Combating the Surge of AI-Driven Business Fraud

How businesses can leverage cutting-edge technology to strengthen their defenses and help prevent automated fraud.

The accelerated adoption of digital commerce coupled with the rise of artificial intelligence (AI) has propelled fraud to unprecedented heights. Traditional anti-fraud practices have been overwhelmed, resulting in soaring losses and reduced customer trust.

In today’s dynamic business landscape, organizations need a proactive approach to help combat this pervasive issue. Using machine learning, scammers have gained capabilities to automate and expand their activities. The impact extends across industries, and the emergence of new generative AI solutions that are widely available presents new challenges that businesses need to understand and anticipate.

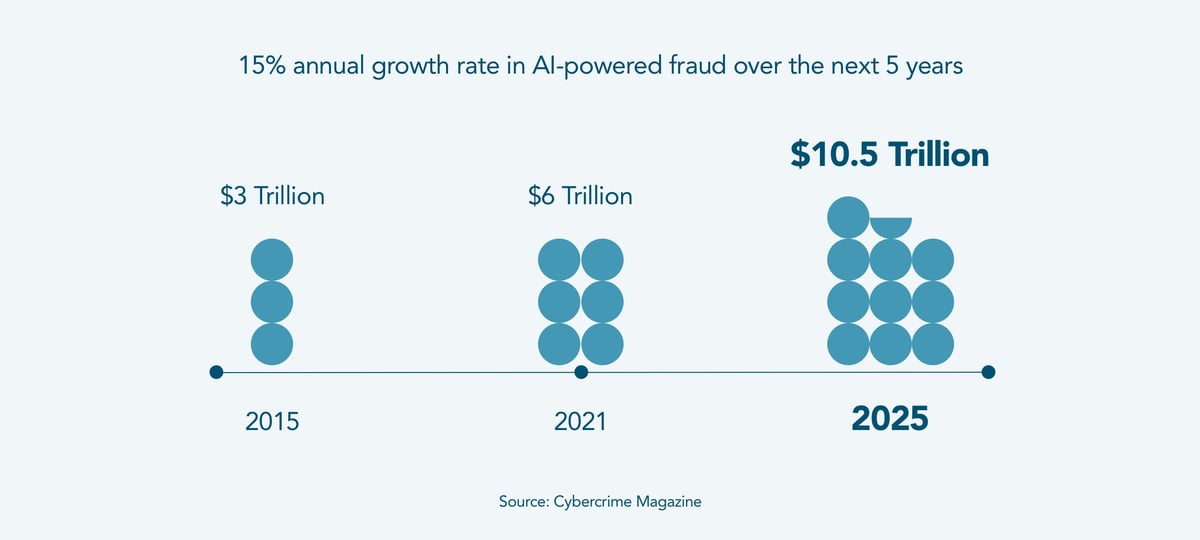

A recent report by Cybersecurity Ventures shows that AI-powered fraud is projected to grow at an astounding rate of 15% annually over the next few years, soaring to a staggering $10.5 trillion annually by 2025. This expected surge highlights the urgent need for companies to fortify their defenses and develop strategies that help outsmart bad actors. Leveraging AI-powered anti-fraud solutions can be part of a plan that helps businesses thrive and expand.

As businesses increasingly embrace these technologies to combat fraud, those without a comprehensive AI anti-fraud strategy may find themselves exposed as vulnerable targets. Machine learning algorithms can be used to generate convincing audio recordings or phone calls, carry out automated attacks on vulnerable systems and even create synthetic identities. Difficult to detect, these fraudulent identities can be used to open accounts, apply for loans and conduct other illegal activities.

How experts can help companies protect themselves from fraud

Running billions of automated algorithms at once, scammers are capable of infiltrating companies at an unprecedented scale. Vincent Smith, Senior Principal Product Manager at Dun & Bradstreet, emphasizes that collaborating with fraud risk management experts can help businesses more effectively shield their supply chains, customer portfolios, resources and operations against fraud.

Companies are increasingly concerned about the speed, reach and potential impacts of fraud, and are more likely today to seek out experts who possess extensive knowledge in identifying, analyzing and mitigating fraud risks.

Smith recalls the story of a customer in the automobile industry that dealt with fraud involving high-priced vehicles. Criminals used compromised and synthetic business information to acquire expensive autos. The company reached out to Dun & Bradstreet to help conduct an investigation.

Smith’s colleague Andrew La Marca, Dun & Bradstreet’s Senior Director of Risk and Intelligence Operations, and the company’s team of certified fraud examiners used data analytics and other cutting-edge investigative tools to identify and mitigate the threat. Their analysis helped unravel a larger fraud ring and uncovered multiple automobile companies and leasing agencies that were also victims. Ultimately, Dun & Bradstreet’s fraud risk services and expertise not only helped the customer save millions of dollars, but also played a role in exposing the perpetrators and their tactics.

“One successful fraud attempt against their company could cost them millions,” says Smith. “The cost of expert services to detect fraud can be a fraction of what companies might lose if even one fraud attempt gets through.”

Fraud risk management experts play a vital role in conducting vulnerability assessments and educating companies about preventive measures. Sophisticated technologies and data analytics tools can provide access to advanced detection capabilities, helping companies identify risks before they escalate.

“When we identify a new fraud scheme or an anomaly that proves to be fraudulent, we swiftly incorporate it into our models, bolstering their detection capabilities,” Smith says. “Our models generate scores and probabilities for fraud related to identity theft, business misrepresentation and first-payment default.”

The impact of sophisticated fraud prevention tools

To counter the weaponization of AI by hackers and other bad actors, businesses can respond with equal force and incorporate AI into their anti-fraud defense strategies.

By leveraging AI and sophisticated algorithms, businesses can proactively enhance their fraud detection and prevention measures to help them keep pace with the evolving tactics of bad actors in an increasingly interconnected world.

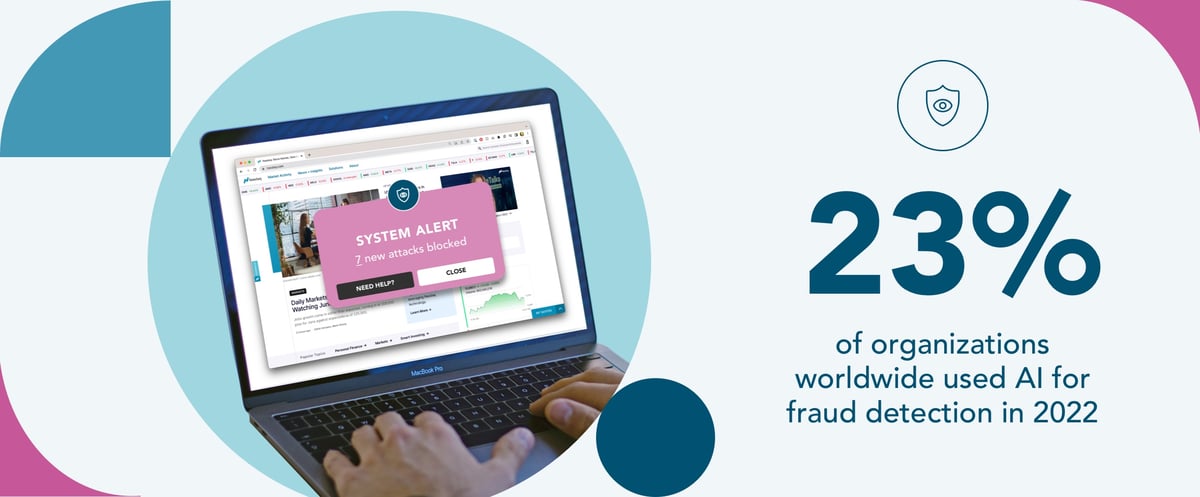

AI adoption has more than doubled globally since 2017, according to a survey by McKinsey & Company. Companies that have made significant investments in AI to optimize their operations are seeing the highest financial returns and outperforming their competitors.

However, adoption of AI-powered fraud detection solutions continues to lag, with only 23% of organizations worldwide using AI for fraud detection in 2022, IBM reports.

“Gone are the days when fraud required physical presence and direct interaction. Now, they can defraud millions of companies simultaneously from a laptop. That’s how technology has transformed the landscape,” says Smith.

“Look at who is not protecting themselves—that is where the fraudsters may attempt to hit,” he says. “They do not want hard targets, and they do not want to be investigated. They want to take the easy path.”

Key takeaways for fraud prevention teams

Fraud incidents can severely damage a company’s reputation and customer trust. Implementing robust risk management and anti-fraud practices can be beneficial for every business, and can ensure that a brand’s reputation remains intact and customers feel confident in their transactions.

In the relentless battle against fraud, businesses can fortify their defenses, adapt to emerging threats and stay one step ahead of bad actors.

What a company does today for fraud prevention and mitigation is unlikely to be sustainable for the long term. As threats evolve, businesses can benefit from frequent, regular reviews of their prevention, mitigation and investigation tactics. The cost of investing in fraud prevention can pale in comparison to the potential losses from a successful fraud attempt.

As hackers weaponize AI to commit fraud, companies that take proactive measures to protect their assets, safeguard their reputations and foster secure and sustainable growth can better prepare themselves for a prosperous future.