The Engine of Germany’s Economic Future

New research reveals German enterprises’ innovative edge is fueled by their embrace of connectivity.

Germany’s economy was projected to contract by 0.2% in the third quarter of 2022, in part due to the rising energy costs that are affecting the country’s manufacturing sector. But Europe’s largest economy demonstrated its resilience, defying expectations and delivering a 0.3% expansion.

While analysts anticipate that such positive performance is likely to be challenged in the coming months, the nation’s robust remote workforce and recent announcements of major new manufacturing projects indicate that despite adversity, Germany will continue to invest in the future.

Enhanced connectivity is critical to unlock the operational efficiencies and opportunities required to maintain this momentum—and German enterprise leaders are embracing it.

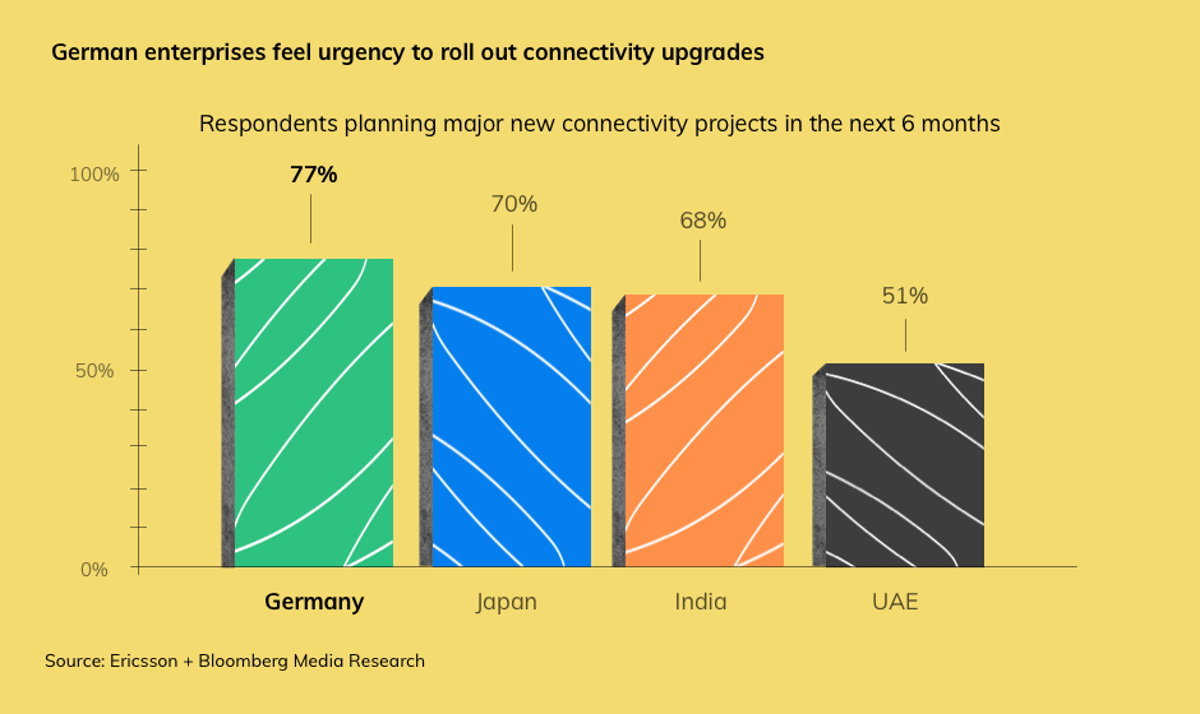

A recent survey of IT decision makers in four global connectivity hotspots—Germany, India, Japan and the UAE—revealed that Germany-based respondents are leading the pack in prioritizing cellular solutions for their businesses. The survey, conducted by Bloomberg Media Studios on behalf of Ericsson, reflects a desire to increase agility and boost productivity with the help of today’s 5G technology.

These moves will help fortify German enterprises against the headwinds facing the global economy. George Mulhern, Head of Enterprise Wireless Solutions at Ericsson, says that the country’s connectivity investments can boost its resilience.

“Companies that have invested in connectivity are the ones that are best positioned to make quick pivots. Having cellular in the mix in a more robust way will help German manufacturers stay agile.”

EVs and semiconductors reshape the German manufacturing landscape

Germany ranks fourth in the world in manufacturing output, according to the World Economic Forum, which has rated the German economy among the world’s most innovative in recent years.

That distinction is attributed in part to the country’s moves toward the future of driverless vehicles. Today, transportation and mobility continue to loom large in the German manufacturing mix.

A new Tesla factory outside of Berlin will dramatically increase Germany’s stake in the booming EV market at a critical time for the industry; more than 20% of new cars sold in Europe and Britain in December 2021 were powered solely by electricity, according to Schmidt Automotive Research. And a new €17 billion semiconductor factory in Magdeburg, a city in central Germany, will help fortify the supply chains of German manufacturers, including automakers.

Further expansions into electromobility will be key to maintaining the innovative spirit that has characterized Germany’s economy, and demand on these factories will only increase. To reach peak efficiency and save time and money in the face of rising energy costs, they will rely more and more heavily on sensors and robots, says Mulhern.

"We're used to hearing Germany described as Europe's industrial heartland, but what we're hearing from IT leaders there paints a more forward-looking picture."

Cellular technology’s place in the modern manufacturing mindset

The forward-thinking attitude of German enterprises is evident in recent research that surveyed IT leaders working in the manufacturing, automotive, energy/utilities and port sectors.

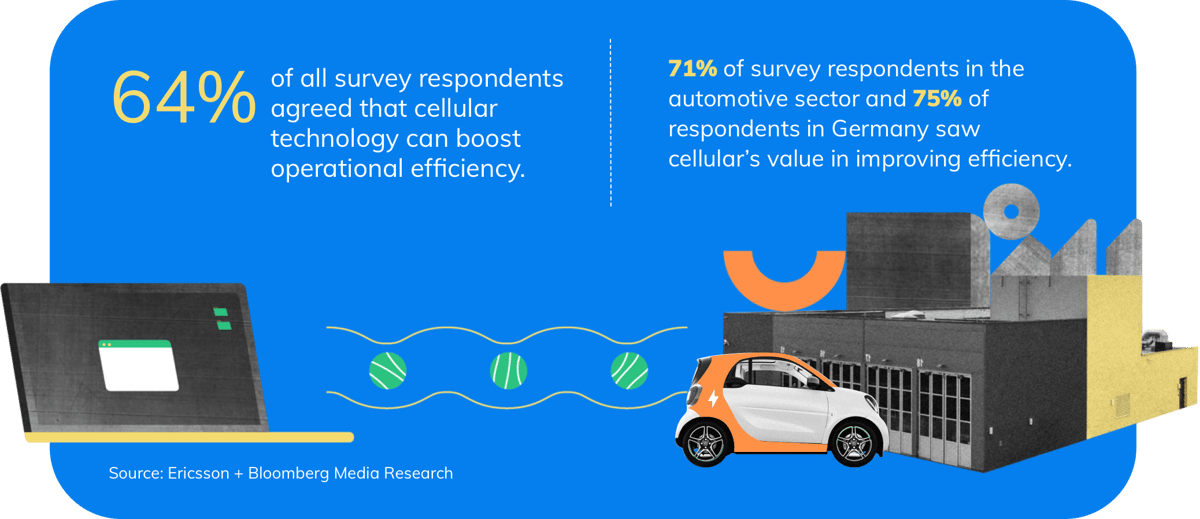

The results show that Germany-based respondents across sectors are highly attuned to the benefits of cellular technology. The German IT community’s attitudes nearly matched those of the global automotive sector’s IT community, which proved to be the most connectivity-minded industry group surveyed.

German respondents and automotive IT workers were also more likely to value cellular connectivity’s facilitation of real-time data analysis—a critical intelligence-gathering tool for a factory full of connected devices.

It’s telling that the survey’s German sample and global automotive sample highly value connectivity, says Mulhern. “That’s a very modern manufacturing mindset, and those that have it hold a competitive edge,” he says.

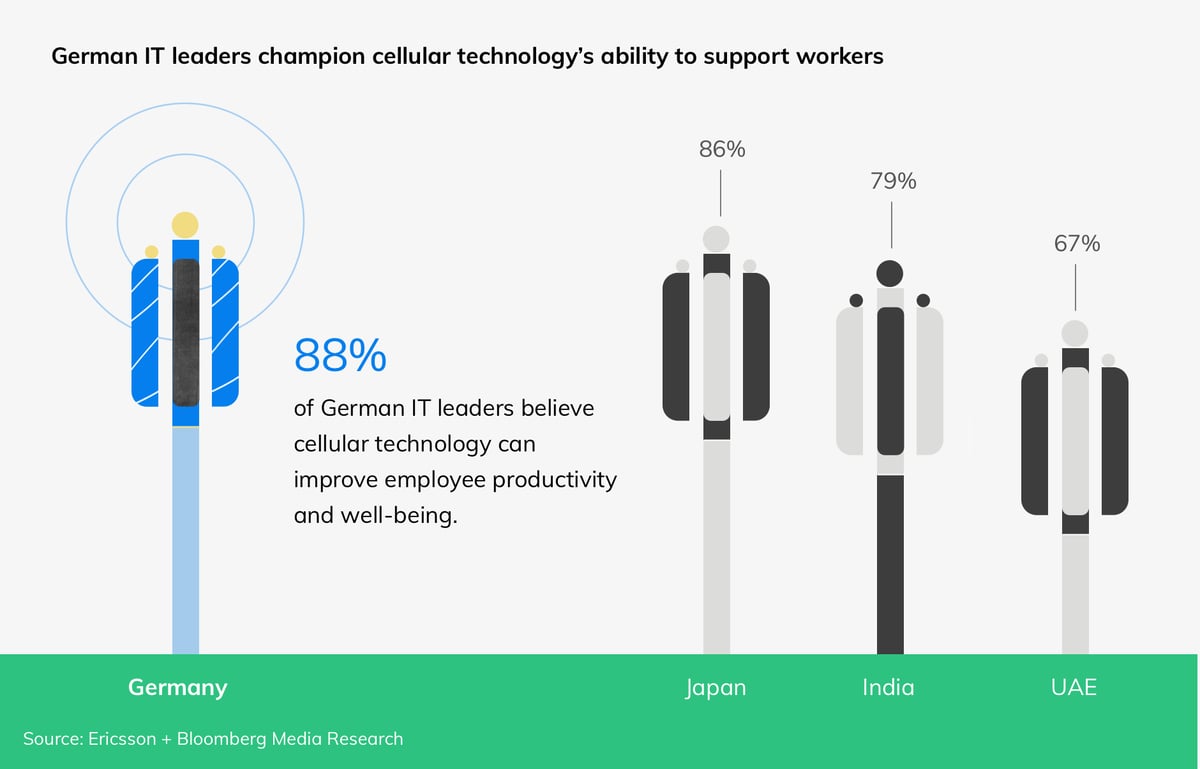

Connecting people, not just devices, also offers a competitive edge

The attitudes revealed in the connectivity survey are playing out not only in German company operations, but also in hiring and training strategies that are shaping the workforce of the future. For example, the semiconductor factory that’s set to create jobs in the town of Magdeburg has prompted a nearby university to develop a nanotechnology program that will add to the pipeline of skilled workers.

The survey also assessed IT leaders’ perceptions of cellular technology in improving the worker experience. Here, too, Germany leads the global average, demonstrating that German firms value deeper connectivity not only for their factories and their devices, but also for their people.

The results are no surprise coming from a country ranked as one of the world’s best for remote workers, says Mulhern. German IT leaders are keenly aware of the opportunities unlocked by improved connectivity for a distributed workforce.

In addition to facilitating better collaboration, enhanced connectivity can enable companies to more easily hire workers who may not live near a company’s campus or factory, offering access to a global and more diverse talent pool.

Germany-based survey respondents were more likely than their peers in other countries to see cellular technology’s potential to advance their company’s diversity, equity and inclusion goals—meaning that as Germany’s economy continues to evolve and lean into more efficient, intelligent connected systems with the help of 5G, it will also continue to advance the humanity of its workforce.

“Keeping your distributed workforce motivated and productive requires the right culture, but it also requires the right technology,” says Mulhern. “What’s encouraging about these findings is that German companies appear to be striking the right balance between good intentions and good infrastructure.”