From Local to Global: How Asia Is Redefining Business Expansion

New businesses in Asia are growing at an unprecedented pace. Here’s how banks are helping them avoid the speed bumps.

Asia offers unparalleled opportunities for companies looking to scale.

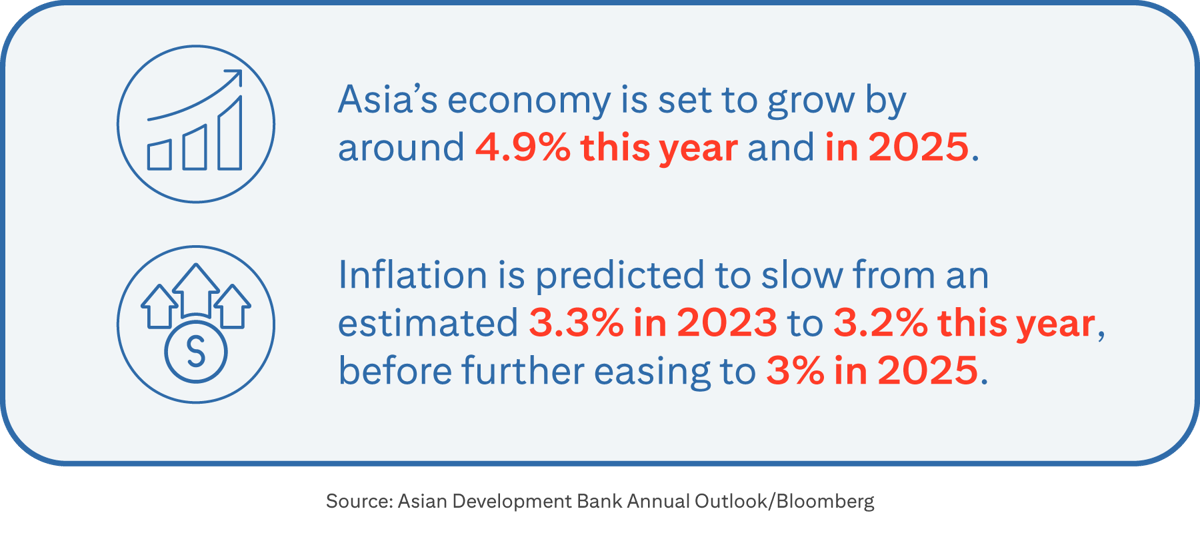

The region's economic outlook is promising, driven by robust consumer demand spurred by higher wealth generation and easing inflation, while its skilled workforce, favorable trade policies, vibrant startup ecosystem, and accelerating infrastructure development support business growth.

“This is Asia’s moment. New companies are forming and expanding beyond their borders in record time; the region is home to a young, dynamic population; and technology, innovation, and entrepreneurship are flourishing,” says Gunjan Kalra, Head of Citi Commercial Bank, Japan, Asia North and Australia, Asia South.

However, the Asian business landscape is not without its challenges. Companies looking to establish a presence across Asia must navigate legal complexities, market nuances, geopolitical uncertainty, and any technical or infrastructure gaps in the markets they enter.

These challenges make having the right banking partner essential.

Why local knowledge matters

Citi Commercial Bank’s presence in 12 territories across the Asia-Pacific region—coupled with the bank’s presence in more than 90 markets internationally—gives it valuable insights into local market conditions, which enable it to help clients make more informed decisions.

The bank provides solutions tailored to meet specific needs, such as supply chain finance to facilitate international trade and manage trade risks; foreign exchange management; and tools to drive efficient cash flow, including automated payment processing.

As a global bank that helps commercial clients establish a presence across Asia, Citi Commercial Bank is equally comfortable helping homegrown businesses expand beyond the region.

“Our banking franchise is equally strong in North America, Latin America, Europe, and the Middle East, so we’re able to support businesses with a consistent level of service wherever they choose to do business,” says Kalra.

Comprehensive banking solutions

Citi Commercial Bank supports companies at all stages of their journey.

For example, a Malaysia-based company specializing in AI-driven drone technology was able to exploit a gap in the market by using its cutting-edge autonomous drones to carry out industrial tasks that were previously done manually and at greater cost, such as inspecting critical assets like power lines and wind turbines. The firm quickly grew from three employees to over 1,000 people, establishing a presence in more than 45 countries, and it needed banking solutions agile enough to keep pace with its rapid growth.

The company’s most critical banking requirement continues to be fast money transfers—both payments and collections—and the ability to connect its subsidiaries wherever they are.

Citi’s global network enables the firm to conduct seamless cross-border transactions using electronic fund transfers, wire transfers and other payment methods. Citi’s integrated collection services, including electronic invoicing and direct debit, streamline the receipt of payments and enhance cash flow. And, leveraging advanced technology, Citi's digital platforms offer real-time transaction monitoring and analytics, which help the company to make more informed financial decisions.

Another client, a Hong Kong-based retail jeweler, has a longer history. Originally a family run business, it was founded in 1934 in Guangzhou, China, and has since grown into a multi-brand jewelry retail group with more than 1,000 stores across Hong Kong, Macau and mainland China. It has also introduced 39 e-commerce channels with 24/7 smart shopping assistants that serve customers in destinations where it doesn’t have a physical presence.

To keep up with demand—offline and online—the jeweler invested in a state-of-the-art manufacturing facility, which includes robot-supported assembly systems that are able to ship as many as 80,000 pieces of jewelry every 24 hours.

Since 2003, Citi Commercial Bank has played a significant role in the jeweler’s journey, by providing a simplified digital banking experience. For instance, its host-to-host and merchant acquiring solution has boosted the jeweler's e-commerce business by facilitating direct secure payments from the customer directly to the merchant without any manual intervention.

Accelerating business growth in Asia and beyond

One of the most significant trends in Asia is the speed at which companies are going global.

“Over the last few years, we have seen more companies going from small to mid-sized, to large, multinational organizations in a short span of time. Previously, this would have taken 10 to 20 years,” says Kalra.

Many of these businesses are fully invested in digital transformation through AI, automation, and cloud computing to gain a competitive advantage and give consumers a more personalized and seamless experience, increase operational efficiency and reduce costs.

“Client needs are more sophisticated than ever,” says Kalra. “They need banks to be just as innovative, quick, and agile. They want a full-service bank that can support every stage of their growth journey—payments, cash management, trade finance and working capital to loans, and fundraising through capital markets.”

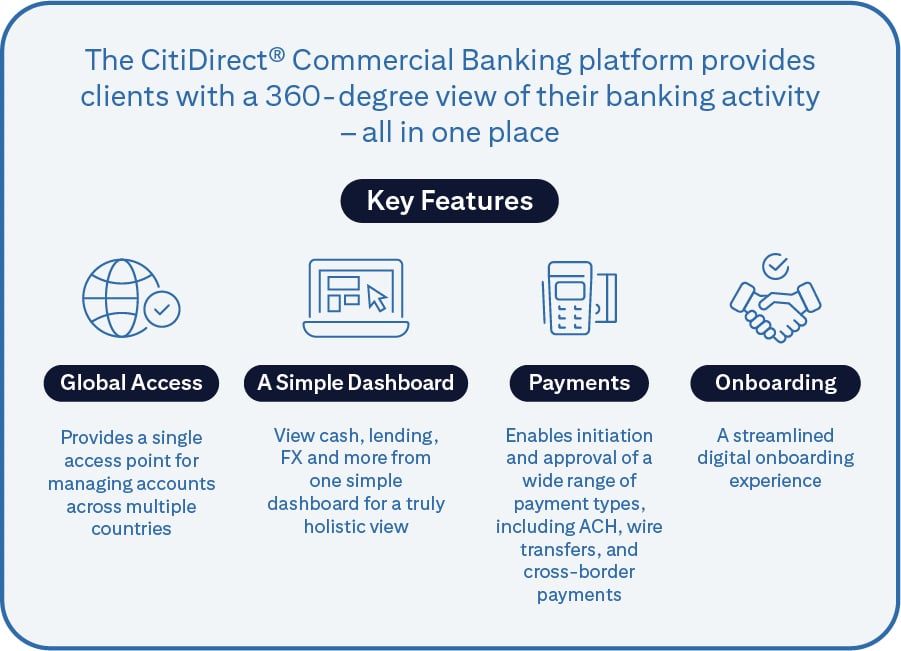

In response to the evolving expectations of mid-sized companies and their global needs, Citi Commercial Bank has launched a new platform, developed specifically for, and in collaboration with, clients. Currently being rolled out on a phased basis across Asia, CitiDirect® Commercial Banking provides clients with a streamlined digital experience, a holistic view of all their banking activity—including cash, loans, and FX—as well as the ability to onboard and transact.

Capital access is key

To effectively support today’s expanding businesses, banks must provide solutions across multiple fronts: scalable and agile digital banking platforms; expert advisory services with industry-specific knowledge across markets; and access to capital—perhaps the most critical area for high-growth companies.

“As our clients scale, they require more capital,” says Kalra. “Citi can help them find the best capital-raising solutions with our investment banking advisory and execution capabilities across mergers and acquisitions, equity, and debt capital markets.”

Kalra says the bank’s network of global investors is “always on the lookout” for good investment opportunities in Asia.

“Citi is in a position to facilitate those discussions and connect investors with companies,” she says. “There’s a lot to be excited about in future.”