Dollar under threat

With Joe W. Sullivan

Brazil, Russia, India, China and South Africa, also known as BRICS countries, are ramping up their rhetoric about introducing a new BRICS currency.

Which raises the question about how a BRICS currency would impact the global dominance of the US dollar.

According to former White House economist Joe W. Sullivan, the success of the currency roll out will depend on the skill of BRICS policy makers.

“The BRICS governments have all indicated that they want to walk arm in arm through the door together to issue a joint currency. They may sort of stumble through that door and disappoint those who expect the BRICS currency to be a geopolitical shockwave, or they might move forward with a BRICS currency.”

One of the reasons for the push by Russia and China for a BRICS currency is the weaponization of the US dollar.

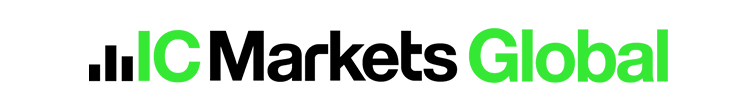

Over the last decade, the US has been more willing to impose sanctions on larger countries like China and Russia, which has fueled de-dollarization.

“A world in which the US is sanctioning countries as large as Russia and China is a very different world than a world in which the US was sanctioning terrorist groups were relatively small economies like Venezuela and Iran.”

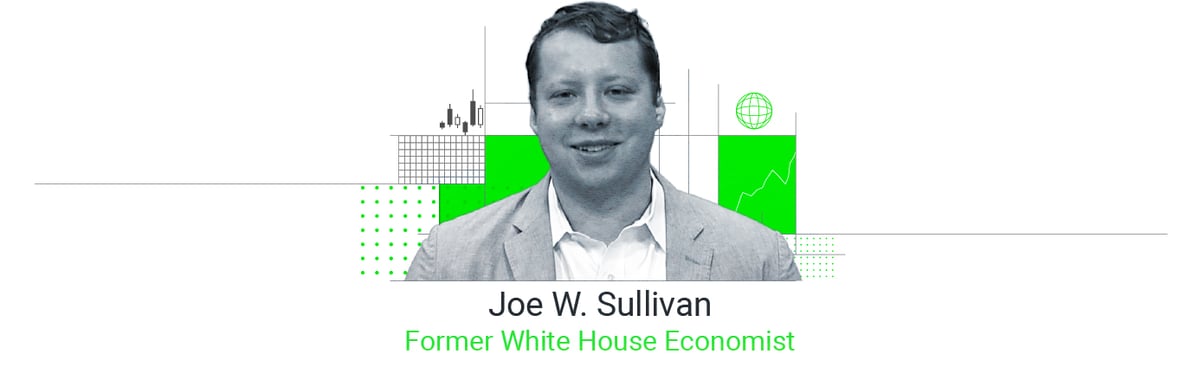

The challenge facing US policy makers following Russia’s invasion of Ukraine, was how to deprive Russia of oil revenue, without spiking gas prices in the United States.

While the US achieved this balance with the oil price cap, Russia responded by ramping up production and selling cheap oil to countries including India and China.

The US has faced criticism for deploying a range of tactics like prohibiting countries from accessing their US foreign reserves, as well as imposing economic sanctions and boycotts.

“I think the binge tends to be followed by the hangover and so, yes, Washington is now experiencing a hangover from its binge on essentially financial weaponry.”

Aside from sanctions, countries like China are also demanding that commodities contracts are denominated in Renminbi.

Oil contracts from Saudi Arabia and iron ore contracts from Australia are now routinely priced in the Chinese currency.

One school of thought about the demise of the US dollar is that it may actually benefit the US economy by making the US more competitive globally.

“I think Washington should not cry about the dollar's demise or rather its decline in the global economy. The US dollar, I think, has been too expensive for US exporters to be competitive in a global economy for a long time.”

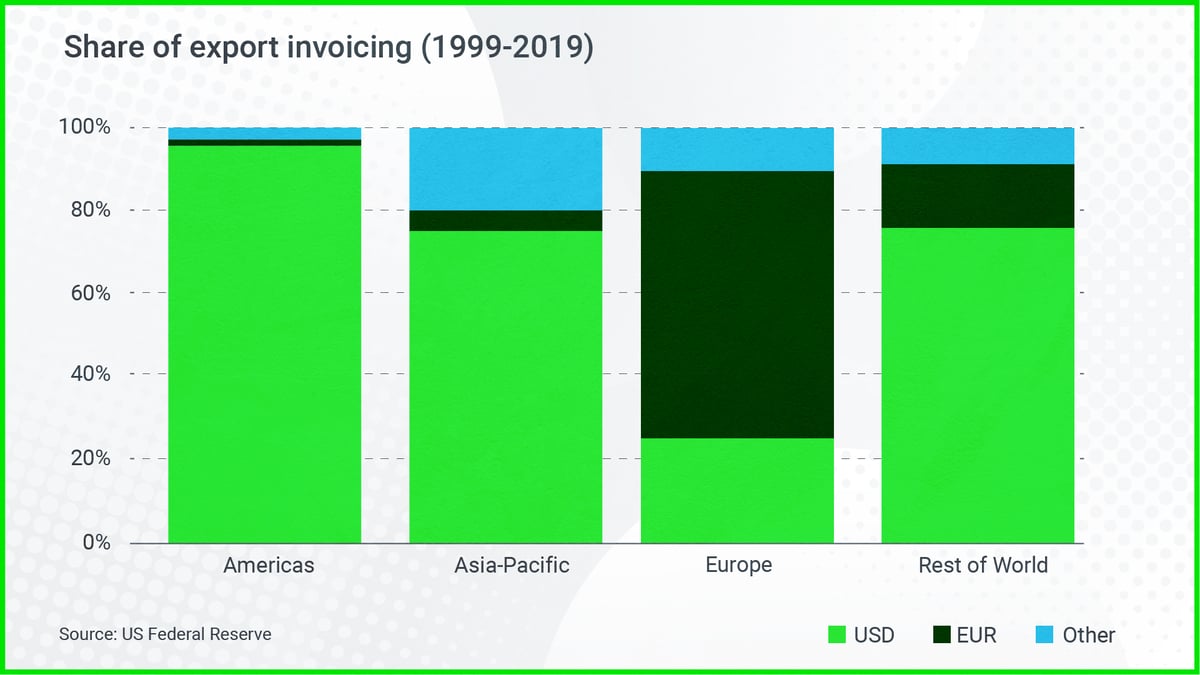

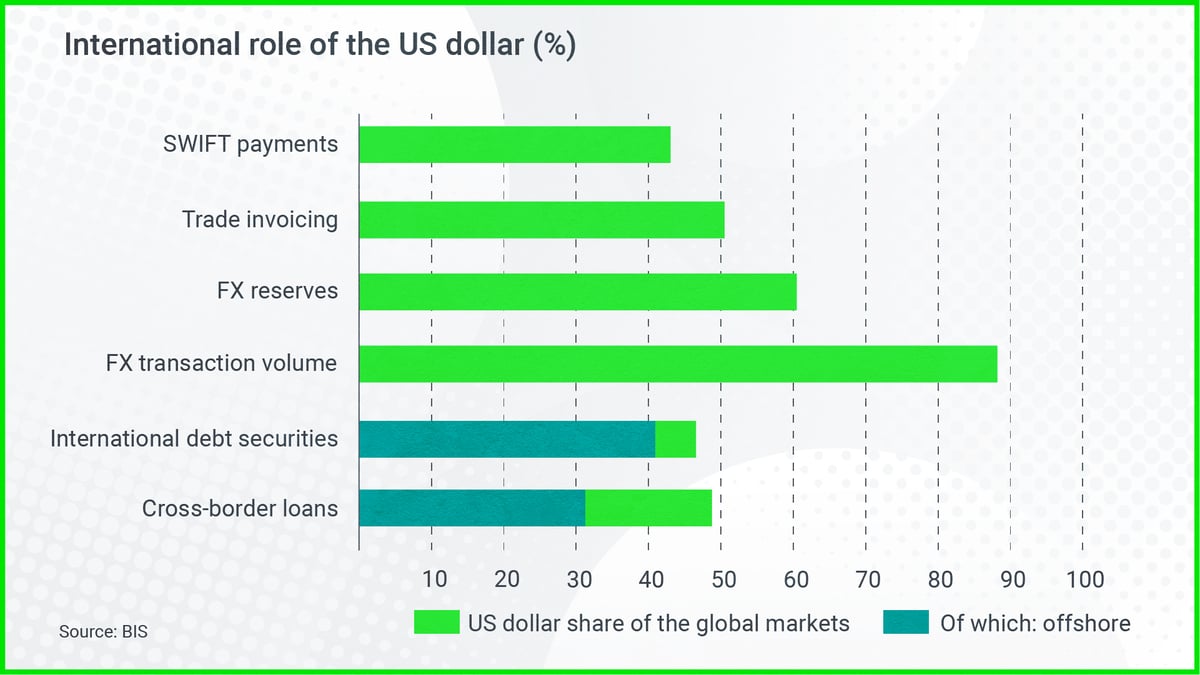

According to Alex Holmes from Oxford Economics, the US dollar has an intrinsic role in the modern financial system because over 90% of currency transactions still involve the US dollar.

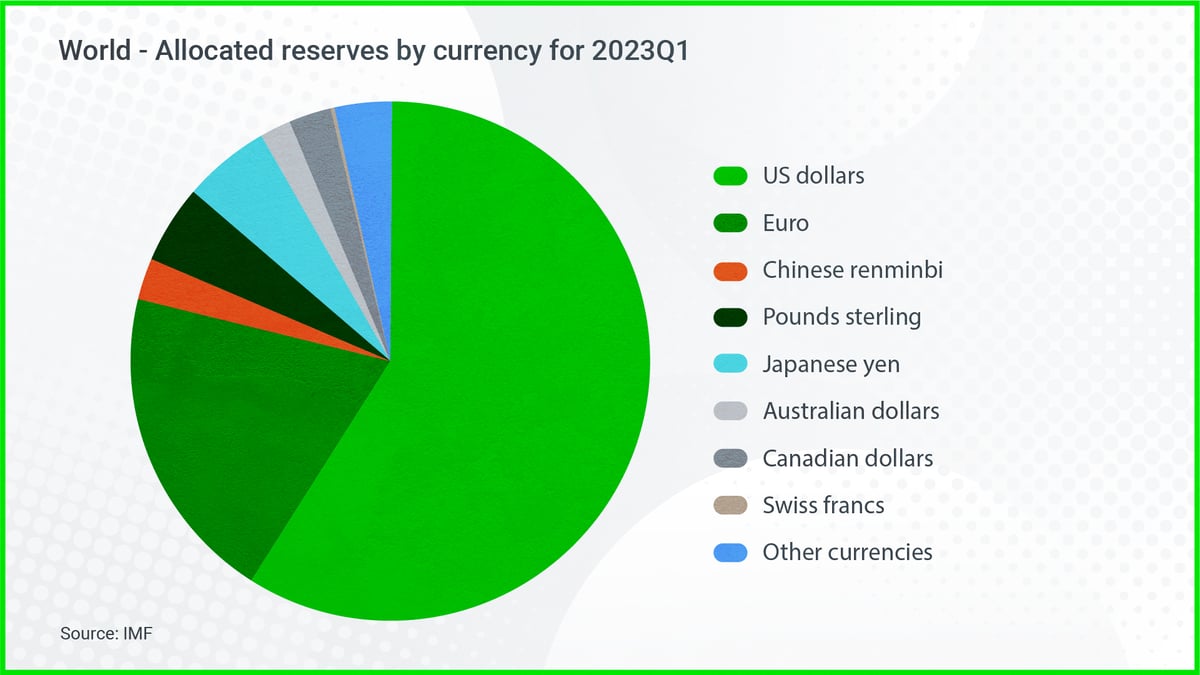

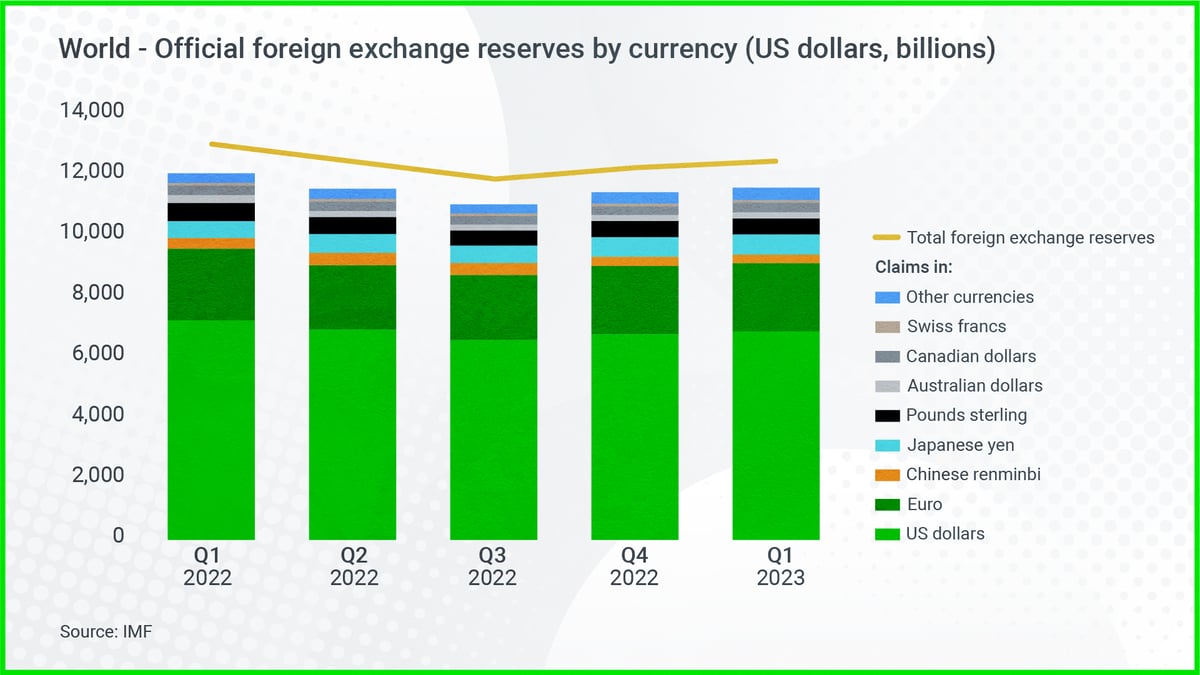

The US dollar is also still the most reliable store of value, with countries holding large volumes of USD as liquid cash-like securities.

The US Treasury market is still worth about $24 trillion.

And on the point of whether Bitcoin can become a reserve currency, Sullivan isn’t convinced.

“You fundamentally need men with guns to back you up. But the defining feature of Bitcoin is that no government and no set of men with guns backs it up. For that reason, bitcoin may have uses in some contexts, but it will never be a reserve currency.”

This is a marketing communication and does not contain, and should not be construed as containing, investment advice or an investment recommendation or, an offer of or solicitation for any transactions in financial instruments. Past performance is not a guarantee of or prediction of future performance. The analysis contained herein does not constitute a personal recommendation and does not consider your personal investment objectives, investment strategies, financial situation or needs. IC Markets makes no representation and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or other information supplied by IC Markets.

The information on this site is not intended for any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. There is a possibility to lose all your initial capital. For further information please consider our Risk Disclosure Notices for your relevant jurisdiction.

International Capital Markets Pty Ltd with registration number 123 289 109, is regulated by the Australian Securities and Investments Commission with License No. 335692.

Risk Warning:Trading derivatives involves high risks to your capital. General advice only. Please read the PDS, TMD and other legal documents on our website: icmarkets.com/au.