Island of Opportunity: Singapore Riding the Wave of Asian Wealth

The balance of global prosperity is steadily tilting eastward.

Asia-Pacific is already home to more billionaires than any other region on Earth. Of the 500 richest individuals profiled by the Bloomberg Billionaires Index[1], one-third are in Asia-Pacific. The region’s population of ultra-high-net-worth individuals (UHNWIs) with assets of more than US$30 million is forecast to grow 33% by 2025, the fastest pace in the world.[2]

Rapidly rising Asian prosperity is reshaping the global investment landscape. Wealth managers are literally following the money as generations of newly wealthy Asian entrepreneurs trigger an industry pivot away from the traditional Western focus on wealth-preservation and toward more dynamic wealth-creation investment strategies.

“Singapore’s ability to attract global businesses and its rich ecosystem of services and capabilities to support wealth managers, makes it an important financial hub for global banks, including HSBC.”

— Mr Anurag Mathur, Head of Wealth and Personal Banking, HSBC Singapore

This, in turn, is creating opportunities that financial institutions with a track record of global reach, wealth management expertise and access to international markets are best placed to explore.

One of the consequences of this trend is strong growth in onshore wealth management in many burgeoning Asian markets, such as Vietnam and India. Despite this, established regional financial hubs such as Singapore and Hong Kong will continue to flourish.

“Southeast Asia is at the epicenter of four major transitions – the shift of trade and investment flows to ASEAN, increasing personal wealth, rapid digital adoption and a pivot to ESG,” said Mr Anurag Mathur, Head of Wealth and Personal Banking, HSBC Singapore. “Singapore’s ability to attract global businesses and its rich ecosystem of services and capabilities to support wealth managers, makes it an important financial hub for global banks, including HSBC.”

Climbing the Ranks

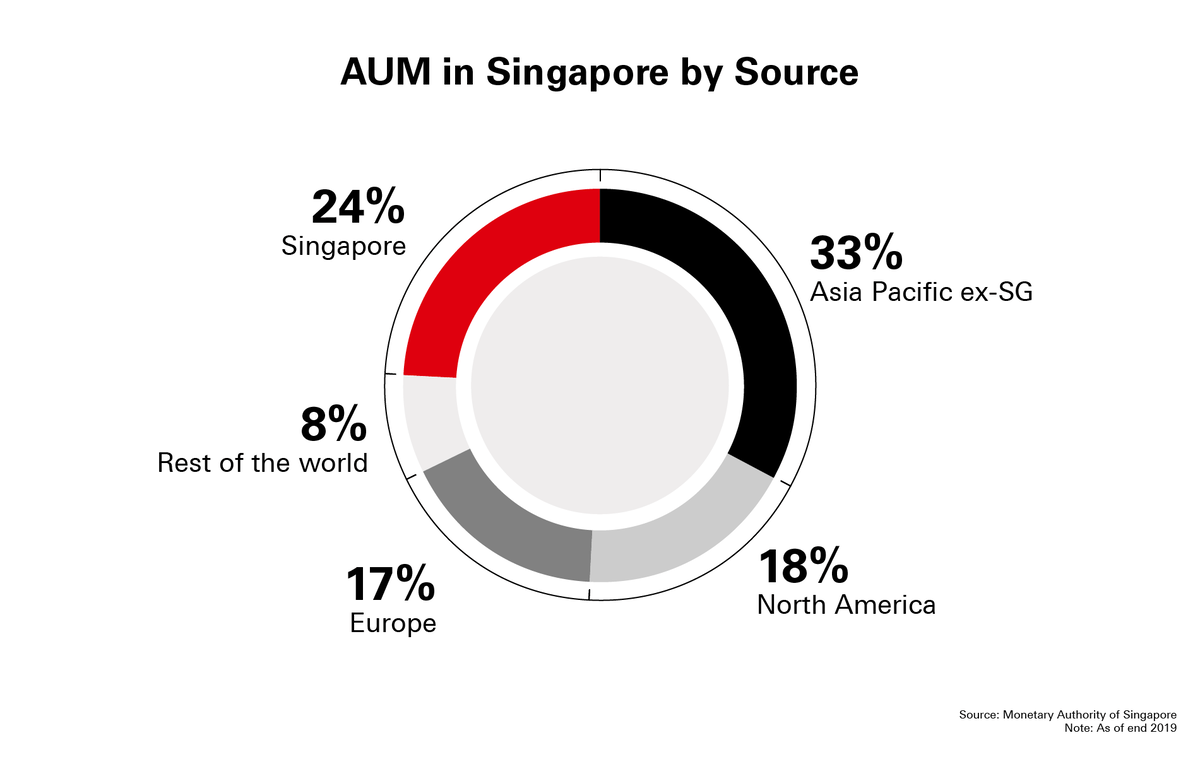

Singapore is climbing the ranks among the world’s largest asset-management centers and emerging as a destination of choice for offshore wealth stewardship. About 75% of assets under management (AUM) in Singapore are from diverse overseas sources, with North America and Europe each contributing about 17-18% of the city-state’s AUM and 33% coming from Asia.

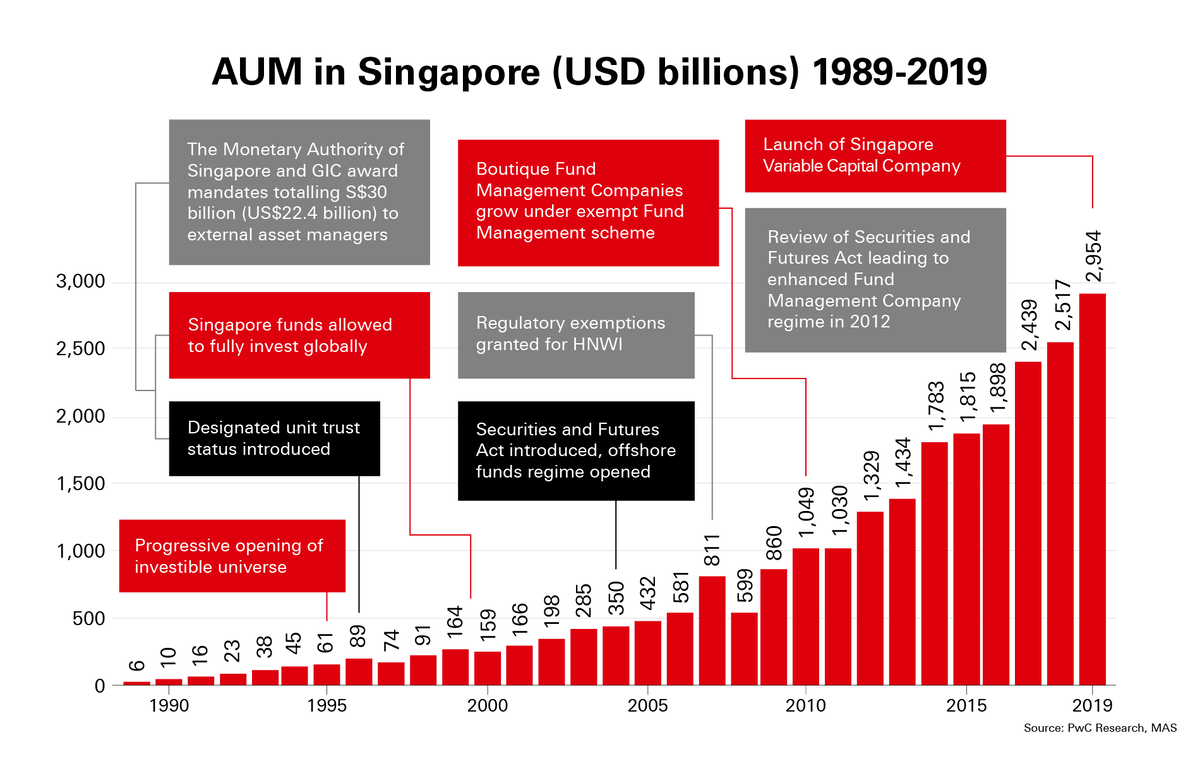

As Asia moves to the forefront of global wealth creation, a surge of investment capital into Singapore is already happening. In 2020, AUM on the island grew 17% to S$4.7 trillion, more than half of which was attributed to inflows, Monetary Authority of Singapore (MAS) data show[3]. In fact, offshore wealth flows into Singapore are expected to grow at the second-fastest pace of any global financial hub, after Hong Kong.

In the past three years, HSBC’s Global Private Banking in Singapore grew Net New Money assets by 40% CAGR (FY2018-2020). This demonstrates strong growth in tandem with investments in the business to attract a greater share of HNW/UHNW wealth in ASEAN.

“Singapore has all the right ingredients to attract global investors,” Mr Mathur added. “Since 2018, we have expanded our front-line wealth teams and grown total wealth balances at a double-digit annualised growth rate. This momentum will continue as we deepen our position as an International Wealth Hub.”

Proactive Steps

There are multiple reasons for Singapore’s ascendancy. The island’s transparent and efficient regulatory style, and resilient banking industry are already well-established, but Singapore’s dynamic efforts to future-proof its wealth management sector are helping the country stand apart in uncertain times.

The MAS is taking a proactive role in drafting policies and regulations that will bolster investor confidence and trust, including a strong push for banks to invest in technology upgrades that will place Singapore at the vanguard of the accelerating fintech sector. Singapore has also positioned itself not only to benefit from strong global appetite for private banking and family offices, but also the rapidly accelerating trend in alternative investments, which continue to outstrip traditional asset classes.

The city’s status as a leading offshore RMB centre, and the launch of new variable capital company regulations in 2021, will also bolster Singapore as a wealth hub.

“Singapore has long attracted investors from Southeast Asia markets, including Malaysia, Indonesia and Thailand, but even those farther afield are now looking to park their wealth here,” Mr Mathur said. “HSBC is uniquely placed to help our clients given our commercial heritage, on-the-ground expertise, digital capabilities and international connectivity. In particular, our strong presence in the world’s top wealth hubs, including Singapore, enables the bank to deliver transactional banking and wealth management services in these markets to affluent clients looking for international opportunities.”

Asian growth is now a global investment story, and banks like HSBC have an unrivaled global network and a presence in every progressive economy. No other financial institution can lay claim to the depth and breadth of expertise and specialisation in financial management, which enables investors from first-timers to UHNWIs to access, explore and tap into the best opportunities in the world.