What's better than gold?

With Shaokai Fan

The price of gold has surged in 2023, fuelled by uncertainty about the global banking system, coupled with ongoing inflationary pressures.

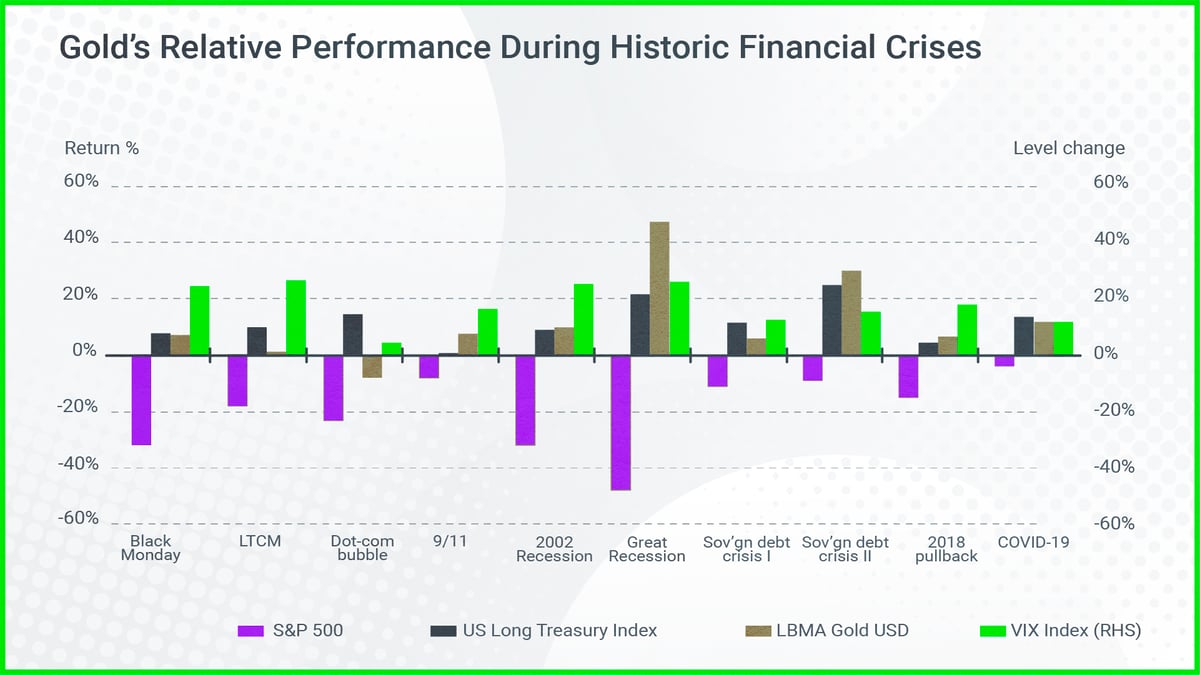

Traders can use gold as a store of value, as a hedge against riskier assets and perhaps most commonly, for speculation.

The World Gold Council says that the shaky market conditions are putting gold back into sharp focus.

“There's a level of market concern and uncertainty in general which drives people to gold as a safe haven asset. So interest rates are definitely part of the equation, but not the only part of the equation for gold.”

The spot gold price hovered near all-time highs during March 2023 and momentarily broke through the US$2,000 per ounce barrier.

However, it was unable to maintain its position, pulling back below the US$2,000/oz threshold shortly after.

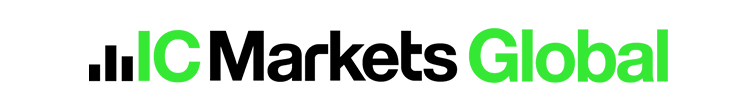

The gold price is also impacted by the outlook for interest rate movements by the US Federal Reserve.

Oxford Economics is forecasting another 50 basis points of rate increases, before the Federal Reserve begins to cut rates by the end of the year.

Uncertainty about inflation has also fuelled gold purchases by central banks.

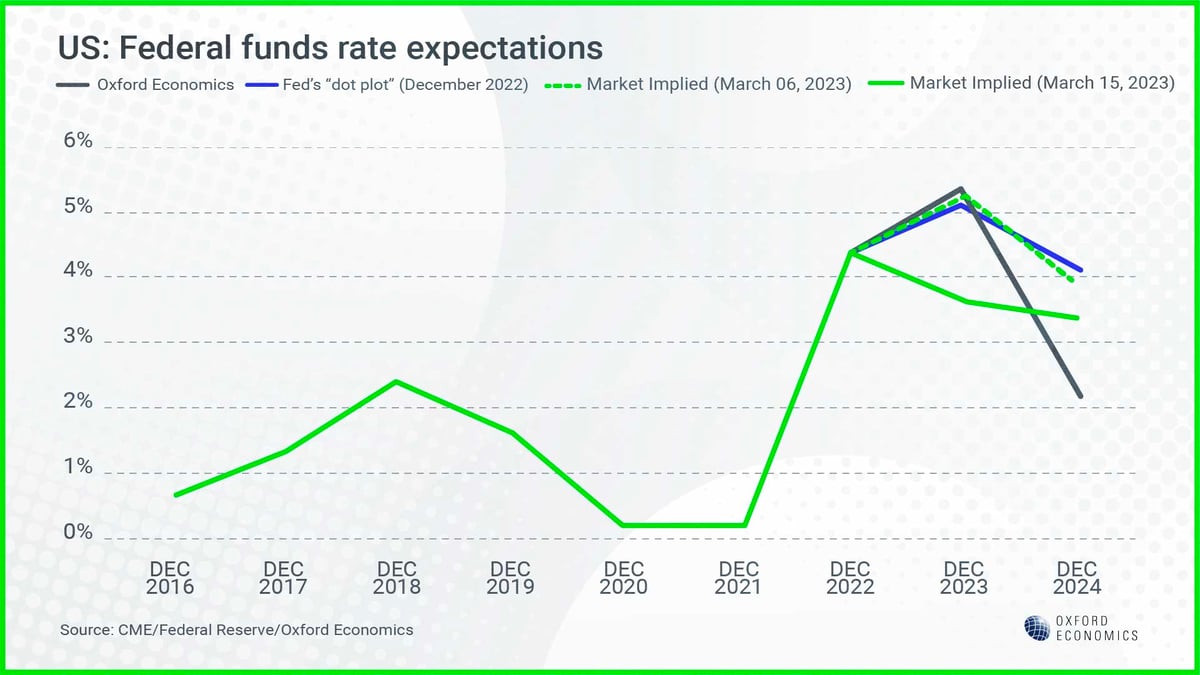

The World Gold Council data shows that central bank gold purchases rose to record levels in 2022. Central banks purchased about 1,100 tonnes of gold on a net basis in 2022.

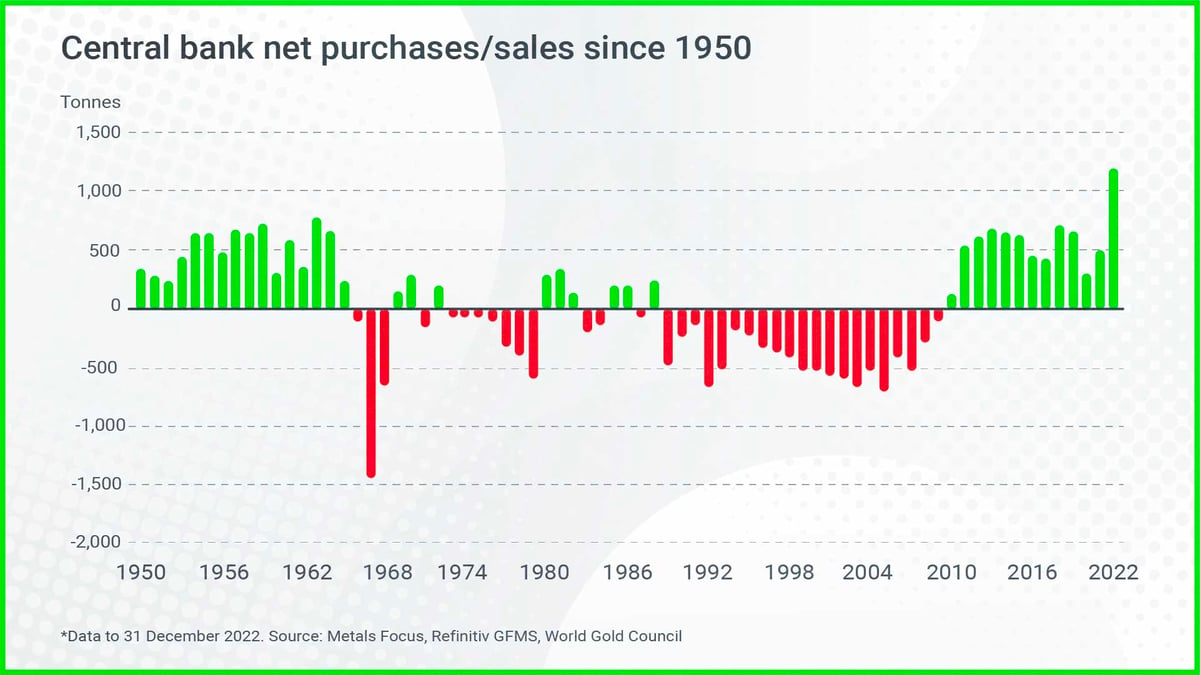

The net purchases of gold by central banks is also indicative of political risk emerging from the ongoing conflict between Russia and the Ukraine.

“There's been a shift in how central banks are viewing the political risk now, because after the Russian invasion of Ukraine, there were sanctions placed on the Central Bank of Russia, which is a step that many central banks did not anticipate,” said Mr Fan.

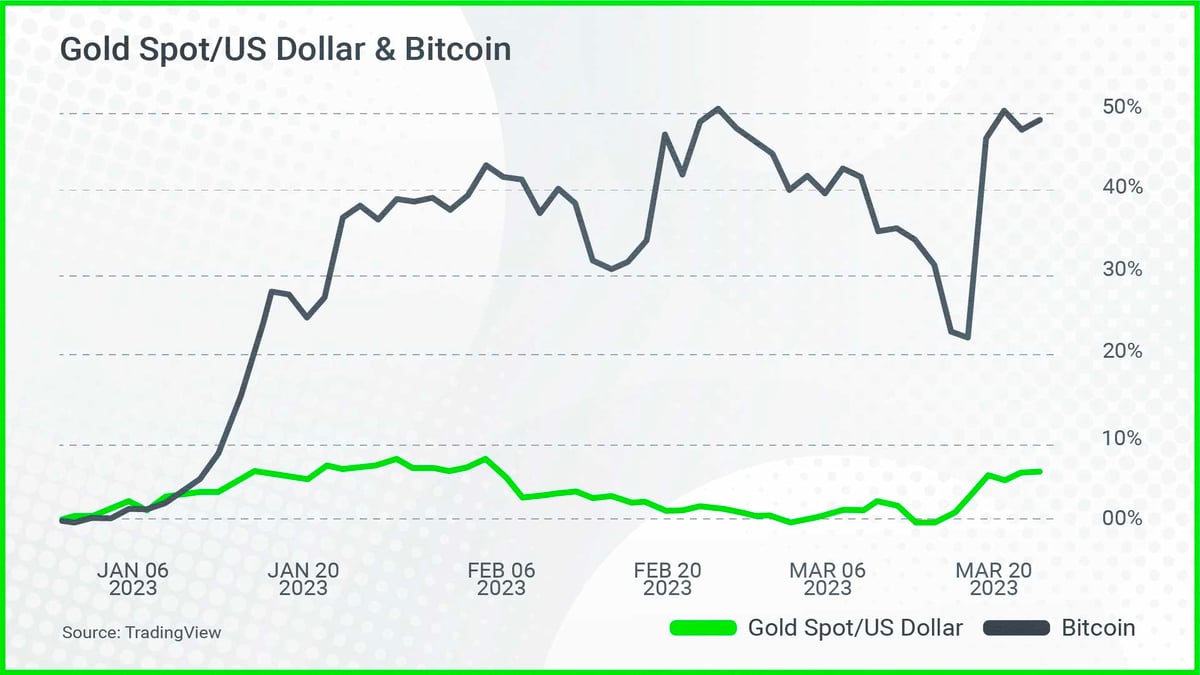

Geopolitical tensions haven’t impacted the price of Bitcoin in the same way as the physical asset.

Bitcoin is often referred to as “digital gold”, but the World Gold Council points out that the crypto asset didn’t follow the same upwards trajectory when Russia invaded Ukraine.

“All you have to do is rewind to the day that Russia invaded Ukraine and look at the difference in performance of the two different asset classes,” said Mr Fan.

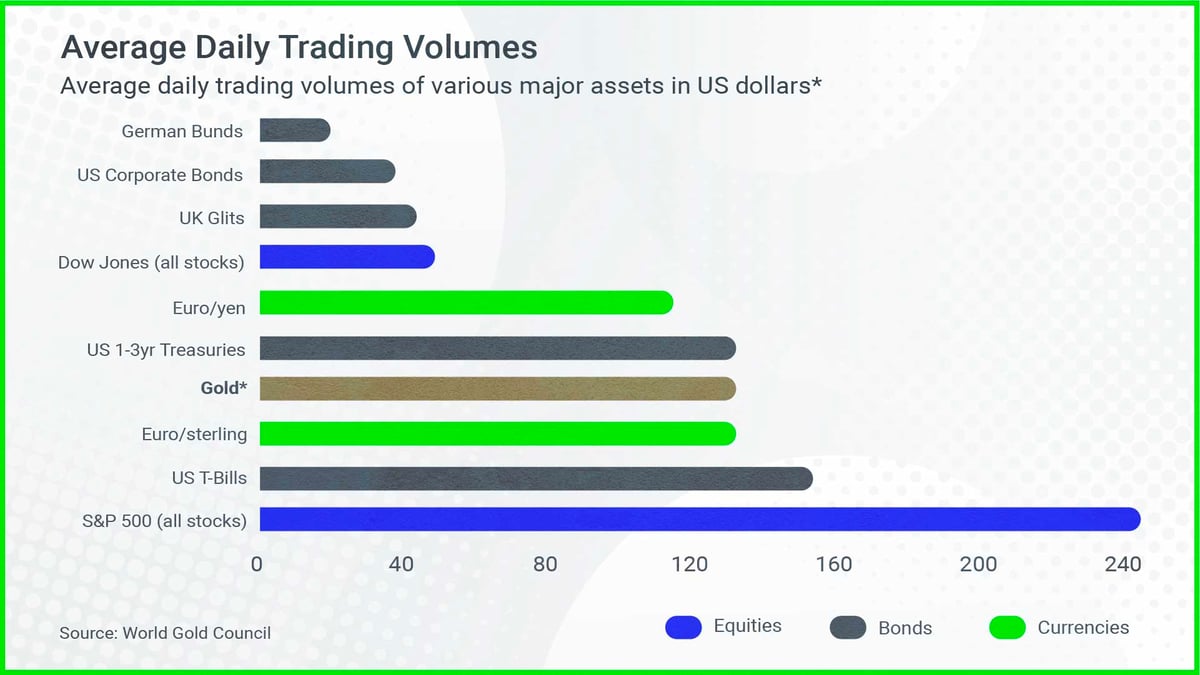

The World Gold Council highlights the structural shifts in gold markets over the past 30 years, which have seen gold trading become more ubiquitous.

In particular, the introduction of gold ETFs, which allow anyone to easily trade gold on most online trading platforms.

Another major structural change for gold has been the central banks becoming net buyers of gold over the past 13 years, basically since the Global Financial Crisis (GFC) in 2008.

Before the GFC, central banks were actually net sellers of gold.

The gold market has undergone extensive transformation in the past 30 years, with gold now being sought by buyers of physical gold as well as being more extensively traded in derivatives markets.

Gold is one of the oldest commodities to be traded in the world and continues to carve out new meaning in modern financial markets.

This is a marketing communication and does not contain, and should not be construed as containing, investment advice or an investment recommendation or, an offer of or solicitation for any transactions in financial instruments. Past performance is not a guarantee of or prediction of future performance. The analysis contained herein does not constitute a personal recommendation and does not consider your personal investment objectives, investment strategies, financial situation or needs. IC Markets makes no representation and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or other information supplied by IC Markets.

The information on this site is not intended for any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. There is a possibility to lose all your initial capital. For further information please consider our Risk Disclosure Notices for your relevant jurisdiction.

International Capital Markets Pty Ltd

with registration number 123 289 109, is regulated by the Australian Securities and Investments Commission with License No. 335692.

Risk Warning:

Trading derivatives involves high risks to your capital. General advice only. Please read the PDS, TMD and other legal documents on our website: icmarkets.com/au.