Live a Little: Evolving Hong Kong Woos Global Investors and Capital

When James Thompson relocated to Hong Kong in the late 1970s, he never expected the city to have such a positive impact on his business.

“Establishing a company here was a very easy process with no red tape, so we were able to become profitable in our first year,” he says.

Thompson, who founded Crown Worldwide, a logistics and transportation company, discovered that Hong Kong is open to all investors and treats them equally—regardless of nationality.

“English is widely spoken, which is a huge benefit for multinational businesses,” he adds. “And as a regional—even global—base we’ve not found a better place to operate from.”

Crown Worldwide, which is still headquartered in Hong Kong, now operates in more than 40 countries.

Hong Kong’s resilience

Affluent and entrepreneurial expatriates like Thompson have long been drawn to a city that’s always in motion, constantly adapting to changing conditions and new challenges.

Hong Kong weathered the Asian financial crisis in 1997, successfully defending the Hong Kong dollar from speculators, and quickly bounced back after the SARS outbreak in 2003. From 2003 to 2006, its average annual economic growth surged to 6.3%, up from around 1.9% between 1997 and 2002.[1]

This resilience is underpinned by Hong Kong’s strategic geographic location—at the crossroads between East and West—a robust legal system, and a free-market economy. Its world-class financial services sector, advanced infrastructure, and skilled workforce have burnished its reputation as a stable and business-friendly environment, which has been the key to luring investment and talent.

The New Capital Investment Entrant Scheme

The Hong Kong government recently introduced a scheme that aims to make it even easier for high-net worth individuals to reside in the city.

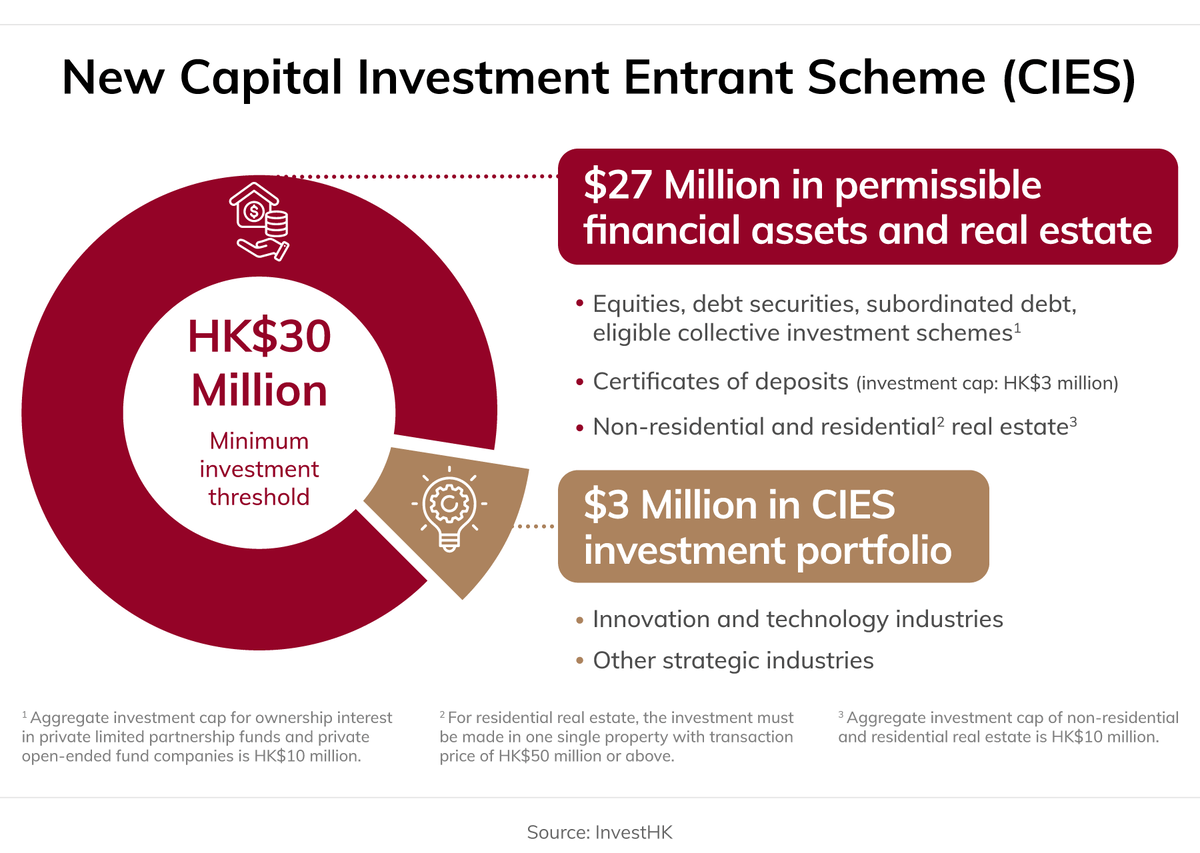

The New Capital Investment Entrant Scheme (New CIES),[2] launched in March this year, allows foreign nationals and their families to fast track residency in return for investments of at least HK$30 million (US$3.8 million). A diverse range of investment opportunities include equities, debt securities, certificates of deposits, subordinated debt, eligible collective investment schemes, ownership interest in limited partnership funds, and real estate.

As Asia's leading financial hub, Hong Kong is home to more than 9,000 multinational companies, which include banks, asset management firms, and insurance companies.[3] The anticipated influx of talent is expected to further bolster the city’s standing in the financial sector, drawing more businesses and investors to establish operations in Hong Kong.

The government hopes the New CIES will also incentivize more applicants to set up businesses and live in the city, consolidating its position as an international asset and wealth management hub.

Why Hong Kong?

For Thompson, an American, one of Hong Kong’s biggest strengths is the speed of development, particularly its infrastructure.

“When we started here in 1970, the only transport from Hong Kong island to Kowloon and the New Territories was by ferry,” he says. “But today the underground (MTR) connects all parts of Hong Kong quickly, which is a huge benefit for people choosing to live anywhere in the city.”

Thompson is equally effusive in his praise for Hong Kong International Airport (HKIA). As the world’s busiest cargo hub—handling around 4.3 million tons of cargo in 2023[4]—it plays a critical role keeping global businesses like Crown connected.

HKIA is due to open a third runway in late 2024, which will allow it to increase annual capacity to 120 million passengers–up from around 45 million currently—and 10 million tons of cargo.[5] It also serves more than 220 destinations globally, and has a direct road route to key destinations in Mainland China’s Greater Bay Area (GBA).

Home to more than 86 million people, the GBA comprises the Special Administrative Regions of Hong Kong and Macao, and nine cities in Guangdong Province—Guangzhou, Shenzhen, Zhuhai, Foshan, Huizhou, Dongguan, Zhongshan, Jiangmen and Zhaoqing. In 2023, the region’s GDP was US$1.97 trillion[6]—which is 11% of China’s overall GDP[7]—up from US$1.67 trillion in 2019,[8] representing a significant economic opportunity.

Investors and businesses with a presence in Hong Kong can benefit from GBA-focused initiatives such as Wealth Management Connect,[9] a cross-border scheme that enables them to invest in wealth management products across the region, streamlined customs procedures and enhanced logistics networks to make it easier to trade, and the option to invest in the region’s thriving technology ecosystem, which has emerged as a global powerhouse in recent years.

While Hong Kong is a Special Administrative Region (SAR) under the Central People’s Government in Beijing, its common law system continues to be practiced as constitutionally guaranteed, making the city the only common law jurisdiction within China. It facilitates the movement of funds, information, and talent across borders, with no exchange controls. It also boasts an open Internet.

Quality of Life Matters

The New CIES scheme isn’t just aimed at attracting investment, it’s about promoting the city as a great place to live.

“I would absolutely recommend Hong Kong as a place to live for my foreign friends,” says Thompson. “With low tax and many places to enjoy reasonable food and drink, the overall cost of living can be offset. The lack of crime and overall safety of Hong Kong has been a huge benefit when compared with other big cities of the world. This allows people to go about their lives with peace of mind."

While Hong Kong is known for its skyscrapers and bustling cityscape, it also offers an abundance of natural beauty—and the chance to unwind. Dramatic coastlines are set against the backdrop of breathtaking mountains, while many of the territory’s islands can be reached within 30 to 40 minutes from Victoria Harbour.

Enduring appeal

James Thompson's experience living and working in Hong Kong illustrates its enduring appeal to international businesses and investors. The introduction of the New CIES reflects the city’s proactive approach to adapting to changing global dynamics and reinforcing its position as a financial powerhouse. And as Hong Kong continues to innovate and develop new opportunities, incoming talent will find the city just as appealing as Thompson did when he first arrived decades ago.