How Carbon Capture and Storage Can Help the World Meet Its Climate Commitments

Carbon capture and storage can remove CO2 emissions from industrial processes and even the atmosphere—making it vital to catalyzing the transition to a lower-carbon energy future. Known as CCS, it’s one of the key technologies—alongside renewables-based electrification, bioenergy and hydrogen—that can help the world get to net-zero emissions by 2050, according to the International Energy Agency.

In order to meaningfully contribute to global climate objectives, CCS technology needs to continue to be rolled out at scale in this decade. That’s according to the Climate Target Plan of the European Union—which set out to be the first carbon neutral continent by 2050—and aligns with the IEA’s 2050 roadmap. One reason is because CCS is one of the few technologies available today that could significantly reduce emissions in high-emitting industrial sectors—iron and steel, cement, refining and petrochemicals—which account for almost 20% of global CO2 emissions today, where other technology options are limited.

CCS can also play a critical role in helping to decarbonize the power generation industry. Roughly two-thirds of energy-related emissions originate from stationary sources like power plants and industry. CCS can be added to new power and industrial infrastructure, as well as used in existing infrastructure which could avoid an estimated 7 billion metric tons of CO2 emissions in 2050, according to the IEA Net Zero Scenario.

CCS enables cost-effective production of low-carbon hydrogen

As one of a limited number of viable clean-energy sources for the transportation sector, hydrogen is expected to play a central role in the future of energy. Hydrogen can combust with oxygen to produce heat (as diesel and gasoline do); it can react in a fuel cell to produce emissions-free electricity; and it can be used directly in industrial processes.

CCS could enable a rapid scaling up of “blue hydrogen” production to help meet current and future demand from new applications in transport, industry and buildings. CCS is used to capture the CO2 emissions from blue hydrogen production. Through fuel-switching, blue hydrogen can be leveraged as a cost-efficient means to reduce emissions from existing refineries or chemical plants.

As interest from capital markets in lower-emission industries and asset classes grows, investors are pushing companies to focus more on sustainability. The use of CCS technology can play a part in helping achieve companies’ ESG goals—whether it’s companies capturing more CO2 from industrial plants to offset their carbon footprint, or as an opportunity as a low-carbon investment. Making CCS eligible for financing under institutional ESG standards could further satisfy demand from shareholders and other stakeholders. “Energy and industrial companies that act now [on CCS] can create, and benefit from, a global industry that could be worth $90 billion in the next decade. By moving early, companies can secure their market position in readiness for the opportunities to come,” according to the Boston Consulting Group.

Stronger climate targets and investment incentives are already injecting new momentum into CCS. Total CCS projects in operation or development more than doubled in the nine months ending in September 2021, according to the 2021 Global CCS Institute annual report. If all of these projects were developed they would add 111 million tons a year of CO2 capture capacity—almost three times the current annual capacity of around 40 million metric tons.

The fact is that in order to achieve societal net-zero emissions by 2050, more than 40 times as much CCS capacity will need to be built in the next decade as there is now, according to IEA calculations. By 2050, capacity will need to reach 7.6 billion metric tons.

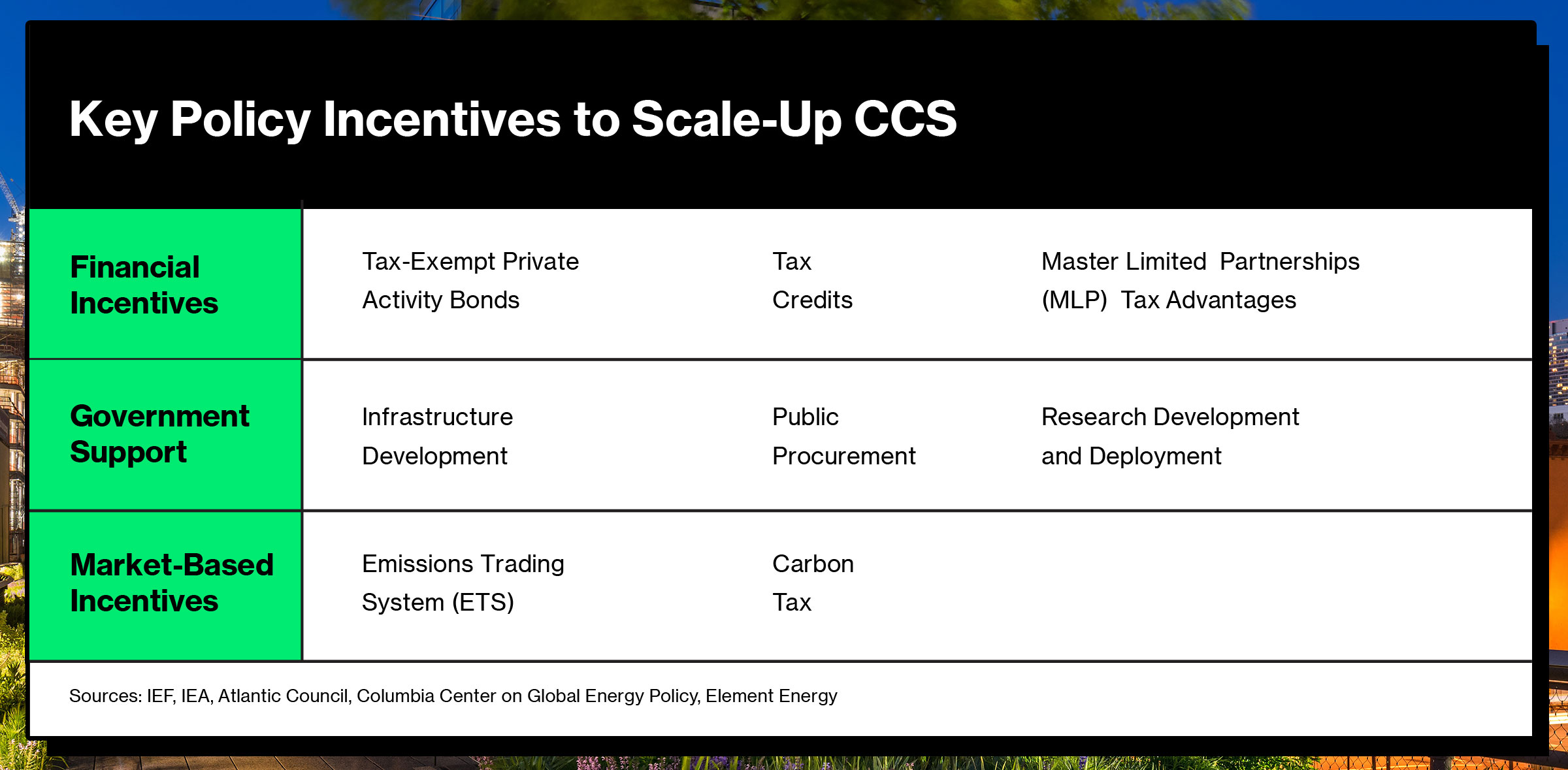

CCS was introduced about 40 years ago and can be deployed now at scale with the right policies in place. One way to finance CCS is through tax credits, which are proven to accelerate innovation and incentivize investment, particularly in the energy sector.

In the United States, production and investment tax credits (the PTC and ITC, respectively) have been provided to wind and solar industries since the 1970s. The results speak for themselves: The American Wind Energy Association has credited the PTC with spurring more than a 300% increase in U.S. wind power between 2008 and 2016, and, according to Solar Energy Industries Association, the solar ITC has contributed to a more than 10,000% growth of solar installation since it was enacted in 2006.

Incentives must be extended to all technologies critical for a net-zero world

The U.S. Department of Energy has earmarked $109.5 million to support jobs related to the CCS industry. Another key incentive is a price on carbon. An incentive of $90 to $110 per ton could drive annual CO2 capture in the United States to 500 million metric tons from 25 million in 2019, according to study conducted that year by the National Petroleum Council. This is twice as much as the current $50 per ton that exists through the U.S. federal 45Q tax credit. Congress is also considering a range of incentives for hydrogen, which may include CCS as an enabler of blue hydrogen.

As we emerge from COP26, there is increasing global momentum for corporations and governments to work together to develop, invest in and incentivize technologies to help society reach net zero. Using CCS to reduce CO2 entering the atmosphere today, we can ramp up lower-carbon sources of energy to help fuel society’s economic system and consumption patterns for tomorrow.