The Flexspace Revolution

Adding value to real estate portfolios in the era of hybrid work

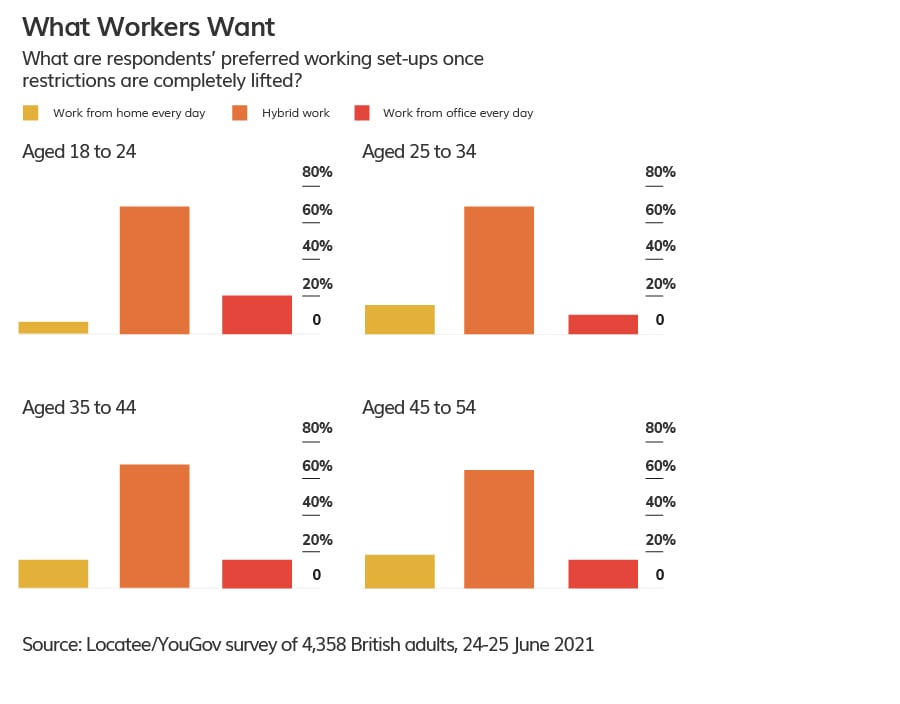

From New York to Berlin, Seoul to Paris, the way we work has fundamentally changed—and for those who’ve been working from home since March 2020, a full-time return to the office holds limited allure. Citing a desire for a better work-life balance as a key motivation, more than two-thirds of U.K. workers want to adopt a hybrid approach to their own office attendance, working from home some days and from the office on others.

Before the pandemic, the average time for a daily round-trip commute in Tokyo was 102 minutes, according to the Japanese research institute NHK. But as office workers emerge from 18 months of working from home, they have a lower tolerance for lengthy commutes that drain their time, energy and money.

“The pandemic has certainly had a dramatic and permanent effect, but it’s merely accelerated a trend that’s been under-way for several years, as organizations progressively move to a ‘hybrid’ way of working: at home, at a local office and occasionally at a corporate HQ,” explains Mark Dixon, founder and CEO of the International Workplace Group (IWG).

“Herding people to the office is looking increasingly obsolete, expensive and inconvenient,” he says. “In some cases, data saved in the cloud isn’t even in the same country as the staff accessing it. So why should workers go to the effort and expense of dragging themselves into work to spend the day working on a device that they have brought with them, and will return home with at the end of the day?”

Increased employee demand for flexible working, coupled with a focus on costs, has led to major global companies permanently adopting hybrid work models. Google recently approved 85% of its staff’s requests to work remotely or relocate once offices fully reopen, while financial institutions such as HSBC have announced plans to cut office space globally.

An analysis commissioned by IWG brand Regus and conducted by independent economists concluded that flexible working could contribute $10.04 trillion to the global economy by 2030, thanks to cost savings for businesses and increased productivity.

A focus on local

As the global leader in flexible office real estate for more than 30 years, IWG plc is well-placed to anticipate what happens next as the flexspace revolution unfolds. Known for its Regus, Spaces, HQ and No.18 brands, among others, IWG offers a sustainable, turnkey model to enable investors, landlords, entrepreneurs and brokers to capitalize on the flexspace revolution—and it’s looking to expand. Its experts predict that the hub-and-spoke model of office working will grow in popularity, with central headquarters (“hubs”) hosting occasional collaborations and most staff working from locations (“spokes”) closer to home the rest of the time.

“I believe that over the next three to five years, we will see more and more companies make the property choices that so many of our clients have already made,” Dixon says.

The hub-and-spoke model rings true for Professor Leigh Sparks, a retail expert at Scotland’s University of Stirling, who attributes its growth to pandemic-related lockdowns that forced many people to travel less and live more locally.

“We’re seeing more of this idea of the 20-minute neighborhood, where the things you need—to live, to work or to play—are within a reasonable distance, and you can get there by active travel, as opposed to having to commute,” he says. “There could be some radical shifts in behavior patterns. Localization of workspaces makes all sorts of sense from a personal point of view and from an environmental point of view, as well.”

The challenge for property owners

Naturally, the knock-on effects of all these changes for commercial property owners could be significant. Traditional lease terms are trending downward as landlords confront the impact of flexible working on their portfolios.

Jeffrey Langbaum, Senior REIT Analyst for Bloomberg Intelligence, is seeing a reduction in lease terms in the New York City market, as well as anecdotal evidence of the reduced square-footage requirements of tenants.

“Where there’s a real shift is on the pricing side, because it’s a tenant-friendly market at the moment,” he says. “Now, tenants have a little bit more of the power in negotiations. And that’s flowing through in terms of the rent, or the cost that landlords need to contribute to build out space requirements.”

As they adapt to the “new normal” of office work, some real estate owners are transforming their portfolios and diversifying their offerings to meet the needs of today’s hybrid workforce—and capitalize on the growing corporate appetite for flexspace.

Despite the obvious challenges that the rise of flexspace presents for commercial landlords, there are also potential benefits, including a reduction of tenancy void periods by retaining existing tenants and attracting new ones using a mix of short-, medium- and long-term contracts.

“This is a world away from a traditional long-term lease and the traditional landlord-tenant dynamic,” says Thomas Sinclair, IWG’s Group CIO and Global Head of Network Development. “There’s a huge amount of value added in the flex system compared with what people have been used to providing and what they have been used to receiving in the past. Flexspace diversifies your portfolio and allows you to immediately plug into the biggest and fastest-growing source of demand, ensuring you are positioned for where—without a shadow of a doubt—the market is heading.”

Filling retail space

Retail is one sector where commercial landlords see flexspace as a clear opportunity to add value to their portfolios. As digitalization pushes shopping online, and as people increasingly aspire to live more localized lives, larger retail spaces in city centers could be left vacant.

“If we look at department stores that have now closed down, we see that some of that real estate has been repurposed as office space, some has been repurposed as leisure spaces like gyms and some of it will still be smaller retail space,” says Sparks. “That mix is going to be much more important in the future.”

It’s precisely this mix that Todd Zapolski, who has owned real estate in California’s Bay Area and Napa Valley for more than 20 years, is trying to cultivate in his own portfolio. Partway through developing his recent project, First Street Napa, Zapolski decided to reimagine its second floor—originally destined to be a department store—as a suite of workspaces, including a 4,000-square-foot coworking venue.

The result is an innovative mixed-use development that brings together stores, restaurants, a boutique hotel, a rooftop bar and flexible working space franchised through the IWG brand Spaces. Offering private workspaces, 24/7 access, meeting rooms and adjustable furniture, the highly adaptable Spaces Napa Valley opened earlier this year—and Zapolski quickly noticed how the shift to hybrid work is bringing people into his coworking offices.

“There are a lot of what I call ‘half-backs’—people who realize they don’t need to be in the office the whole time, who have worked from home and thought it was pretty cool, but now want to get into an office environment, with some flexibility,” he says.

Delivering sustainable returns

For real estate owners like Zapolski, the appeal of IWG is its longevity and experience. As the global leader in flexible workspace, the company is also trusted by landlords because of its robust, turnkey operating model.

“Flexspace is a business you need to run at scale,” says Sinclair. “It’s expensive to set up, it’s expensive to run and it is not easy to operate. You need to go with the most experienced, the biggest and the best.”

Across thousands of locations worldwide, IWG offers its franchise partners practical advice on opening new centers in the best locations, finding the right premises and structuring floor plans to maximize revenue, as well as business development support to ensure that investments are performing at optimum levels of return. Franchise partners are also able to leverage the name recognition and established sales and marketing channels of IWG brands including Regus, Spaces No.18 and HQ.

This year alone, more than 2 million users have joined IWG’s network, bringing its total customer base to 7 million and representing the largest increase in the company's 30-year history. As part of this network, multinational corporations like Google, Amazon and IBM minimize their exposure and risk as the world of work changes, while their employees enjoy greater flexibility in their working lives, along with the associated reductions in commuting time and costs.

In January 2021, London-based banking and financial services giant Standard Chartered signed a global deal with IWG enabling its 95,000 employees to access more than 3,500 IWG offices across the world. The deal is part of the organization’s effort to increase flexibility for its staff, giving them the opportunity to work in well-equipped offices in locations closer to where they live.

Speaking about the deal, Andy Halford, Standard Chartered’s Chief Financial Officer, said at the time: “We hope this partnership will provide suitable alternatives to working from home and from the office, enabling our employees to work closer to clients, colleagues and their teams, as well as reducing commute time, travel costs and our individual and collective carbon footprint.”

Halford’s aspirations for his company and its staff reflect IWG’s own ambitions. As the working landscape continues to change, IWG is committed to deliver not just profits, but benefits for people, partners and the planet.

IWG is actively seeking individual, multi-unit and regional franchisees with visions for growth.

For Property Owners > Learn More

For Investors, Entrepreneurs & Franchisees > Learn More

Hybrid working at a glance

IWG’s Groundbreaking Global Flexspaces

New York

Spaces Park Avenue South

Located in Manhattan’s Midtown South and easily accessible from Grand Central Terminal and the 6 subway, this workspace is close to a plethora of upscale hotels, restaurants and entertainment venues.

Chicago

Spaces The Adlake Building

This smart business hub is situated at 320 West Ohio Street, once home to the iconic Adams & Westlake railroad lantern factory.

London

Spaces Kensington Village

Built in the 1880s, Kensington Village was a former warehouse unit for West London department store Whiteley’s, and today features a leafy, green leisure area, a café and a gym.

Jakarta

Signature South Quarter

A 30-minute drive from Soekarno-Hatta International Airport and close to the bases of many prominent oil firms, this large flexible workspace is co-located with luxury residences, retail outlets and other business premises.

Manila

Zuellig Building

Featuring a double-glazed curtain wall, motion sensors and an integrated recycling system, this 33-storey office tower in the Makati Central Business District is built with sustainability in mind.

IWG has more than 3,500 locations in 110 countries and is looking to expand exponentially. With its focus on people, planet and profits, IWG is the better partner for entrepreneurs, investors and franchisees seeking to thrive in the new world of work.