How Institutional Investors Take Advantage of Crypto Volatility

As the crypto ecosystem grows, new ways to manage volatility have emerged

Like virtually every other investable asset, cryptocurrency has experienced some stomach-churning volatility this year. It’s a good time to step back and recall the dot-com bust, when many investors made the historic error of giving up on the internet. As digital assets and the blockchain promise to underpin the internet’s next generation, the fits and starts along the way should be no surprise.

“Really, this is about re-architecting the internet at its base layers,” says Scott Army, Chief Investment Officer of Galaxy Vision Hill, part of crypto- and blockchain-focused Galaxy Fund Management. “That requires a lot of time and patience.”

Ethereum cofounder Vitalik Buterin has posited that any “crypto winter” will ultimately benefit the digital-asset space because it will shake out projects that are not sustainable in the long term. Meanwhile, the sustainable projects may be trading at a significant discount—which is how volatility produces opportunity.

Many of the top digital assets today were born out of the last crypto bear market, in 2018. Army notes that software developers continue to leave big tech firms to work on Web3 projects.

“Developers come to this space because they want to solve really interesting problems or create great solutions,” Army says. “Price can be distracting because it’s an artificial indicator of short-term success. If you can block that out, you can focus on what you’re building and the problem you’re solving for real users.”

But what about those sobering charts? Volatility is a fact of life, but as the crypto ecosystem grows, so do the ways to manage and leverage volatility—just as with traditional assets. These options are especially important for institutional investors, whose resources, patience and access to expertise give them the freedom to choose exactly how they want to invest in this intriguing new world.

Digital asset hedge funds take off

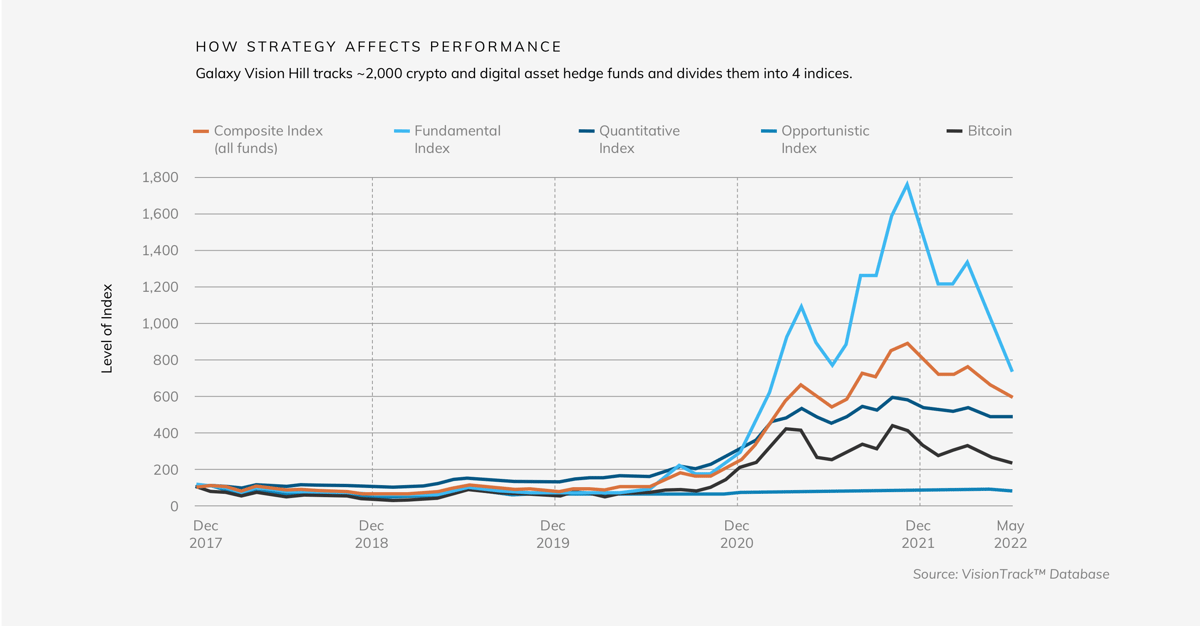

As interest in digital assets has blossomed, so has the number of crypto and digital asset funds, and more than 2,000 are monitored by Galaxy’s VisionTrack™ database. Not all of them will last—but they are providing lots of options that go beyond buy-and-HODL (“hold on for dear life”) Bitcoin or Ethereum.

Many of the hedge funds employ fundamental, research-based strategies, such as long-only and long-short. Others offer quantitative directional strategies, such as momentum and trend following where systematic signal-based techniques are applied; there is also a growing cohort of market-neutral strategies involving various types of arbitrage, including bash and carry and basis trading; and finally more opportunistic strategies such as options trading and crypto lending.

These different categories can yield highly divergent results. As the Galaxy Vision Hill indices demonstrate, fundamental funds (on average) demonstrated explosive performance beginning in December 2020, outpacing other strategies and Bitcoin, as well. But this year, as volatility struck, market-neutral funds fulfilled their purpose by avoiding absolute losses, and quantitative directional funds provided considerable downside protection; during 2018’s crypto winter, the quantitative funds even managed to generate positive returns, according to Galaxy data.

Meanwhile, other hedge funds are investing in venture strategies focused on crypto and blockchains, and specialized funds are exploring trends including NFTs, gaming, decentralized finance, DAOs and infrastructure. Crypto and blockchain venture funds hold special appeal for institutional investors because they fit nicely into allocations for private equity or venture capital, for which many institutions already have a broad mandate, Army says.

“Venture-focused crypto or blockchain maps well into the way folks think of this space as a long-duration bet on technology, so it’s easy to slot it alongside their other venture capital-type allocations that already have a sleeve of allocation,” he says.

Specialized expertise offers new opportunities

A growing number of digital hedge fund managers are specializing in geographies, applications, venture stages and other niches—mirroring what has already occurred in traditional asset categories. Complementing Galaxy Fund Management’s single-asset and multi-asset funds, Galaxy Vision Hill’s multi-manager funds aim to take advantage of this emerging expertise.

“At this stage, the winners in these emerging categories of digital assets and blockchain have yet to be definitively determined,” Army says. “So, diverse exposure across sectors, geographies, stages and manager strategies can help ensure that investors effectively capture secular growth while minimizing idiosyncratic risk.”

Galaxy Vision Hill’s VisionTrack™ database uses proprietary analytics models to identify top performers. The Galaxy Vision Hill product suite offers institutional quality offerings across both liquid hedge fund and venture strategies. Its flagship multi-strategy hedge fund offering provides diversified exposure across multiple, unique strategies while its market neutral strategy focused on lower volatility, lower beta, uncorrelated returns. These liquid strategies are complementary, but unique from its longer duration, closed-end venture-focused funds.

“If you believe in the long-term thesis about blockchain technology and Web3, that’s a multi-decade investment opportunity,” Army adds. “You get the most leverage by effectively hiring experts in every category in the market.”

The most successful crypto and digital asset investment strategies have recently shifted, notes Army; in late 2021, it was arbitrage and basis trading, while in early 2022, it was providing liquidity to decentralized finance pools. As the year wears on, yield-based strategies, like private credit and overcollateralized lending, look to be smart moves. And as derivative markets expand, more routes for options trading are emerging.

Choosing digital assets amid volatility

This year has made volatility top of mind for investors. While 2022’s charts have convinced some to gravitate to market-neutral funds to protect capital, others have moved into long-biased funds to take advantage of possible bargains.

When evaluating long-biased funds in a market that has pulled back a lot, Army recommends analyzing risk metrics like the Sortino ratio, rather than the better-known Sharpe ratio.

“In thinking about directional crypto hedge funds, you want to capture the asymmetric upside potential of this asset class,” says Army. “Therefore, you are okay with large upside volatility. You just don’t want 1:1 participation to the downside, so limiting downside volatility is much more important.”

Both metrics compare volatility again return, but Sortino only focuses on downside volatility – which is what really matters to most investors – without effectively penalizing strategies for capturing considerable upside in the market.

For institutional investors who already have a mandate that includes (or can include) crypto or blockchain assets, a period of volatility can create a fortuitous entry point. For institutions that aren’t there yet, but suspect crypto or blockchain could play a role in the future of the internet and their portfolio, now is the time to find guidance through this complex investment landscape.

Picking a winning digital asset or technology isn’t easy. But—as their success with private assets has shown—institutional investors tend to be very good at picking good managers and good strategies. Chances are, they can do the same in the brave new worlds of crypto and blockchain.

Important Disclaimer:

Certain statements reflect GDCM’s views, estimates, opinions or predictions (which may be based on proprietary models and assumptions, including, in particular, GDCM’s views on the current and future market for digital assets), and there is no guarantee that these views, estimates, opinions or predictions

are currently accurate or that they will be ultimately realized. To the extent these assumptions or models are not correct or circumstances change, the actual performance of GDCM may vary substantially from, and be less than, the estimated performance. None of GDCM nor any of their respective affiliates, shareholders, partners, members, directors, officers, management, employees or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of any of the Information or any other information (whether communicated in written or oral form) transmitted or made available to you. Each of the aforementioned parties expressly disclaims any and all liability relating to or resulting from the use of the Information or such other information.

Hedge funds and other alternative investments involve a high degree of risk and can be illiquid due to restrictions on transfer and lack of a secondary trading market. They can be highly leveraged, speculative, and volatile, and an investor could lose all or a substantial amount of an investment.

Alternative investments may lack transparency to investors of information as to share price, valuation, and portfolio holdings. Complex tax structures often result in delayed tax reporting and potentially materially different returns for offshore versus onshore investors. Compared to mutual funds, alternative investments are subject to less regulation and often charge higher fees.

Certain information contained herein (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by GDCM, and GDCM does not assume responsibility for the accuracy of such information. GDCM does not provide tax, accounting or legal advice, or advice with respect to portfolio construction. Recipients are encouraged to consult with their own advisors.

Certain information contained herein constitutes forward-looking statements, which can be identified by the use of terms such as “may”, “will”, “should”, “expect”, “anticipate”, “project”, “estimate”, “intend”, “continue” or “believe” (or the negatives thereof) or other variations thereof. Due to various risks and uncertainties, including those discussed above, actual events or results, the ultimate business or activities of GDCM or the Fund or the actual performance of GDCM or the Fund may differ materially from those reflected or contemplated in such forward-looking statements. As a result, investors should not rely on such forward-looking statements in making their investment decisions.

None of the Information has been filed with the U.S. Securities and Exchange Commission, any securities administrator under any state securities laws or any other governmental or self-regulatory authority. No governmental authority has opined on the merits of the offering of any securities by the Fund, or the adequacy of the information contained herein. Any representation to the contrary is a criminal offense in the United States. Affiliates of GDCM own investments in some of the digital assets and protocols discussed in this document.

Securities transactions are effected through Galaxy Digital Partners LLC, a member of FINRA and SIPC.