The Machines Behind the Market

Today’s investors have access to more information than at any other point in history. With a deluge of research, financial data and commentary to sift through each day, institutional investors face the challenge of making sense of it all—and finding meaningful and trustworthy insights amid information overload.

That challenge has sharpened client expectations. As artificial intelligence reshapes how people find and filter information in their personal lives, investors also want comparable abilities in their professional lives.

But creating a tool for financial professionals takes a level of trust that consumer products aren’t built to achieve.

Confidence and convenience can coexist

The balance between convenience and confidence has long been difficult to manage in financial services, but major institutions are implementing AI to change that. The same technology that makes it easy to search and synthesize information is now being refined for the requirements of institutional investing.

The goal is to move quickly without compromising the accuracy and security upon which markets depend. In a field where trillions of dollars are at stake, reliability is essential.

That’s where Hussein Malik, Head of Global Research at J.P. Morgan, sees the opportunity. His focus is on building systems that deliver both speed and trust at scale. The firm’s new AI Search is built directly into the J. P. Morgan Markets platform.

J.P. Morgan’s significant, ongoing investment in artificial intelligence across the entire firm has been a key enabler of innovation within its Global Research unit. Drawing on its deep internal expertise and advanced technology developed at scale, the Research team built AI Search with unique capabilities tailored for market participants. The firmwide commitment to AI provides the foundation for this powerful tool, which combines cutting-edge technology with the rigor and reliability clients expect from J.P. Morgan.

The firm’s collaborative approach means that the development of AI Search was not just a technical project, but a broad strategic initiative drawing on the strengths of the entire organization.

A search tool built for professionals

The AI Search tool is designed for the way buy-side clients actually think: Investors can type questions in plain English—How is AI impacting the semiconductor industry? What does renewable energy demand in Europe look like right now?—and instantly surface the most relevant analysis from the firm’s current research and archive.

J.P. Morgan Global Research is recognized for its award-winning analysis and breadth of coverage. In 2025, it was named by Extel Global Research (formerly Institutional Investor) as the Top Global Research Firm, the #1 Global Equity Research Team and the #1 Global Fixed Income Research Team—the second consecutive year it had claimed all three titles and the sixth year it was named Top Global Research Firm.

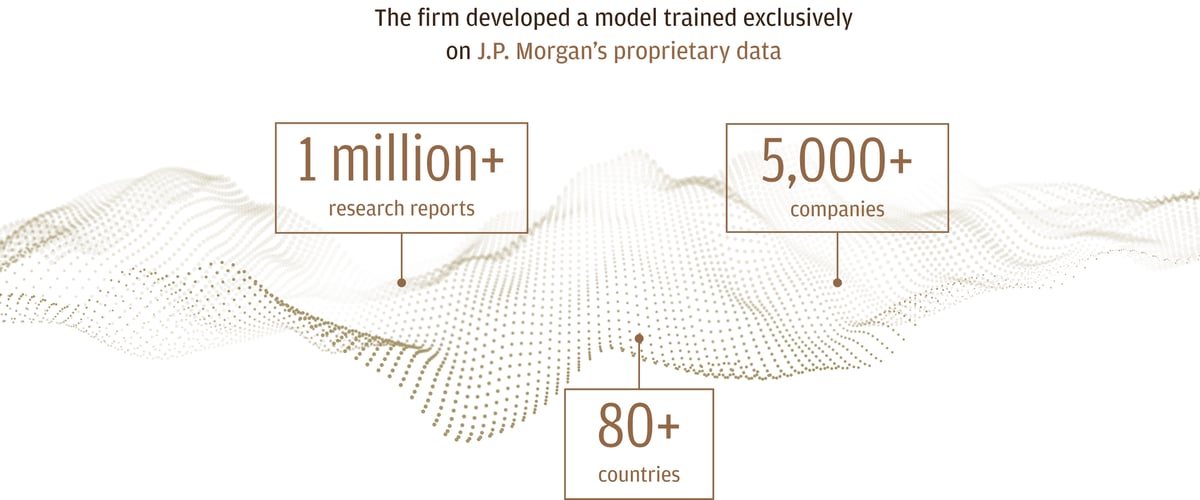

It has developed a model trained exclusively on J.P. Morgan’s proprietary research and data collected over the last 10 years: more than a million of the highest quality research reports covering over 5,000 companies across sectors and asset classes in over 80 countries.

The team delivers in-depth research across a wide spectrum of financial topics, including macroeconomic trends, equity markets and credit analysis. This comprehensive approach ensures that clients have access to timely, relevant insights spanning global economies, industries and asset classes. The depth and diversity of J.P. Morgan’s research archive form the foundation of AI Search, enabling the tool to address complex questions with authority and precision.

J.P. Morgan’s Global Research Analysts—who authored the reports—dedicated hundreds of hours to refine how the tool interprets nuance, tone and context, ensuring generative answers aligned with their insights. In addition, investment professionals from J.P Morgan Markets Sales and Trading teams who are consumers of research tested AI Search and provided feedback over multiple months before external launch. “The quality of our analysts determined the quality of the tool we've produced for clients,” says Malik.

It interprets the intent behind a question, identifies the most relevant passages from published reports and assembles them into a concise, well-structured response with links to the original sources.

Personalization is the new expectation

The launch of AI Search reflects a deeper shift in what financial professionals now expect from their institutions. Today’s investors want to set their own filters, tailor their feeds and trust that what they see reflects their own unique strategies.

The integration of J.P. Morgan analysts into the development of AI Search makes it unique. As AI becomes entrenched in everyday life, the advantage of AI Search is knowing that every answer is grounded in reality and understanding.

Authorized users can access AI Search here. Sign-in required.

AI Search is currently available to J.P. Morgan clients in EMEA and the Americas, with select APAC jurisdictions coming soon.