From Simple Index Tracking to Precise Exposures: The Evolution of Bond ETFs

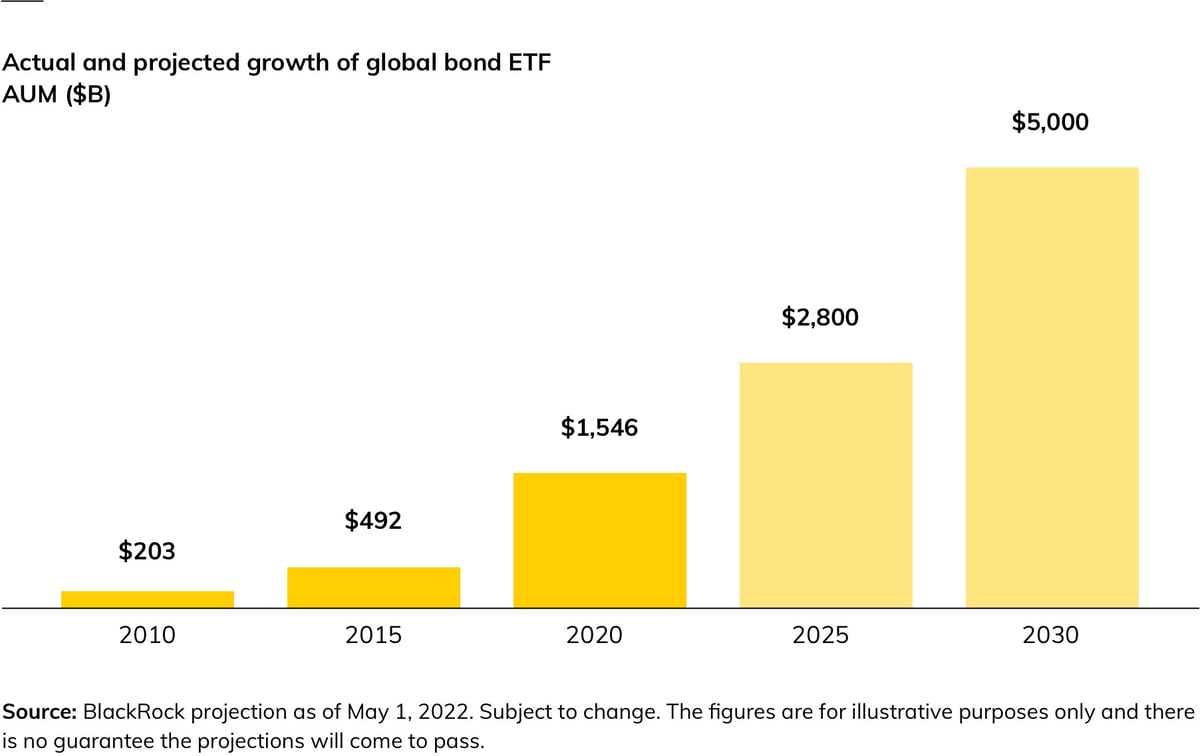

As fixed income ETFs turn 20 years old, here are the trends that could propel their global AUM to $5 trillion by 2030

Twenty years ago, computerized stock trading was reshaping the unseen market plumbing that connects buyers with sellers. Pit-style trading floors were going digital and global stock exchanges were becoming electronic. These advances delivered convenience and efficiency to equity investing.

The pace of change was slower in fixed income markets. Back then, individuals often had no way to get real-time price quotes for thousands of bonds. Big investors typically phoned bond dealers, hoped for inventory on hand, then negotiated terms. Buying or selling could be cumbersome and opaque.

Then, in the summer of 2002, iShares launched the first U.S.-domiciled fixed income ETFs, innovations that went on to break down barriers to fixed income investing. Bond ETFs connected the fragmented fixed income markets with transparent and liquid on-exchange trading, creating a new class of building blocks for assembling fixed income portfolios. For the first time, investors could buy a portfolio of bonds with the click of a button.

It was a point of no return. A movement that started with four iShares fixed income ETFs has grown into an industry with $1.7 trillion in assets under management (AUM). Now, according to iShares, the global fixed income ETF industry is poised to reach $2 trillion in 2023 and projected to reach $5 trillion by the end of 2030.

The acceleration in ETF adoption is being fueled by these powerful trends that broaden and deepen their usage.

Tools for seeking active returns

The world’s largest institutional investors became among the fastest-growing adopters of fixed income ETFs based on the resilience and liquidity the products demonstrated in the early days of the pandemic. According to the “2022 Global ETF Investor Survey” conducted by Brown Brothers Harriman in March 2022, 65% of institutions globally have allocated more than 30% of their portfolio to fixed income ETFs, which offer transparency, liquidity, efficiency and increasingly granular access to a variety of fixed income exposures.

According to a BlackRock analysis of SEC 13-F filings for the US, the 10 largest global asset managers all use fixed income ETFs, and many have found new ways to use them. Active managers who historically built portfolios exclusively with individual bonds are using fixed income ETFs as tools for liquidity management, portfolio efficiency and potential portfolio-level alpha generation. Managers are also increasingly using fixed income ETFs as risk management alternatives to futures or swaps, as cash and liquidity management instruments and as tools for large-scale portfolio transitions.

“Traditionally we used individual bonds to express our tactical views,” says James Keenan, BlackRock’s Chief Investment Officer and Global Head of Credit. “Today, we increasingly use ETFs as liquidity solutions in our portfolios alongside bonds, futures and other investment vehicles.”

Catalysts for modernizing bond markets

The growth of fixed income ETFs has helped drive advances in electronic trading and algorithmic pricing of individual bonds, which together have helped improve transparency and liquidity in underlying bond markets.

These advances are creating a virtuous cycle that enables more primary and secondary ETF market transactions and expands the number of individual bonds that can be priced and traded daily. The pandemic only quickened the pace of ETF-driven market modernization.

The new architecture increasingly pivots around trading baskets of bonds, particularly high yield and investment grade holdings in liquid ETFs. Electronic trading and sophisticated pricing allow broker-dealers to simultaneously buy or sell large numbers of individual bonds through so-called portfolio trades. This basket-centered marketplace favors even greater acceleration of fixed income ETF adoption since a growing number of fixed income transactions either directly or indirectly involve fixed income ETFs for sourcing or hedging risk.

Increasingly precise source of potential returns

Newer fixed income ETFs are slicing the fixed income marketplace into ever more granular exposures that can be blended into highly customizable portfolios. Many strategies featured in newer fixed income ETFs were previously available only to larger investors at high cost and great difficulty, if at all.

The first fixed income ETFs largely delivered broad, index- tracking exposure to entire markets or asset classes. Newer fixed income ETFs break down asset classes into more precise exposures across credit, sectors, durations, sustainability and other risk factors. This increasing granularity allows investors to redefine their desired market exposure.

The next-generation precision fixed income ETFs will finally allow investors to think of portfolios not as lists of bonds, but as collections of risk that can be disaggregated and reassembled based on evolving market conditions, investment objectives, and risk preferences.

The path to $5 trillion

Over 20 years, bond ETFs have become fundamental to fixed income investing. Their growth persists even in the face of challenging macroeconomic conditions. In fact, iShares believes the challenges associated with high inflation and rising interest rates will attract even more first-time ETF investors and prompt existing ones to find new ways to use these versatile investment tools.

Last year, fixed income ETFs accounted for just 2% of the $124 trillion global fixed income marketplace, up from about 0.3% of global assets 10 years ago.1 However, iShares expects the size of the global fixed income ETF industry to nearly triple and reach $5 trillion by the end of this decade. At $5 trillion in AUM, fixed income ETF penetration would still amount only to around 5% of the global fixed income market – less than half ETFs’ share of global equities.2

With so much market share available, the future looks bright for the growth of fixed income ETFs.

1 Current global bond market size: Bank of International Settlements, Securities Industry and Financial Markets Association estimates found in 2021 SIFMA Capital Markets Fact Book, July 28, 2021; See also: BlackRock, “Transforming the Bond Markets with Fixed Income ETFs,” July 2021.

2 Bloomberg (as of March 31, 2022) for stocks. Market capitalization of the Russell 3000 Index, STOXX Europe 600 Index, and MSCI Asia Pacific All Country Index equals $74.6 trillion; Markit, BlackRock for ETFs (as of March 31, 2022). AUM for U.S., European, and Asia-Pacific equity ETFs market was $7.6 trillion.

DISCLOSURE:

Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses which may be obtained by visiting www.iShares.com or www.blackrock.com. Read the prospectus carefully before investing.

Investing involves risk, including possible loss of principal.

Fixed income risks include interest-rate and credit risk. Typically, when interest rates rise, there is a corresponding decline in bond values. Credit risk refers to the possibility that the bond issuer will not be able to make principal and interest payments.

Non-investment-grade debt securities (high-yield/junk bonds) may be subject to greater market fluctuations, risk of default or loss of income and principal than higher-rated securities.

Funds that concentrate investments in specific industries, sectors, markets or asset classes may underperform or be more volatile than other industries, sectors, markets or asset classes and the general securities market.

This information should not be relied upon as research, investment advice, or a recommendation regarding any products, strategies, or any security in particular. This material is strictly for illustrative, educational, or informational purposes and is subject to change.

Buying and selling shares of ETFs may result in brokerage commissions.

Shares of ETFs may be bought and sold throughout the day on the exchange through any brokerage account. Shares are not individually redeemable from an ETF, however, shares may be redeemed directly from an ETF by Authorized Participants, in very large creation/redemption units.

There can be no assurance that an active trading market for shares of an ETF will develop or be maintained.

This material represents an assessment of the market environment as of the date indicated; is subject to change; and is not intended to be a forecast of future events or a guarantee of future results. This information should not be relied upon by the reader as research or investment advice regarding the funds or any issuer or security in particular.

Prepared by BlackRock Investments, LLC, member FINRA.

©2022 BlackRock, Inc. All rights reserved. iSHARES and BLACKROCK are trademarks of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners .

iCRMH1022U/S-2553540