Positioning for Inflation: The Historical Outperformance of Value Stocks

In a world with higher rates, now could be the time to favor value stocks and quality companies

Inflation is a constant in our post-COVID world, and it likely isn’t going anywhere. Looking beyond 2022, above trend inflation should persist given restart dynamics, persistent supply chain challenges, strength in shelter inflation and a savings- and wage-rich consumer.

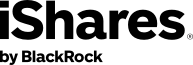

Traditionally, real assets such as commodities have been a popular way to hedge inflation. It’s easy to see why, as their correlation with rising inflation has historically been high.

Source: Morningstar. As of December 31, 2021. Commodities: S&P GSCI Commodities Index; U.S. Stocks: S&P 500 Index; U.S. bonds: U.S. Aggregate Bond Index.

In times of inflation, it may be important for investors to consider being more selective within their equities. Value stocks are a great place to start, as they may fare well in an environment characterized by higher inflation, higher rates, and a continued economic reopening. Additionally, quality stocks may be a natural ballast to value, especially during inflationary periods where strong pricing power and balance sheets may be prudent. Value and quality factor ETFs, like iShares MSCI USA Value Factor ETF (VLUE) and iShares MSCI USA Quality Factor ETF (QUAL), make it easy to shift equity allocations to potentially take advantage of these trends and this inflationary period.

Factoring in inflation

Rising inflation has often coincided with higher discount rates, which is what we have seen in the current market environment. Put simply, this means that money today is worth more than it will be in the future, creating opportunity for investors to position their portfolios accordingly.

When we apply this thinking to the value vs. growth framework, both data and economic intuition suggest value may be the better hedge for inflation.1 High inflation reduces the value of growth companies’ future cash flows, and has instead typically favored value firms whose profitability is based more in the present.

Value stocks from companies with strong pricing power may be better positioned to combat rising costs and beat earnings expectations. Pricing power and asset-light operations are key components of stock price success during inflationary periods.

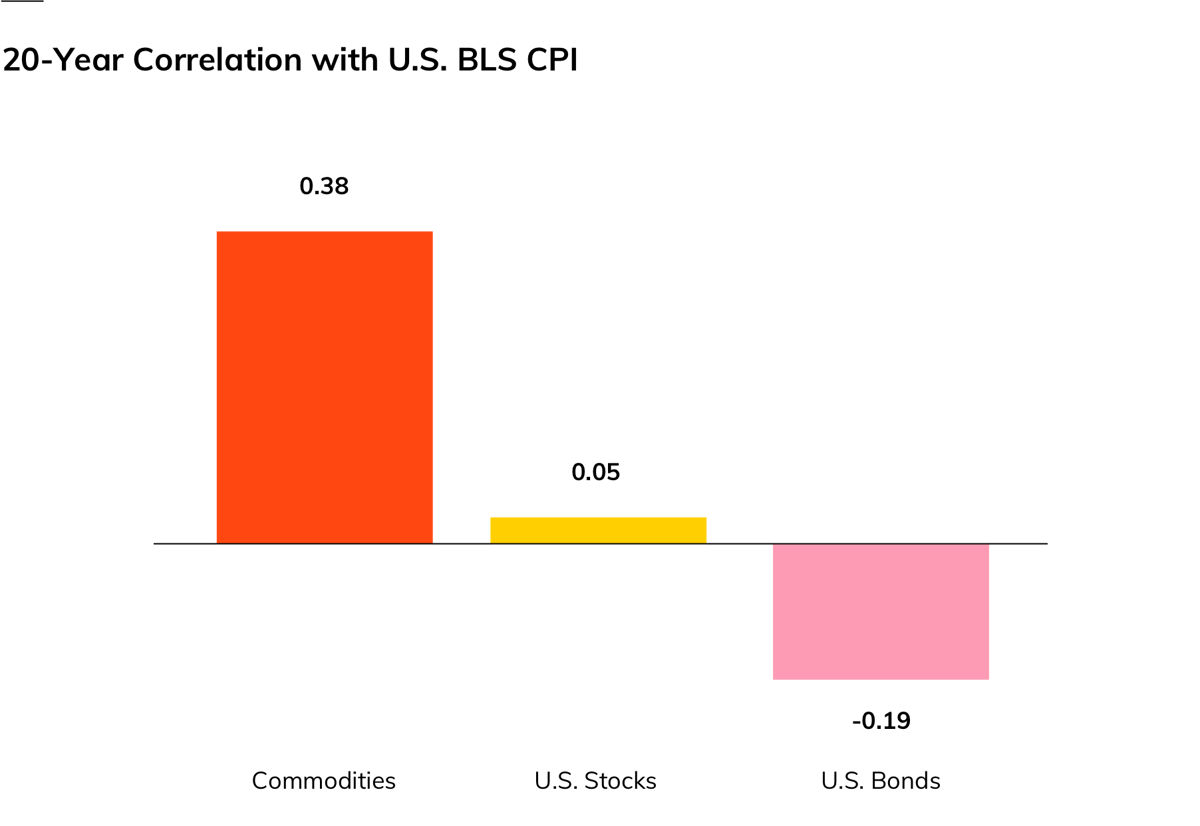

Value stocks have historically fared well in an environment characterized by higher inflation, a steeper yield curve and consumer-powered economic reopening. Looking at almost a century of data, value has outperformed growth meaningfully in periods of higher inflation. It is only when inflation was very low that value performance paled.

While rising inflation can be a source of market angst, a BlackRock review of available data back to the 1920s finds that stocks generally perform well as long as inflation isn’t out of control (over 10%),” says Tony DeSpirito, CIO of Fundamental US Equities. “Value stocks, in particular, have historically outperformed growth stocks during periods of middling and high inflation.”

The level of annual inflation is defined as the year-over-year change in the Consumer Price Index (CPI). “Lowest inflation” represents the bottom 20 years of inflation readings; “highest inflation” represents the top 20 years; and “middling inflation” represents the remainder.

Themes of economic reopening have also been a catalyst for value stocks, which may continue as the world returns to normal.

Source: BlackRock, with data from the Kenneth R. French Data Library and from Robert J. Shiller. Fama/French data uses the CRSP universe, which includes all companies incorporated in the U.S. and listed on the NYSE, AMEX or NASDAQ exchanges. The level of annual inflation is defined as the year-over-year change in the Consumer Price Index (CPI). Value outperformance is annualized and calculated across various inflation regimes using annual data from 1927 to 2020. Value outperformance represents the performance of value stocks minus growth stocks, as defined by the Fama/French HML research factor (i.e., “high valuation minus low valuation” using book to price). Past performance does not guarantee future results.

Quality companies as portfolio ballast

While value provides an attractive way to possibly combat inflation and take advantage of the continued economic reopening, there is still so much uncertainty in our post-COVID world. This slow-growth environment may also call for a value ballast through quality, blue-chip companies.

A quality, blue-chip ballast to value may be better positioned than a traditional growth ballast. Profitable blue-chips with stable earnings and low debt may be better positioned in an uncertain world of slowing growth.

Quality firms also have the opportunity to absorb higher input costs associated with inflation, leveraging their pricing power to retain or increase market share. Subsectors with pricing power, such as semiconductors, may also offer resilience during high inflation. The iShares MSCI USA Quality Factor ETF (QUAL), is currently overweight semiconductors by 2.5% vs. the S&P 500.2

Building a portfolio for today’s market

BlackRock model portfolios, such as the Target Allocation ETF Model, take a long-term view but seek to adapt to current market conditions. Michael Gates, BlackRock’s Head of Model Portfolio Solutions, has said that in order “to compensate for the uncertainty associated with the beginning of the Fed’s tightening cycle, we scale down some sector bets and lean a bit more into quality.”

Higher inflation and interest rates may benefit value, which has historically outperformed growth in such environments. Especially during inflationary periods where strong pricing power and balance sheets may be prudent, quality blue-chip companies with strong pricing power may act as a better ballast to value securities than traditional growth.

With higher inflation, higher rates and slowing growth, it may be time to consider value and quality.

1 Source: BlackRock with data from Kenneth R.FrenchData Library and Robert J. Shiller. http://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html . Data from 7/1926 to 10/2021. Data uses the CRSP universe which includes all companies incorporated in the U.S. and listed on the NYSE, AMEX or NASDAQ exchanges. Inflation determined by using YoY changes in CPI and breaking into quintiles. “Value outperformance” represents performance of value stocks minus growth stocks as defined by the Fama and French HML research factor (high book to price minus low book to price). Past performance does not guarantee future results.

2 Source: Morningstar as of 12/31/2021. Holdings subject to change.

Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses which may be obtained by visiting www.iShares.com or www.blackrock.com. Read the prospectus carefully before investing.

Investing involves risk, including possible loss of principal. This information should not be relied upon as investment advice, research, or a recommendation by BlackRock regarding (i) the funds, (ii) the use or suitability of the model portfolios or (iii) any security in particular. Only an investor and their financial professional know enough about their circumstances to make an investment decision.

There can be no assurance that performance will be enhanced or risk will be reduced for funds that seek to provide exposure to certain quantitative investment characteristics ("factors"). Exposure to such investment factors may detract from performance in some market environments, perhaps for extended periods. In such circumstances, a fund may seek to maintain exposure to the targeted investment factors and not adjust to target different factors, which could result in losses.

The BlackRock model portfolios are made available to financial professionals by BlackRock Fund Advisors (“BFA”) or BlackRock Investment Management, LLC (“BIM”), which are registered investment advisers, or by BlackRock Investments, LLC (“BRIL”), which is the distributor of the BlackRock and iShares funds within the BlackRock model portfolios. BFA, BIM and BRIL (collectively, “BlackRock”) are affiliates. The BlackRock model portfolios are provided for illustrative and educational purposes only. The BlackRock model portfolios do not constitute research, are not personalized investment advice or an investment recommendation from BlackRock to any client of a third party financial professional, and are intended for use only by a third party financial professional, with other information, as a resource to help build a portfolio or as an input in the development of investment advice for its own clients. The BlackRock model portfolios themselves are not funds.

BlackRock intends to allocate all or a significant percentage of the BlackRock model portfolios to funds for which it and/or its affiliates serve as investment manager and/or are compensated for services provided to the funds ("BlackRock Affiliated Funds"). Clients will indirectly bear fund expenses relating to assets allocated to funds, including BlackRock Affiliated Funds. BlackRock has an incentive to (a) select BlackRock Affiliated Funds and (b) select BlackRock Affiliated Funds with higher fees over BlackRock Affiliated Funds with lower fees.

Diversification and asset allocation may not protect against market risk or loss of principal.

No proprietary technology or asset allocation model is a guarantee against loss of principal. There can be no assurance that an investment strategy based on the tools will be successful.

This information should not be relied upon as research, investment advice, or a recommendation regarding any products, strategies, or any security in particular. This material is strictly for illustrative, educational, or informational purposes and is subject to change.

This material represents an assessment of the market environment as of the date indicated; is subject to change; and is not intended to be a forecast of future events or a guarantee of future results. This information should not be relied upon by the reader as research or investment advice regarding the funds or any issuer or security in particular. The strategies discussed are strictly for illustrative and educational purposes and are not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. There is no guarantee that any strategies discussed will be effective.

The iShares and BlackRock Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”).

The iShares Funds are not sponsored, endorsed, issued, sold or promoted by MSCI Inc., nor does this company make any representation regarding the advisability of investing in the Funds. BlackRock is not affiliated with MSCI Inc.

©2022 BlackRock, Inc. All rights reserved. iSHARES and BLACKROCK are trademarks of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners .

iCRMH1122U/S-2451437