How AI Shopping Sidekicks Are Setting a New Standard for Trust

Rami Josef is confident he’ll never miss a great online deal—thanks to his trusted sidekick: an AI shopping agent.

“I have dedicated agents tracking specific items, like car parts,” he says. “If the price drops, the agent notifies me and completes the purchase automatically. My card details are already stored, so as soon as the price hits a certain threshold, it checks out on my behalf.”

As Agentic Commerce Lead at Checkout.com, Josef represents the forefront of a new kind of shopping behavior still unfamiliar to most consumers. While tools like ChatGPT are now mainstream, many people remain unaware of how AI can be used in retail.

Most shoppers have yet to experiment with AI-powered assistants, and over 60% of consumers in the UK, US, China and Australia express concerns about data privacy when it comes to AI in retail.

Still, Josef believes his approach will soon be mainstream. The widespread adoption of AI, he says, is the next natural evolution in commerce—just as the industry moved from brick-and-mortar businesses to APIs, and from desktop to mobile.

But the arrival of bargain-hunting agents, armed with user permissions and payment credentials, has clear implications for identity verification and fraud. It brings a new dimension to an already complex picture for shoppers and retailers alike.

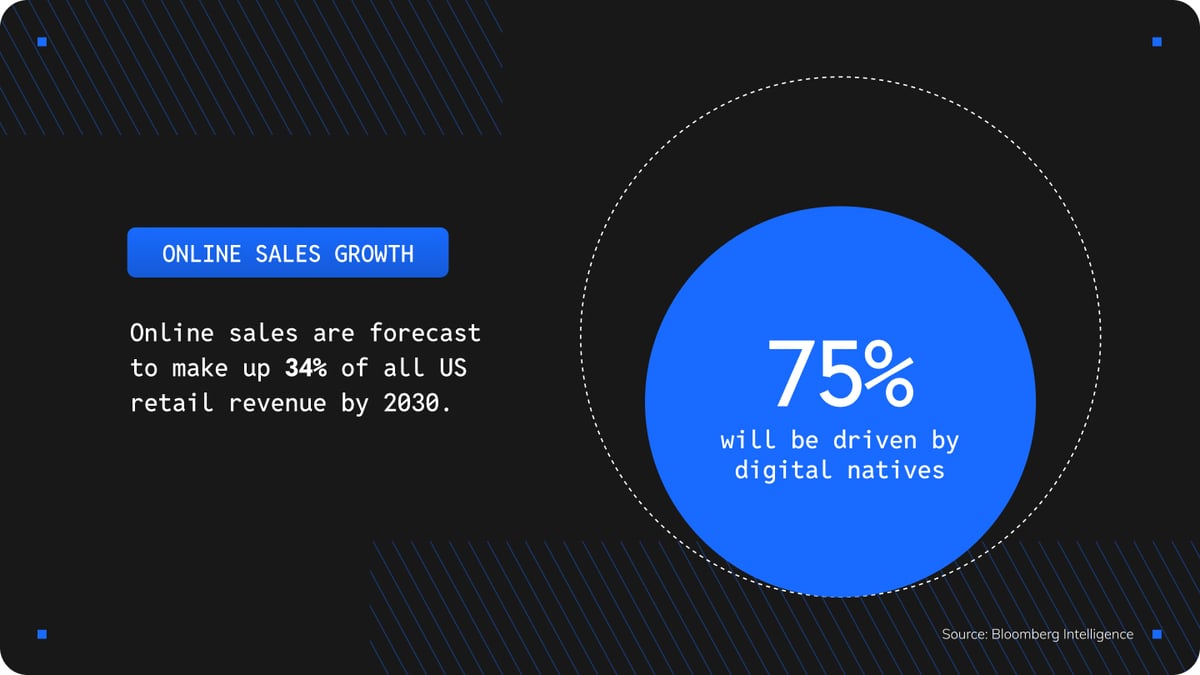

The surge in digital shopping certainly looks unstoppable. Bloomberg Intelligence predicts online sales will jump to 34% of US retail revenue by 2030, with digital natives driving 75% of that growth.

The fragility of trust in digital payments

Customer authentication and digital ID verification play critical roles in protecting the system. Yet consumer confidence is undermined on multiple fronts.

Slightly more than half of consumers think that AI tech is making the digital economy safer, but it is almost too close to call, according to a new study by YouGov for Checkout.com.

The study, which surveyed 18,000 consumers across 16 markets, reveals diverging attitudes across different geographies and generations—and not always along obvious lines.

For example, while a third of the boomer generation now feels safe storing their credit card details on e-commerce sites, only 27% of digital-native Gen Z are similarly confident.

AI is recognized by all age groups as a fraud threat. Gen Z, often frustrated in their pursuit of high-demand product drops such as concert tickets, are most concerned about resale bots distorting the e-commerce experience.

Baby boomers, however, are most likely (48%) to believe that they are at direct risk of AI deepfakes, and 36% of Gen Z are concerned, too. They have a point: Deloitte’s Center for Financial Services forecasts that generative AI could push fraud losses to $40 billion in the US by 2027, up from $12.3 billion in 2023.

For retailers, AI now sits at the crux of the trust imperative—posing real potential risks, but simultaneously promising secure solutions to drive customer conversion and retention.

Payment performance has overtaken traditional trust signals

The priorities of online customers at the critical checkout point have transformed over the past five years.

In 2020, at the start of the pandemic, the top concern of e-commerce shoppers was knowing that the vendor they were about to buy from offered a clear, hassle-free returns process. Today, with returns largely standardized, that concern has eased.

Shoppers’ biggest concerns now center on the payment experience itself. Failed payments and uncertainty about the security of a vendor’s payment page are the biggest trust killers. For AI shopping agents operating on behalf of consumers, these performance issues are even more problematic, as a failed payment can disrupt an automated purchasing workflow.

According to Checkout.com’s research, two-thirds of customers will lose trust in a brand if its payments performance is poor. More striking, 42% say a failed payment would deter them from returning to a site or app in the future.

The cost of a customer acquisition in e-commerce averages $50 to $130, underlining the high stakes of a legitimate but rejected payment or a security failure, says Milan Jani, VP of Product at Checkout.com.

“Don’t think of each person in that 42% cohort as one lost transaction, because what you’ve actually lost is the lifetime value of that customer from their repeat purchasing,” he says.

“We need to strike a balance between allowing good customers through and blocking fraud. Fraud is an issuer red flag. Allowing a bad transaction through can therefore have a knock-on impact on your overall approval rating.”

How algorithms are enabling seamless payments for AI commerce

With this in mind, how can merchants best walk this tightrope to ensure watertight security, without creating excessive friction for their customers or the AI agents shopping on their behalf?

The solution is inevitably complex, and depends on navigating the diverse approaches of thousands of issuers with subtly different preferences, who are subject to ever-changing regulations in their respective jurisdictions.

Deploying the adaptive capabilities of machine learning, Checkout.com’s Intelligent Acceptance platform applies an average of 87 million daily optimizations at every step of the payment process. Its algorithms determine the best way to structure and route each payment to an issuer, while running a fraud model on each transaction to combat bad actors.

This level of real-time optimization becomes essential as AI shopping assistants generate more frequent, automated transactions that need to flow seamlessly through payment systems.

The company also works in collaboration with banks in multiple regions to compare fraud scores and agree which transactions are safe. This goes beyond digital guardrails to real-world conversations, says Daniel Linder, Senior Director of Payment Performance at Checkout.com. “It isn’t an algorithmic thing,” he says. “You actually need the right partnerships with banks. And crucially, you need trust.”

Checkout.com also leverages “transaction risk assessment exemptions” to reduce friction. By maintaining very low fraud rates, the company is granted the ability to override Visa and Mastercard’s 3D Secure authentication for transactions under, for example, $500.

Trust is a valuable currency

So far, says Linder, the precision of Intelligent Acceptance has saved merchants over $10 billion in revenue that would otherwise have been lost to falsely declined payments, while retaining customer trust and loyalty.

But Linder is candid about the need to keep evolving the system to stay ahead of accelerating fraud threats, shifting regulations and the next phase of sweeping innovation.

“A payment optimization of one or two years ago might be completely obsolete today,” he points out. “With payment performance, you have to be humble enough to realize that you’re never going to be able to predict all the ways it will change—but be ready to act quickly when it happens.”

The next chapter of commerce

Rami Josef’s AI-powered shopping assistants offer a glimpse into what’s already becoming reality. Agentic commerce is the natural evolution of how we buy and sell, building on decades of digital innovation.

This shift promises unprecedented convenience for consumers. But it also presents merchants with a new challenge: creating payment experiences that can authenticate human shoppers and their AI representatives without compromising security or adding friction.

The companies that get this balance right will define what trust means in an age where AI algorithms shop on our behalf. For Checkout.com, this means continuing to evolve payment technology that recognizes the difference between beneficial AI agents and malicious actors—enabling merchants to embrace the future of commerce with confidence.