European Attitudes Toward Sustainable Investing Have Changed

In 2020, Censuswide surveyed 400 professional portfolio builders across the U.K., Italy, Germany and Switzerland to uncover attitudes toward sustainable investing and the role of sustainable indexing.

Sustainable is the new standard

Climate change, wildfires and the Covid-19 pandemic have had an increasing impact on European investors. Climate risk is now widely embraced as an investment risk, and transitioning from traditional investments to sustainable ones is quickly becoming imperative, especially for those investing for the long term.

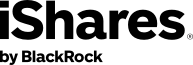

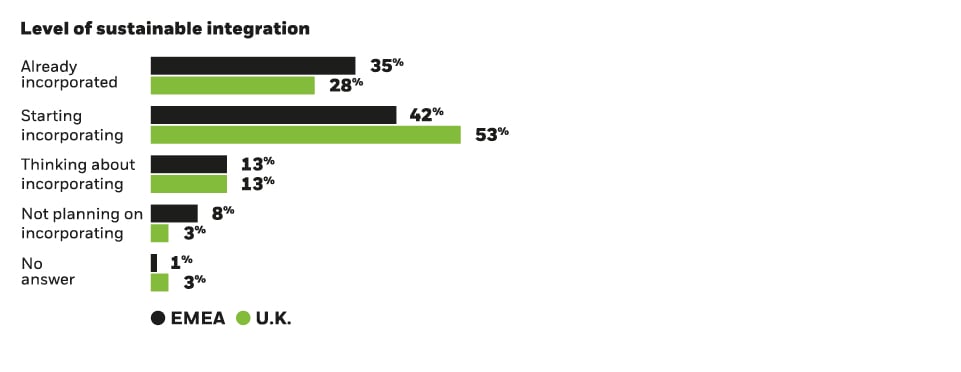

As a result, an unstoppable transition to sustainable investing is now in progress, with 77% of European and 81% of U.K. investors already integrating sustainability into their portfolios.

Many of our clients are under pressure to transition their portfolios to be more sustainable, and this was confirmed in our survey, with 80% of European investors, on average, saying the incorporation of sustainability into their portfolio construction strategies is either urgent or very urgent.

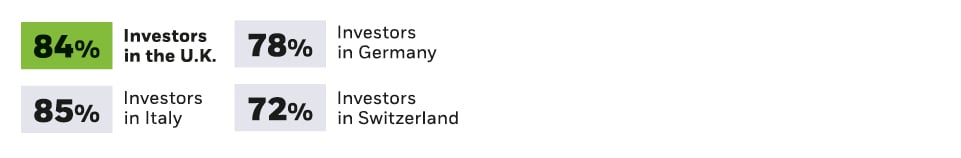

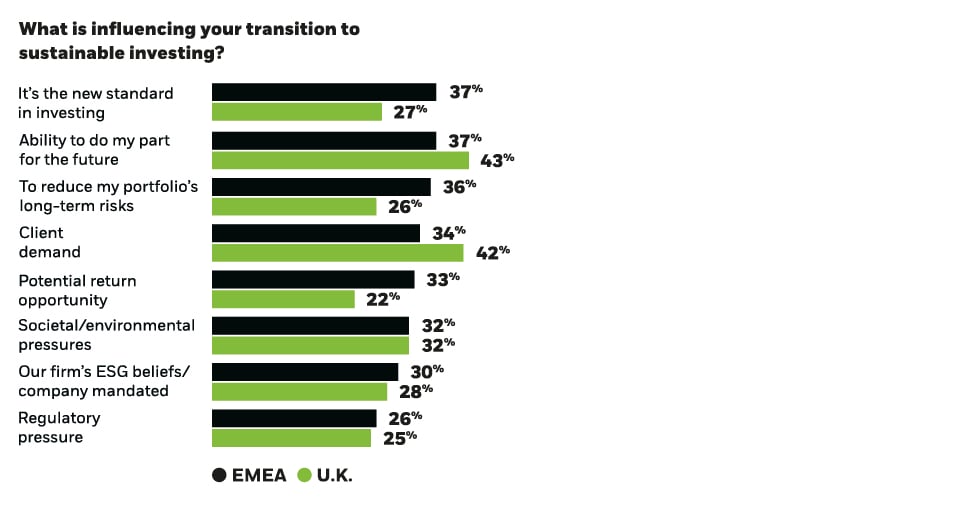

We asked investors what the driving forces are behind this urgency to transition portfolios.

Whether due to ethical considerations, corporate beliefs, client demand or potential return opportunities, sustainable investing is reshaping portfolio models.

Transitioning to sustainable investing is not without its roadblocks. We identified three main challenges professional investors are facing today:

As investors seek more sustainable investment avenues, indexing has naturally come to the forefront, and on average of 80% of the investors surveyed believe indexing is crucial to achieving a more sustainable portfolio.

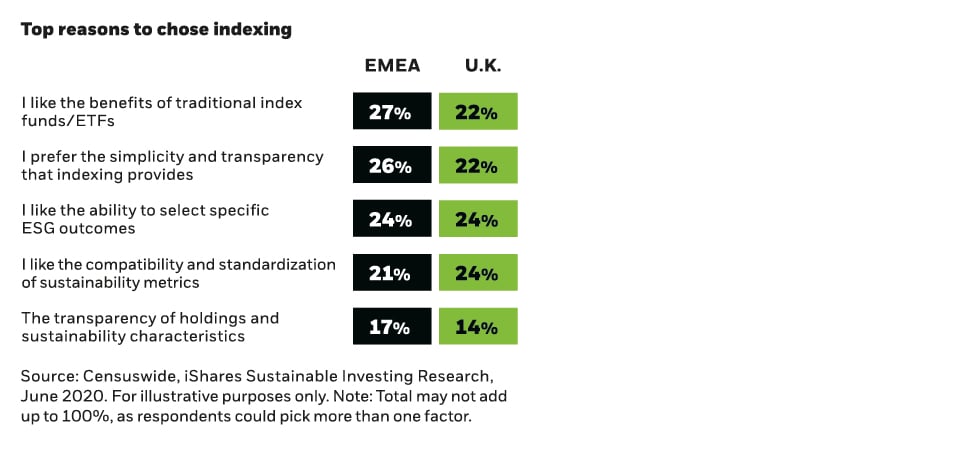

To uncover why investors believe indexing will play such a crucial role, we asked them why they currently choose indexing.

Our research tells us that as investors transition into sustainable investments, navigating the choices, terminology and data interpretations can be challenging. We believe an important reason why so many investors are turning to indexing is because it can help provide the clarity and simplicity investors need to pursue their specific financial and sustainability goals.

The sustainable indexing investment revolution has started.

As European professional investors begin a decade-long reallocation of capital from traditional strategies into sustainable investments, download the full iShares research report and learn the role indexing can play.

Capital at risk. This information should not be relied upon as investment advice, or a recommendation regarding any products, strategies. The environmental, social and governance (“ESG”) considerations discussed herein may affect an investment team’s decision to invest in certain companies or industries from time to time. Results may differ from portfolios that do not apply similar ESG considerations to their investment process.

**********************

FOR PROFESSIONAL CLIENTS AND QUALIFIED INVESTORS ONLY

Source: Censuswide, iShares Sustainable Investing Research, June 2020. For illustrative purposes only. Note: Total may not add up to 100%, as respondents could pick more than one factor.