The Power of Data in Healthcare

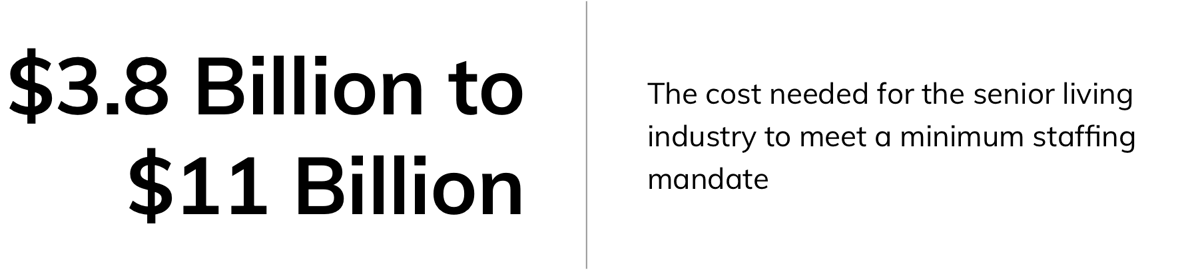

A new study reveals the unintended impacts of an unfunded federal staffing mandate that could cost the challenged industry $11 billion.

In February 2022, a multipoint plan to increase the quality of care in nursing homes was proposed by the Centers for Medicare & Medicaid Services (CMS), a division of the US Department of Health and Human Services (HHS). While well intentioned, the initiatives put forth include the unfunded Minimum Nursing Home Staffing Requirement, which could cost the already stressed senior living industry an estimated $11 billion — a price tag facilities simply can’t afford.

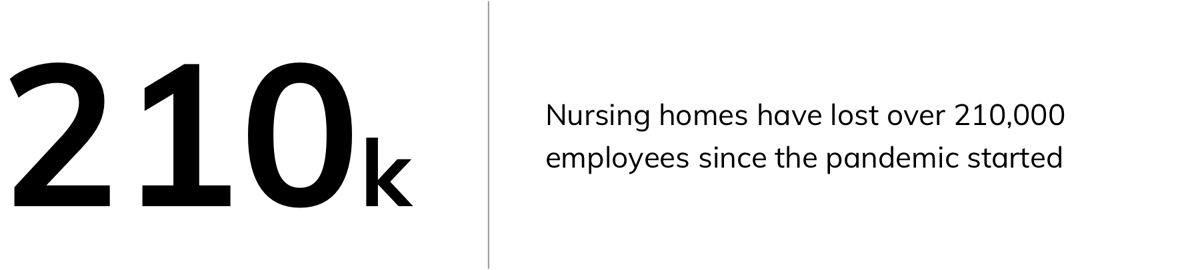

The Covid-19 pandemic severely impacted the health care workforce, particularly in nursing homes, where staff shortages were already a major concern. According to the American Health Care Association (AHCA), nursing homes have lost over 210,000 employees since the pandemic started — a staggering 13.3% of their workforce.

Hiring caregivers has been a challenge for 96% of nursing homes, according to AHCA. While all parties agree that staffing must be ramped up as soon as possible, nursing home organizations say that forcing compliance with the federal mandate — which could go into effect as early as October 1, 2023 — would negatively impact patient access, especially in remote areas, and could lead to the closure of small rural facilities.

Data insights reveal the true costs of a staffing mandate

Deb Emerson, Healthcare and Life Sciences Principal at CLA (CliftonLarsonAllen), the eighth-largest accounting firm in the United States, points out that if an organization can’t meet a staffing mandate, “it impacts residents who may not be able to get admitted to a nursing home in the future.”

CLA analyzed three staffing minimum mandates that CMS could potentially implement, with concerning results. “We were able to use data from various different sources to determine that if an unfunded staffing minimum was actually mandated by CMS, it would be a $3.8 billion to $11 billion cost to the senior living industry, and that it would need to find anywhere from 58,000 to 191,000 individuals to work in the nursing facilities, which is a challenge right now,” says Emerson.

“The mandate would break the whole ecosystem of how the skilled nursing world works because there’s not an extra $11 billion sitting around,” says Cory Rutledge, CLA Managing Principal of Industry. “The role CLA played was leveraging our industry knowledge and data analytics capabilities to tell a story and allow for data-driven decisions.”

The staffing mandate is aiming for perfection, but there are a lot of unintended consequences not being considered. Our role is to shine a light on the unintended consequences with data.

Better data enables better decisions

Around 1.5 million older adults live in US nursing homes, which are primarily funded by state and federal government sources. A significant percentage of these facilities would be unable to pay for and comply with an unfunded mandate’s minimum staffing requirements — and patient access to these essential care facilities could suffer.

“There’s the potential they would close, but the more likely scenario is that they would not take any new admissions to their facility,” says Emerson.

CLA’s findings provide a comprehensive overview of the effects of the proposed staffing minimum mandate, and AHCA has referred to this study to tell that story to legislators. CLA’s data has also enabled CMS to review the overall impact before implementing a mandate, and CMS will now conduct a new study before deciding on explicit minimums, which could take years to take effect.

Data tells the real story

CLA relies on data and analysis to point the best way forward, giving decision makers a more holistic view and uncovering actionable insights to help solve complex challenges faster and more accurately.

“We let data tell the story, so we can have honest conversations about strategies that are sustainable and viable,” Rutledge says. “It’s looking at a very human challenge we face as a society and applying data to it so we can have intelligent conversations on it and come to a better conclusion.”

The nursing home staffing study is just one example of how CLA uses data and analytics to enable businesses to operate more effectively and efficiently. By combining industry knowledge and insights with technological capabilities, CLA helps clients stay sharp and competitive in today’s digital age.

“We’re an industry-driven firm focused on privately held businesses and their owners,” says Rutledge. “When you put these two things together, you can deliver insights that are meaningful to an organization and relevant to the problems they’re trying to solve. And we leverage digital solutions to help them do that.”

Here’s how CLA can help your business.

The information contained herein is general in nature and is not intended, and should not be construed, as legal, accounting, investment, or tax advice or opinion provided by CliftonLarsonAllen LLP (CLA) to the reader. For more information, visit CLAconnect.com.

CLA exists to create opportunities for our clients, our people, and our communities through our industry-focused wealth advisory, digital, audit, tax, consulting, and outsourcing services. CLA (CliftonLarsonAllen LLP) is an independent network member of CLA Global. See CLAglobal.com/disclaimer. Investment advisory services are offered through CliftonLarsonAllen Wealth Advisors, LLC, an SEC-registered investment advisor.