The Importance of Rethinking Your Volatility Toolkit

In periods of market uncertainty, investors can seek to add resilience to their portfolios through Factor ETFs, specifically leaning into quality and minimum volatility strategies

The Federal Reserve’s September decision to hold steady on benchmark interest rates comes with important caveats. Twelve of 19 officials favor another rate hike later in the year, and new economic projections make it likely that borrowing costs will stay higher for longer in 2024. The result is a continued lack of clarity in the market.

In response to rising uncertainty, investors may be tempted to reduce their equity exposure, seeking the relative safety of high-quality fixed income or cash. However, there are ways that investors can maintain their long-term equity allocations while aiming to add resilience to their portfolios with quality and minimum volatility strategies. Advisors can easily incorporate quality and min vol factors into their clients’ portfolios with ETFs, such as QUAL and USMV.

“We believe time in the market is ultimately more important than trying to time the market,” says Robert Hum, BlackRock’s US Head of Factor ETFs. “Using quality and min vol may help keep investors invested in today’s uncertain markets.”1

The Case for Quality

In anticipation of periods of economic slowdown, bond investors may move into higher quality companies, reasoning that they may hold up better in a market downturn. Equity investors can follow the lead of their fixed income counterparts, adding exposure to higher quality stocks in an attempt to add resilience to their portfolios.

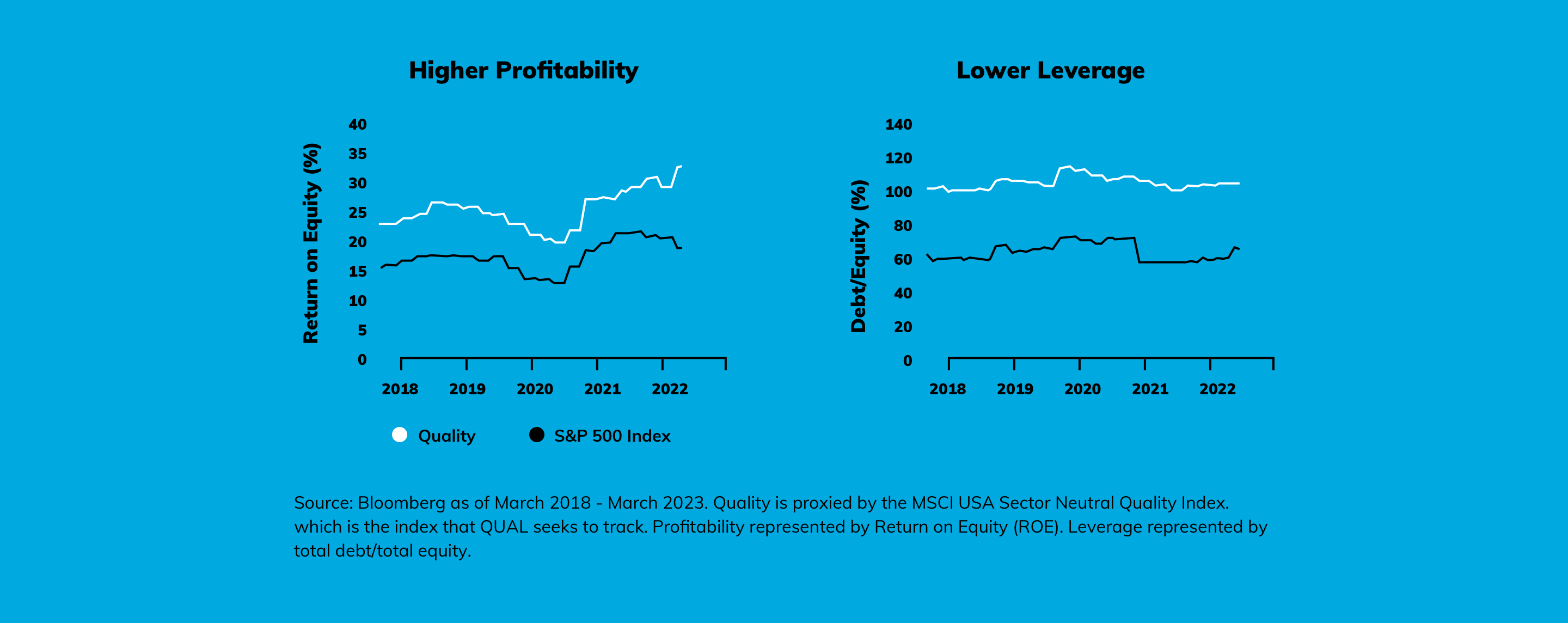

The MSCI USA Sector Neutral Quality Index, the index that iShares MSCI USA Quality Factor ETF (QUAL) seeks to track, takes a multiple metric approach to defining quality that considers how profitable a company is, how much leverage they use and how stable their earnings are over time:

- Focus on profitability: Target firms with high return on equity, which may act as a cushion should the economy start to slow.

- Avoid excessive leverage: Leverage can be an effective tool to fuel growth, but excessive amounts can represent a burden if the economy slows.

- Earnings consistency matters: A preference for firms with a history of consistent and predictable earnings in good or bad economic conditions.

Once higher quality companies have been identified, an advisor can build a portfolio for their clients that provides strong exposure to the quality factor. The MSCI USA Sector Neutral Quality Index targets the 30% of the market that scores highest across three quality metrics. It takes a sector neutral approach and is designed to avoid persistent bets that may result from targeting profitability (e.g., overweight technology) and leverage (e.g., underweight financials). Additionally, it is selective within industries.

The iShares MSCI USA Quality Factor ETF (QUAL) seeks to deliver deep exposure to high quality companies in a sector neutral framework, which may be appropriate for investors looking to add potential resilience to their equity portfolios while maintaining a return focus.

The Case for Minimum Volatility

Advisors seeking a more defensive exposure for their clients may consider a minimum volatility portfolio, which seeks to deliver equity exposure but with less volatility than the broad market.

BlackRock believes risk is more than volatility, and that risk reduction should be a consideration for the core of a portfolio. The MSCI USA Minimum Volatility Index, the index iShares MSCI USA Min Vol Factor ETF (USMV) seeks to track, takes a holistic view when considering risk:

- A sophisticated risk lens: Evaluate a stock’s risk based on exposures across a set of macro and style factors as well as stock-specific risk.

- Manage risk at the portfolio level: Consider both volatility and correlations to identify low-risk, and potentially diversifying, stocks.

- Limit sector bets: 5% caps on active sector weights help the index manage other sources of risk and serve a role as a core position.

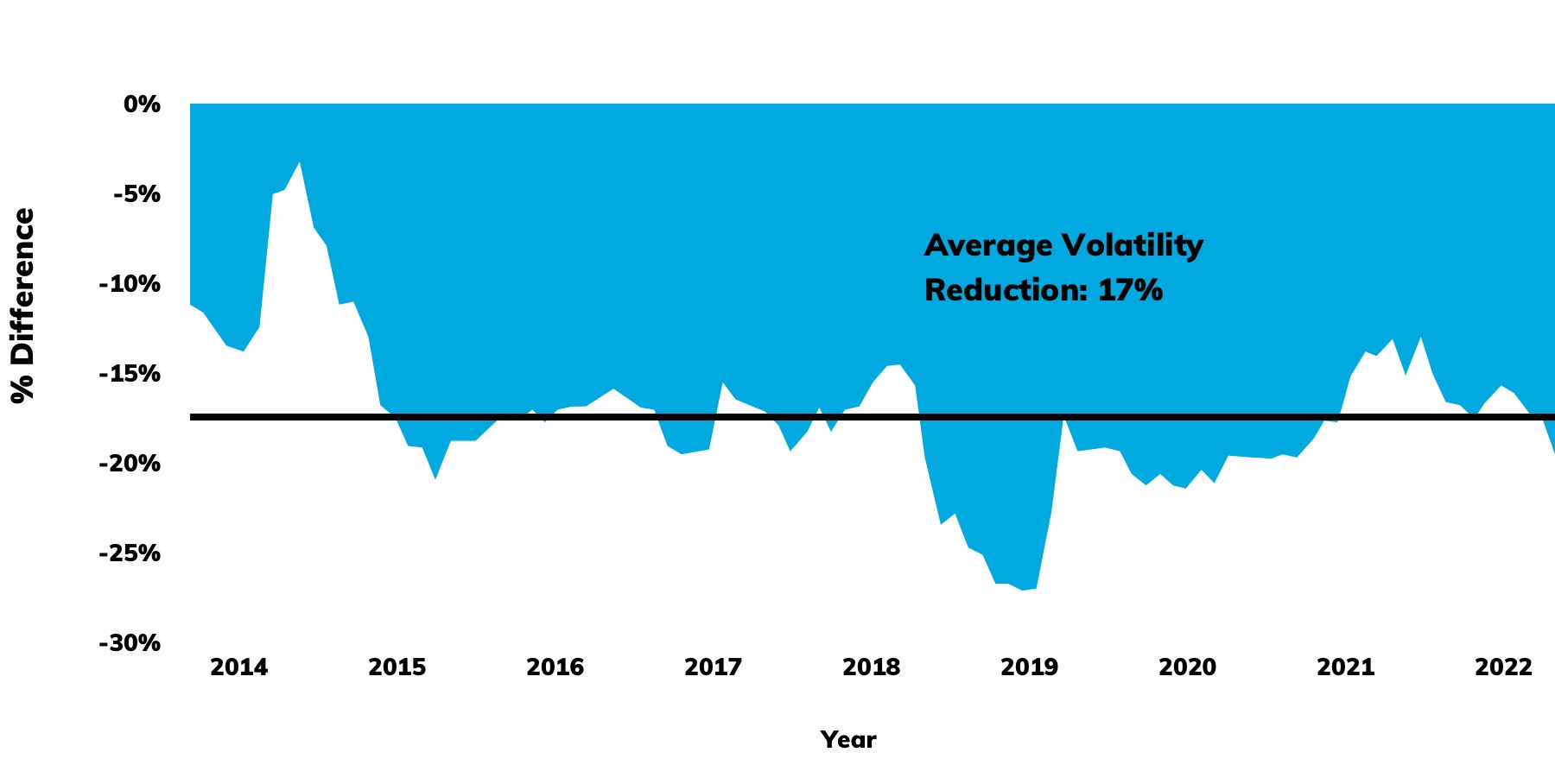

- Core equity exposure with less volatility: The MSCI USA Minimum Volatility Index has delivered roughly 17% less volatility on average than the S&P 500 index since the start of 2014.

Volatility chart2

Advisors seeking to maintain long-term equity allocations while managing their clients’ portfolios may want to consider the iShares MSCI USA Min Vol Factor ETF (USMV), which seeks to deliver exposure to the US large and mid-cap equity market with less volatility.

Building Resilience

The year has been a rollercoaster so far. We entered 2023 with central banks expected to keep interest rates higher for longer as they looked to tame elevated inflation. Recently, cracks began to form across the financial sector, raising concerns that decreased lending could lead to a further slowdown in the economy.

Facing potentially slower growth and increased interest rate volatility, many investors are looking for ways to navigate rising uncertainty. Quality and minimum volatility exposures have tended to outperform3 during the slowdown and contractionary part of the economic cycle, potentially adding resilience to portfolios should we see continued market weakness. Regardless of outlook, the iShares suite of factor ETFs provides a set of tools investors can use to navigate uncertain markets.

To learn more, please visit ishares.com

1 BlackRock, Rethink your volatility toolkit, May 2023

2 Source: Morningstar Direct, 2014-2022. Compares the S&P 500 index to the MSCI USA Minimum Volatility Index, which is the index that USMV seeks to track. Volatility calculated using standard deviation over rolling 3-year periods.

Standard deviation measures how dispersed returns are around the average. A higher standard deviation indicates that returns are spread out over a larger range of values and thus, more volatile. Index performance is for illustrative purposes only. Index performance does not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results. Index performance does not represent actual Fund performance. For actual fund performance, please visit www.iShares.com or www.blackrock.com.

3 BlackRock, Quality Time, June 2023

Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses which may be obtained by visiting www.iShares.com or www.blackrock.com. Read the prospectus carefully before investing.

Investing involves risk, including possible loss of principal.

There can be no assurance that performance will be enhanced or risk will be reduced for funds that seek to provide exposure to certain quantitative investment characteristics ("factors"). Exposure to such investment factors may detract from performance in some market environments, perhaps for extended periods. In such circumstances, a fund may seek to maintain exposure to the targeted investment factors and not adjust to target different factors, which could result in losses.

The iShares Minimum Volatility Funds may experience more than minimum volatility as there is no guarantee that the underlying index's strategy of seeking to lower volatility will be successful. Diversification and asset allocation may not protect against market risk or loss of principal. Buying and selling shares of ETFs may result in brokerage commissions.

This information should not be relied upon as research, investment advice, or a recommendation regarding any products, strategies, or any security in particular. This material is strictly for illustrative, educational, or informational purposes and is subject to change.

The iShares and BlackRock Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”).

The iShares Funds are not sponsored, endorsed, issued, sold or promoted by MSCI Inc., nor does this company make any representation regarding the advisability of investing in the Funds. BlackRock is not affiliated with MSCI Inc.

© 2023 BlackRock, Inc. or its affiliates. All Rights Reserved. BLACKROCK and iSHARES are trademarks of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

This is co-sponsored by BlackRock iSHARES and by MSCI Inc.

Although they may utilize MSCI products or services, none of the financial products or services of BlackRock, Inc. or its affiliates, including the [funds/accounts/products/securities] referred to herein, are sponsored, endorsed or promoted by MSCI Inc. or its affiliates. MSCI bears no liability with respect to any such BlackRock products or services or any index on which they are based. The applicable prospectuses contain a more detailed description of MSCI’s limited commercial relationship with BlackRock or its affiliates and any related products or services.

iCRMH1023U/S-3002995