Singapore: Balancing Profit and Purpose for a Better World

Since the turn of the millennium, the world has endured a tumultuous period marked by upheaval and crisis. Societies globally face mounting and intensifying challenges, from climate change and food insecurity to widening inequality.

As the global population expands, the task of ending malnutrition and ensuring every citizen has access to a healthy and sustainable diet becomes more daunting, and the need to find viable alternative sources of protein to farmed land animals grows more pressing.

Growing populations use more resources and demand more energy, yet it is now abundantly clear that the world needs to find a way to meet those needs without burning fossil fuels or accelerating the consumption of finite materials.

The digital economy is providing some of the answers to that problem, offering economic opportunities that require less consumption, but there is a danger that the rapidly developing Internet economy may leave behind those without basic online access.

Each of these issues poses an enormous challenge to societies and the companies that serve them. Businesses that adapt and innovate to solve these problems have the opportunity to thrive; those that don’t face obsolescence.

In Asia, the majority of leaders believe recent world events have had a negative impact on humanity, surveys suggest. Conversely, however, about half of companies in the region say these negative forces have triggered positive changes in their businesses, encouraging them to become more agile, flexible, innovative, and focused on the well-being of their employees, customers, and the environment.

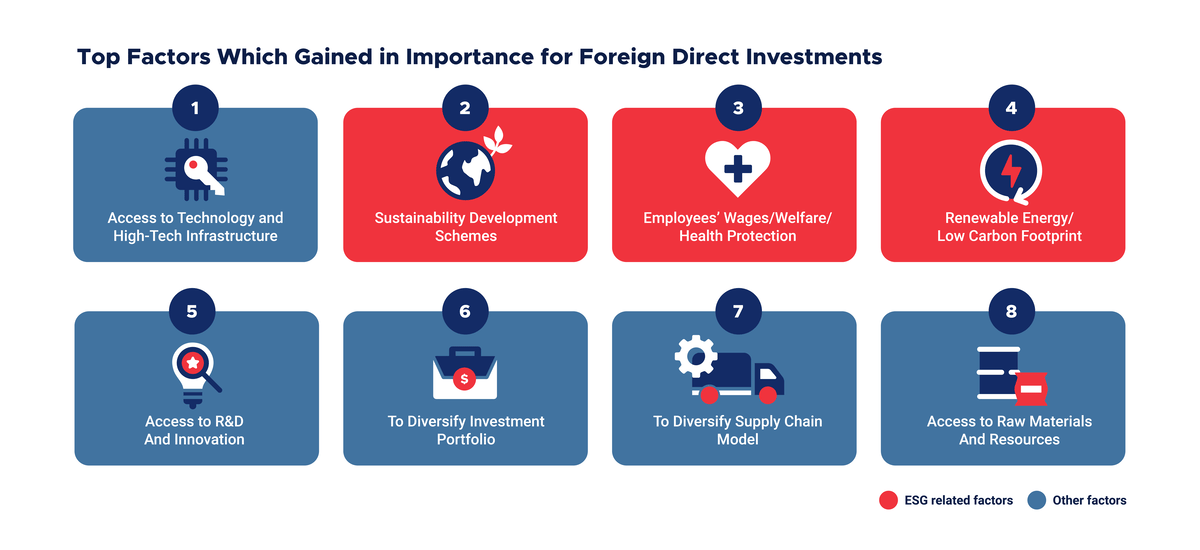

Foreign Direct Investors (FDIs) have embraced this positive shift, too. According to a 2022 Bloomberg survey of global FDIs, more than half say they are more optimistic about the world economy than they were in 2021. About 60% now integrate Environmental, Social and Governance (ESG) factors into their investment strategies, while 80% intend to expand their operations internationally within the next three years.

Why is this good news? Because it suggests strongly that, despite the looming wall of challenges the world faces, business leaders are confident that solutions will be found, and are prepared to invest if they can find the right environment.

Bloomberg’s research suggests that FDIs are becoming more focused in finding what they need to shape the future economy and thrive in it. This means accessing a highly skilled workforce, developed financial markets, and an operating environment that meets international standards. These factors are just as important as avoiding political instability, security risks, and doing business in stable currencies.

The survey found that investors are also looking for agile, flexible locations that embrace technological change. ESG factors are another increasingly critical component of investment decisions. Two-thirds of companies surveyed said they are more likely to invest in countries that have adopted sustainability initiatives.

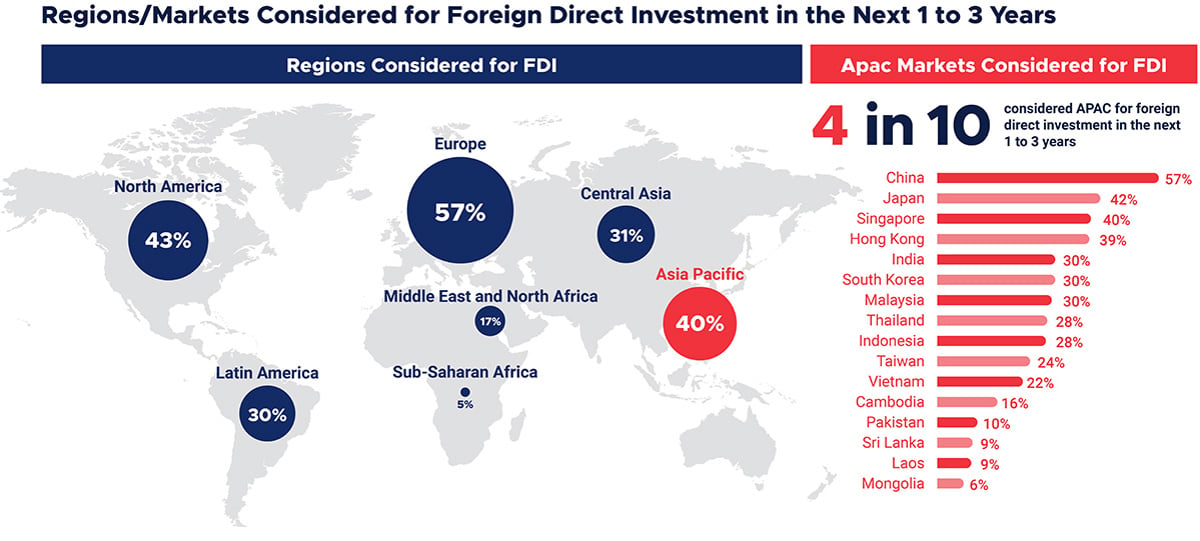

Among FDIs worldwide, four in 10 are looking at investments in Asia-Pacific over the next one-to-three years. And when they look at Asia, Singapore is among the top three destinations they have in mind.

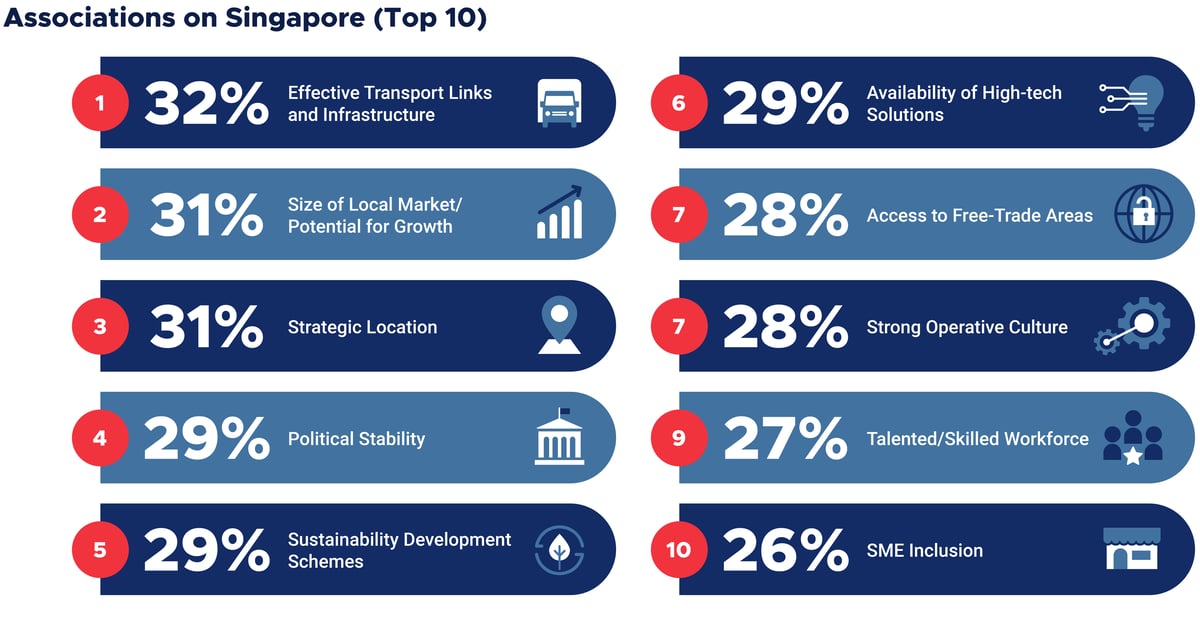

As their investment criteria become more complex and demanding, many FDIs are now looking to Singapore to meet their evolving needs. According to global research, FDIs primarily associate Singapore with sustainable development programmes, the availability of high-tech solutions, world-class infrastructure, political stability, and a skilled workforce.

In fact, based on almost all criteria covering socio-political, economic, tech & infrastructure, and human/health factors, Singapore ranked higher than the average rating of both emerging and developed markets, according to the Bloomberg survey.

When it comes to investment potential, Singapore ranks highly among FDIs for advanced technology and innovation, and the country has become the first-choice destination for innovative greenfield investment projects in the ASEAN region1.

In the first half of 2022, Singapore drew in more FDI than ASEAN countries, China, South Korea, and Japan.2 In the whole of 2022, the country’s Economic Development Board attracted a record $22.5 billion (approximately S$30.2 billion) in fixed-asset investment commitments.3

Companies leading the way to innovate in areas like food security, renewable energy, carbon management services, and the digital economy are choosing Singapore for the availability of high-tech solutions, a skilled and knowledgeable workforce, progressive regulatory environment, and business-friendly investment climate.

They include Microsoft and Google, which have chosen Singapore as a base to advance their regional and global plans for digital inclusivity and the deployment of technology to solve some of the world’s most pressing problems.

They also include Arkema, a world leader in the development of specialty materials that meet the ever-growing demand for sustainable and innovative solutions, and EDPR APAC, part of EDP Renewables, a global leader in the renewable energy sector and fourth largest wind and solar energy producer worldwide.

And as the search for healthy and sustainable food sources intensifies, companies such as aquaculture AI solutions provider AquaEasy and fruit-and-vegetable giant Dole are designing innovative production and upcycling solutions that make food production less wasteful and more cost-effective.

Societies already contain the talent and vision to address the major challenges we face. For many of the world’s most pioneering companies that are determined to face those challenges, Singapore offers the combination of partnership, collaboration, innovation, and openness to change that they need to reshape the world for generations to come.

[1] FDI Intelligence [2] FDI Intelligence [3] EDB