the link between sustainability and value, Enel’s subsequent step was to identify the most relevant SDGs linked to these drivers and create a clear and transparent way to align corporate investment plans with them. Currently, Enel Group evaluates and manages these commitments annually as part of strategic planning.

CFO Coalition investment in SDGs

Around 94% of Enel’s capital expenditure plan is now aligned with the its SDG commitments. The plan is also fully aligned with Enel’s target to reach net zero by 2040.

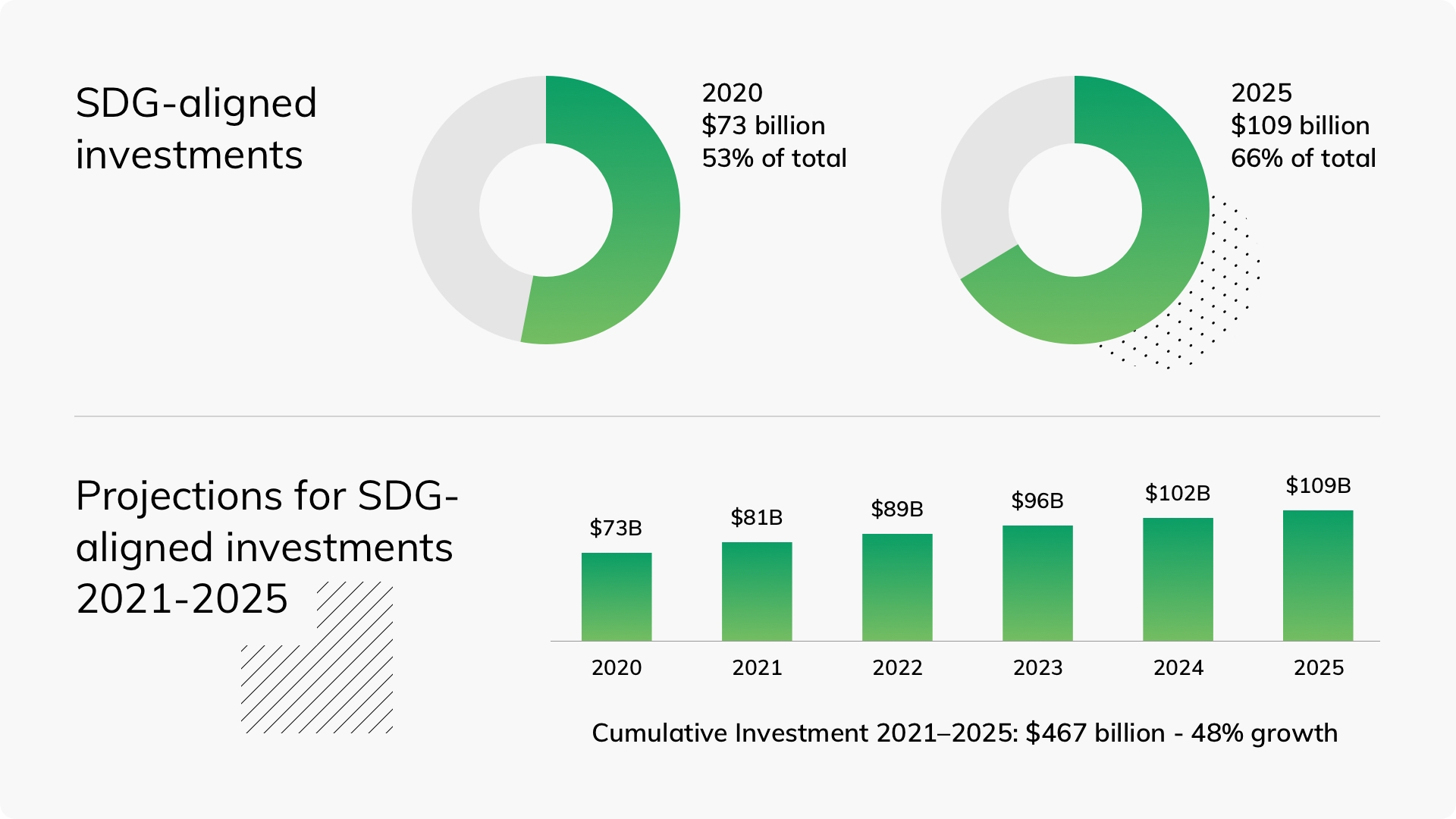

Enel’s achievements and targets place it in the upper echelons of businesses represented by CFO Coalition members. In 2020, the coalition’s combined SDG-aligned investments accounted for just over half of its total investments. By 2025, that proportion will increase to two-thirds, while its total value is projected to hit $109 billion.

Principles for renewal

Integration of SDG strategy and investments is among four CFO principles drawn up by the coalition to guide and track its ambitions. The others are based around setting targets, and reporting and auditing SDG impact; integrated corporate SDG finance; and integrated SDG communications and reporting.

By 2024, the coalition aims to reach critical mass as it fosters a community of at least 1,000 signatories to its principles. De Paoli is convinced that momentum is already on the coalition’s side: “Companies are increasingly deploying SDG targets that reflect their sustainable finance strategy, showing materiality, ambition and granularity.”