Inclusive Finance for a Just Transition

By empowering individuals and businesses to make sustainable choices, the financial sector can play a crucial role in supporting a greener future

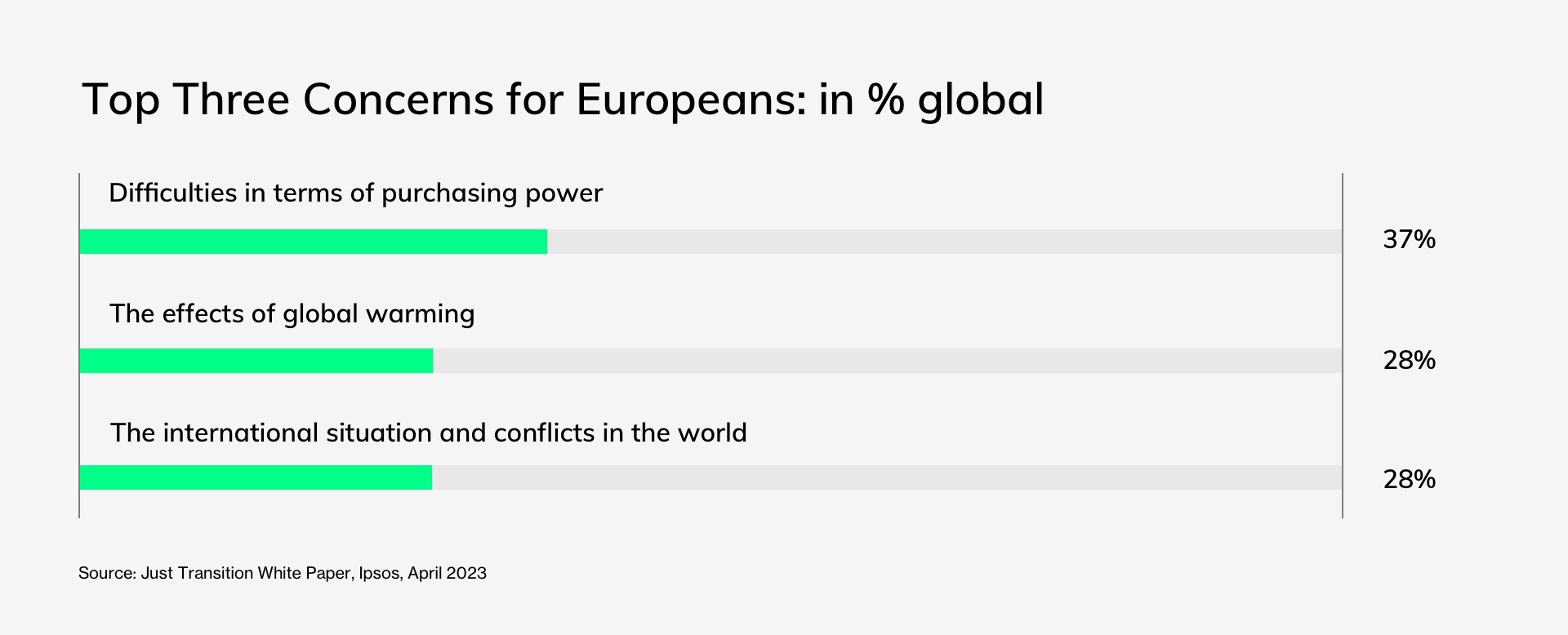

Climate change is causing increasing global concern. More than 70% of Europeans worry about climate change, according to research by Ipsos for BNP Paribas. Yet they diverge when it comes to solutions: 46% prefer mitigating global warming at the expense of their own lifestyles while 38% prefer to protect their purchasing power, regardless of the impact on climate change.

A just transition will require mass mobilization and can only succeed if society as a whole is involved. However, it is crucial to acknowledge that this transition will impact various individuals and communities differently.

How can it be achieved not only effectively, but also in a way that is fair and inclusive?

No one left behind

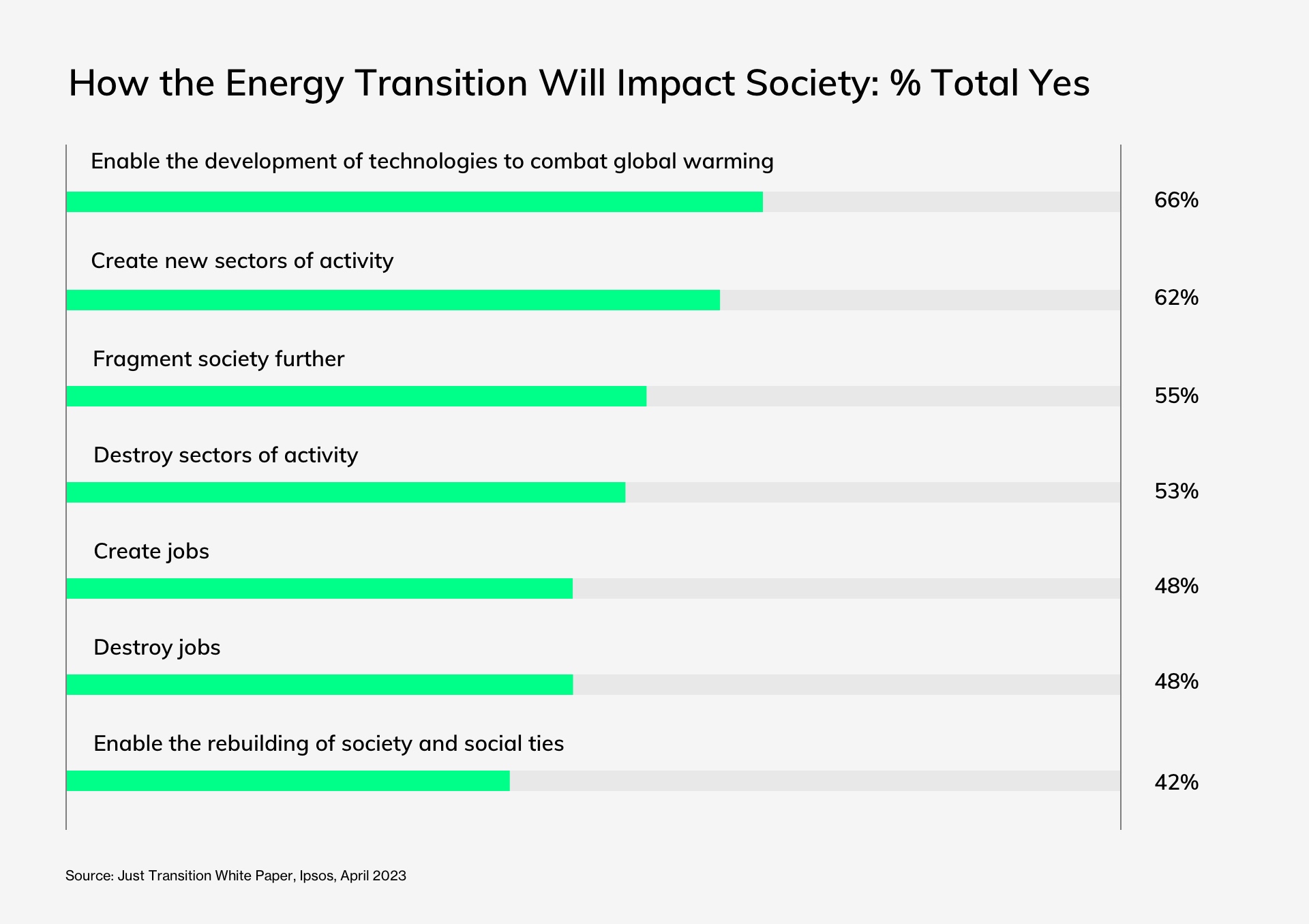

The good news is that the transition presents a major opportunity for job creation, ranging from renewable energy and infrastructure development to energy-efficient building renovations. There will be job losses, too, as industries and companies with large carbon footprints will face declining demand if they do not adapt. It is therefore essential to develop robust transition programs that provide retraining opportunities, job placement assistance and support for entrepreneurs. Public authorities will need to evolve their policy thinking and companies will need to adapt their activities.

“For the transition to work, it has to be a just transition — and a transition to a sustainable world. A just transition means that it needs to be accepted by society,” explains Antoine Sire, Head of Company Engagement at BNP Paribas.

He adds that lawmakers and companies must prioritize policies that support vulnerable populations, ensuring that the burden of the transition does not fall disproportionately on them. This includes targeted financial support, such as income-dependent vouchers for energy transition investments, or reinjecting carbon taxes into the economy to benefit lower-income households and small businesses.

A financial support network

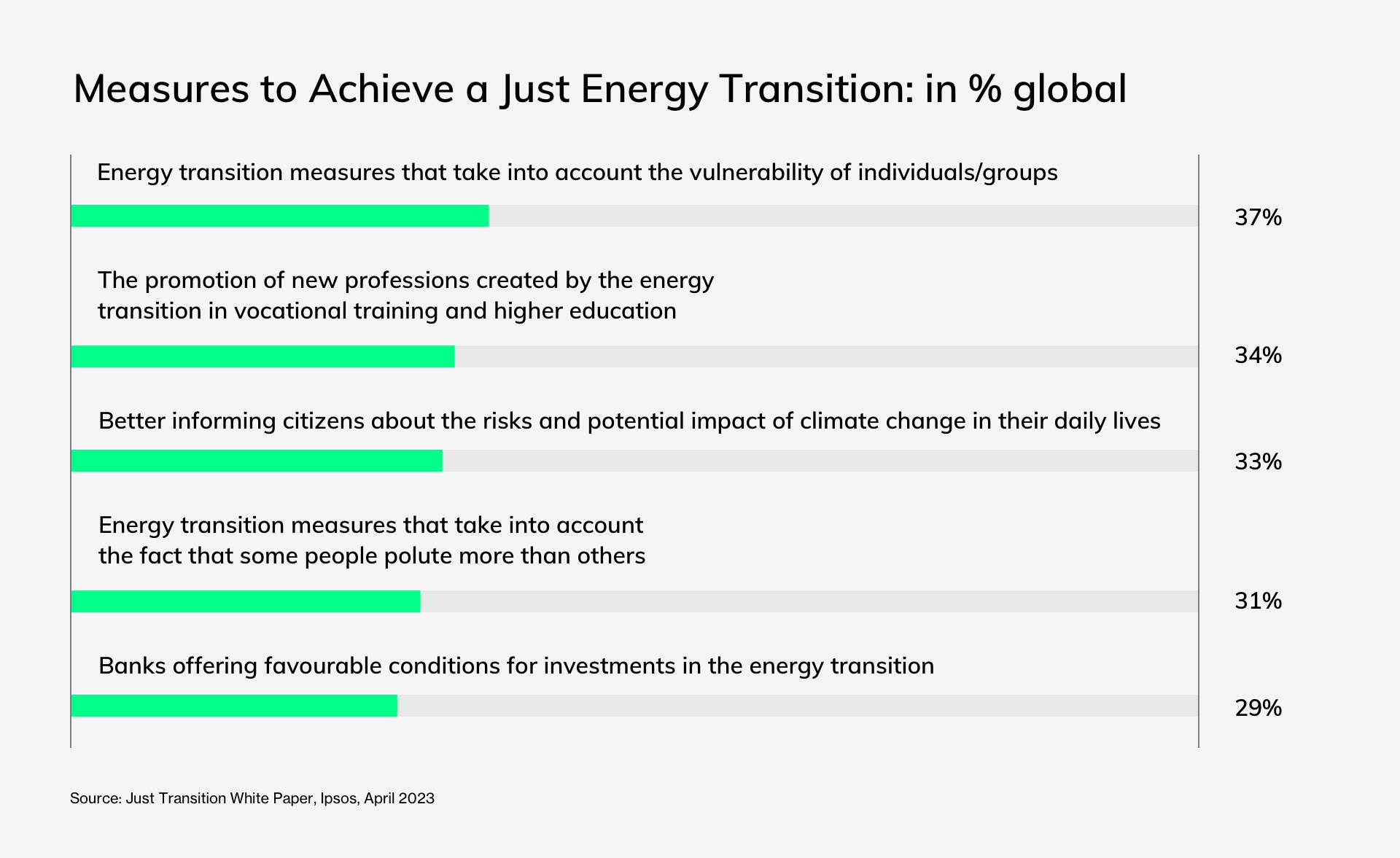

By leveraging its expertise, and by providing guidance and access to funding, the financial sector can provide this targeted support, and play a pivotal role in accelerating the adoption of sustainable practices across various domains.

For example, purchasing a less-polluting but expensive car, such as an electric or hybrid vehicle, can be a significant financial hurdle for many individuals. Banks can help bridge this gap by offering tailored financing options with favorable interest rates and flexible terms.

Encouraging portfolio managers to incorporate ESG metrics into their investments is another important route toward sustainability. So is encouraging energy-efficient building renovations. Navigating the complex landscape of government and regional subsidies can be overwhelming for individuals seeking to undertake sustainable home renovations. But, by leveraging their knowledge and networks, banks can help customers access financial incentives and make informed decisions that reduce their carbon footprint.

For example, ADEME, the French Agency for Ecological Transition, offers such incentives. In collaboration with BNP Paribas, it has also developed a range of financial tools including ecological impact bonds that enable sustainable project developers to raise funds through private investors.

Financial literacy at scale is paramount, emphasizes Gudrun Cartwright, who is Climate Action Director at U.K. nonprofit Business in the Community (BITC). In 2022, BITC, supported by BNP Paribas, brought together more than 100 leaders from business, government and communities in a series of training sprints. “Both technical and essential skills are needed to unleash the flexibility, creativity and problem-solving that will enable individuals and organizations to develop the skills they need to thrive in the transition,” says Cartwright.

Achieving carbon neutrality in 2050 will be no easy task. However, we can be certain that collaboration between the financial sector, customers and policy makers is critical to create a thriving ecosystem that aligns financial interests with sustainability objectives. Through these efforts, the financial sector can significantly contribute to building a more sustainable and resilient future.For more, see On Just Transition.