Investing in Gold: Is Gold Still Considered a Safe Bet in Uncertain Economic Times?

One of history’s most enduring commodities, gold has long been touted as the world’s safe-haven metal, thought to help protect investors against inflation and economic downturns. But as we enter a fresh recession, can gold still act as an effective hedge?

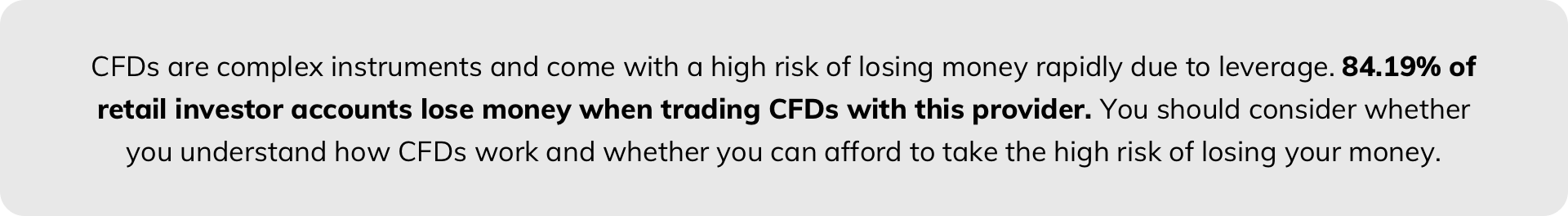

Gold prices have been synonymous with volatility this year in the wake of Russia’s invasion of Ukraine. Europe’s deepening energy crisis has resulted in a weaker euro, while an increase in US interest rates has sent the dollar up, affecting gold spot prices on an almost daily basis. While central banks have raised interest rates to stave off inflation, Bloomberg Intelligence expects them to continue to view gold favorably as a reserve asset.

What affects gold prices?

Several factors influence gold prices, one of the most important being inflation and interest, which are linked. Gold has an inherently limited supply, which makes it an inflation hedge, but despite the commodity’s reputation for being a safe-haven investment, gold is not risk-free.

The effects of recession on gold

While the price of the yellow metal has an inversely proportional relationship to inflation rates, gold is less affected by recessions than many commodities. Gold is consistently in demand around the world, so a recession in any one region is unlikely to skew its international value. In the case of a global recession, gold is still seen as a valuable commodity because of its liquidity, and it is thought to be an easy asset to cash in on when the markets are down.

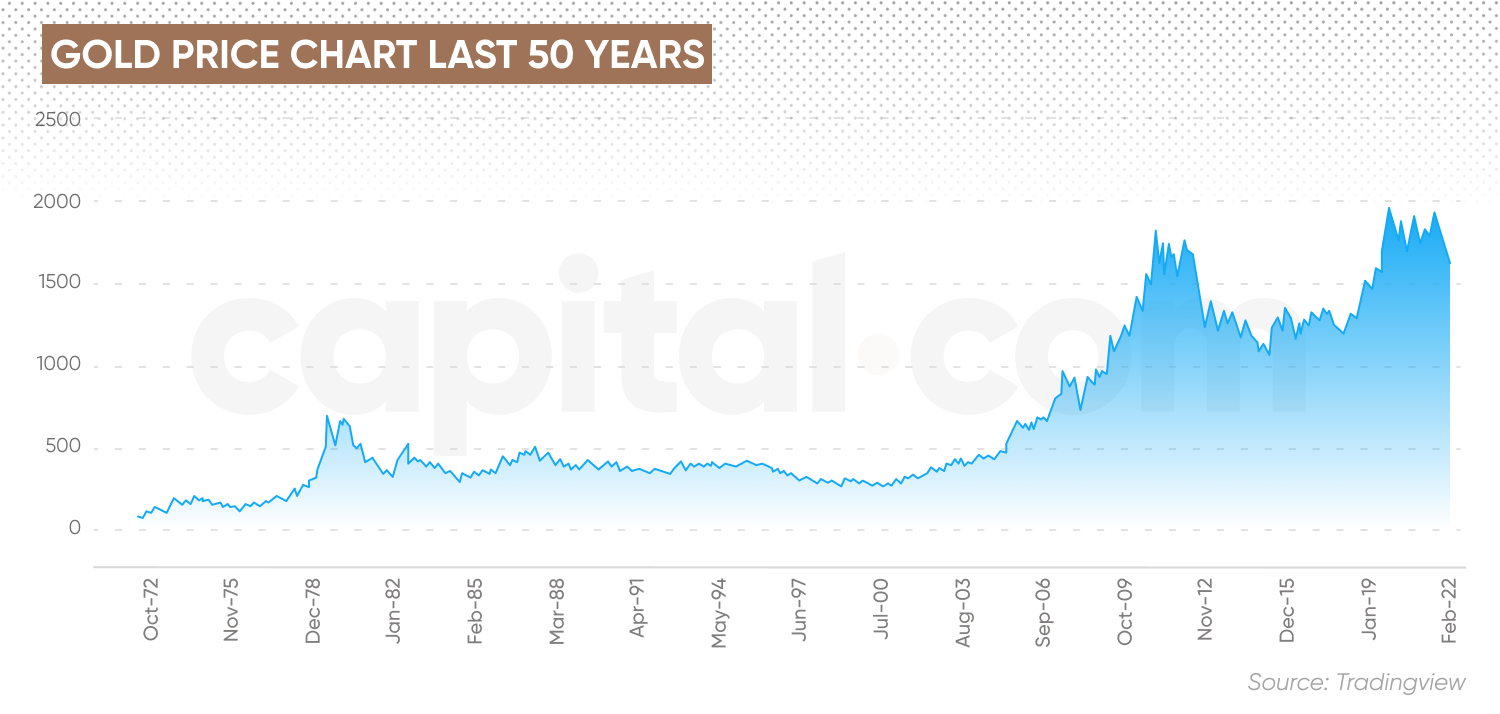

Due to its reputation for being a safe-haven asset, gold tends to perform well during a recession. For example, when the stock market collapsed in 2007, investment demand for gold spiked and continued to rise, and gold doubled in value between 2007 and 2011. Similarly, with fear and uncertainty at an all-time high during the Covid-19 pandemic, the price of the metal hit record highs, as did inflows of gold-backed exchange-traded funds.

Is it wise to invest in gold during a recession?

“It’s interesting that this phrase ‘safe haven’ gets thrown about when it comes to investing in gold. It doesn’t always make sense to hold gold, which doesn’t give a yield,” says Brian Gould, Head of Dealing, Australia at Capital.com. He explains that while gold can work as a safe haven in a lower-interest-rate environment, it doesn’t work as well if investors hold gold against the US dollar, which does produce a yield.

To counter the effects of a recession, a central bank injects liquidity into the market, which leads to inflation that lowers the value of the currency. This lowers investor confidence in the strength of the currency and increases demand for gold, which usually holds its value in weak economic environments.

Inflation and gold

“The problem at the moment is that inflation has gotten so out of control and central banks are being forced to hike rates like we’ve not seen in a lifetime,” says Gould.“If you look at gold against the US dollar, we reached new all-time highs in 2018, and the market has fallen back since. It looks quite dramatic, and this year, gold is down against the dollar. But gold is 14% higher against the Japanese yen, 8.6% higher versus the pound and 4.3% higher versus the euro.“

So, there’s an argument there that, yes, it can be held as an inflation hedge—just not against the dollar. For all intents and purposes, gold trades more like a risk asset a lot of the time.”

Like the value of any asset, gold prices are influenced by market uncertainty. During the pandemic, investors shored up gold investments in bullion, stocks and exchange-traded funds as trillions of dollars in cash were injected into the US economy through stimulus packages, pushing interest rates to record-low levels.

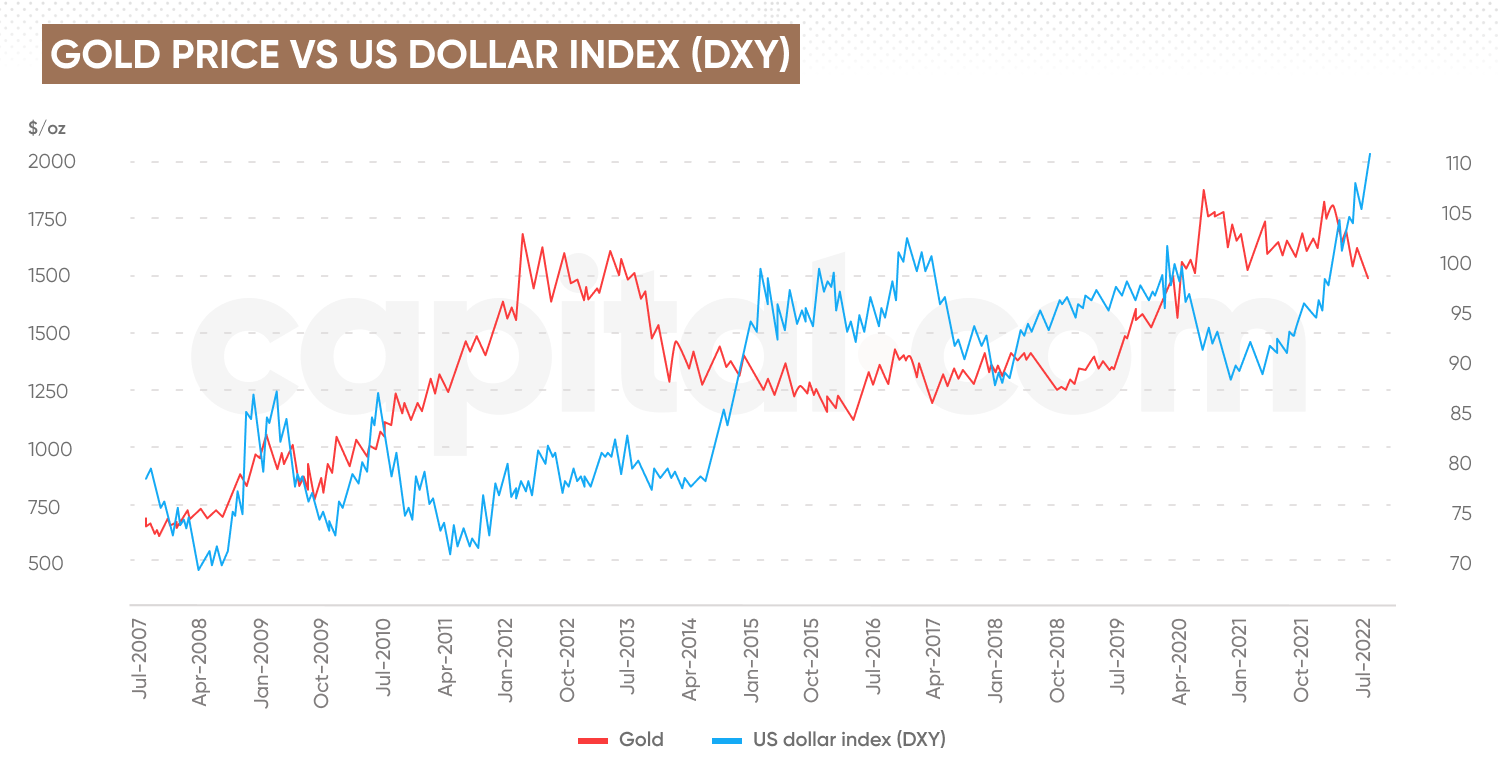

Real Treasury yields and gold

Gold prices are linked to US Treasury real yields, or net returns of expected inflation, according to Piero Cingari, Forex and Commodities Specialist at Capital.com.

“When US real yields increase, gold’s value decreases and vice versa, because a higher real expected return on a safe asset like US Treasury bonds discourages investment demand in non-yielding assets, such as gold,” he says.

In other words, when investors assume that the Federal Reserve will continue raising interest rates aggressively and will be successful in lowering inflation, that is not always a good environment for gold, as Treasuries may offer relatively more attractive returns.

“However, when the market believes that inflation cannot be significantly reduced even when interest rates rise—as it may be dependent on supply-side factors such as an energy crisis over which central banks have little or no control—gold returns to the forefront of investors’ minds,” says Cingari.

Many people seek safety in the precious metal when they are concerned about losing real value from otherwise safe assets like cash and US government bonds, Cingari explains. These assets tend to decline in value when inflation expectations rise faster than nominal yields. “We haven’t gotten there yet, but we’re not that far away,” he says.

Traditional gold investment products

Historically, gold helps diversify a multi-asset portfolio to smooth risk and return and reduce overall losses when stocks, bonds, real estate and other assets fall. The commodity can be traded as physical gold, stocks and futures, including contracts for differences (CFDs) and exchange-traded funds (ETFs). Buying bullion bars or coins is one way to gain exposure to gold, but storage and insurance costs can be expensive.

Another factor to note is that jewelry demand has slumped since 2021, following the strengthening dollar, which has made gold bought in local currencies more expensive. China has also seen a decline in gold jewelry demand year-on-year to June 2022. Spot prices have dropped since reaching record highs following the Russian invasion of Ukraine. According to the World Gold Council, central banks are likely to retain their tight monetary policies, which lowers the appeal of non-interest-bearing assets like gold jewelry for the rest of 2022.

Buying physical gold gives investors the flexibility to resell it when needed, but there is no guarantee that investors will get the same market price when they sell, and physical gold does not produce a yield while it is held. As an investment asset, the profit made from selling gold is subject to capital gains tax.

Holding gold mining company shares is another way to gain exposure to the precious metal, but performance depends on a lot more than just gold prices, and the company’s reputation, production costs, reserves and exploration all factor into share performance.

Buying gold online

Investors interested in speculating on gold price rather than owning physical gold can gain exposure to the yellow metal via a trading platform like Capital.com. Gold ETFs are commodity funds that trade like individual stocks through online brokers. This investment product allows investors to gain exposure to the gold price without having to purchase the physical metal.Meanwhile, gold CFDs are contracts that pay traders for the difference between the entry and exit price, so investors benefit from upward changes in the price of the commodity. It is also possible to go short with CFDs and potentially benefit from downward changes. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Success can depend on a trader’s ability to analyze and predict market trends and understand the factors that affect price movement. Futures, including CFDs, do not require full funding up front, which may be an option for investors looking for leverage. However, futures contracts need to be managed to maintain appropriate levels of exposure, which may suit investors who prefer a more hands-on, long-term strategic approach.

Education and technology can help manage risks

Investing in any security is risky, Gould warns, and you should consider the risk before trading gold, as you would for any asset. “The thing with CFDs is you have to be careful. It’s not for everyone,” he says. “You’re trading with leverage, so you need to understand risk management. Capital.com prides itself on having an educational app that clients can download for free once they sign up, and it gives in-depth guidance on leverage, managing your risk and understanding profits and stock losses.”Gould points out that while gold is a strong instrument that has stood the test of time for millennia, it can be very volatile. “Any new traders who are coming into the market need to understand that sometimes gold can move a couple of percentage points and it can be very liquid at times,” he says. This is where investors can benefit from educating themselves on price movements in the commodity market, especially as world economies enter an uncertain period.