What Does a Next-Gen Sustainable Business Look Like?

Defining and achieving sustainability is the corporate world’s biggest challenge. Italian utility Enel is pioneering an approach that turns the concept of company value on its head.

Italian utility giant Enel Group, which operates in 30 countries, is redefining how salaries are perceived. Instead of a business cost, it now defines salaries as value distributed to its employees, in the same way that the taxes it pays are classified as value distributed to communities.

In fact, the Group now measures its performance entirely against the value it provides to its stakeholders—up to and including the planet itself.

For Enel, this radical thinking is simply the logical result of putting sustainability and all stakeholders at the center of its activities. That’s something most businesses now strive to do, but Enel believes it has redefined what a truly sustainable company looks like. Last May, it trademarked its approach: the ENEL STAKECAP©™ model.

From profit to purpose

Today, most businesses aim—or at least claim—to be pursuing sustainability, which generally entails net-zero ambitions and setting ESG targets. At a broader level, the idea that a business must have a social purpose, as well as a profit motive, is being gradually embraced.

This shift has been accelerated by globalization and the climate crisis, suggests Klaus Schwab, founder of the World Economic Forum (WEF), who believes that a heightened awareness of our interconnectedness has highlighted the responsibilities of business to society and the planet.

In his recent book, “Stakeholder Capitalism,” Schwab maintains that shareholder primacy and state capitalism lead to suboptimal outcomes by focusing on the profits or prosperity of a company or country. 1

In the stakeholder model, he says, “neither of the more granular objectives is set aside, but the interconnectivity and the overarching well-being of people and the planet are central, ensuring a more harmonious outcome over time.”

Stakeholder capitalism metrics

The WEF has suggested common metrics that could enable companies to integrate sustainability and finance. However, few firms have yet reached the stage of embedding stakeholder capitalism in their business model and strategy. Enel is an exception.

Enel Group—the world’s biggest private energy utility by renewable installed capacity—was already committed to sustainability in other ways, for example issuing its pioneering sustainability-linked bonds in September 2019.

But Enel has reframed its entire strategy. In 2019, its strategic plan introduced the concept of “sustainability is value” to highlight the close link between sustainable practices and financial performance. Now, with the launch of ENEL STAKECAP©™ Integrated Reporting, it has doubled down on that intent.

“In an increasingly interconnected world with ambitious challenges ahead, long-term value creation will only be possible if it is based on business models that are sustainable and consider all relevant stakeholders,” explains Alberto De Paoli, Enel’s Chief Financial Officer.

The platform presents the ENEL STAKECAP©™ model with a set of indicators that measure the company’s impact on its stakeholders: the planet, communities, customers, employees, partners, suppliers, debt holders and shareholders.

.jpg)

Five ways to track business value

Enel’s approach is based on five pillars, within the scope of its broad objective of creating value. According to Enel, the model’s “Value Created” pillar is based on a metric that represents “the amount of sustainable result a company generates”; in 2021 it totaled €23.1 billion ($23.3 billion). “Value Distributed” is the next pillar, represented by a metric that accounts for how much of the value created is distributed to beneficiaries.

These figures are accompanied by the “Quality” indicator, which defines the sustainable, responsible way in which the financial performance is achieved to stakeholders’ benefit, and by “Communication,” which presents results achieved for each stakeholder. According to Enel, “the model cannot evolve without the help of a new communication strategy that constantly presents results achieved and our plans for the future in a structured manner to our stakeholders.”

The group’s indicators quantify reduced emissions and use of raw materials, increased rates of household electrification, raising the proportion of female managers it employs and boosting its sources of sustainable finance (55% of its total gross debt in 2021). Targets for the next three years are incorporated; the group aims to reduce its direct (Scope 1) CO2 emissions by 38% by 2024 compared to 2021.

Enel categorizes taxes and employee salaries as elements of the value distributed to its stakeholders; in 2021, value distributed was €16.1 billion ($16.2 billion), around 70% of the value created by Enel. Customers, suppliers and partners are indirect beneficiaries of this value creation through Enel’s products, services and partnerships.

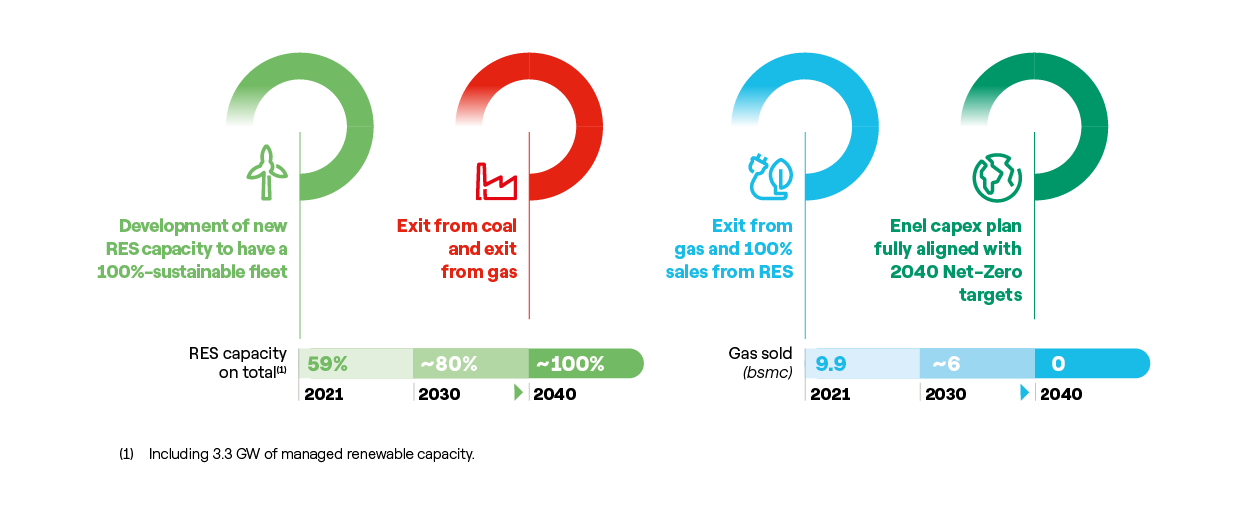

“Value Retained” by the company—the fourth indicator—provides the funding needed for its development strategy, which came to €7 billion ($7.1 billion) in 2021, and the Group has brought forward its net-zero commitment by 10 years, to 2040. Investment is focused on achieving sustainable goals such as installing new renewable energy capacity.

Enel Accelerates its Net-zero Targets

A model for the long term

Over time, stakeholders will be able to track the group’s performance against its long-term strategy. Enel intends to increase value created by roughly 60%, and value distributed by around 40% by 2030.

The group aims to achieve total installed renewable capacity of 154 GW globally by 2030. By then, it plans to have 86 million customers connected to its distribution networks, and it will support their sustainability journeys by increasing the proportion of renewable energy sold and providing new services such as electric transport.

From Enel’s perspective, stakeholder capitalism is not a passing trend, but a long-term ethos: “The interests of organizations and their stakeholders grow together. This is why Enel will continue to pursue sustainable business models that support the organization’s development and achieve holistic results to create greater value for all stakeholders.”

Could other businesses soon adopt this framework to track their own value creation? Enel certainly seems to think so, and the ENEL STAKECAP©™ model has crystalized how the group intends to move shared value forward for each category of stakeholder, as well as achieve its purpose and goals.

1 www.weforum.org/agenda/2021/01/klaus-schwab-on-what-is-stakeholder-capitalism-history-relevance

Hero image credit: Shutterstock

Body image credit: Unsplash