After the Bell: Turning Market Risks Into Round-the-Clock Opportunities

Searching for Extended Hours Alpha

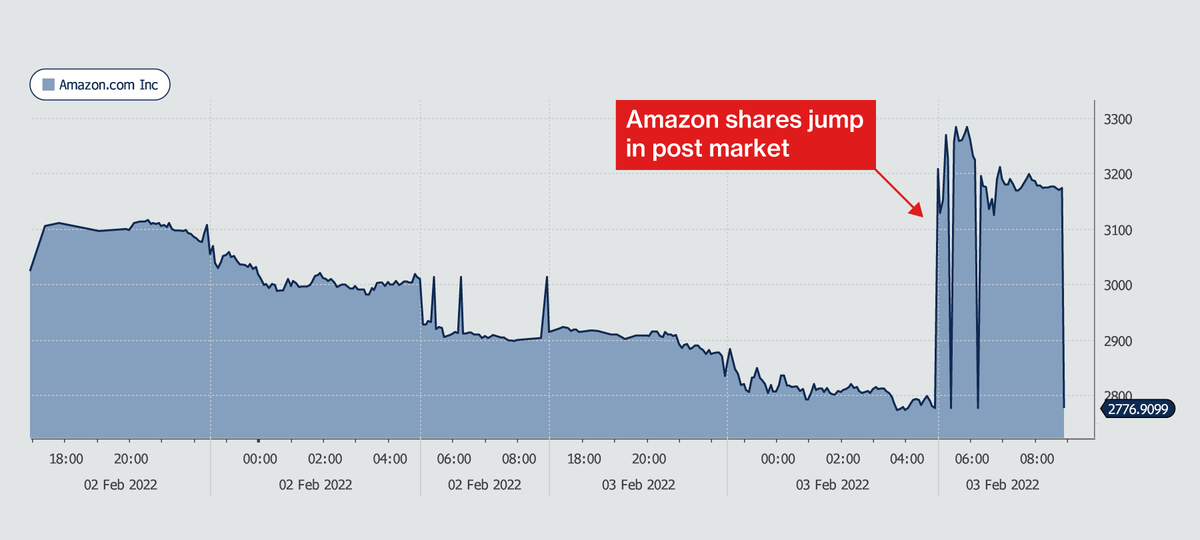

On February 4, 2022, Amazon shares surged to their biggest increase in nearly seven years, generating the largest single-day market value gain in U.S. history.

Strong earnings and a rise in Amazon Prime membership prices fueled a 19% jump in the company’s stock. The Invesco QQQ Trust Series 1 – the biggest Exchange Traded Fund that tracks the Nasdaq 100 – added as much as 2.2%.

But here’s the key: most of those gains happened after the main trading session closed, and only investors with access to extended trading were able to reap the rewards or (for those on the wrong side) defend their positions.

The concept of extended hours trading may seem a little unfair to those who think of stock markets as shops with regular opening and closing times. To a degree, they are, but they are also shops that open the back doors to special customers after regular shoppers have gone.

Even when there is little news around in the market we still see our clients very active in the pre and post market session,” said Dan Herriotts, Head of Trading at IG Australia. “This can increase to the majority of our daily volume on that stock if it has a big move and it’s a popular stock. This is particularly evident during earnings seasons.”

For the traditional buy-and-hold investor, it is not a matter for major concern whether stocks move by night or day. But for investors who aim to take advantage of these daily movements in prices, having access to the extended hours shelves in the market offers a key advantage.

According to some research[1], since 1993, anyone buying the S&P500 Index on the last second of every trading day and selling at the market open would have seen a profit of more than 500%. Any investor doing the opposite would have made a loss.

In other words, remarkably, the net gains from the index over the past three decades have all been made outside of regular hours.

Happily, retail traders are no longer locked outside watching the Members Only crowd clean up after markets close. Thanks to technology that operates independently from regular stock exchanges, everyday investors can now participate, too.

Missed Opportunities

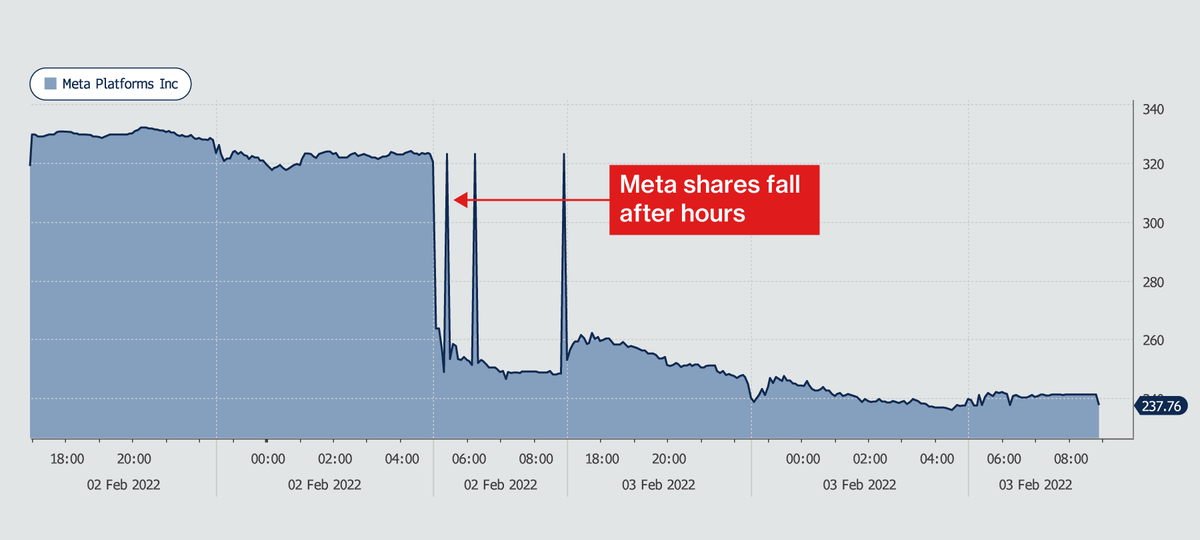

In late January-early February 2022, things seemed stable for shares of Meta Platforms (the company formerly known as Facebook). After a spectacular pandemic surge, the stock had been relatively range-bound for several months. In the run-up to 1Q22 earnings, the price had seen a modest bounce as investors bought shares, anticipating the customary buoyant news.

They were in for a shock. Not only did earnings disappoint, causing the stock to fall, but on a conference call later the company announced Facebook’s first-ever drop in daily users and forecast a US$10 billion advertising revenue loss from an Apple iOS update that enabled users to opt out of ad tracking. That triggered another extended hours sell-off, and Meta stock lost more than $230 billion in value, the largest single-day market capitalization slump in history.

The wipeout demonstrated the value of extended hours market access, particularly for investors in Asian time zones, who may have gone to sleep confident in another solid Meta quarter and found their portfolios to be worth substantially less in the morning.

“When you’re just trading in the main session, if there’s anything that moves markets during the extended hours session, you don’t have the opportunity to trade,” said Matthew Davidson, Commercial Director at IG. “Secondly, you don’t have the opportunity to use risk-management tools to control your exposure to these events.

“Say there’s news overnight that causes the market to run down, if you have extended hours access you can set up stops that are triggered to limit your losses. In the case of Meta, instead of seeing a 20% loss overnight and then waiting for the market to open, you could have limited your loss to 5% or 10%, depending on where your stop was.”

Using Contracts for Difference (CFDs) opens the opportunity for investors to use several important risk-management strategies. Short selling goes against the traditional mantra of buying low and selling high. But it can be a useful tool, helping traders to find opportunity even in falling markets. Traders can hedge their positions. For example, investors not confident in Meta’s results could have shorted an index tracker or a Meta share CFD as protection. Also, investors can use guaranteed stops and trailing stops to limit losses triggered by surprise announcements.

Since these events can’t be predicted – even during a rigidly scheduled earnings season – these tools need to be a permanent fixture in every smart trader’s portfolio. For investors in Asia trading U.S. stocks, there’s no reason to wake up to overnight shocks.

“That’s when a lot of the big volatility and the big moves happen in those stocks,” Davidson said. “Again, it’s about managing risks – so when your companies report you don’t just wake up the next day and see where the stocks re-open; there’s an opportunity to trade through it.”

Surprises Around Every Corner

These risks and opportunities are not just limited to earnings season. In markets, surprises can happen at any time, and come from anywhere – be it trader sentiment, social media activism, geopolitical tension or corporate announcements.

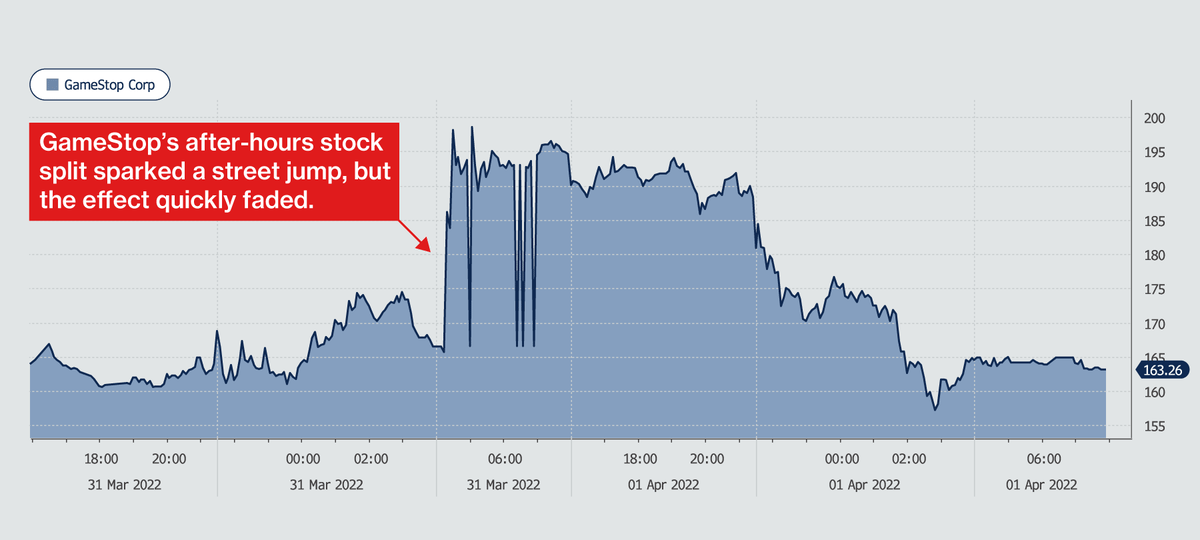

At the end of March 2022, GameStop announced – after market hours – that it would ask shareholders at its upcoming annual meeting to approve a stock split in the form of a dividend, increasing the shares on the market from 300 million to one billion.

Similar recent announcements by Tesla, Amazon and Alphabet had prompted a jump in their share prices.

Despite GameStop becoming something of a hot potato stock, associated with wild and irrational volatility driven by retail investor activism, the move worked. GameStop stock rose from $166.58 at the close in New York to a high of $203.98 during extended hours. The next day, the effect rapidly faded and the shares closed 1% lower. Any investors hoping to ride that short wave of optimism in normal market hours had missed their chance.

In markets, surprises can happen at any time, and come from anywhere. The well-prepared investor tends to be the most successful one.

“If you are with a broker that’s not covering all these hours, you’re missing opportunities,” Davidson said. “Some brokers have some of them, but not many have all of them. IG has the best within the industry, because we have access to tier-one brokers who can provide access to us.”

CFDs come with a high risk of losing money rapidly due to leverage. You do not have any interest in the underlying asset. Refer to our PDS and TMD at www.ig.com/au. The information on this page does not contain personal financial or investment advice or other recommendation, or an offer of, or solicitation for, a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of the above information. Consequently, any person acting on it does so entirely at his or her own risk. The information does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. IG Australia Pty Ltd ABN 93 096 585 410, AFSL 515106.

Source: