Strengthening Asia's Future with Sustainable Infrastructure

How public-private collaboration is catalyzing sustainable development in Asia’s emerging markets.

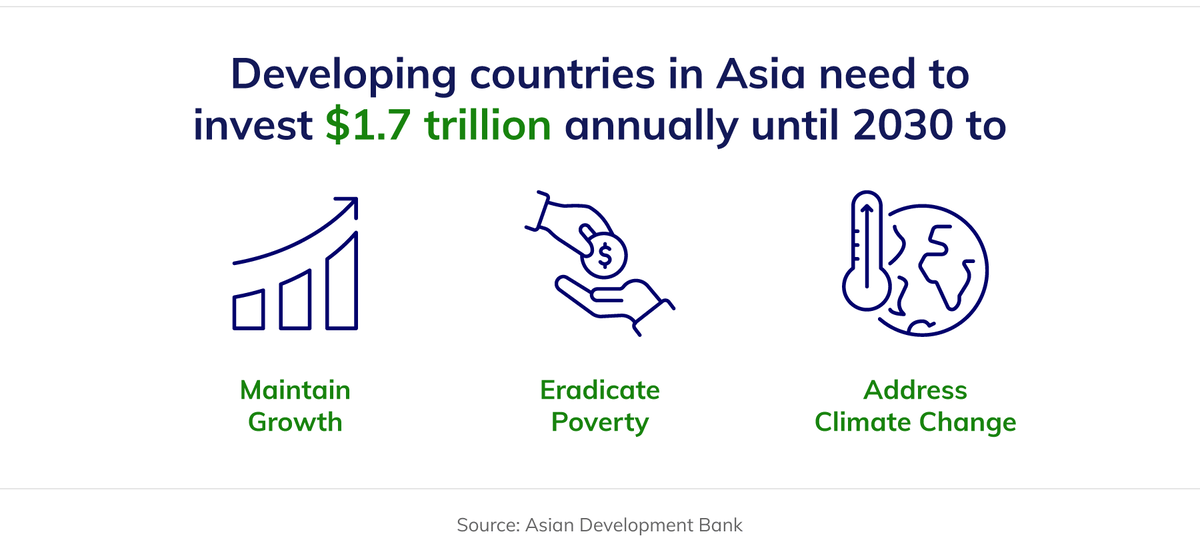

From roads and bridges to water and energy, the demand for new infrastructure across Asia is surging. This heightened demand is being driven by the region’s growing and rapidly urbanizing population, and the need to spur economic development, and by the effects of climate change.

However, the complexity of modern infrastructure projects—from navigating numerous regulations to integrating the necessary technology—makes it extremely challenging for a single entity to successfully deliver them.

As a result, the traditional model of government-led infrastructure development is giving way to a more collaborative landscape in which private investors, developers, and communities play an increasingly critical role. These innovative partnerships bring a broader range of expertise and financing solutions to address Asia’s infrastructure challenges.

Funding clean water in the Philippines

Around 60 million people in the Philippines—52% of its population—lack access to clean water, while 43 million people lack access to a “safe toilet.”[1] Much of the country’s water and sanitation infrastructure is outdated, inefficient and poorly maintained. Frequent severe flooding regularly exceeds its capacity, resulting in contaminated water.

The Philippines government, through its Public-Private Partnership (PPP) Center,[2] plans to leverage private-sector expertise and capital globally to invest in new infrastructure projects, upgrade aging water facilities, and implement modern water management technologies.

A major advantage of public-private partnerships is the ability to transfer certain project risks to private sector partners who are often better equipped to assess, price, and manage those risks, which can result in more effective risk mitigation throughout a project's lifecycle. The public sector typically handles risks related to policy and the regulatory landscape, as well as incentives to ensure project completion.

According to the PPP Center, the recent enactment of the PPP Code of the Philippines and its Implementing Rules and Regulations, along with amendments to the Public Service Act, provides a stable and predictable environment for the private sector to invest in PPP projects.

To identify investors and technical experts able to provide the right support for the country’s projects, the PPP Center has developed a key partnership with Infrastructure Asia, which was set up by Enterprise Singapore and the Monetary Authority of Singapore in 2018 to support Asia’s social and economic growth through infrastructure development.

The PPP Center also works with organizations like Climate Fund Managers[3] to fund projects in the Philippines. The for-profit investment manager uses a blended finance approach, combining public and private funds that include concessional capital from government aid and philanthropy to attract private investment and de-risk projects that generate social benefits.

This type of collaboration is bringing results. In 2024, the Philippines Department of Environment and Natural Resources announced 112 new water projects open for public-private investment, in addition to the 135 projects offered in 2023.[4] Major projects that will soon be completed include Manila Water’s Darangan Pipe Bridge project in Binangonan, Rizal, which will improve water access for more than 20,000 households.

Keeping Cambodia connected

As one of the newest members of the Association Southeast Asian Nations (ASEAN), Cambodia has been among the world’s fastest-growing economies.[5] To realize its ambition of becoming a middle income country by 2030, Cambodia will have to prioritize investment in its transport infrastructure to enable more seamless integration with its neighbors.

Cambodia rebuilt its road network—the backbone of its transport system—after decades of conflict destroyed much of it. Today, an estimated 85% of its national roads are paved, compared to 38% of provincial roads and just 10% of rural roads.[6] The rail network is limited, with just two operational lines, though there are plans to build new tracks connecting Phnom Penh to Bangkok and Ho Chi Minh City.[7] The country has two main seaports: the Phnom Penh Autonomous Port on the Mekong River and the Sihanoukville Autonomous Port on the Gulf of Thailand. Sihanoukville has benefited from new investment, with plans underway for a new deep-water container port.[8]

While the Cambodian government has taken steps to make the country more attractive to investors, such as permitting 100% foreign ownership of companies, significant challenges remain when it comes to accelerating infrastructure development to keep pace with the country’s rapid growth. These include a funding gap, a shortage of technical expertise and a complicated regulatory landscape.[9]

In Cambodia, public-private partnerships have again proved critical.

Infrastructure Asia brought together YCH Group, a leading Asian logistics and supply chain provider, and Cambodia’s Ministry of Public Works and Transport to develop the $200 million Phnom Penh Logistics Complex, a state-of-the-art multi-modal logistics hub in the capital. Crucially, YCH also collaborated with the WorldBridge Group, a prominent Cambodian conglomerate, to leverage its deep local market knowledge and experience in real estate and logistics.

“WorldBridge Group brings valuable insights and know-how of building and operating businesses there. A local partner rooted in the country has been instrumental in helping our project team navigate the regulatory landscape and in bringing in expertise in local management,” YCH says.

Powering Bangladesh and Indonesia with green energy

Falling solar power prices have the potential to help ease the energy crunch in countries such as Bangladesh, where an over-dependence on fossil fuels presents significant challenges to its energy security and environmental sustainability—not to mention its foreign exchange reserves.[10] Renewable energy production in Bangladesh is extremely low, at 1% of total generation,[11] with solar accounting for a third of this figure.

While several new solar photovoltaic (PV) power projects are underway, the solar sector in Bangladesh is not scaling quickly enough. This is due to several factors, including vague policies governing the development of renewable energy and a complicated land acquisition process.[12]

However, international investors seeking to navigate these challenges are benefiting from the support of infrastructure experts across the region, such as Rajah & Tann, a leading Singapore-based legal firm that specializes in energy and infrastructure projects.[13]

The firm provides legal support to investors early in the project planning phase to assess commercial viability before a final investment decision is made. This support includes advising on applicable regulatory frameworks and compliance, undertaking legal due diligence—for instance, evaluating land rights and liaising with relevant government agencies to facilitate collaboration between all project stakeholders.

Like Bangladesh, Indonesia is also trying to reduce its dependence on fossil fuels.

For example, a hybrid renewable power project that utilizes solar and wind is now being piloted in Nusa Penida, Bali. The objective of the project is to transform Nusa Penida into the first fully renewable-powered island in Indonesia, thus becoming a case study for other islands across the archipelago.

The Nusa Penida project involves multiple stakeholders, including the Bali Provincial Government, PT PLN Indonesia Power, and private developers. These partnerships are critical to financing and implementing the renewable energy infrastructure that Indonesia needs to realize its net-zero emissions goal by 2060 or sooner.[14]

Bridging the gap

Close collaboration between the public and private sectors is essential to bridge Asia’s huge infrastructure funding gap, overcome institutional and regulatory challenges and provide the necessary technical expertise.

“This is where Infrastructure Asia continues to play a critical role in the development of sustainable infrastructure across the region, by cultivating a larger pipeline of bankable projects and investment opportunities, and working closely with governments, the private sector, and other key stakeholders such as multilateral banks,” says Lavan Thiru, Executive Director, Infrastructure Asia.