From Lakes to Rivers: New Investment Approaches Among Indian Diaspora Family Offices

Family offices are synonymous with succession planning and wealth preservation. But an increasingly complex economic landscape globally is making investment decisions more challenging and forcing a rethink of priorities.

For the family offices of the ultra-high-net-worth (UHNW) Indian diaspora, this means turning to new asset classes and investment approaches to ensure the longevity of their wealth.

“We're in such a fluid state of economic affairs. What is relevant today may not be relevant in a decade's time, and that timeframe is rapidly shrinking. I want to ensure my children have financial security, so they can navigate uncertainty with the freedom to explore and take risks,” says Adeeb Ahamed, managing director of LuLu Financial Holdings.

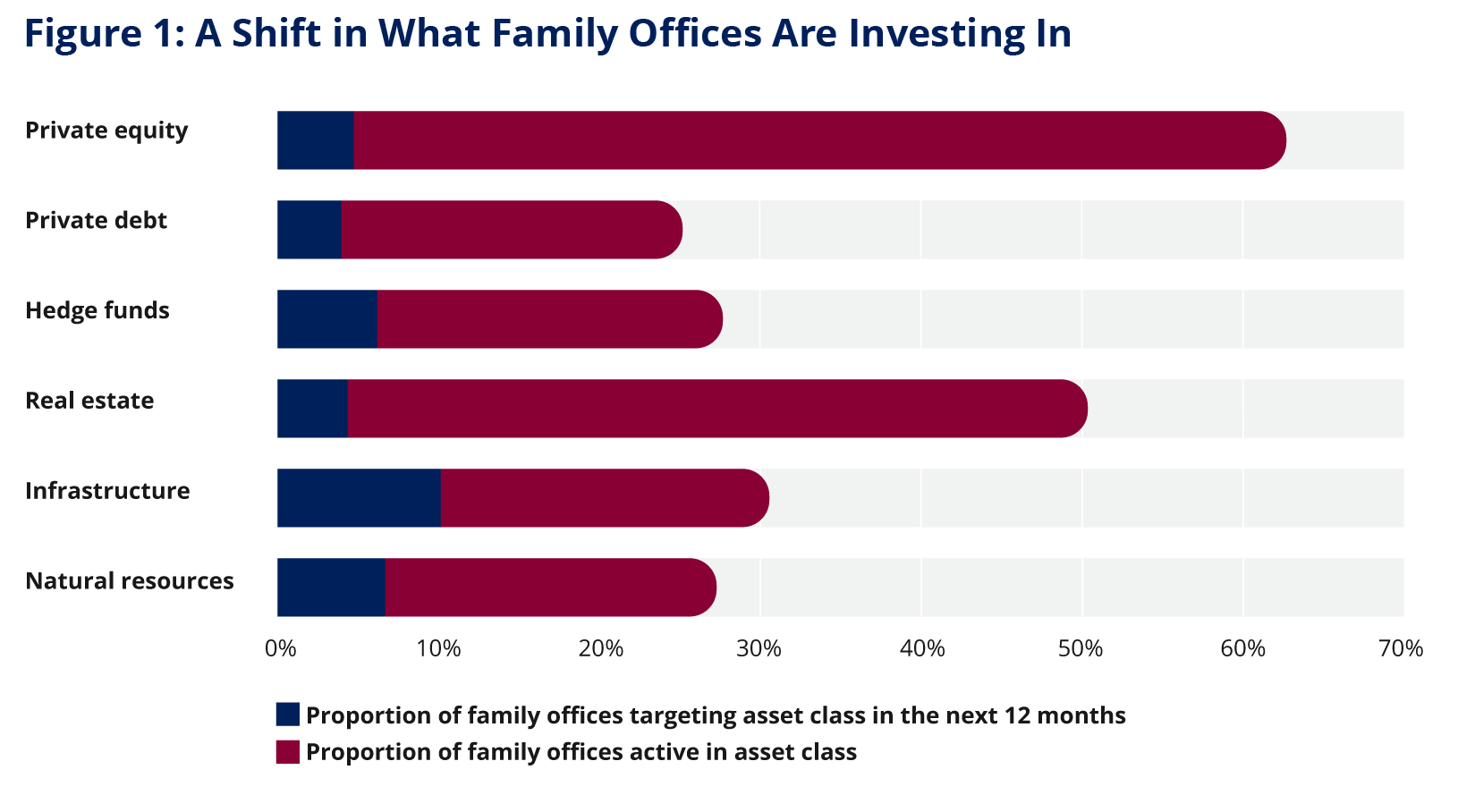

As younger members of family businesses become involved in investment strategies and higher interest rates reduce the appetite for debt, the UHNW Indian diaspora is increasingly shifting their investments away from traditional classes like real estate and equities, and toward alternatives like private equity and hedge funds.[1]

This follows a global trend, with more than 60% of family offices seeking new investment opportunities, 53% looking to diversify their portfolios, and 33% employing inflation mitigation tactics, according to a recent report.[2]

“We've gone from essentially a really safe risk spectrum to become a well-diversified asset manager across asset classes,” says the senior vice president of a New Delhi-based venture investment firm, who asked to remain anonymous.

Mirroring this global change, UHNW Indian diaspora families are also harnessing the expertise of their family offices to diversify their portfolios to incorporate a range of assets, according to a new report by DBS Private Bank and Bloomberg Media Studios. This includes hedge funds, private equity and private debt, with UHNWI Indian asset allocations to private markets doubling in the past five years.[3]

Some Indian diaspora family offices, like that of second-generation family entrepreneur Rishabh Mariwala, focuses on wealth creation, rather than wealth preservation—which Mariwala likens to a running river rather than a stagnant lake.

“In terms of asset allocation, we’ve chosen not to go into gold, real estate, commodities, or anything too exotic to us. We prefer to focus on public markets, venture capital and private equity,” says Mariwala. Younger, more tech-savvy members of the UHNW Indian diaspora, like Mariwala, are leading the charge in leveraging their global education, along with their family’s wealth and business experience, to shape a more active investment strategy. Many invest in startups—Indian family offices have invested in over 200 startups in the past decade alone—or found their own startup ventures in industries where they have an in-depth understanding.[4]

For example, after the sale of his family’s computer business, Amit Patni started his own family office. He drew upon his experience of investing in startups to establish several venture funds, including Nirvana Ventures and Ideaspring Capital, which focus on consumer tech, internet tech, software-as-a-service and artificial intelligence.

“All that knowledge of running your own business and being an entrepreneur comes into play, because of the advice you can give. That's the role you play being an investor, board member and a mentor to the founders,” Patni says.

“We have a set of people who have investing as well as operating experience,” adds the senior vice president of a New Delhi-based venture investment firm. “That creates a unique set of experiences across the front and back office.”

Another trend among UHNW Indian family offices to ensure the longevity of their wealth is investing in assets across multiple geographies and using tax-friendly jurisdictions as an investment base.

In 2022, Indians at home and in the diaspora allocated $1.7 billion into foreign banks, equity and debt instruments and overseas property.[5] The same year, an estimated 7,500 Indian millionaires moved abroad in search of favorable tax regimes, robust business ecosystems, better education for their children and stable political landscapes.[6]

Many of these families base themselves in major financial hubs like Singapore and Dubai. These markets have large populations of diaspora Indians, and many families have strong roots in both markets. Both cities also provide easy access to India.

Motivated by pull factors like the city-state’s strong legal system and access to world-class financial advisors,[7] prominent families with a family office in Singapore include the Lohias, founders of the Indorama group of companies; Rishabh Mariwala, founder of Sharrp Ventures; and Manoj Punjabi, co-founder and CEO of Indonesian film behemoth MD Entertainment, according to DBS Private and Bloomberg Media Studios' report. These families join the Ambanis of Reliance Industries, who recently set up a family office in Singapore in 2022.[8]

“There is strong governance, and there's a strong strategy framework,” notes Mariwala. “Singapore is one of the best in class, even more so than the Middle East, which is very easy as a base to deploy capital.”

Others, like Nirav Shah, chief investment officer of the RP Group of Companies, engage multi-family offices across the world to ensure they have the best structures for their investments, along with a diversity of advice.

“The office can be in Singapore, Mauritius, Dubai and Switzerland. We also use offices in the London time zone. They give us advice, and we as a family decipher exactly where we want to go and what we want to do,” he explains.

Sustainability and philanthropy have also emerged as core themes in Indian family offices’ investment decisions, driven by the recognition of the growing impact of climate risk.[9] And although most family offices are clear that their investment activities are driven by opportunities for returns, the influence of younger generations and the increasing importance of sustainability has translated into a heightened focus on impact investing among family UHNW Indian diaspora family offices.[10]

Globally, more than half of all family offices are invested in environmental, social and governance (ESG) initiatives. Sustainable investments—which now make up 36% of an average portfolio—are expected to account for 43% of investments in the next five years.[11]

Ahamed said he changed his mind on impact investing after his wife completed a master’s degree in the subject.

“When my wife first told me about impact investing, I was not so clued in. Now she has come back from Cambridge with all that deep knowledge, and she has created momentum within the family. We will support that,” he says.

The growing understanding of impact investing contributes to improved portfolio security, according to many of the UHNW Indian diaspora. Impact investing increases the diversity of investments and mitigates climate risk, while its ESG focus has helped many family office owners actively incorporate resilience into their own management and investment approach.

“As long as you make money the right way for solving a genuine problem, and you're creating a business with a genuine purpose in mind, I think impact naturally follows,” explains Ashish Saboo, managing director of General Atlantic in Indonesia.