How Women Advisors Are Changing the Face of Wealth Management

An Inside Look at First Horizon’s Women and Wealth Program

At First Horizon Bank, Laura Bunn is the Triangle Market President and leads private client relationship teams in business development, where she spends time building relationships with women of wealth who may have been ignored in the traditionally male-dominated world of wealth management. But with her two decades of banking experience, Bunn has occasionally been rendered invisible in her own financial management.

For example, during a meeting with her husband and a lawyer about a family matter, the lawyer never asked her what she did for a living or if she had an opinion on the matter being discussed. The attorney talked to her husband the entire meeting.

“When we walked out,” Bunn says, “I told my husband that we will work with someone else.”

Women are transforming wealth management

By 2023, women will control $93 trillion in wealth globally, and women account for nearly 40% of all wealth in North America, according to Boston Consulting Group (BCG), which expects women’s wealth to outpace global wealth growth over the next several years.1 A failure to tailor products and services to women is costing the US finance industry $700 billion a year, according to management consultancy Oliver Wyman.2

First Horizon Advisors—the wealth management unit of Memphis, Tenn.-based First Horizon Bank, with assets of $89 billion and 412 branches across 12 states—is addressing this challenge by training more female financial professionals.3 BCG says that women are 1.7 times more confident in financial institutions when their relationship managers are women.4

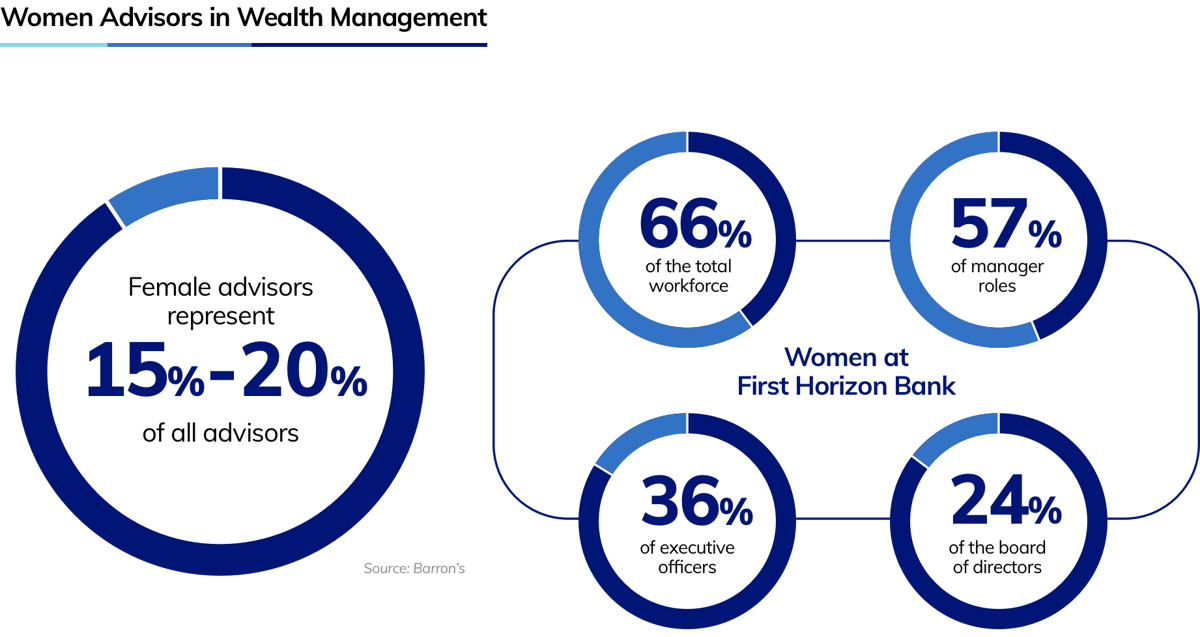

In an industry where, according to Barron’s, female advisors represent just 15%–20% of all advisors, women at First Horizon Bank represent 66% of the total workforce, 57% of manager roles, 36% of executive officers and 24% of the board of directors.5

Creating a safe space for women to talk about wealth

The bank’s Women and Wealth strategy revolves around the power of networking events, where its financial professionals lead prospective clients in discussions around the economy and the importance of having both a financial plan and a financial team. These events also facilitate candid conversations that empower women in their personal and family finances.

“When you have a diverse team, you bring a perspective to the table that gives you the opportunity to connect with everybody,” says Bunn. “I have never had a client reach out and say that they wanted to work with me because I’m a female. I think there is an element of appreciation for shared grit in your career. That might get you the conversation, but winning the business comes down to something more than that. Clients want to work with the best team that will help them build their wealth.”

During a recent First Horizon networking event, a female participant sought advice from a group of 100 attendees about a delicate family matter. As the breadwinner in her family, she wanted to know how others in the room navigated difficult conversations about money with their spouses. The question sparked a lively discussion that illuminated both the challenges and opportunities for these women and for the financial institutions, like First Horizon, that serve them.

“My guess is that probably half of the women in that room nodded in support”, says Wendy Martin, Senior Trust Officer at First Horizon Bank. “It’s a recognition that the topics that are important to women are changing.”

Martin believes there are advantages for female financial advisors when working with female clients.

“Women are often more comfortable building relationships with women,” she says. “There are connection points that we recognize might be different for certain clients. My female clients sometimes share personal experiences more quickly and this fosters growth in the relationship.”

Respecting the perspectives of women clients

First Horizon Advisors has a broad range of women clients, from breadwinners and business owners to homemakers. The financial needs of these women may vary, and at First Horizon, they are all taken seriously.

“The most important advice I could give a financial advisor is to never overlook a female client,” Bunn says. “Regardless of her status in that relationship or client meeting, she’s there for a reason. If they are in that meeting, they are either there to learn more or to make sure you understand their goals and fears, or to support their partners.”

Female clients understand when their perspectives are undervalued or ignored. For example, a woman in her 40s had a major liquidity event and wanted to put the money to work. First Horizon Advisors showed her various scenarios where she could invest the money and take advantage of a low mortgage rate for her home. While she didn’t implement all the solutions discussed, she did select First Horizon to manage her money.

“She told us she selected our team because we took the time to understand her, and we respected her voice and gave her the option that she asked for, but we also came to her with ideas and we weren’t fearful about showing her other scenarios,” Bunn says. “Two other firms had simply given her paperwork to open a new account without offering any advice or making the effort to get to know her.”

This kind of feedback from clients confirms First Horizon’s belief in the value of its Women and Wealth program, which continues to grow its client base. For Bunn and First Horizon, building these relationships for solid financial planning begins with encouraging the voices of women at the table, so that no one feels ignored or marginalized in important decisions that could shape their lives.

“When we meet with clients, it’s important that we listen to not just what they’re saying, but also to what they’re not saying, and understand their goals and objectives,” says Bunn. “We may not be able to resolve all of their concerns, but we must demonstrate that they are heard and we are there to help them create a financial plan to achieve their goals.”

1Managing the Next Decade of Women’s Wealth, by BCG.

2A $700 Billion Missed Opportunity, by Oliver Wyman.

3As of 3/2/22.

4Managing the Next Decade of Women’s Wealth, by BCG.

5Women Make Great Financial Advisors. So Why Aren’t There More?, by Barron's.

Insurance Products, Investments and Annuities: Not A Deposit | Not Guaranteed By The Bank Or Its Affiliates | Not FDIC Insured | Not Insured By Any Federal Government Agency | May Go Down In Value

Insurance Products and Annuities: May be purchased from any agent or company, and the customer’s choice will not affect current or future credit decisions.

First Horizon Advisors is the trade name for wealth management products and services provided by First Horizon Bank and its affiliates. Trust services and financial planning provided by First Horizon Bank. Investment management services, investments, and annuities available through First Horizon Advisors, Inc., member FINRA, SIPC, and a subsidiary of First Horizon Bank. Arkansas License # 416584. Insurance products available through First Horizon Insurance Services, Inc. (”FHIS”), a subsidiary of First Horizon Bank. Arkansas License # 100102095. First Horizon Advisors, Inc., FHIS, and their agents may transact insurance business or offer annuities only in states where they are licensed or where they are exempted or excluded from state insurance licensing requirements. First Horizon Advisors does not offer tax or legal advice. You should consult your personal tax and/or legal advisor concerning your individual situation.

©2022 First Horizon Bank.