Why Better Data Is the Key to Growing Investment in Communities

With the exception of a handful of tech- and innovation-heavy “superstar cities,” communities across the United States are starved for investment. This need was apparent throughout the decade-long recovery from the Great Recession—which saw the nation’s 53 metro areas with populations exceeding 1 million account for nearly 75% of employment growth—and has become more acute during the coronavirus pandemic.

In response, public policy experts are calling for a surge of post-pandemic investment in America’s communities, especially in the areas most afflicted by what the Brookings Institute calls the “interconnected challenges” of poor public health, poverty, and environmental degradation. Meanwhile, a growing number of investors are prioritizing development projects that address communities’ specific social needs, like affordable housing and youth services.

Nationwide, over 8,700 census tracts have been designated as federal “Opportunity Zones,” places where private investors can receive capital gains tax deferments by investing in projects that spark job creation and economic development.

According to the Economic Innovation Group, a bipartisan think tank, 31.5 million Americans live in these zones. Nearly 60% of those people are non-white, have lower life expectancy, educational attainment, economic mobility, median family incomes, and rates of homeownership than people living outside of these areas.

What data points help investors understand community needs?

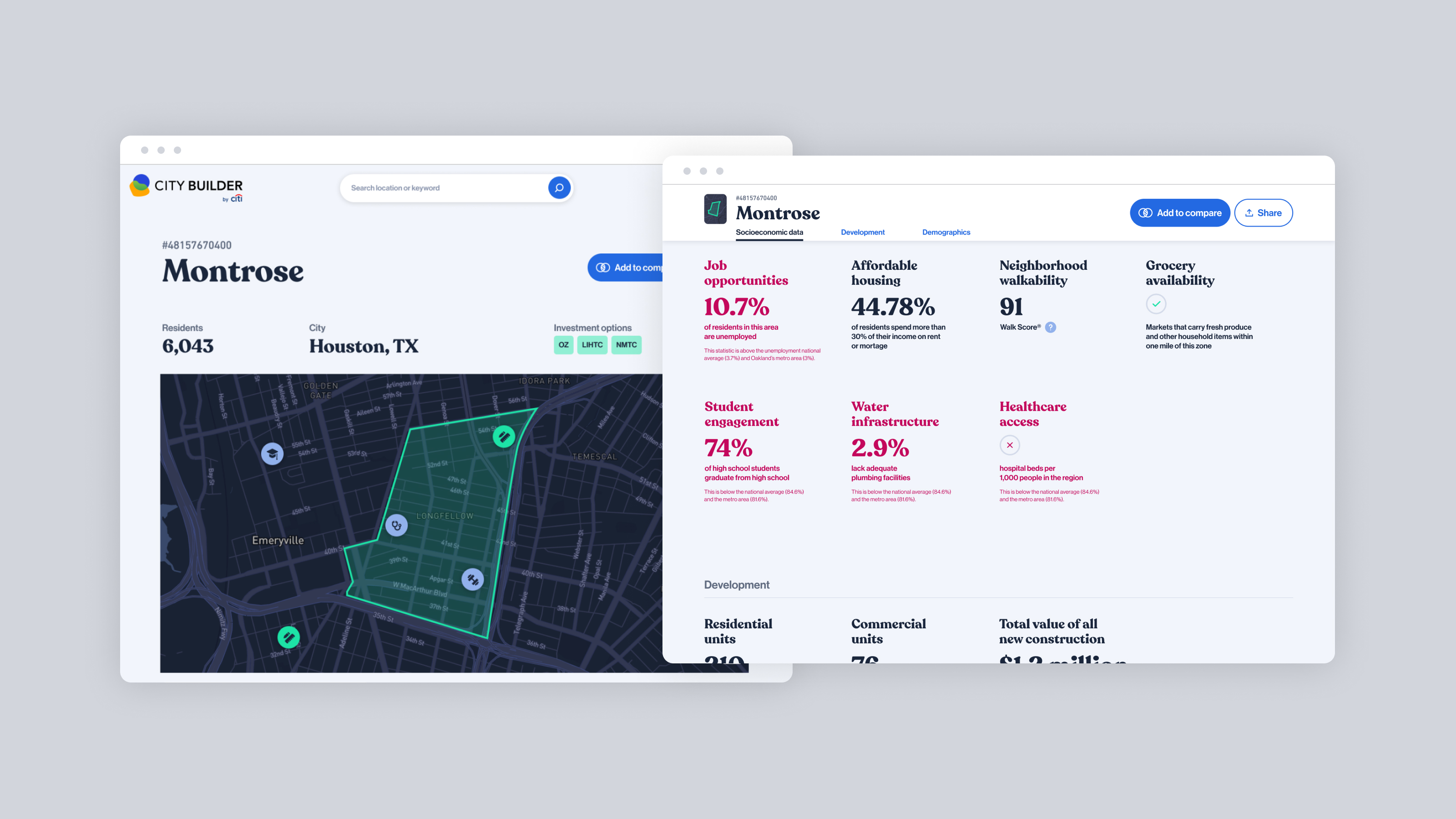

For meaningful socioeconomic transformation to occur in cities such as Stockton, Calif. and Newark, N.J., investors need hyper-localized data to make the best possible decisions. For instance, suppose you’re an investor who wants to improve public health by addressing a particular city or town’s “food deserts,” defined by the U.S. Department of Agriculture as low-income census tracts without a full service grocery store within a one-mile radius in urban areas or within a 10-mile radius in rural areas. You will need to know local employment rates, commercial land-use density, what sort of projects already are in development, and the specific areas where a significant number of people need to travel a mile or more to reach a supermarket. You also will need to need to know all of these things for multiple areas within and around that city or town.

Currently, finding and compiling that sort of information is tedious and expensive—requiring granular searches through U.S. Census statistics and various state and municipal databases, as well as the old-fashioned method of driving block-to-block to eyeball conditions in particular neighborhoods.

This data challenge limits both who can invest in urban revitalization and where investments end up going. Smaller and nonprofit funds traditionally have not been able to afford quality data. And even larger players have struggled to make impactful place-based investments. The challenge also extends to cities themselves, which need more and better ways to showcase their specific needs and investment opportunities.

Turn unique, data-driven insights into investment opportunities

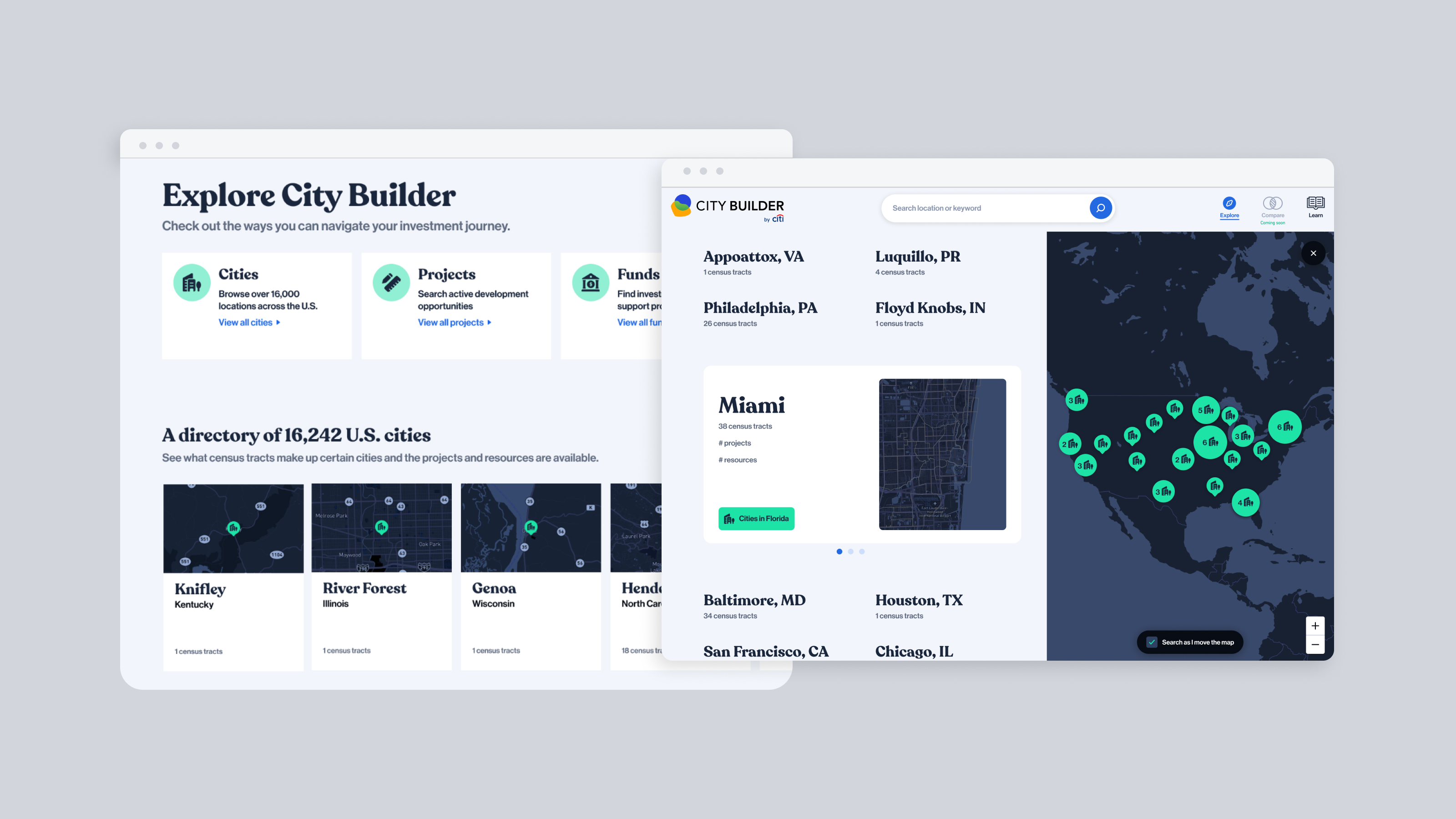

City Builder ® by Citi was created to meet this challenge. A free online tool developed by Citi Ventures Studio, City Builder is designed to give investors rapid and unique insights into place-based investment opportunities across the United States, including over 16,000 locations and 484 community development projects sourced from municipal prospectuses.

Built with the help of public and private development organizations, and data partners including the U.S. EPA, and the U.S. Census Bureau, the City Builder platform allows users to view people, place, and development information for every U.S. census tract. The tool also enables users to compare communities across eight areas of socioeconomic need, such as affordable housing, job creation, and food access, as well as review applicable investment incentives like Low-Income Housing Tax Credits and Opportunity Zone eligibility.

Similar to an e-commerce app or website that allows anyone looking for a new smartphone to compare prices and features across dozens of different models, the City Builder platform is visually oriented and easy to use. In a few steps, users can sift through real estate information that otherwise would take hours or even days to collect and analyze. Selecting affordable housing, for instance, highlights areas where, on average, residents spend more than 30 percent of their income on rent or mortgage payments.

How new data tools can help address inequality

The City Builder platform is just one example of how greater data availability and innovative ways of analyzing that information can help public and private stakeholders improve a wide variety of social and economic outcomes for communities.

The ongoing, multibillion-dollar federal effort to provide high-speed broadband to homes and businesses, for example, has long been hamstrung by inaccurate data that fails to fully show where Americans can and can’t get a signal; last summer, the FCC approved a new and potentially more accurate mapping method that promises to direct resources to where they are most needed. Similarly, the OZ Reporting Framework—created by the U.S. Impact Investing Alliance, the Beeck Center for Social Impact + Innovation at Georgetown University, and the Federal Reserve Bank of New York—is using quality data to guide Opportunity Zone investments and report on the resulting community impact.

With Covid-19 vaccinations now underway and widespread dissemination of them expected this year, many of America’s communities may be on the verge of shifting their attention and efforts away from managing an acute public health crisis and toward long-term recovery across multiple fronts. Place-based investment can aid those efforts by spurring equitable growth and socioeconomic vibrancy—but to maximize positive outcomes, governments, philanthropies and private investors need better information to both direct their dollars and measure their impact over time. The work of building back better begins with better data.

By Valla Vakili, Managing Director & Head of Studio, Citi Ventures