Ireland’s Fintech Revolution: Fueling Global Impact With Innovation

With an entrepreneurial spirit, substantial investment and a highly skilled workforce, Irish fintech and payment solution providers have emerged as leaders in global financial innovation, propelling Ireland’s fintech boom to new heights.

Leo Clancy, CEO of Enterprise Ireland, the government agency supporting Irish businesses to go global.

Ireland continues to make waves in the world of finance as its fintech sector thrives and expands. The industry’s impressive growth is underscored by the presence of 17 of the world’s top 20 banks and the servicing of over 40% of global hedge fund assets. But what makes this small country, with a population of just 5 million, such a fertile ground for fintech innovation and collaboration?

Ireland’s ascent in the fintech landscape can be attributed to a combination of factors that have propelled it to the forefront of global financial innovation. The country boasts a large international financial services industry, bolstered by a pool of skilled talent equipped with broad expertise. “We have a large international financial services center with lots of capability on industry subject matter and technical skills. This comes together in fintech,” says Leo Clancy, CEO of Enterprise Ireland, the government agency supporting global Irish businesses.

Ireland’s unique advantages have created an ecosystem conducive to fintech success. The country’s skilled workforce, favorable regulatory environment, robust infrastructure, strategic location and collaborative culture provide a solid foundation for fintech companies to flourish.

The presence of major multinational companies significantly contributes to Ireland’s fintech prowess. Financial industry giants like Stripe, PayPal, Mastercard, Elavon, Fiserv, Coinbase and Block have made Ireland their home, bringing expertise, investment and invaluable partnerships to the Irish fintech landscape. This aggregation of key players has fostered an environment of innovation and knowledge sharing, propelling the sector’s growth.

Collaboration is a cornerstone of Ireland’s fintech success story. Enterprise Ireland and other government agencies have shown unwavering support, recognizing fintech as a priority growth sector. Enterprise Ireland, with a portfolio of over 250 companies, is one of the largest investors in fintech startups worldwide by deal count.

Support from Enterprise Ireland, Ireland’s membership in the EU and global fintech momentum have acted as powerful catalysts for the sector’s growth. In 2022, global fintech investment reached a staggering $164.1 billion, a testament to the sector’s tremendous potential and opportunities. New regulations—such as the European Payment Services Directive 2 (PSD2)—the rise of mobile-first platforms and the Irish government’s commitment to fostering fintech innovation have all contributed to Ireland’s fintech boom.

Exporting fintech

Ireland’s fintech success extends far beyond its borders. UN figures show that Ireland is the sixth-largest exporter of financial services globally, showcasing the country’s ability to compete on the international stage. “Not only does it boast a number of companies which have reached billion-dollar valuations within a few years of starting up, but it can also lay claim to global leaders in areas such as payments and regulation,” notes Clancy.

The growth of the Irish fintech sector has created a vibrant ecosystem with remarkable success stories. Wayflyer, a revenue-based financing and growth platform for e-commerce companies, achieved unicorn valuation at the start of 2022, joining regtech unicorn Fenergo. Enterprise Ireland is a long-time supporter of Fenergo, whose software-as-a-service (SaaS) regulatory technology solutions are leveraged by major financial institutions and fintechs around the world to increase operational efficiencies, reduce risk and drive revenue growth.

Security is a primary concern in the financial industry, and Irish companies have risen to the challenge. Tines, a security automation platform, empowers financial institutions to effectively streamline their operations and combat today’s ever-increasing cyber threats. With the support of Enterprise Ireland, Tines has partnered with multinational corporations such as Amazon Web Services, Guidepoint, Optiv and Wiz.

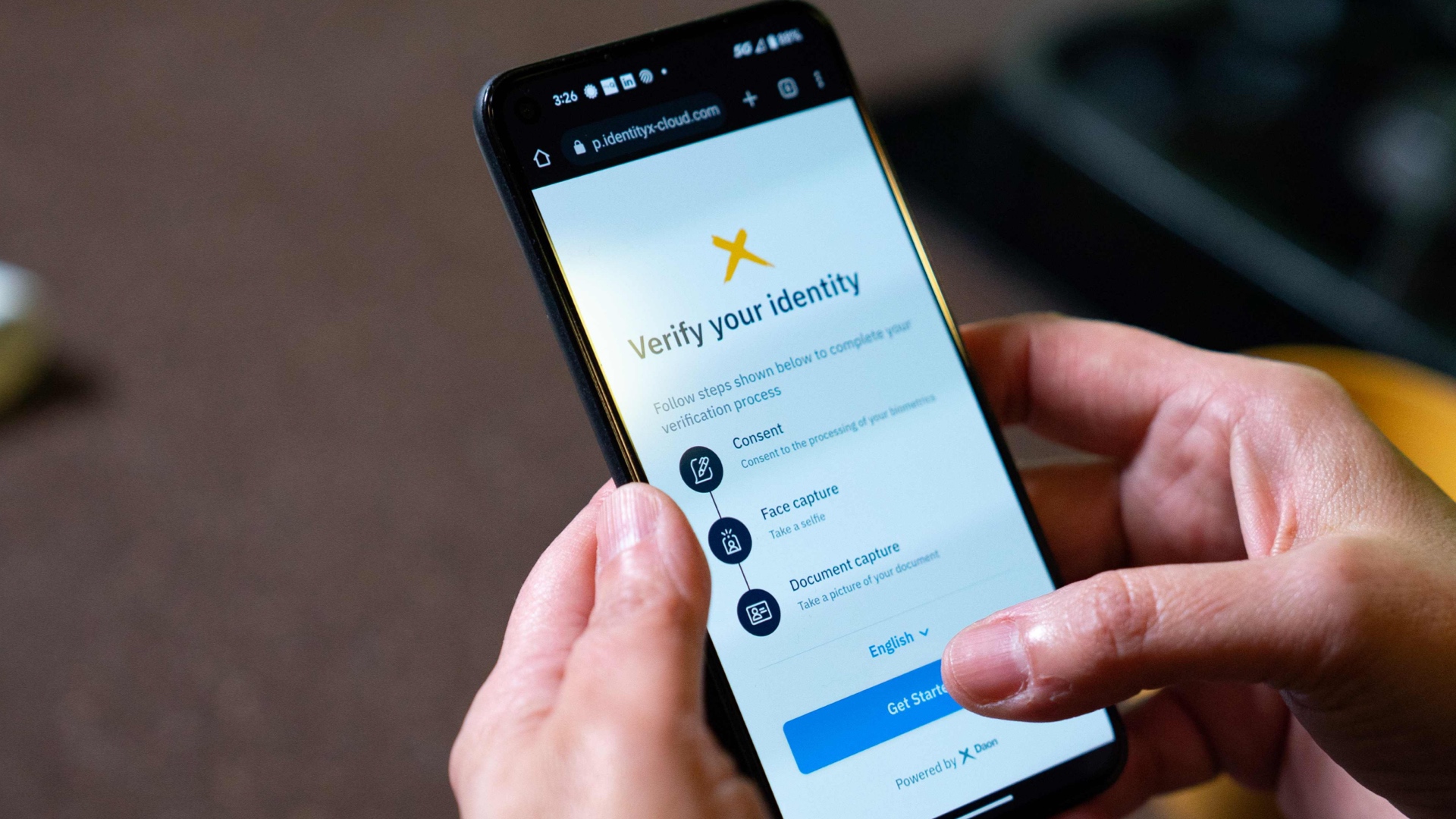

Daon, an Irish identity assurance and biometrics innovator focused on creating certainty in online identification, is another standout Irish fintech company. As identity theft becomes more sophisticated, Daon’s cutting-edge solutions offer a glimpse into a future where secure authentication is the norm rather than the exception.

FINEOS, a group and employee benefits software company, has found its niche in the insurtech space. The firm’s end-to-end SaaS solution simplifies the complexities of the insurance market, further bolstering Ireland as one of Europe’s top insurance markets. Serving 25 million policyholders in 110 countries, Ireland’s insurance sector is a significant contributor to the country’s fintech landscape.

Beyond providing innovative fintech solutions, Irish companies like Teamwork.com are making waves across industries by enhancing day-to-day operations, resource management, future planning and customer communication for large organizations. This diversified approach has positioned Ireland as a hub for comprehensive business solutions.

Supporting global expansion

Ireland’s fintech sector has greatly benefited from the support of the Irish government, and the establishment of the Fintech and Payments Association of Ireland and the nurturing of the venture capital ecosystem have encouraged capital flow into startups.

Through Enterprise Ireland’s €175 million Seed and Venture Capital Scheme (2019–2024), which is now fully allocated, Enterprise Ireland co-invests in venture capital funds to ensure adequate funding in the Irish market for companies to start up and scale. Finch Capital, with offices in Dublin, London and Amsterdam, launched a €150 million fund focused on high-growth fintech startups in Europe, with Ireland as a key market. MiddleGame Ventures, an early backer of Wayflyer, launched a €40 million fintech-focused seed fund. In partnership with Enterprise, MiddleGame Ventures also ran an early stage fintech accelerator, ensuring a strong pipeline of fintech startups in the emerging areas of digital payments, digital banking, regtech and digital assets.

“As a global technology and fintech hub, Ireland is producing top-class innovators who are transforming the world’s financial services industry,” says Dr. Jennifer Carroll MacNeill, Ireland's Minister of State for Financial Services. ”Through continuous investment, international collaboration and talent development, our exciting Irish companies are providing a strong pipeline of fintech exports which are of strategic economic importance to the country. The government, through Enterprise Ireland, is fully supportive of their ambition to further expand their reach into new markets.”

Enterprise Ireland plays a pivotal role in supporting the fintech sector and building its capabilities, funding expansion, innovation, training and employment. Looking ahead, Ireland’s innovative verve is set to propel the industry to new heights. Clancy is optimistic about the future and believes that Irish enterprise is well positioned for continued growth and success.

“Irish companies are renowned for quality, service and innovation. These hallmarks have underscored their success internationally and will continue to do so in 2023 and beyond. Building on their global success and ensuring that Ireland has a strong pipeline of startups and scaling companies, over the medium term, Irish-owned companies will be the prime driver of Ireland’s economy,” says Clancy.

One thing is for sure: In the dynamic landscape of global fintech, Ireland has emerged as a force to be reckoned with.