Leading the Global Push for Green Financing

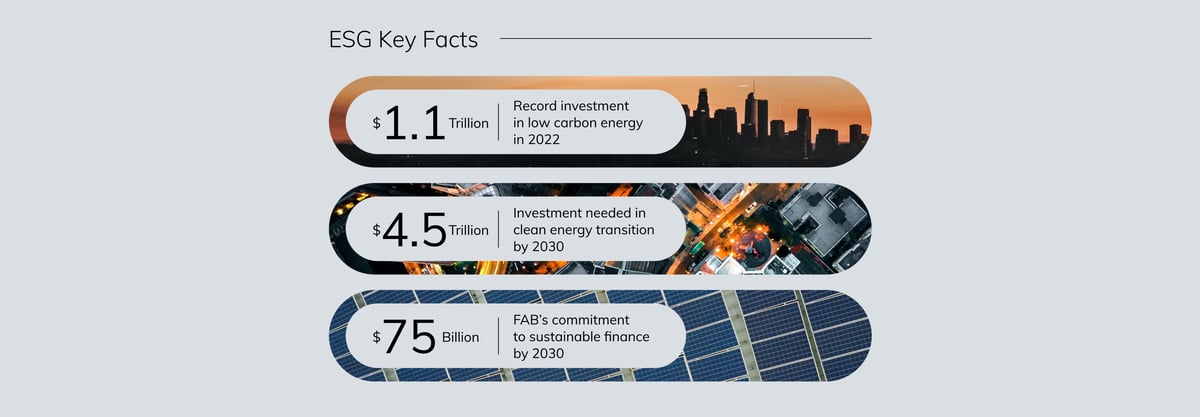

Low carbon tech investment crosses $1 trillion

As global leaders come to grips with the threat of climate change, there is good news on the green transition front.

BloombergNEF (BNEF) research shows that global investment in low-carbon energy transition has smashed previous records to cross $1.1 trillion for 2022 — a massive acceleration over the year before. The spike in investment is evenly distributed with practically every low-carbon sector setting new records — including renewable energy, energy storage, electrified transport, electrified heat, carbon capture and storage (CCS), hydrogen and sustainable materials. 2022 was the year that global energy transition investment matched that in fossil fuels.

However, the challenge of staying within the 1.5°C temperature increase limit set by the UNFCCC Paris Agreement is immense. According to Sarah Pirzada Usmani, MD and Head of Loan Capital Markets & Sustainable Finance, First Abu Dhabi Bank (FAB), there is a $4 trillion annual shortfall in sustainable finance globally. This is backed by WEF research, which indicates that annual investments in clean energy need to be around the $4-5 trillion mark by 2030 to avoid catastrophe —a substantial increase over current levels. BNEF estimates that the world needs to spend at least $8.3 trillion on renewable energy deployment between 2023 and 2030 to align with a global net-zero trajectory by 2050, keeping global warming below 2°C.

In the UAE and some neighboring countries, sustainable finance is a hot topic given ambitious commitments to Net Zero. Financial matters and green transition finance are also expected to take center stage at COP28, when the United Arab Emirates hosts the global meeting in December 2023.

A regional financing gap remains, and it’s one that FAB is helping narrow. The bank has formalized a commitment to lend, invest and facilitate $75 billion in sustainable finance by 2030 as part of its ESG Strategy. It is a goal FAB is moving steadily towards, facilitating over $27 billion in sustainable finance since 2022, amounting to 36% of its 2030 target. Its green bond contributions, meanwhile, have helped the world avoid 354,000 tonnes of CO2 emissions.

FAB’s green momentum continued in 2023 as the bank hit major green bond milestones. It facilitated the first-ever green bond for UAE renewable energy company Masdar, and helped arrange a $1 billion 10-year green bond for the Abu Dhabi National Energy Company PJSC (TAQA).

In 2023, FAB also issued the UAE’s first ever dirham-denominated green sukuk. The AED 1.3 billion ($353.93 million) Sharia-compliant instrument marked FAB’s first dirham-denominated public issuance and became the largest ever dirham sukuk to date. Usmani says the funds raised are earmarked for green projects under Shariah compliant financing structures. She notes that FAB is also directly financing green projects, working with clients on a portfolio of wind and solar renewable energy projects across the UAE, Saudi Arabia and beyond.

According to her, FAB is walking the sustainability talk. “We were the first bank, back in 2017, to issue a green bond in the region. We are the also first regional bank in GCC to commit to net zero by 2050 across our operations,” she says.

Investors are proactively seeking green products because of wider ESG considerations. The next step in unlocking viable green finance is to attract a broader investor base through standardization of ESG disclosures, transparency in reporting, and product innovation in competitive sustainable financing structures.

There is need for markets and regulatory frameworks to evolve and establish clear guidelines around sustainable finance. Also important is the creation of innovation hubs where green finance products can be developed and trialed.

Cue the Abu Dhabi Global Markets (ADGM), the international financial center and freezone situated on Abu Dhabi’s Al Maryah Island and regulated by the Financial Services Regulatory Authority (FSRA). Its role, according to Emmanuel Givanakis, CEO of ADGM’s FSRA, is to link Abu Dhabi to the world while creating a fair, efficient and transparent marketplace.

Earlier this year, ADGM built on the sustainable finance principles it first published in 2020 to implement its sustainable finance regulatory framework. ADGM describes the framework as carrying the region’s most comprehensive ESG disclosure requirements and offering guidance for funds, discretionary managed portfolios, bonds and sukuks designed to accelerate the transition of the UAE to net zero.

“We think of ADGM as a platform that facilitates the finance industry in innovating green products and services,” he says. “We are creating a market with integrity around sustainable finance so that investors gain the clarity they require. Our sustainability finance framework gives the industry a clear set of road rules to innovate by, so investors have confidence in the products and services they put their money in. This brings the entire industry into the light and creates financial momentum behind global net zero goals.”

Greenfield investment in new sites is only a small piece of the decarbonization puzzle. The true game changer is helping conventional industries and energy production go green. That is what Givanakis hopes ADGM’s regulatory framework will also facilitate — helping create mainstream and well-regulated financial products tailored to investing in this green transition.

While governments can paint visions and the likes of ADGM can offer a playing field, the financial industry also needs to bring more viable green products to the fore in a way that whets investor appetites. As Givanakis explains, “Going green must be a sustained effort by all stakeholders.”

Sarah agrees. She says FAB is a signatory to ADGM’s sustainable finance declaration and also consulted on the recently launched regulatory framework. The bank continues structuring sustainable finance solutions championing financial innovation in the sustainability space, and encouraging clients to embed ESG within their finance strategies.

She too says that sustainable finance requires a concerted effort. “Clients, regulators and banks need to collaborate towards a greener future. We all have a part to play. At FAB we are firmly committed to playing a leading role in the green transition.”